|

Even

in ordinary times, putting together a list such as this one is

a devilishly difficult task. After all, there's something or the

other happening at every company. So, how do you decide which

to drop and which to keep? And in these extraordinary times, zeroing

in on 20 companies to watch is a million times harder. The economy

is booming, companies large and small are betting big on acquisitions,

new products, new markets, and new strategies. Private equity

and venture capital is flowing into little-known firms, start-ups

are mushrooming across sectors, and interesting new technologies

are emerging both online and offline. Therefore, to bring you

a list of 20 companies to keep an eye on next year, BT's reporters

and editors across the country spoke to a variety of experts,

including D-street analysts, fund managers, investment bankers,

private equity and venture investors, bankers, and senior executives.

As you can imagine, the list we ended

up with comprised more than just 20 companies. To whittle it down

to the required number, we employed a few filters: One, the company

needed to be most popularly cited by our experts; Two, the list

needed to be well balanced in terms of the nature and size of

companies; Three, the company should not have featured in our

listing the previous year. However, we had to make an exception

in the case of two companies-Tata Steel and Maruti Udyog-simply

because they seemed to be on everyone's to-watch list. For good

reason. Next year, Tata Steel will begin putting India Inc.'s

biggest overseas acquisition, Corus, to work; next year, too,

Maruti, having once retreated from the diesel car market, will

again seek to displace Tata Motors' Indica as the diesel car of

choice. The others also have a lot going for themselves. Turn

the page to find out.

ABB

Stepping Up the India Charge

|

| ABB Indo's Uppal: The investments will

continue no matter what |

It has grown

for each of the past 24 quarters, upped revenues from Rs 1,000

crore to around Rs 4,000 crore in that time, and boosted profits

from Rs 65 crore to analysts' estimate of Rs 290 crore this year.

Is it possible then, that there's more steam left in ABB India,

subsidiary of the Geneva-based power-automation-engineering giant?

Yes, say analysts, because with the economy on a roll and investment

in infrastructure and industrial projects gathering speed, ABB

is plugged into a multi-billion-dollar opportunity. According

to estimates, there are power and industrial projects in the pipeline

worth several hundreds of crores. No wonder, ABB's order book

is brimming over, with contracts worth Rs 4,211 crore over the

next several years, and folks in Geneva have declared India a

"prime focus" country. In response, the engineering

giant is ramping up manufacturing capacities in the country. By

the middle of 2007, it would have completed a $100-million (Rs

450 crore) investment programme that will not just boost throughput,

but increase the breadth and depth of portfolio offerings in the

market place. Says Ravi Uppal, Vice Chairman & MD, ABB India:

"There is no cap on capex. We will continue to invest whatever

it takes." Apparently, investors have no issues with the

strategy. ABB India's stock price has almost doubled to Rs 3,490

in the last one year alone and trades at a p-e multiple of 51.

-Venkatesha Babu

|

| Adlab's Shetty: Plans to grow his 50-screen

multiplex business fourfold |

ADLABS

The Picture Gets Bigger and Better

Like in every

good bollywood movie, the Adlabs' story has had a happy twist.

"If you ask me whether I knew the business would assume this

scale before July last year, the answer is no," says Manmohan

Shetty, Chairman & MD, Adlabs. June 2005 was when Anil Ambani's

Reliance Capital bought a majority stake in Adlabs Films. "The

money, new talent, and management have helped create a media house

present in every sphere of entertainment business," says

Shetty, who runs a movies-to-film processing-to-multiplex group.

How life has changed is evident not just from its Q2 results (revenues

up 115 per cent to Rs 50 crore) but also investment plans. In

the film production business, from investing Rs 15-20 crore a

year hitherto, the company is now investing Rs 60-70 crore. It

has struck a multi-film, co-production deal with Ashok Amritraj's

Hyde Park Entertainment, set up a new animation arm that is already

working on a 3D film called Superstar, and plans to invest Rs

40-50 crore in film distribution. Shetty is also looking to grow

his 50-screen multiplex business fourfold, and scale up television

content production following the purchase of a majority stake

in Siddhartha Basu's Synergy Communication. Plus, "the demerger

of the radio business is expected to unlock substantial shareholder

value," says Chiraj Negandhi, an analyst with Enam.

-Shivani Lath

AIRCEL

New Owner, New Plans

|

| Aircel's Kini: Sets his eyes nationwide |

My mandate is

to make Aircel a national player from a regional player,"

says Jagdish Kini, also answering the question why the erstwhile

C. Sivasankaran-owned mobile services company made it to our list

this year. As you might know, Malaysia's Maxis group (and Apollo)

acquired Aircel in January 2006 and has since obtained licences

to operate in nine circles. It has applied for 14 more as part

of its plan to offer services across India. Maxis' proposed investment

in cellular roll-out, 3G spectrum and WiMax is $3 billion, or

Rs 13,500 crore. Aircel, which has 3.8 million subscribers mainly

in Tamil Nadu, is betting on WiMax, or last-mile, wide-area wireless

broadband (It WiMaxed Baramati with Intel). Neither the investments

in nor the revenues from WiMax are expected to be significant,

yet "Aircel hopes to get a first-mover advantage," says

Ram Shinde, Aircel's Head (Business Solutions).

-Nitya Varadarajan

|

| Shifting focus to smart cards: Yes,

that's the Bartronics boss |

BARTRONICS

Coming Soon to Every Pack in Your Shopping

Bag

Mumbai-based

Karvy Stockbroking has been quietly accumulating the Bartronics

stock since it was at Rs 55 about five months ago. And Ambareesh

Baliga, the firm's Vice President, has no intentions of taking

his eye off the stock, which now trades at over Rs 100. "It's

one of the best proxy plays available in the organised retail

space," says Baliga. What does the Rs 30-crore (at the end

of March 2006) Bartronics do? The Hyderabad-based company makes

a wide variety of data capturing equipment such as barcode scanners,

terminals and printers, smart card readers, and RFID tags. Interestingly

enough, retail is currently a small part of Bartronics' business,

"but we believe it will definitely constitute a major portion

of our business in the next two years," says MD & CEO

Sudhir Rao. Accordingly, Bartronics is shifting focus to smart

cards and point of sale (pos) systems, and hopes to become a Rs

200-250 crore company in another two years. RFID-based solutions

fetched half of Bartronics' revenues in the first half of current

fiscal. But Rao is betting big: "We are working towards a

Rs 1,000-crore sales target," he says. Baliga must be smiling.

-Mahesh Nayak

BHEL

Power-packed PSU

|

| BHEL's Puri: India must acquire technology |

How's this for

growth potential? India plans to add 674,000 mw of power capacity

over the next 25 years, and there's only one end-to-end domestic

manufacturer of power plants in the country: BHEL. "The company

currently has limitless order intake and earnings visibility,"

quips Satyam Aggarwal, a power industry analyst at Motilal Oswal

Securities. "There were some concerns over BHEL lacking supercritical

technology (requiring a plant of at least 4,000 mw with constituent

units of 800 mw or more), but those issues seem to have been sorted

out," he adds. To some extent, yes. BHEL's Chairman &

Managing Director, Ashok K. Puri, for instance, has struck deals

with France's Alstom (for boilers) and Siemens (turbine generator

sets) for supercritical plants for ultra mega power projects.

More importantly, he's lined up Rs 1,000 crore for acquisitions

abroad. "India must learn from the Dabhol debacle and acquire

technology. Otherwise, we could be investing billions on buying

equipment and not know how to run them," he says. BHEL's

topline surged 41 per cent last year to Rs 14,525 crore, and this

year it may cross Rs 20,000 crore.

-Kapil Bajaj

|

| BillDesk's Kaushal: From Arthur Andersen

to India's leading electronic payment gateway |

BillDesk

They are Killing the Bill Queues

In early 2000,

three Arthur Andersen executives-M.N. Srinivasu, Ajay Kaushal,

and Karthik Ganapathy-quit their cushy jobs to launch a start-up

out of a small house on suburban Mumbai's Carter Road. The trio

thought they had a great payment management service idea (read:

third-party bill collection) and, hence, kicked off IndiaIdeas.

And, boy, were they right. Today, as many as 25 banks (Citi, SBI,

HDFC Bank, among others) and more than 100 companies (including

Hutch, Reliance Energy, Tata AIG) are part of IndiaIdeas' electronic

payment gateway, BillDesk. "We are the largest player with

over a million bills processed every month," says Kaushal.

BillDesk already has 240 employees across 30 cities, but has plans

of ramping up operations. "There is a huge potential. The

share of online billing, which is less than 2 per cent, is expected

to go up to 6-8 per cent in the next three to five years,"

says Kaushal. There are plenty of believers in BillDesk's business

model. In June this year, SBI and us-based venture capital firm

Clearstone Ventures invested $7.5 million (Rs 34 crore) in the

company. So, expect an IPO a few years down the line.

-Anand Adhikari

DLF

The IPO is in Sight Again

|

| DLF: Its troubled IPO issue could be

resolved shortly |

The Delhi-based

real estate giant DLF's initial public offering (IPO) may well

have been a top contender for the most talked of non-event of

the year. The company had been planning to roll out one of India's

biggest-and realty's biggest-IPOs aimed at raising more than Rs

10,000 crore, until its minority shareholders cried foul and forced

SEBI to show the red flag. When BT went to press, DLF, which had

been valued between Rs 77,200-85,300 crore, had an extra-ordinary

general body meeting coming up on November 14 to settle the issue.

That means the IPO is in sight again. "If the minority shareholder

issue is resolved, then the public offer could hit the market

during the January-March quarter," confirms Rajeev Talwar,

DLF group's Executive Director. The IPO, however, is not the only

reason why DLF has made it to our list. The other reason is, of

course, the real estate boom. The Indian real estate market estimated

at $40-45 billion (Rs 1.8-2 lakh crore) is expected to grow at

20 per cent compounded annual growth rate over the next five years

or so, according to UBS Investment Research. And DLF has plans

for everything from houses to commercial buildings to SEZs. "Eventually

each of (these) verticals should become large enough to become

separate companies," says Talwar. Now, that is some ambition.

-Shalini S. Dagar

|

| All smiles and why not? Prasad (L) &

Satish Reddy, MD |

Dr Reddy's

The Recipe is Working

It's possibly

the highest-ever quarterly sales announced by an Indian drug company.

For the second quarter of this year, Dr Reddy's Labs announced

a year-on-year 245 per cent growth in topline to Rs 2,004 crore

and a 214 per cent jump in net profits to Rs 280 crore. If all

goes well, Dr Reddy's will be pushing a billion dollars in revenues

before 2007 is rung out. "The acquisitions added a lot of

firepower to the business coupled with a few upsides," says

company CEO, G.V. Prasad. The new acquisitions such as betapharm

fetched a fifth of the Q2 revenues, and international sales made

up an impressive 88 per cent versus 61 per cent same period last

year. There are two other reasons to watch Dr Reddy's: One, its

generic version of GSK's $1-billion drug Zofran (an anti-emetic),

Prasad says, is likely to get an approval. That could mean Rs

225 crore in profits during the exclusivity period. Two, one of

its new molecules (balaglitazone) for treatment of diabetes is

expected to enter phase III of clinical trials over the next six

months, making Dr Reddy's India's first company to have a phase

III asset. Also, Prasad isn't ruling out more acquisitions abroad.

-E. Kumar Sharma

Ginger

Smart Basics for Road Warriors

|

| Ginger, Bangalore: This no-frills budget

hotel has been an instant hit |

It was an idea

borrowed straight out of C.K. Prahalad's bestseller on bottom

of the pyramid (bop) marketing. No surprises, then, that Indian

Hotels' budget hotel subsidiary, Roots Corporation, is pleased

as punch with the results. Its no-frills budget hotel Ginger,

launched in June 2004, has been a roaring success. All Ginger

properties (Bangalore, Mysore, Haridwar, Pune, Trivandrum and

Bhubaneshwar) have a simple layout and design with around 100

rooms in each property. Since land price is a key determinant

of the eventual tariff, most of these hotels are located on the

outskirts or at least outside the central business district, where

prices tend to be more reasonable. There's no room service or

travel desk or swimming pool, but the rooms have everything a

budget-conscious business traveler would need, including Wi-Fi.

Also, there's a closed circuit camera in the lobby of all Ginger

hotels for greater security. There are just two types of rooms,

single bed (180 sq. ft) and double bed (220 sq. ft) with transparent

prices of Rs 999 and Rs 1,199, respectively that are uniform across

properties. "We call our model smart basics, which means

good quality at affordable prices," says Prabhat Pani, CEO,

Roots. By March 2008, Ginger hopes to be in 30 cities. Road warriors,

rejoice.

-Venkatesha Babu

|

| Coming soon: New-look Delhi & Hyderabad

airports, courtesy GMR |

GMR Infrastructure

The Long Road from Jute to Airports

If the Hyderabad

airport gets up and running by April 2008 and Delhi too sports

a spiffy new one by 2010, air travellers will have one Bangalore-based

company to thank: GMR Infrastructure. The Hyderabad airport is

a Rs 2,284-crore project, while Delhi's has a cost of Rs 7,000

crore. That should make GMR one of the biggest infrastructure

developers. For a company that entered infrastructure only in

the 90s, GMR has been able to bag some big projects. The airports

apart, GMR has landed a number of road projects under the Golden

Quadrilateral project. Focussing on project development, as opposed

to mere execution, has enabled GMR, which once was in the jute

business, to build assets worth Rs 15,000 crore from Rs 900 crore

in 1999.

GMR executives say that the group has a healthy

blend of fixed and volume-driven revenues. Investors in the newly-ipoed

company have nothing to complain about. The stock is trading 70

per cent above the issue price of Rs 210. "As India's infrastructure

needs explode, GMR Group will strive to meet them," says

Chairman G.M. Rao. Investors expect as much.

-Venkatesha Babu

Idea Cellular

Its Time Has Come

|

| Idea Cellular's Aga: Man to watch |

For Sanjeev Aga,

the last several months have been incredibly busy. After the Tatas

sold their stake in Idea to the Aditya Birla Group, the cellular

services provider went on an overdrive and launched operations

in three new circles (Rajasthan, Himachal Pradesh, and Uttar Pradesh-East),

taking the tally to 11. Between March and September this year,

the subscriber base jumped 54 per cent, and first half revenues

rose 38 per cent to Rs 1,906 crore and net profit by 160 per cent

to Rs 192 crore. "We are in a very strong position in the

circles we operate and our renewed focus will help us to power

ahead," states Aga, who has taken over as Idea Cellular's

Managing Director from his earlier assignment as MD of Aditya

Birla Nuvo.

The big story for Idea is yet to unfold,

though. With a pan-India launch on the anvil and licence awaited

for the National Long Distance Service (NLD) service, growth-and

a place alongside Bharti, Hutch and Reliance Infocomm-appears

inevitable. Then, there's the IPO story. With Idea already valued

at Rs 12,000 crore following private equity investment from Providence

Partners and ChrysCapital and its footprint growing, the company

can only get more valuable. "To us, nothing is more important

than Idea being a top-notch company. We want it to be a class

act," says Aga in modesty. A good idea, too.

-Krishna Gopalan

|

| Kale's Jain: Looking to leverage the

company's position to cater to the entire travel industry |

Kale Consultants

Reprogrammed, But Keeping Its Fingers Crossed

It's possibly

the only reinvention of its kind in the Indian it industry and

if it works, it may well inspire several other small companies

to find their own niches. Founded in 1986, Kale continued to operate

in a number of industry verticals but without achieving viable

scale in any of them. Starting 2001, the Pune-based company began

spinning out all the verticals (banking, generic software, and

healthcare) and selling them to willing buyers. In October 2004,

it acquired Cognosys, a travel solutions company, and merged it

with itself. "We focussed on the airline vertical as we've

had some global exposure there," says Vipul Jain, CEO &

MD, Kale. With the result, the Rs 73-crore firm has emerged as

a focussed airline software and BPO player, offering outsourced

services to airlines that include passenger revenue accounting,

cargo management and travel solutions for travel companies. Over

the years, Kale has shifted to a 'per transaction' model from

the "licensing model' it followed earlier. "We have

the foundation. Now we are looking to leverage our position to

cater to the entire travel industry," says Jain. Investors

aren't yet convinced, since the stock has stayed stoically between

Rs 90 and Rs 100 for a year now. Just the same, it's a reinvention

worth watching.

-Shaleen Agrawal

Larsen & Toubro

A Makeover on Many Fronts

|

| L&T: All set to become bigger and more

diversified |

Not too far in

the future, Larsen & Toubro may look very different than what

it does today. While its flagship engineering and construction

business still fetches 70 per cent of the revenues, Chairman &

Managing Director A.M. Naik seems determined to turn the conglomerate

into a bigger and even more diversified entity. Among L&T's

new forays are the ones into shipbuilding, defence equipment,

and nuclear power. Simultaneously, Naik is pushing L&T into

newer markets overseas in the core business. For instance, West

Asia and China, he says, will be important makets. "Gulf

(alone) will bring in $1 billion (Rs 4,500 crore) in revenues

next year," says Naik. In power, L&T Power Development

is moving from merely building power plants to running and maintaining

them, thus creating steadier revenues. L&T Infotech, the IT

arm, is planning to add 3,000 employees to the existing 8,000

by March 2008. Some time soon in the future, Naik expects 60 per

cent of L&T's revenues to come from projects, 30 per cent

from manufacturing, and 10 per cent from services, against 75,

20, and 5 per cent, respectively, at present. "Infrastructure

is a long-term play and the most demanding one," he says.

And few Indian companies can claim to have the sort of execution

skills that L&T has.

-Shaleen Agrawal

|

| Maruti: Khattar has a bolder diesel

plan this time around |

Maruti

Driving (Back) Into Diesel

As a rule, a

company never gets to be on our "to watch" list for

two years in a row. If we are breaking that rule for Maruti, it's

for good reason. Next year is when the market leader will ride

back into the diesel segment with a vengeance, putting pressure

on Tata Motors' small car, the Indica. This will mark Marurti's

second foray into diesel. The first attempt, made on the back

of Zen diesel, didn't quite work. This time around, Maruti is

dropping a 1.3-litre diesel engine into the hot selling small

car, Swift. Between the first and second attempt, Maruti has increased

car making capacity from 4 to 6 lakh per annum, and also set up

a diesel engine plant at Manesar near Gurgaon with an annual capacity

of 3 lakh engines. "I look forward to 2007 with cautious

optimism. There has been strong growth in this fiscal so far.

This is a decisive year when many of our new projects go on stream,"

says Maruti's MD, Jagdish Khattar. The small diesel car segment

accounts for 13 per cent of the car market. Expect the fight between

Maruti and Tata Motors to be bruising.

-Kushan Mitra

Praj Industries

Betting on Biofuels

|

| On Chaudhari's mind: A Rs 1,000-crore

company by 2010 |

Be it the US

or India, venture investor Vinod Khosla is a tough cookie. So,

when Khosla, a former partner at Kleiner Perkins, decided to pick

up a 10 per cent stake in a little-known Pune-based company, Praj

Industries, people sat up to take note. Some years ago, India's

stock market bull, Rakesh Jhunjhunwala, had also picked up an

identical stake in Praj. What's special about the Rs 267-crore

company? To put it simply, ethanol. Praj, promoted by IIT alumnus

Pramod Chaudhari, specialises in setting up ethanol machinery

and has executed projects across five continents. "We are

the only company out of India offering end-to-end solutions in

ethanol," says the 57-year-old Chaudhari. Over the last 10

months, Praj has received an equal number of export orders, especially

from the US. Chaudhari's target: Make Praj a Rs 1,000-crore company

by 2010. If ethanol-blended fuel takes off in the future, Praj

will soar in tow.

-Anand Adhikari

|

| Reliance Fresh store in Hyderabad: Just

a curtain-raiser |

Reliance Retail

The Game Changer

Back in may

this year, reliance fresh was just a gleam in the eye of executives

at Reliance Retail. By the end of October, they had launched the

first store on Hyderabad's Banjara Hills. That's just one reason

why Reliance is like an elephant in India's organised retail industry.

The other is, of course, the fact that no one else has the kind

of investment plans hat Reliance has: Rs 25,000 crore across formats

and across categories, ranging from produce to groceries to footwear

to consumer durables, and vertically integrated supply chain.

In 2007 (and beyond) more of Reliance's retail strategy will unfold,

potentially rattling existing players. "The end goal,"

says Raghu Pillai, President and Chief Executive (Operations and

Strategy), Reliance Retail, "is clear and that is to cover

across all formats, 100 million sq. ft of retail space and have

a topline of Rs 1 lakh crore by 2010-11." Seems patently

Reliance.

-E. Kumar Sharma

Shriram Transport Finance

Trucking On All Over

|

| Sridhar: He's hitched his stars to the

truck financing business |

Financing commercial

vehicles isn't a terribly exciting business to be in. Three-fourths

of the fleet owners who get their trucks financed own less than

five trucks. Most of them are semi-literate, but that's not the

only reason why they aren't the easiest of customers to handle.

Yet, if private equity investors such as Citi, Newbridge and ChrysCapital

have been falling over each other to get a piece of Chennai-based

Shriram Transport Finance, it's because the company knows how

to make the business throw up oodles of cash. With Rs 9,000 crore

in assets, Shriram churns out net interest margins of 9 per cent

and logged a net profit of Rs 140 crore last year. And according

to a study commissioned by Shriram, the opportunity for truck

financing is set to boom. The study estimates a minimum potential

demand of Rs 45,000-50,000 crore over the next 10 years. Of that,

financing pre-owned trucks less than four years old and trucks

between five and 10 years old, segments where Shriram dominates,

will account for Rs 40,000 crore. Besides, the firm has also started

financing new trucks, where it already has a 10 per cent share.

"All the new trucks that are bought will come to us for modernisation

funds once they are four years old," says the company's Managing

Director R. Sridhar. By March next year, the company will grow

assets to Rs 10,500 crore. Moral of the story: Businesses needn't

be exciting; they only need to be profitable.

-Nitya Varadarajan

|

| Muthuraman: It's all about synergies |

Tata Steel

Now Comes the Tough Part

At Bombay House,

the Tata Group headquarters, celebrations over the $8-billion

(Rs 36,800 crore) Corus acquisition are long over. B. Muthuraman,

Tata Steel's Managing Director, is already hunkering down for

hard work next year. "For us, the most important thing is

to complete the deal in time (by January 2007) and then being

prepared for the synergies to be worked out thereafter,"

says the man about India Inc.'s biggest overseas acquisition so

far. What Tata Steel makes of Corus-a much larger steel manufacturer,

but much less efficient than the Indian buyer-will be important

not just for the Tatas, but for Indian industry in general. After

all, Tata Steel will be raising $6 billion (Rs 27,600 crore) in

debt to fund the purchase, and how it handles a downturn-if any

comes along-will be keenly watched by analysts and others. "We

will be sharing our best practices. There will be operational

synergies, market synergies, synergies on logistics management

and on so many other areas," says Muthuraman. One way or

another, it has all the makings of a B-school case study.

-Ritwik Mukherjee

TransWork

New Worlds to Conquer

|

| Kanwar (R) and his team: Global ambitions |

A year ago, transworks,

the Aditya Birla group's BPO arm, was just one of the 200-odd

BPO companies in India. But on July 3 this year, the Mumbai-headquartered

operator changed all that with just one deal when it acquired

the Santiago, Chile-based Minacs for $125 million (Rs 558 crore

then) and in the process shot up the bpo rankings to #2. From

being a company with revenues of Rs 164 crore, TransWorks metamorphosed

to a Rs 1,350-crore vendor. "With the acquisition of Minacs,

the company (which has more than doubled the headcount to 10,000)

operates out of 25 centres spanning North America, Europe and

India, and delivering services in 28 languages," says Atul

Kanwar, Managing Director, TransWorks. "We will be adding

facilities in Canada, India & the Philippines in the near

term to deliver an expanded range of services and solutions to

our global customers." Translation: watch TransWorks.

-Rahul Sachitanand

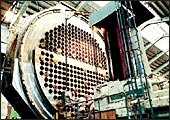

|

| Videocon's target: First Thomson (plant

above), now Daewoo |

Videocon Industries

Raider in a Hurry

When it comes

to numbers, Venugopal Dhoot rolls them out faster than TV sets

off assembly lines in his factories around the world. "We

have set a goal to be a $10 billion (Rs 45,000 crore) company

in the next three years (from Rs 18,000 crore today) and by December

2007, the hope is to have a market cap of Rs 25,000 crore (compared

to about Rs 11,000 crore at present and Rs 5,000 crore last year),"

says the Chairman of Videocon. If not too many today doubt Dhoot's

determination, if not numbers, it's because he's won everyone's

respect in a spectacular fashion. In August last year, he acquired

Thomson's global picture tube business for Rs 1,300 crore and

Electrolux Kelvinator India for Rs 400 crore, and is now close

to gaining a controlling stake in Korea's debt-ridden Daewoo Electronics

in a deal worth Rs 3,300 crore. "The next three months will

see some consolidation happening, but that doesn't mean we will

go slow on acquisitions," declares Dhoot. "Next year

is going to be hectic." Better believe him.

-E. Kumar Sharma

| HOW THE 20 COMPANIES TO WATCH IN 2006 HAVE

PERFORMED |

Air Deccan

Has not had it easy. Its IPO in May drew a lukewarm response,

forcing it to reduce its price band. On June 30, 2006, reported

losses to the tune of Rs 340 crore for a 15-month period,

despite which the airline has announced it would offer one

lakh tickets for as low as Rs 9.

Bilcare

In October this year, it acquired DHP, a UK-based clinical

trials services provider, for $5 million (Rs 22 crore).

The company intends to evolve itself into a life sciences

knowledge partner.

CavinKare

CavinKare is entering the home hygiene market with

the launch of Tex, a toilet cleaner, tapping the Rs 100-crore

toilet cleaner market. This year, the CavinKare group's

turnover is expected to reach Rs 575 crore as against Rs

572 crore in '05-06.

Centurion Bank (now Centurion Bank

of Punjab)

The bank, which completed its merger with Bank of

Punjab in September last year, is currently in the news

for its merger with Lord Krishna Bank, which has run into

some rough weather.

DQ Entertainment

Plans to raise around $100 million (Rs 450 crore)

to help its private equity investors exit and support its

major expansion plans. It is also opening new facilities

both within and outside the country.

Geometric Software

In October this year, it acquired the engineering

services division of US-based Modern Engineering for close

to $32 million (Rs 144 crore), with about $7 million (Rs

31.5 crore) in working capital loan. Just a few days after

the acquisition, there were reports that the Godrej Group

now wants to sell its stake (18.5 per cent valued at Rs

150 crore) in the company and is looking for potential buyers.

|

| GVK's G.V. Sanjay Reddy |

GVK Biosciences

Things are still looking up for a company that was

one of the pioneers of bioinformatics in the country. In

January, Wyeth Pharmaceuticals outsourced research services

to GVK Bio; the deal was reportedly worth $8-10 million

(Rs 36-46 crore).

Indian Rayon (now Aditya Birla Nuvo)

The company has had a good year, especially the last quarter,

reporting a nearly 40 per cent jump in profits in the corresponding

quarter from the previous fiscal.

Maruti Udyog

The government looks set to divest its 10.27 per cent stake

in the company and is awaiting the Cabinet's nod. The launch

of an LPG version of WagonR by Maruti Udyog in July has

done wonders for the 'tall boy' multi-activity vehicle,

with sales more than doubling. Sales of WagonR Duo touched

13,200 in October, up 116 per cent over the July numbers

of 6,100 units.

Midas Communication Technologies

In June this year, it came out with a new switch that enables

faster deployment of cable internet. Called Catius, the

new solution is targeted at the local cable operators (LCO)

segment.

NTPC

Is hiring aggressively; plans to hire at least 1,000 people

every year for the next three years. NTPC seems on course

to add 22,000 MW capacity by 2012.

Rico Auto

Has benefited from the growing auto story. Like its competitors,

Rico Auto is scaling up from producing individual components

to making assemblies and systems. Has, however, registered

a modest 14 per cent topline growth in Q2 this fiscal with

a decline in bottom line (largely attributed to rising aluminium

costs).

State Bank Of India

Was the only large PSU bank to register a fall in its net

earnings (its net fell by 2.5 per cent) in Q2. The stock

has, however, done well and has risen by about 20 per cent

in the last six months. The bank, India's largest, is eyeing

a global presence, especially in markets like the West Asia.

Symphony Services

The $100-million (Rs 450 crore) firm is in an expansion

mode; in June this year, it opened a second facility in

Bangalore with plans to double capacity in Pune. It may

also set up base in China. Symphony has registered 170 per

cent compounded annual growth from 2002 to 2005.

|

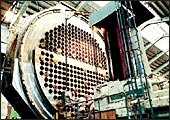

| Tata Steel plant in Jamshedpur |

Tata Steel

After acquiring Anglo-Dutch giant Corus, the company is

all set to enter the Fortune 500 list, only the seventh

Indian company that would be on the list. The combined entity

would have revenues of over $22 billion (Rs 99,000 crore).

The company hopes to return to its annual margin of about

30 per cent in the next four to five years.

Tejas Networks

This leader in next generation optical networking products

has acquired $20 million (Rs 90 crore) in new equity financing.

It plans to use this money to fund its international expansion

plans and for R&D to develop packet-aware optical products.

The company is eyeing Rs 250 crore in revenues this fiscal,

up from Rs 130 crore during 2005-06.

TKML

It says it plans to launch a small car in the next two-to-three

years and would look at a 10 per cent market share in the

segment by 2010. It also plans to set up a second facility

with a capacity of 150,000 units in Karnataka near its existing

plant in Bidadi, near Bangalore.

United Spirits

After reaching the US and Europe, UB's Vijay Mallya is all

set to enter China and Russia. In September this year, UB

acquired France-based wine manufacturing company Bouvet

Ladubay, which gave it a strong distribution network to

sell its products in the European and American markets,

while helping tap the rapidly growing market for wines in

India. The company has a 55 per cent share in the IMFL category.

Vimta Labs

In January this year, the company decided to raise Rs 125

crore to fund the second phase of expansion. The company

inaugurated its new facility in March in Hyderabad.

WNS

When WNS Holdings listed on the NYSE in July 2005 (it raised

$224 million), Indian stock markets were in the grip of

a downturn after the May-June crash. But the stock has held

up and is trading at 50 per cent higher than the price it

was listed at. The company soon plans to enter East Europe

and does not rule out using part of the money raised for

acquisitions.

|

|