|

ADVERTISING

They Also Make

TV Ads

There may be no finesse in their ads, but

a several hundred-crore industry has spawned around Mom-and-Pop brands

that use M-and-P agencies to advertise on regional channels.

By Debojyoti

Chatterjee & Vinod Mahanta

|

|

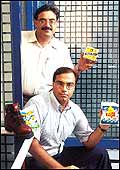

Sandeep Bhatia &

Vivek Sethi

Prime Time Communications

Theirs is a television production house, spot-marketing organisation,

and ad agency rolled into one. And they are not short on jargon

either. |

The office of sweet advertisers is a

one-room cubby hole on the 13th floor of a high-rise building in New

Delhi's crowded Tolstoy Road. It is from this strategic-bunker that

Rajender Nanchahal, a portly 50-year-old who looks more like the

owner-manager of a neighbourhood store of the kind that are ubiquitous in

India, rules over his establishment of three, a peon, a receptionist, and

a creative executive (the appellation is a noun, not an adjective).

Nanchahal's desk is littered with prints of the ads he has made for the

small screen: Taj Reetha detergent, Mugli Ghutti 555 (a tonic for

children), Haridarshan Dhoop incense sticks, and Simco hair fixer.

Nanchahal doesn't know it-and he probably

couldn't care less, as the fact that follows is of little utilitarian

value-but he is representative of a growing breed of advertising

entrepreneurs. Like Sumitava Ghosh who runs Ghosh Publicity in Kolkata,

Lekha Ratnakumar of Lekha Productions, in Chennai, Vandana Banerjee who

owns Hyderabad-based Aakarshana Advertising, and a couple of hundred

others.

Nanchahal, Ghosh, and Ratnakumar don't gripe

about the slowdown in the advertising business; they are busy counting

their profits. The first is reluctant to talk numbers, the second doesn't

need much persuasion to boast that he nets between Rs 14 lakh and 16 lakh

a year (not bad for a one-man operation), and all the third will say is

that he releases Rs 3 crore worth of ads to one Tamil media-vehicle every

year. Says Amitava Basu, marketing head of CTVN, a local Bengali channel:

''Around 75 per cent of our revenue comes from local brands. And most of

it is in the form of retail advertising-anything from a saree shop to

private tutorials.'' And the bulk of such advertising is done by local

agencies.

|

|

Rajender Nanchahal

Sweet Advertising

Head of a three-man agency, Nanchahal is part of an invisible Rs

500-900 crore industry |

Kanchan Datta is one entrepreneur who

anticipated the trend. In 1997, Datta, then 30, and a manager at Saatchi

& Saatchi's Bangalore-office handed in his papers and decided to start

his own agency, Inner Circle in Kolkata. His peers mocked him, but four

years down the line Datta has a 10-man operation, billings of Rs 2 crore

and his feet firmly on terra firma. ''I felt that if one had to do

something (on one's own in advertising) it would have to be regional; the

signs that big-time ad spending was slowing down were clear even when I

started out.''

Agencies like Inner Circle owe their

existence, and sustenance, to vernacular-language television channels and

the local print media. Between 1996 and 2001, the number of these channels

has increased from 5 to more than 20. And advertising rates have dropped,

from a few thousands (for a 10-second spot) for popular vern channels like

Sun and e-TV, to a few hundreds for those like CTVN and Tara. ''Small-time

advertising agencies feed off vernacular television channels; they simply

create an ad, and let the client negotiate the rates with the channel,''

says Pravin Tripathy, the head of Starcom India, Leo Burnett's media arm.

Not all agencies of this kind are content to

merely create the ad; some do offer media-planning and media-buying

services to their clients. And not all are pure-advertising agencies. Some

like Delhi-based Prime Time Communications are TV production houses,

spot-marketing organisations, and advertising agencies bundled into one.

All types of agencies belong to this genus, though, slip under the radar

of the advertising industry in all its organised glory. Most agencies like

Sweet Advertisers aren't accredited with ins (Indian Newspaper Society);

few are members of AAAI (Advertising Agencies Association of India); and

it is a rare representative of this species that makes an appearance in

A&M magazine's annual advertising survey, a numerical-weathervane in

an industry where most people hate numbers.

Conservative industry-minders put the size of

the unorganised advertising business at Rs 500 crore. Others believe it

could be as high as Rs 900-odd crore. But, as Tarun Rai, Senior

Vice-President and General Manager, HTA admits, there's no denying the

existence of this industry. ''The number of agencies making a living from

producing ads for small companies could range from 100 to over 400. But

they are out there.''

Plainspeak, ageing starlets, and focussed

clients

The names David Ogilvy, Jean Noel Kapferer,

and John Philip Jones mean little to Ghosh, Rajkumar and their peers.

Some, like Sudeep Bhatia of Prime Time do take a stab at mouthing

impressive sound-bytes. ''The advertising plan (for a local brand) has to

be unique (Sic), keeping local nuances in mind.'' Or, ''The logic behind

using starlets in ads is that some products have no differentiator (Sic),

so a known face becomes the differentiator.'' The majority, though, is

under no delusion about what it does. ''I'm not into advertising; I'm into

publicity,'' confesses Sumitava Ghosh of Ghosh Publicity. ''All I need is

a couple of actors from the sitcom circuit to endorse the product. And

lining up a guy with a video camera is neither difficult nor expensive.''

The starlet, and her male equivalent,

whatever he be called, are recurring themes in this genre of advertising.

Prime Time had Deepti Bhatnagar in the Shimla Paan Masala ad and Sweet

Advertisers roped in Dara Singh and Rajeshwari for a commercial for

Shaktibog Atta. ''These people work for between Rs 15,000 and Rs 30,000 a

shoot,'' says Nanchahal. ''People like seeing these stars and starlets,

and the companies believe they get their money's worth.''

| A

Rough Guide To Regional Advertising-Related Numbers |

|

100% |

Ads

on Engligh language channels that are of national brands |

|

80% |

Ads

on mainstream Hindi entertainment channels that are of national

brands |

|

75% |

Ads

in strong vernacular (other than Hindi) language channels that are

of regional brands |

|

70% |

Ads

on other Hindi channels that are of regional brands wishing to go

national |

|

70% |

Ads

for regional brands that are created by smaller advertising agencies |

|

20% |

Ads

on mainstream Hindi entertainment channels that are of regional

brands wanting to go national |

That most clients certainly do. Santoshi

Kanjilal, the owner of Mohini Mohan Kanjilal, one of Kolkata's oldest

garment retail outlets believes simple ads on local channels are just what

the marketing maven ordered. ''We cater not to the sophisticated

customers, but to those from semi-urban Bengal. In fact, a sophisticated

ad might actually frighten my customer away.''

Then, there are companies that insist there

are several advantages to actually using smaller agencies. Ashwani Subba

Rao, the managing director of Ashwani Homeo and Ayurvedic Products, a

Hyderabad-based company that owns the best-selling Ashwani brand of hair

oil (promise, no more Ashwanis) is one such. ''We don't go for the larger

ad agencies, because they do not think we are big enough for them. All

they are worried about is monthly billing.'' Vuyyuru Satish, the managing

director of an eponymously named beverage company that makes and sells the

Biky's brand of club soda popular in parts of Andhra and Orissa,

quantifies that billing. ''We spend between Rs 50,000 and Rs 60,000 a

month on ads, but a bog agency will not work for any company that offers

them billings less than Rs 300,000 a month.''

Small agencies focussed on regional brands

can work for less because their overheads are lower. Ratnakumar-purely for

kicks, one of his large clients is a lingerie/night-wear brand called

Rasathe Darling-employs three people, his daughter, and two other

relatives. J.A. Khan, runs Media House Advertising & Marketing

(2000-01 billings-Rs 1 crore), a one-man outfit. ''My only investments

have been in a car, a mobile phone, and a computer. I put in between 15

and 18 hours a day.''

Limited aspirations, size-related issues,

and an uncertain future

None of these smaller agencies have larger

ambitions. Vimal Anand of Bigdot, an agency with billings of Rs 5 crore is

pretty clear about his agency's place in the advertising food chain.

''Large companies have two agencies, one for brand-advertising, and

another, like us, for below the line activities. We have our limitations;

we don't talk strategy to clients, and we don't have the media-clout the

biggies do; but what we do, we do well.''

There's little these agencies can do,

however, when the brands they handle become large enough to attract the

attention of bigger agencies. For instance, Look Ads, which handled

Sumangal, a leading men's store brand, for atleast eight years creating

major brand awareness for the store in Kolkata lost the account to HTA,

once the brand became bigger. Worse, larger agencies in the quest for

growth may think it worth their while to take on smaller regional

accounts. ''What is small today may be big tomorrow,'' says Aditya Atri, a

Vice-President at McCann Erickson. ''We have to convince this client that

we wish to partner him and (that we are) not one of those agencies chasing

billings. Only then can we succeed in the lesser metros and other towns.''

That puts a question mark over the future of

small agencies surviving off regional and local brands. Right now, though,

all's well in the lower reaches of India's advertising industry. Air-play

on vern channels is still going cheap, clients still think loud music,

bright colours, and happening starlets will sell their product (as long as

the cost involved isn't too high), and there are enough small-time

agencies to fulfil this need. Their work may never win a Golden Lion at

Cannes but what the heck, it is advertising too.

additional reporting by E.

Kumar Sharma and Nitya Varadarajan

|