|

Why

do businesses sell for values higher than the actual value of their

physical assets? When a brand is sold, why is its value often higher

then the revenues it generates? The answer lie in the realm of the

intangibles. The goodwill a business or a brand possesses drives

its value to the outside world. Now, apply that concept to the professional-turned-entrepreneur. Why

do businesses sell for values higher than the actual value of their

physical assets? When a brand is sold, why is its value often higher

then the revenues it generates? The answer lie in the realm of the

intangibles. The goodwill a business or a brand possesses drives

its value to the outside world. Now, apply that concept to the professional-turned-entrepreneur.

The West has shown the world a generation of

entrepreneurs that worked its way forward more on the strength of

its ideas and brain power than on the money in the bank. Larry Ellison,

Bill Gates, Richard Branson-they are all pioneers of this concept.

We've seen it in India too, from the oft-quoted N.R. Narayana Murthy

and the legion of tech wannabes that followed.

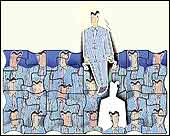

But tomorrow will be different. As important

as grit and determination will be the defection capital a wannabe

entrepreneur holds. Simply put, this is the value that could be

put to an entrepreneur's ability to muster a group of professionals

with their contacts. It is an entrepreneur's capacity to keep a

concern going. The career of the budding entrepreneur will be built

on the foundation of defection capital.

The 1990s was the decade of venture capital,

a key factor in the spurt of entrepreneurism that India has seen.

So it's only likely that the future will extrapolate itself from

here. The formula of the 1990s was: raise money, leave your job,

and become an entrepreneur. This will now change. The entrepreneur

will no longer necessarily be associated with seed money. We have

reached what Dr Roopen Roy, Head (Management Consulting), PricewaterhouseCoopers,

calls an "inflexion point'', a take-off point for accelerated

growth. Funding is no longer a problem.

Take a look at the working of VCs today. In

many cases VCs have the money as well as the idea but neither the

inclination nor the ability to run the venture. Thus they look for

entrepreneurs who can bring in defection capital. It's already happened.

In 1998, Chase Private Equity was funding an $8 million infotech

services company called e-Capital. The idea and money was the domain

of the VC. But it bought in an individual with the experience and

capability to be the entrepreneur. His name was Suresh Rajpal, and

the company went on to be known as Trigyn Technologies, a respected

name in the business today. What Rajpal brought to the table was

defection capital in the form of experience and contacts in the

infotech field from his old job as CEO of the HCL-HP joint venture.

Defection capital goes both ways: it can remain

in the company, it can leave. Even companies that encourage entrepreneurial

behaviour and aren't threatened by it put together defection capital-of

course they don't term it as such today. If you were to judge a

company in terms of defection capital, Wipro would be right up there.

It has spawned more entrepreneurs than almost any Indian company.

Accountants in the future might even say it maintains high levels

of defection capital. The time may have come to put a value to it.

Welcome The New Entrepreneur

The

late 1990s saw educated professionals starting up on their own.

The future will stem from that core. A highly educated man or woman,

who not only knows how to take risks but takes them at a pace quicker

than ever before. A person conversant in global trends and processes,

confident of enduring failure. From the person who raked in the

money, the entrepreneur is becoming the champion of knowledge in

the institution. The age of the fixit general manager, the overbearing

lala, the chairman in his ivory tower, is done. The

late 1990s saw educated professionals starting up on their own.

The future will stem from that core. A highly educated man or woman,

who not only knows how to take risks but takes them at a pace quicker

than ever before. A person conversant in global trends and processes,

confident of enduring failure. From the person who raked in the

money, the entrepreneur is becoming the champion of knowledge in

the institution. The age of the fixit general manager, the overbearing

lala, the chairman in his ivory tower, is done.

"In the future entrepreneurism will not

be about manipulation of the environment but about the difference

in customer service an enterprise can bring about," says Dr

C. Srinivasan, Managing Director, at Kearney consultants. "A

lot of the uniqueness of the offering will be motivated by the individual

entrepreneur.'' It is knowledge that will provide the competitive

edge to the organisation. Obviously, managing this resource will

be a critical function of the entrepreneur. Being tech savvy will

come naturally. The entrepreneur may not have to be a deep expert

but will have an appreciation of what tech can or cannot do. All

this will be possible because financing will not be an entrepreneur's

sole concern. The start-up of the future will be a collaborative

effort shared with VCs and others. With outsourcing making increasing

economic sense, entrepreneurs will increasingly partner suppliers.

Getting along with people, the ability to work with others as equals,

will be of prime concern to the new entrepreneur in the coming days

of growing pluralism in not just business but also in society. Unlike

the old days, no entrepreneur of the coming era can harbour hopes

of being lord of all that he or she surveys.

-Seema Shukla

|