|

People

Sirs Saviour

|

|

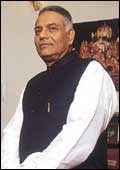

| YASHWANT

SINHA: not sitting so pretty |

|

|

| RATAN TATA:

the knight in shining armour |

If this were

medieval Europe and Yashwant Sinha not India's Finance Minister, but Henry

the VIII, two knighthoods would have been conferred in recent days. One on

Tata group head honcho Ratan Tata and the other on troubled Mahendra

Nahata of the Delhi-based hfcl. Reason? They are two brave warriors who've

jumped in to rescue Sinha's distressed disinvestment programme. Tata

snapped up the state-owned CMCc (Computer Maintenance Corporation) for Rs

152 crore, and Nahata acquired a 74 per cent stake in Hindustan

Teleprinters for Rs 55 crore. Otherwise, the finance minister might have

closed the calendar with no sale to show.

|

| MAHENDRA

NAHATA: did he buy HTL for a song? |

Despite the twin success, it is unlikely that

Sinha will meet his disinvestment target of Rs 12,000 crore for 2001-02.

Videsh Sanchar Nigam Ltd (VSNL), which is up for sale too, will receive

money bids in December this year. Somehow, the signs aren't too

encouraging. Of the six original bidders-A.V. Birla Group, Videocon

International, Bharti-Singtel, Reliance, Tata, and a BPL Communications

consortium-only the last three are in the running. Besides, if

Communications Minister Pramod Mahajan keeps his promise of allowing

internet telephony by April next year, VSNL's lure as the sole

international long distance service provider will weaken.

The other PSUs-such as IPCL, IBP, Indian

Airlines, Air India, and Maruti Udyog-on Sinha's plate could fetch Rs

5,000 crore to Rs 6,000 crore. But the point is none of these seems close

to getting sold. Sure, Maruti Udyog does, but it may rake in much less

than the Rs 3,000 crore the government expects. The other PSUs on the list

are still waiting for suitors to publicise themselves. For example, in the

case of IPCL, a clutch of bidders, including Reliance, Dow Chemicals,

Indian Oil, and Exxon are rumoured to exist. Yet, a serious bid hasn't

been forthcoming. Any takers for King Sinha's knighthoods?

Straight Suit

|

| PETER

BLOCK: mincing no words |

Even a war

could not stop author, consultant, and speaker Peter Block from making his

seventh trip to India this month. So just what was this gripping trip

about? A leadership summit hosted by Anil Sachdev's Grow Talent. Says

Block: ''I have come to India to change my mind. It is both a social

agenda and an eye opener for me.'' Till date his experience in India has

been limited to the Gujarat Cooperative Milk Marketers' Federation (GCMMF),

better known as Amul. He worked with the National Dairy Development Board

helping the cooperative manage the transition in leadership, with its

long-time chief Verghese Kurien leaving. His take on management in India?

It's good, but don't ape American fads blindly. He asks companies to be

wary of management consultants-or as he put it, ''mosquitoes that carry

business fashion statements to India.'' Guess he didn't make too many

friends at the leadership summit.

Family Man

|

| M.V.

SUBBIAH: a strong believer in ethics and corporate governance |

For a man

painfully media shy, dressing up in a tuxedo and handling all the media

glare at the 12th Annual World Conference of the Family Business Network

in Italy last fortnight must have been difficult. But M.V. Subbiah,

third-generation patriarch of the Murugappa Group, did that with panache

and, justifiably, pride. For, he was in Italy to receive the IMD,

Distinguished Family Business Award 2001-a first for any business family

in Asia. IMD, which is a top-notch business school, gives away this award

every year to a company that combines ''traditional values with

professional management.'' Over the last two years, Subbiah has been busy

minimising the family's role in day-to-day running of the group. Instead,

the family sits on a ''corporate board'' that sets the strategic direction

for the group. Says M.M. Murugappan, eldest of the family who received the

award: ''We believe that the world will know of us through the

institutions we have nurtured, rather than the wealth we have created.''

Indeed.

|