|

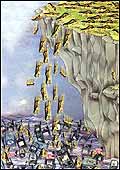

The Wireless Rush

Wireless-software is the destination of

choice for a rash of Indian start-ups. But few have what it takes to last

in a largely out-of-India market.

By Ashutosh

Sinha

Bluetooth,

the much-hyped wireless device-to-device standard created by a consortium

of mobile telephony companies-not to be confused with Bluebeard, the

much-married character created by French writer, Charles Perrault-may be

named after the 10th century Danish King Harald Blatand, but a clutch of

Indian companies, small and big, would have us believe that it is as

Indian as Butter Chicken and Malabar Adai. "We are the toppers in the

R&D area of Bluetooth technology and develop applications for every

(sic) wireless client (in the world),'' brags Kiran Varanasi with

schoolboyish enthusiasm. Varanasi is the CEO of a Hyderabad-based company

called Wilsys Technologies which, according to its spokesperson Harihar

Thota, ''doesn't have any overseas clients yet''. ''Our services,''

declares the website of the Arthur D. Little-incubated MobiApps, a

Bangalore-based wireless applications company, Bluetooth,

the much-hyped wireless device-to-device standard created by a consortium

of mobile telephony companies-not to be confused with Bluebeard, the

much-married character created by French writer, Charles Perrault-may be

named after the 10th century Danish King Harald Blatand, but a clutch of

Indian companies, small and big, would have us believe that it is as

Indian as Butter Chicken and Malabar Adai. "We are the toppers in the

R&D area of Bluetooth technology and develop applications for every

(sic) wireless client (in the world),'' brags Kiran Varanasi with

schoolboyish enthusiasm. Varanasi is the CEO of a Hyderabad-based company

called Wilsys Technologies which, according to its spokesperson Harihar

Thota, ''doesn't have any overseas clients yet''. ''Our services,''

declares the website of the Arthur D. Little-incubated MobiApps, a

Bangalore-based wireless applications company,

''include the development of core software

stacks (including Bluetooth), as well as porting of existing embedded

software to multiple target platforms''.

Three is a good number, so here goes. The

Hyderabad-based Infocomm Solutions expects its turnover to grow from Rs 6

crore in 2000-01 to Rs 20 crore in 2000-02. A staggering 75 per cent of

that Rs 14 crore incremental revenue is expected to come from 'Bluetooth

training and consulting'. If you're experiencing dotcom déjà vu right

now, patient reader, give in to the feeling. Turn on, tune in, and (wait

for them to) drop out.

It's A Virtual Stampede

| A

RANDOM SAMPLE OF 15 WIRELESS WANNABES & THEIR PROSPECTS |

| Company |

Area

of Operations |

Comments |

| Unimobile |

Messaging

applications |

(L)

/ Recent change in focus |

| Jataayu |

WAP

solutions |

(L)

/ Low value solutions |

| Onscan |

Middleware

solutions |

(L)

/ More marketing muscle needed |

| MindTree

Consulting |

Wireless

systems design |

(H)

/ But could do

with a global focus |

| MobiApps |

Wireless

consulting

and products |

(H)

/ Products remain untested yet |

| Tarang

Software |

Consulting

& Systems Integration |

(L)

/ No presence in Europe |

| Hughes

Software |

Wireless;

IP

telephony solutions |

(H)

/ Needs to tap global market |

| RiverRun

Software |

Mobile

automation |

(H)

/ Out-of-India focus |

Ways

India

Solution Platforms |

M-commerce |

(L)

/ Mass market is still distant |

| LifeTree

Convergence |

Wireless

applications solutions |

(L)

/ Late entrant in

the wireless domain |

| Infozech

Software |

Billing

solutions |

(L)

/ Too narrow scope |

| Ruksun

Software |

Payment

platforms |

(L)

/ Partnerships

hold the key |

| eVector

Mobile |

Wireless

convergence solutions |

(C)

/ Suite of products,

but none unique |

| Kshema

Technologies |

Middleware

for

devices |

(H)

/ Needs to focus on alliances |

| Winphoria

Networks |

Next

generation mobile switching centre |

(L)

/ Business dependent on applications taking off |

| (H)

- Hot (L) Lukewarm (C) - Cold |

Wireless technologies is the newest

domain-of-choice of the ungulate-minded. This correspondent found 287

companies of varying pedigree (Editor's note: and this man normally

doesn't look too hard) in the first 10 days of his Odyssey.

The list is heterogeneous: seasoned

software companies like Hughes Software Systems and Sasken, tech hotshops

that have received more than a fair share of publicity like Unimobile,

Ionic Microsystems, and Impulsesoft, and obscure start-ups with names like

Mobyz and Tanla Solutions jostle for space with software-brands like

Infosys, HCL Technologies, and Wipro.

Wireless-fever isn't a plague unknown to

mankind. The Scandinavian countries-the penetration of mobile phones in

some of them is as high as 70 per cent-were the first to be infected, and

it was as bad as tulipmania. That was in 1999; by the time the fever

broke, the market was cluttered with almost 700 companies, mostly funded

by mobile phone manufacturers and service providers, and offering a range

of wireless solutions.

|

|

"If

you are investing in research, you are a few steps ahead of the

competition"

VINOD SOOD,

Head (Engg.), Hughes Software |

Today, less than 75 of those companies are

around. Companies in India have been more prudent with their investments,

but that hasn't stopped entrepreneurs. ''Wireless is a nascent market and

some standards haven't been frozen,'' says Vijay Shekhar Sharma, the Chief

Operating Officer of One97 Communications. ''After the dotcom downturn,

some people thought it was hot.'' Sharma himself did: his company offers

location-based solutions for service providers. ''The proliferation of

companies is a result of the hype that has been created about wireless;

few of them offer any value to the end-customer,'' concedes Milind

Agnihotri, CEO, Isolv, a Pune-based wireless solutions provider.

That the Indian market can't support all

these companies is evident. Telcos and mobile phone equipment

manufacturers are realising that consumer adoption cycles for WAP

(Wireless Access Protocol), and Bluetooth will likely be far longer than

originally estimated. And Indian companies are far removed from the most

happening wireless market of them all, Europe, making it extremely

difficult for them to be part of consortia that define standards in the

wireless domain. ''Maybe Indian companies should focus on the emerging

standards related work that is being subcontracted,'' offers Arjun Sethi,

an Associate Consultant at Kearney. They could, but only if they stop

flaunting their skills in WAP, Bluetooth, WI-FI and other open standards

long enough to realise where the opportunities lie.

Bowing to the cold logic of numbers, there

should be more companies battling it out in the software-for-wireless

market. Estimates put the ratio of wireless devices-this includes

handhelds, mobile phones, laptops, even wrist watches-to personal

computers at 1:2. By 2005, this ratio will be 1:1. That's over 800-900

million wireless devices that will need software.

|

|

"Wireless

is a nascent market and some standards have not been frozen"

VIJAY SHEKHAR

SHARMA, CEO, ONE97.COM |

Cellular service providers (or any other

wireless service provider, for that matter) are classic examples of a

smart network in which most applications are resident, connected to dumb

devices (the handsets themselves), which have little intelligence. Delhi's

dominant cellular company Bharti, for instance, offers about 140

applications, each one of which requires software.

The operating system domain is the

exclusive demesne of the biggies: there are already signs that Microsoft's

Stinger and Symbian's (Symbian is owned jointly by Nokia, Ericsson,

Motorola, Psion, Panasonic, and a few other companies) eponymous offering

will slug it out to be the OS of choice for cellular phones, a repeat of

the scuffle in PDA-land between Palm's operating system and the Redmond

Giant's Windows CE.

There is also a lucrative niche (a large

one) in focusing not on the operating system, but on specific software,

like browsers for wireless devices. Today, the market for

wireless-browsers is dominated by Openwave (formed by the merger of

phone.com and software.com in November, 2000). The company's software is

used by the likes of Swisscom, Telstra, and 24 other service providers.

Then there are equipment manufacturers

themselves, like Nokia, Motorola, and Ericsson, which have ventured into

software, independently, or collectively, or both.

Indian companies do not have what it takes

to compete in both markets. They have come into the market early, but not

early enough; they lack the relationships with service providers and

equipment manufacturers required to succeed; and they have little say in

defining standards in a domain where these are still emerging. Thus, their

role may be restricted to building software-parts that companies like

Microsoft, Palm, and Nokia outsource. And that, as most analysts will tell

you, isn't the best way to go about building a competitive advantage.

The systems integration segment of the

business, too, seems out of reach for the local wiscies (wireless software

companies, get it?). Doing a Sapient and advising companies on all aspects

of their wireless strategy isn't as easy as it sounds on paper. The

presence of a not-insignificant (but it isn't thriving either) domestic

telecom market may not help; most Indian cellular companies prefer

multinational vendors. Airtel, for instance, bought its cabs2000 billing

software from Sema.

That leaves smart applications, some

focused on rich verticals like banking, telecom, and financial services,

and technologies with loads of SA, and this is the market where most

Indian companies operate.

|

|

"Indian

companies should focus on the emerging standards -related work that

is being subcontracted"

ARJUN SETHI,

Associate Consultant, At Kearney |

The Essence Of Survival

When the shakeout happens, and the

companies themselves believe it is imminent, the vendors of plain-vanilla

technology solutions will be the first to go. That definition encompasses

tens of companies building WAP gateways, WAP browsers, Bluetooth protocol

stacks, even basic Bluetooth chips.

Third Generation (3g) mobile networks and

high-speed access technologies like GPRs (General Packet Radio Switching)

may make both WAP and Bluetooth widely-accepted, and used standards, but

the basic products and solutions built around them will be rendered

commodities.

''Companies that continue to focus on these

solutions will now disappear,'' says Varun Arora, Senior Director of the

Singapore-based Edgematrix, a Unified Messaging Services (UMS) company.

And those that somehow manage to hang on will see their margins shrivel.

In 1998, the list price of a V5.2 stack (a critical part of any mobile

telephony network) was between $250,000 and $300,000. Today it is around

$80,000, and some companies sell it for as low as $50,000.

The Indian software companies best

positioned to ride the wireless boom are those targeting industries like

banking, financial services, healthcare, telecom, mobile entertainment,

retail, logistics, and location-based services. Says Agnihotri of iSolv:

''Success will be a function of innovating around the standards.'' Even a

great stand-alone technology-rich utility won't help. Unimobile is

realising that the hard way: in 2000, the company terminated its free

unified messaging service to customers; now, its focus is on the

enterprise segment.

Most Indian companies, though, have

preferred to take the easy way out: their focus is restricted to areas

that require above-average technical expertise and just that. That could

be why every company worth its code is vending Bluetooth stacks and WAP

gateways.

Companies offering wireless solutions built

around specific functions or industries, however, will find themselves on

safe ground. Riverrun Software, a company based in Noida, near Delhi is

one such: it offers wireless field-solutions like linking a company's

frontline sales people to the back-end typically located in the corporate

headquarters.

Domain-expertise and the willingness to

invest in research matter says Vinod Sood, the Head of Engineering at

Hughes Software Systems. ''If you are investing in research, you are a few

steps ahead of the competition. That will give you a good time-to-market

advantage.'' And an understanding of the industry in which the customer

operates will help companies move up from being merely component-suppliers

to systems-developers.

Given that the majority of the wiscies

operates in the wireless applications and technologies space, a company

with a portfolio of offerings will have an edge over its competitors.

Openwave CEO Don Listwin, for instance, has often articulated the need to

line up a suite of offerings to hedge against the risks inherent in being

just a mobile-browser company. The easiest route to building a Leveresque

portfolio is acquisitions. There have not been many in the Indian context

thus far, but Sethi believes there's enough logic for M&As: ''You are

in a growth sector, the players are fragmented, and the best thing to do

is to build critical mass so that you don't look like a mom-and-pop

store.''

Indeed some companies like Sapient, which

has reportedly been discussing deals with Indian companies, and Ways

India, which actually acquired a company, McDonell Associates in the US,

aren't averse to acquisitions that will enhance their competitive

position.

The number of companies that feel this way

is certain to grow as the realisation that competing in the wireless

software market isn't the song it appeared to be strikes home. Just

because it is wireless doesn't mean there are no strings attached.

|