|

Lying

on the CEO's desk, it was a hardbound book, with the insurance business'

most famous face, Warren Buffett, prominently displayed on the cover.

Nobody could miss it, Homi Bharucha knew. And as CEO of Liberty

Life's Indian operations, he was pleased by that. Just the other

day, he had e-circulated a quote from the 'sage of Omaha': "In

a business selling a commodity-type product, it's impossible to

be a lot smarter than your dumbest competitor." Lying

on the CEO's desk, it was a hardbound book, with the insurance business'

most famous face, Warren Buffett, prominently displayed on the cover.

Nobody could miss it, Homi Bharucha knew. And as CEO of Liberty

Life's Indian operations, he was pleased by that. Just the other

day, he had e-circulated a quote from the 'sage of Omaha': "In

a business selling a commodity-type product, it's impossible to

be a lot smarter than your dumbest competitor."

Yet, the two others in the room-Dharmesh Raizada,

Vice President (Marketing), and Rajesh Pandit, Vice President (Finance)-were

a little baffled by the book's presence. Hadn't they been through

all that?

The strategy had been finalised months ago.

Liberty had resolved to be a 'quality' player, rather than a price

competitor or marketshare maximiser. The priority was to ensure

the prudential solidity of the business. This was to be done by

rejecting the temptation of soaking in cash by writing policies

for all and sundry, and covering only those risks that it understood

well. On every policy, the premium collected (the 'price') would

have to be high enough to meet pay-out obligations and still leave

a profit margin.

Even then, it would take seven years of projected losses before

break-even. The business was barely over a year old. The good part

was that the strategy had effectively geared Liberty for long-term

success. "Selling policies is not the end-game," Bharucha

had once told his team, "let price wars come and go, we will

sell insurance only when prices make fiscal sense, even if the moment

of truth-the payout-is decades away." This was what 'insurance'

was about. "It's not an investment fund with insurance thrown

in as a side-benefit."

The CEO's words were fresh in everyone's head.

Liberty did offer endowment policies, but its emphasis was on whole-life

and term deals, with suicide the only exclusion and 'critical ailment'

health coverage serving as the product differentiator. In all, it

had eight products, with nine ailment 'riders', which resulted in

some 250 combinations. In its first year of operations in India,

the company had assured a sum in excess of Rs 2,000 crore, collecting

some Rs 60 crore in premium revenue. That, from 75,000 policies-sold

by a team of 2,000 agents in twelve Indian cities.

|

"The typical executive worries more

about an artery clog-up than getting hit by a truck. When

we sell that, we sell"

|

"The basic idea is working," piped

up Raizada, to break the silence, "and people are telling our

agents that they want insurance only as a protection macintosh,

not as a savings fund. Six months back, our agents were going around

telling people this."

"Good," nodded Bharucha, "So

we've repositioned the concept, back to its original form."

"Sure thing," continued Raizada,

"and people are surprised that it costs just Rs 1,200 per year

for Rs 10 lakh of pure life cover. And we're ready to cover people

all their life, into three digits if need be."

"And the CEO of Liberty, whoever it'll

be then, had better not be drawing my face on a punching bag..."

quipped Bharucha, "remember, this isn't a country with a social

security net. Customers depend on us."

"Oh not to worry," said Pandit, "we're

rock solid on capital adequacy, over and above the solvency margin

kept with the RBI. And the investible corpus is mostly in low-risk

debt. Hell or high water, we'll be around, fulfilling commitments."

"Now, now, now... Pandit. What we have

is a high probability that we'll be fine. The chance of an asteroid

striking Earth is infinitesimal, but that outcome is not impossible,"

cut in Bharucha.

Raizada grinned, recalling the earlier discussion

they'd had over the gap between commonly perceived risks and scientifically

assessed risks. If people thought they were in greater danger than

they were, insurance would be the world's most rewarding business.

But reality was the other way round. "It's inauspicious to

talk about it, you see," sighed Raizada, "but those who

do think about mortality are the few who actually are most at risk."

Adverse selection. This was a problem that grew worse every time

a product was refined to meet a more specific need. Yet, refining

was the way forward.

Almost on cue, Subhash Raina, the chief actuary,

entered the room with a dossier marked 'Product Innovations'. If

Liberty was to play quality, then innovative policies were the only

way to gain an edge over rivals. But innovations required truthworthy

actuarial data to make risk estimates that would permit rational

pricing.

"I'm still unhappy with the numbers we've

got," said Raina. "The health scene is a mess. We're dealing

with intelligent guesstimates rather than true measures."

The lack of reliable billing systems had already

retarded the Indian health insurance sector (fake bill fraud was

rampant), and the same problem was keeping Liberty from making the

most of its critical illness riders.

"Whatever the risk estimates," said

Raizada, "the fact is that health riders address a genuine

need. The typical executive worries more about an artery clog-up

than getting hit by a truck. When we sell that, we sell, period."

"That's always been the case," said

Bharucha, narrowing his eyebrows.

"Yes," said Raizada, "but for

all the repositioning work we've done, the fact is that it's one

helluva task selling a pure life policy. Mortality has an uncomfortable

finality to it. Bring up health benefits, and people's face muscles

loosen up. The deal's through."

"Point taken," responded Raina. "The

issue here," he went on, "is the new ailment covers we're

proposing. These illnesses could strike anybody, really. Still,

some of that risk is pretty much man-made, given the changing lifestyles.

The hassle is, the available statistics are for a large population

that may not be representative of our target audience."

"What, for example, do we do about the

wild party animals who'll come running to sign up?" asked Pandit.

"Well," said Bharucha, "all

that is supposed to stabilise once we get a critical mass of policyholders

and the base of that risk exposure is big enough. But getting that

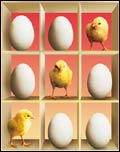

in itself is a major challenge. It's chicken-and-egg."

The others waited for the boss to finish. "Would

the market creation effort be worthwhile in the long run? At what

pace is the risk information quality increasing? Does the Indian

market give us the potential? How long before we get to critical

mass? How much downside loss getting there?"

"Loss-that's the word," said Pandit,

before rephrasing his other worries: "We could end up doing

all the brain and legwork and then have rivals undercutting us.

I'll be staring at Rs 20 crore in dead loss straightaway, and there'll

be no backing out."

"That's a probability," said Bharucha,

"just a probability. But somebody has to develop this market,

and playing the pioneer gives us the advantage of leading market

perceptions to suit our overall strategy. Let's be rational here.

If there's a half-chance of seeing an idea through that would be

of greater value than the loss in case of failure, I'm better off

going for it."

The question: Should Liberty Life go for health-covering

policy innovations?

1 2

|