|

When

the sensex kissed the 10,000 mark for the first time ever on the

Bombay Stock Exchange (BSE) last fortnight, it was yet another

sign that India as a market for global liquidity had arrived.

That the benchmark index dipped below 10k by closing isn't important

(and whether it falls further or goes on to newer highs by the

time you read this isn't the point, either). What's significant

is that a major psychological barrier-and that may be all it is-had

been breached. After all, with the Sensex entering five-digit

territory, it's now rubbing shoulders with the 110-year-old Dow

Jones Industrial Average Index (DJIA)-which was at 10,793.62 on

February 3, 2006 at the time of writing. Says Jaideep Goswami,

Head of Institutional Equities, HDFC Securities: "It reflects

that there is a huge level of interest in our markets and that

sentiments are still very strong. (On the day the Sensex hit 10k),

the Japanese were strong buyers, which certainly augurs well." When

the sensex kissed the 10,000 mark for the first time ever on the

Bombay Stock Exchange (BSE) last fortnight, it was yet another

sign that India as a market for global liquidity had arrived.

That the benchmark index dipped below 10k by closing isn't important

(and whether it falls further or goes on to newer highs by the

time you read this isn't the point, either). What's significant

is that a major psychological barrier-and that may be all it is-had

been breached. After all, with the Sensex entering five-digit

territory, it's now rubbing shoulders with the 110-year-old Dow

Jones Industrial Average Index (DJIA)-which was at 10,793.62 on

February 3, 2006 at the time of writing. Says Jaideep Goswami,

Head of Institutional Equities, HDFC Securities: "It reflects

that there is a huge level of interest in our markets and that

sentiments are still very strong. (On the day the Sensex hit 10k),

the Japanese were strong buyers, which certainly augurs well."

However, the narrowing of the gap between

the Sensex and DJIA shouldn't by any yardstick be taken as a sign

that the Indian markets are in the same league as their American

and Japanese counterparts. For one, DJIA had a market cap of $3,770

billion (Rs 1,69,65,000 crore) as of late last year. The Sensex's

market cap, on the other hand, at the near-10,000 levels is just

$582 billion (Rs 26,19,000 crore). As Andrew Holland, Executive

Vice President, DSP Merrill Lynch, points out: "It wouldn't

be fair comparing the Sensex to the Dow or the Nikkei, as the

depth and breadth of those markets are much superior."

What's more, if India's markets have entered the 10k zone, it

isn't the only one in the emerging market space. Turkey, for instance,

is over four times that level, in the 45,000 range, Poland's benchmark

index is close to 40k, Egypt is on fire, hovering near the 65k

mark, and Brazil is in the 37,000-38,000 range. Even Pakistan

has crossed the 10k mark (before India, we dare say). As per data

from The Economist, there are at least 12 other emerging markets

that have crossed the 10k mark, many of them comfortably, and

a long time ago.

But it's when you start co-relating the gross

domestic product (GDP) growth of emerging markets with their respective

indices-markets are supposed to reflect the health of the economy,

right?-that India emerges as a key player. With a stock market

that's perched at 10k and a GDP growth that stood at 8 per cent

for the third quarter, India is arguably the best placed amongst

the entire emerging market lot. China's GDP did grow at 9.9 per

cent for the fourth quarter, but its stock markets languish in

the 1,300 range. Then you have a country like Brazil, where the

benchmark index is in 37,000 territory, but its GDP grew at just

1 per cent in the third quarter. In a similar vein you have Mexico

with an index in the 18k range, but with GDP growth of just 3.3

per cent (for the third quarter).

The upshot? At the end of the day, index

records in isolation are a great boost for sentiment, but fundamentally

they may account for little, if not backed by solid economic (and

corporate) performance. As Tridib Pathak, CIO, Cholamandalam AMC,

points out: "I don't think we should give too much importance

to the fact that the Sensex has hit 10,000. It is just a figure

and has no consequential meaning. I would look for two things:

market valuation and visibility of growth. If the valuations,

for instance, reach historic highs, then there would be reason

for euphoria." From the investors' point of view, Pathak

adds, more than 10k, what should matter are figures for earnings

growth, price-earning multiples and, of course, the performance

of the economy.

-Krishna Gopalan and Mahesh Nayak

INSTAN

TIP

The fortnight's burning question.

Q. Will Budget 2006 Spur Growth?

Yes. R. Gopalakrishnan,

Executive Director, Tata Sons

We are on a good phase of economic growth.

There are many constraints. And I think the atmosphere is built

up to de-bottleneck those constraints and push the levers of growth.

I don't see too many economic bubbles. But I am concerned whether

India Inc. is prepared for a downturn. We are in a phase where

we could expect a slowdown after a good four-year run. However,

I don't see a disaster.

Yes and No. Subir

Gokarn, Chief Economist, CRISIL

I don't expect the budget to act as a hindrance

to India's growth. However, there are many issues like spend on

infrastructure. It's not important as to how much money is allocated

towards infrastructure development, but the critical issue is

how the government implements and delivers its spending on infrastructure

development.

Yes. Nilesh

Shah, President, Kotak AMC

I think incremental policy in the Budget

towards infrastructure development and manufacturing sector will

help in capacity expansion and, hence, certainly spur growth in

the economy.

--compiled by Mahesh Nayak

Just

What's So Hot About Ganesh Bank?

|

| RBI's Reddy: Staying cool |

It's

not every day that any-forget a nondescript-bank screws up courage

enough to take on the mighty Reserve Bank of India. So, the puny

Ganesh Bank of Kurundwad's decision to successfully move the Supreme

Court to block its RBI-blessed merger with Federal Bank comes

as some surprise. But then perhaps not. The failed and loss-making

Ganesh Bank (Rs 217 crore in deposits and Rs 106 crore in advances)

has vastly bigger banks wooing it, including, reportedly, Citibank,

the largest cooperative bank Saraswat and, of course, Federal

Bank. What makes the 85-year-old Ganesh Bank hot property? For

Saraswat, it's an opportunity to eliminate a competitor in Maharashtra,

while for Citi and Federal Ganesh's network of 32 branches in

Maharashtra and Karnataka is an ideal vehicle to reach the masses.

How is the RBI taking the challenge to its authority? "The

judiciary has its own role in the system," is all that an

insider would say.

-Anand Adhikari

Not

just a fund, but Fund of funds

|

| TWP's Srini: A first for India |

Yet

another fund announcing plans of investing in India doesn't turn

heads anymore. But when an investment banking firm says that it's

stitching together a fund of funds for India, you know the lure

is real. Thomas Weisel Partners (TWP), a US-based investment banking

firm, is close to finalising a $300-million (Rs 1,350-crore) fund

of funds for India. "We plan to distribute this amount between

private equity and venture capital companies focussed on four

high-growth sectors of technology, infrastructure, healthcare/life

sciences and retail," says Vudayagiri "Srini" Sreenivasulu,

37, Director for TWP India. Currently based in San Francisco,

Sreenivasulu, who previously was at Intel Capital in Bangalore,

will relocate to Mumbai.

-Rahul Sachitanand

A

Crude Mess

A sleight of hand won't help oilcos.

|

| Rangarajan: Not an easy job to deliver |

The

high-powered C. Rangarajan committee, set up to evolve a fuel

pricing policy for petro-products, is likely to recommend a trade

parity pricing regime for the oil sector. That means prices of

fuels like petrol, diesel, LPG and kerosene would be determined

by a combination of export and import parity prices. Since it

boasts excess refining capacity, India imports crude and exports

some amount of petrol and diesel. These will now be retailed at

export prices. Other products, such as cooking gas, will be sold

at the imported price and not at the subsidised government-determined

price. Secondly, the committee is expected to reduce import duties

on crude to bring about some kind of parity between it and petroleum

products. After all, Budget 2005 had reduced customs duty on petrol

and diesel by 15 per cent to 10 per cent respectively, but that

on crude only by 5 per cent. Oil companies don't think a mere

tinkering with import tariffs is going to help their bleeding

bottom lines. Instead of wasting time on cosmetic changes, the

government should link prices of petrol and diesel either to international

prices or work out a cost-plus formula on a certain price band,

says an official at Indian Oil. As for the subsidy on kerosene

and LPG, the best way to deal with it, say others, is to shift

the burden from the oil companies to the Budget. With crude prices

unlikely to return to the $40 (Rs 1,800)-a-barrel level of yore,

it's clear that the government needs to take some tough decisions.

Losses at oil companies are soaring, and for the first three quarters

of 2005-06, they stand at Rs 25,000 crore.

-Ashish Gupta

Paper

Balm To The Pain

|

| Oil woes: Will the flow stem? |

Oil

companies are bleeding and all that the government wants to do

is apply Band-Aid. It has offered to allow oil companies to issue

bonds worth Rs 5,763 crore with a coupon rate of 7 per cent, redeemable

in 2012. It's not the first set of oil bonds, but it's the first

one meant to bridge oil marketing companies' yawning losses; most

of them reported losses for the first time ever last year. But

how much will these bonds, which can be transferred in favour

of any other person including banks and corporations, help when

the total losses are at Rs 25,000 crore? Not much. "Oil bonds

will help companies overcome their liquidity crunch in the short

term, but they are not a long-term solution," notes Ravi

Mahajan, energy expert at Ernst & Young. There is only long-term

solution: Removing government controls on oil prices.

-Shaleen Agrawal

The

Numbers Don't Tell The Whole Story

India Inc. delivered as expected in

Q3. But oil and steel ruined the report card.

|

| Q3 results: Here red isn't a good sign |

India

Inc. will be disappointed. a total of 1,984 companies recorded

a net profit of Rs 30,540 crore for the quarter ended December

31, 2005, compared to Rs 29,590 crore during the previous corresponding

period, an increase of a mere 3.2 per cent. The metals and oil

& gas sectors were mainly responsible for the poor show. The

net sales of the companies during the quarter under review jumped

15.3 per cent to Rs 3,87,674 crore from Rs 3,36,207 crore during

the previous corresponding quarter. The logical inference: margins

were under pressure.

However, if we consider the overall results

minus these two sectors, the picture changes quite dramatically.

A total of 1,901 companies recorded a 36 per cent growth in net

profit to Rs 24,716 crore (Rs 18,129 crore) on the back of an

18 per cent rise in net sales to Rs 2,33,848 crore (Rs 1,98,498

crore). This impressive report card is primarily due to the performance

of the software, banking, pharmaceuticals, automobiles, cement

and capital goods sectors. During the quarter under review, the

collective operating profit margins of these companies improved

by 191 basis points to 26.72 per cent from 24.82 per cent, despite

a 19.3 per cent rise in interest costs to Rs 29,721 crore.

Says Gagan Banga, Executive Director, Indiabulls

Financial Services: "India Inc. has delivered as per expectations

if you set aside the results of oil and steel companies. But the

non-performance of these two sectors is a cause for concern, as

they generate substantial employment. It can also have an impact

on the market, as companies from these sectors have a huge market

capitalisation and account for substantial weightage on major

indices."

The steel sector suffered because of the

slowdown in China and a flood of cheap imports. But there's a

silver lining, too. Says Banga: "Steel is a major input for

most companies. If prices remain subdued, the operating margins

of India Inc. will shoot up further." The oil sector suffered,

as it was not allowed to charge market prices for its products

and also made to share the government's subsidy burden. The sector

recorded a 51 per cent fall in net profit to Rs 4,261.5 crore

(Rs 8,746 crore) for the quarter ended December 31, 2005. Its

net sales, however, jumped 15.6 per cent to Rs 1,35,240 crore

(Rs 1,17,001 crore).

Overall, it's been a good show. However rising

interest rates could have an impact on margins in the coming quarters.

-Mahesh Nayak

Another

first for Dr Reddy's

|

| DRL's Prasad: Tapping opportunities |

Dr Reddy's Laboratories

(DRL) has entered into an agreement with pharma major Merck &

Co. to sell and distribute generic versions of two of its patented

drugs, Zocor and Proscar, once they go off patent in the US in

June this year. It is the first Indian pharma company to enter

into such a deal with a multinational. "We will continue

to look at such opportunities going forward," says G.V. Prasad,

Executive Vice chairman and CEO, DRL. "The deal, per se,

is not innovative, as other companies have done it in the past,"

he adds. Prasad, however, is quick to emphasise that this does

not signal a shift in DRL's long-term strategy of becoming a discovery-led

global pharmaceutical company. "It's more in the nature of

a sensible opportunity that the company is tapping in the marketplace,"

he explains. The markets have welcomed the news. DRL's stock touched

a 52-week high of Rs 1,215 on February 2, 2006. It closed at Rs

1,190.40 on February 6.

-E. Kumar Sharma

KKR

Turns to Asia and India

|

| KKR's Marks: Sold on Indian IT |

As the CEO of

Flextronics, Michael Marks in June 2004 led the purchase of Hughes

Software Systems from Rupert Murdoch's DirecTV. Now as a Member

of the legendary buyout firm, Kohlberg Kravis & Roberts, responsible

for advising on Asia and technology, Marks may be helping KKR,

a late entrant to the Asian market that he joined end last year,

strike its first Indian deal. When BT went to press, HSS' (now

called Flextronics Software Systems) President & Managing

Director, Arun Kumar, was in the US as part of the ongoing due

diligence exercise, and a Flextronics International spokesperson

said "we have no comment". But sources told BT that

the deal, which might see KKR buy a significant stake in FSS,

could be announced by February-end. Flextronics had bought HSS

for $226 million, or Rs 1,017 crore.

Filling

the Gap in India?

The government's

decision to allow 51 per cent FDI (foreign direct investment)

in single-brand retail outfits has got some of the biggest players

interested. Gap, the $16.3-billion (Rs 73,350-crore) apparel retailer

with brands like Banana Republic and Old Navy, besides the flagship

label, is making aggressive moves in Asia. It recently announced

its first franchise in South-East Asia with retailer FJ Benjamin,

which will sell the Gap and Banana Republic Brands in Singapore

and Malaysia. Although Pantaloon's Kishore Biyani denies it, he

is expected to land a multi-franchise agreement with Gap in India.

When contacted by BT, a Gap representative, Kris Marubio, said

that Gap "will consider a foray into India at the appropriate

time". Given that in the US, Gap is fighting sluggish sales,

it may not be too long before it builds a presence in virgin markets

like India. Currently, Gap's international operations fetch $1.5

billion (Rs 6,750 crore) a year.

-Rahul Sachitanand

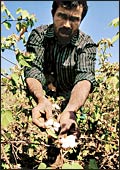

Seeds

Of Discontent

Is Monsanto stiffing cotton farmers?

|

| Bt cotton: Good, but pricey |

On January 23,

as the congress plenary session was winding up at Gachibowli in

Hyderabad, Andhra Pradesh Chief Minister Y.S. Rajasekhara Reddy

handed a letter to Prime Minister Manmohan Singh. It had nothing

to do with party politics. Instead, Reddy was trying to enlist

the pm in a fight against us-based Monsanto, which markets Bt

cotton seeds in India. Why? Reddy argues that Monsanto and its

Indian JV, Mahyco Monsanto Biotech don't have patent over Bt technology

in India, but have collected Rs 50 lakh from other Indian seed

companies to which they sell Bt cotton seeds. That apart, Monsanto

and Mahyco are said to be charging a high "trait value"

(sort of a royalty), which, in the case of a 450-gm seed packet,

works out to Rs 1,250 of the retail price of Rs 1,850. The trait

value, the argument continues, is not just 12 times the cost of

seed production, but higher than those prevailing in the us (Rs

108) and China (Rs 34). Says Poonam Malakondaiah, Commissioner

and Director of Agriculture, AP: "We have nothing against

the company and the technology, but we have been getting large

representations from the farmers (about the) exorbitant price."

About 80 per cent of the farmers in the state have small holdings

and, therefore, find the seed price too high. Pricing, Mahyco

counters, is based on the value that products and technology deliver

to farmers. And technology fees help fund research, and are shared

with the retail technology channel, seed partners, shareholders

and to cover business costs. No doubt Bt seeds have revolutioned

cotton farming in AP, but Monsanto finds itself in a drug innovator

company-like situation. Except in this case, farmers are a far

more powerful vote bank than mere pill-poppers.

-E. Kumar Sharma

|

W

W