|

| NCR's Collins: Milking the ATMs |

The

local ATM is about to get smarter. Over the next year or two,

ATMs will do much more than just spew cash, churn out balance

statements or even book airline tickets. They are likely to morph

into "mini branches." "ATMs have evolved from largely

being cash dispensers to multipurpose machines that can handle

cheque deposits, cash deposits, bill payments, and other electronic

transactions," says Malcolm Collins, Senior VP of global

ATM giant NCR's financial solutions division. NCR is showcasing

an ATM machine in India that accepts cash deposits minus the mandatory

envelope. The ATM accepts the cash, counts it and then hands out

a receipt.

"We have done pilots with a couple of

banks, and have developed the templates for Rs 50, 100 and 500

notes. The technology is ready to be deployed. Banks do not have

to spend a fortune installing these new machines as the technology

is modular. The consoles can be added to existing machines,"

says Deepak Chandnani, Managing Director, NCR India. The only

inhibitor for this technology is the poor quality and variants

of Indian currency in circulation. NCR expects to roll out these

machines in India over the next two years.

Another technology that is likely to be introduced

in the first quarter of 2007 is cheque truncation at ATMs. NCR

plans to deploy machines that will scan the cheques that are being

deposited and send their images across banking networks for clearance,

instead of that happening physically. The new system will ensure

quicker clearance along with reduced costs for banks. NCR is also

pushing Indian banks to adopt cash recycling technologies. "One

of the big operational costs for banks is that cash has to be

replenished regularly at ATMs. Cash recycling allows the ATM to

use cash that has been deposited by customers at the ATM,"

says NCR's Collins.

Banks, themselves, are keen to adopt these

new technologies. UTI Bank has the highest ratio of ATMs to branches

in the country (4.5 ATMs to every branch). As a result, more than

97 per cent of the bank's transactions happen on its 2050 ATMs.

"We are keen to adopt the latest ATM technologies. But there

are issues to be resolved like quality of the currency in India

which is not yet machine readable. Once that's sorted out, we

can look at a technology like no-envelope cash deposits,"

says Hemant Kaul, President (Retail), UTI Bank. The number of

plain cash dispensers in UTI's ATM network is 'negligible.' "Over

the next couple of years, we are likely to see the adoption of

'no-envelope' cash deposits and check truncation at ATMs. In time,

ATMs are likely to become mini-branches with a variety of cash

and non-cash functions being offered," adds Sanjay Sharma,

advisor (it), IDBI Bank.

In addition, NCR also provides remote management

and diagnostic services for ATM networks from its remote management

centre in Mumbai. NCR is also implementing technology that enhances

ATM security. Among other things, ATMs will spray staining ink

on stored currency when breached, thereby, rendering the loot

worthless.

There are about 23,000 ATMs across the country

of which almost 35-40 per cent are single featured cash dispensers.

"India is an important market for us because it's growing

at nearly 30 per cent, adding over 6,000 ATMs per year,"

says NCR's Collins. The potential for growth in the world's second

most populous country can be gauged from the fact that China has

nearly 80,000 ATMs and Brazil nearly 1,00,000.

-T.V. Mahalingam

The

Postman Knocks

If you ate the biscuit but didn't become

taller, this one's for you.

You

might have at some point in time stumbled into Dabur's red toothpaste

ads which promised strong teeth, HLL's radio commercials for Clinic

All Clear Hair Fall Defense which promised 'baal girney ka sawaal

hi nahi', BPCL's ad for speed premium petrol which showed Narain

Karthikeyan zooming on the roads, Hyundai's Santro ad of a young

boy on the bonnet of a moving car, or ITC's ad of Sunfeast biscuits

that showed a boy growing taller after eating the biscuits. All

these ads have been discontinued or withdrawn after complaints

were launched with the Advertising Standards Council of India

(ASCI) highlighting the fact that they were either false or exaggerated

claims or simply dangerous for vulnerable young minds. ASCI's

three new 'postman' ads, created by Leo Burnett, are now on air

for precisely this reason-to make viewers aware that they have

a right to complain against advertisements they find vulgar, exaggerated

and false or dangerous.

After 21 years of existence, the Advertising

Standards Council of India has decided that it is not enough for

just advertisers to know of the body's existence. "The consumer

must have a voice and be aware that he can complain," says

secretary general Gualbert Pereira.

The 'postman' ads, which have a postman riding

onto the screen every time an ad threatens to cross the line of

decency or truth, highlight probable scenarios which viewers might

find exaggerated, indecent or untrue. "The advertising council's

code might be complex to understand for some people, but with

these ads the message has been simplified," says Leo Burnett's

chairman and CEO Arvind Sharma. Knock, Knock...

-Shivani Lath

Bringing

Home the Bucks

Banks queue up for a slice of the NRI remittance

pie.

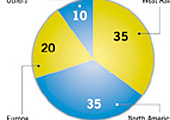

With

more than three lakh Indians migrating abroad every year, it is

hardly surprising that India receives the largest inflow of remittances

globally. India received an estimated $24 billion (Rs 1,08,000

crore) last year of the worldwide remittance market of $240 billion

(Rs 10,80,000 crore). Indian banks are now trying to get a slice

of the remittance pie which has traditionally been dominated by

pure play money transfer companies like Western Union Money Transfer.

And they're doing so via the Internet. "Overall, the remittance

market is growing at 15 per cent. The online segment is significant

and growing," says Manish Misra, Head of Remittance Products

at ICICI Bank. ICICI is among the leading players in the remittance

market in India with a 20 per cent market share; nearly $5 billion

(Rs 23,000 crore) flows into India through its remittance service,

money2india.

For long, non-resident Indians (NRIs) have

relied on traditional money transfer channels to send cheques

or wire money. But cheque clearance can take time (up to four

weeks) while wire transfers are costly, at as much as $40 (Rs

1,840). Banks like ICICI and HDFC Bank have launched online remittance

services that will help NRIs send a remittance by just logging

on to the banks' websites. Customers also have multiple options

for remitting money such as Real Time Gross Settlement (RTGS),

demand drafts and credit to a Visa Card. For example, using the

RTGS option, a remittance can be directly credited to a beneficiary's

account held with any of the 23,700 branches of banks in the RTGS

network within a day or two.

LET IT POUR

Last fortnight, an RBI working group put

out several recommendations for making remittances more efficient.

|

|

» Banks

in India should review their existing scale of charges both

at the foreign and domestic centres.

» Indian

banks, especially public sector banks, should explore tie-ups

with more correspondent banks (especially emerging centres

like Australia) which would bring down costs for the NRIs.

» Banks

should improve their infrastructure by extending the scope

of existing electronic transfer facilities like the Real

Time Gross Settlement (RTGS) or setting up centralised remittance

receiving centres.

» NRIs

may be advised to route their remittances through a branch

of an Indian bank or a foreign bank having a branch in India.

» The

existing cap on number of branches of Indian banks withdrawal

arrangements with Exchange Houses should be reviewed.

|

"The online model offers greater convenience

and transparency than traditional modes of money transfer. A customer

can track the progress of the money he sends home. And since he

does not have to physically go to a brick and mortar outlet, it's

convenient," says Misra. What makes online remittance even

more attractive for NRIs is the fact that ICICI offers 'free'

remittance services. Industry watchers say that ICICI makes its

margins on the exchange rates, which are cheaper in the inter-bank

currency market, and on increased volumes.

To reach out to the NRI population, banks

are busy sewing up relationships with financial banks and houses

internationally. These include public sector banks (PSBs) like

Dena Bank which recently tied up with UAE Exchange Centre LLC,

the largest exchange house in the Emirates, for a rupee-drawing

arrangement. "NRIs in the Gulf can now transfer funds by

sending rupee drafts drawn on uae Exchange Centre to 200 branches

of Dena Bank in India. We expect a growth of 15-20 per cent in

our NRI business through this tie-up," says Paresh Kumar,

General Manager for treasury and forex at Dena Bank. ICICI Bank

itself has tied up with foreign banks across geographies like

Lloyds TSB in the UK, and Wells Fargo in the us. It has also tied

up with exchange houses in the Gulf. In addition, PSBs like Bank

of India are also tying up with money transfer service providers

like Western Union to provide wire services to their NRI clientele.

Gujarat, Andhra Pradesh, Kerala and up receive maximum remittances.

With increasing competition and adoption

of cheaper models for money transfer, two things are likely to

happen. One, the inflow of money through unofficial channels like

Hawala and Hundi are likely to come down. And secondly, the volume

of funds from the 20 million strong Indian diaspora is likely

to go only one way-up.

-T.V. Mahalingam

Of

Nice And Men

Will an 11-member North Indian common economy

work?

Trade

ought to create its own imperatives and its own dialogue. However,

politics often plays the spoilsport, as is evident from the confabulations

of the chief ministers of northern states last fortnight in Chandigarh.

Presided over by Prime Minister, Manmohan Singh and Planning Commission

chief, Montek Singh Ahluwalia, the conclave was to paper the way

for a regional block called nice, an acronym for North Indian

Common Economy.

The states involved include Delhi, Haryana,

Punjab, Himachal Pradesh, Rajasthan, Uttaranchal, Uttar Pradesh,

Jammu and Kashmir, Madhya Pradesh (BJP) and Chattisgarh. The Union

territory of Chandigarh too is a part of the conglomerate.

The idea was originally floated by the PHD

Chamber of Commerce and Industry (PHDCCI) whose membership is

derived primarily from the northern states. "The idea is

to evolve a minimum common economic agenda for these states. If

political consensus could be brought about at the national level

in the Common Minimum Programme of the present government, surely

the same can be done at the regional level," says Sushma

Berlia, President, PHDCCI.

However, the difficulties were immediately

apparent as chief ministers from five out of the 10 states stayed

away. Prominent among the absentees were the non-Congress chief

ministers of Uttar Pradesh and Rajasthan. Of course, they sent

their teams. And ironically enough the perennial issue of water

supply to Sonia Vihar treatment plant in Delhi erupted almost

simultaneously highlighting the fractious water and power sharing

agreements between some of these states.

Delhi chief minister Sheila Dixit was sufficiently

exasperated to say, "This (Sonia Vihar project) is an agreement

which has been reiterated time and again. We are entitled to it

and we have paid for it. To withdraw water at any point for merely

political whims is not justified." However, Dixit is hopeful

that it is exactly issues such as common facilities which can

be ironed out with the development of nice. "It is certainly

an idea whose time has come," she says.

The evolution of a common economic platform

on the lines the European Union is expected to yield significant

economic dividends. According to PHD estimates, if efforts at

integration are pursued the state domestic product of the entire

conglomerate may well increase by 1.5-2.0 per cent. On the agenda

is removal of barriers to inter-state trade, efforts towards power

and water sufficiency and drafting an integrated action plan for

e-governance. Taskforces set up by the industry chamber have already

given specific recommendations in each of these three areas.

Currently, North India accounts for 38 per

cent of the country's population and is the breadbasket of the

country, but in terms of its contribution to industrial output

it is a low 30 per cent. "I just hope it (the nice idea)

works. Seamless transfer of goods, services and people is always

beneficial," says Rajiv Kumar, Director and Chief Executive

of the Indian Council for Research on International Economic Relations.

Some of the scepticism stems from the diverse fiscal and tax policies

that different states have been following in a bid to attract

investments. However, as the Prime Minister recently pointed out,

the road to prosperity is not paved with competitive populism.

Singh warned state governments that the tax breaks and shelters

that have perversely been facilitating development of backward

regions are unsustainable. nice sounds nicer against such a backdrop.

-Shalini S. Dagar

|