|

|

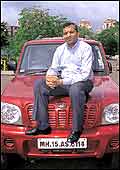

| Revving up: Tata Motors'

Ratan Tata (left) and M&M's Pawan Goenka are eyeing big

export gains |

Hear

that noise? Good guess, but no, it isn't the noise of the CityRover's

1.4 litre mechanical heart as the car does 0-60 in 11.5 seconds.

What you hear is the determined march of a clutch of Indian auto

companies as it ventures into the wide world beyond where sharks

like Toyota, gm, Ford, Harley, Honda, and Daimler-Chrysler (some

ailing, but sharks, all) rule.

There's Tata Motors, which is close to acquiring

South Korea's Daewoo Commercial Vehicle for around Rs 530 crore,

a move that, apart from helping the company make inroads into the

Korean market, will provide it with a convenient beachhead into

the Chinese one. This, from a company that has already started exporting

its small car, Indica, to the UK (badged CityRover) and will, over

the next five years, sell close to 100,000 of these through its

deal with Rover in the UK and Europe.

There's Mahindra & Mahindra (M&M),

which has identified seven overseas markets for its UTE Scorpio.

Two-wheeler makers such as Kinetic, TVS Motor, LML, and Bajaj are

in various stages of going global. Even Hindustan Motors is in the

process of setting up an assembly unit in Sri Lanka to manufacture

its flagship product, the 50-year-old Ambassador.

This wasn't in anyone's script. In the face

of global competition-there's no shortage of it in the local market-India's

indigenous auto industry was expected to surrender. The signs were

all there: falling marketshares, bleeding financial statements,

even dispirited chief executives griping about how their companies

hadn't been given a chance to get used to the rules of the open

market. Then, surprisingly, the industry pulled itself up by the

bootstraps: It focussed on restructuring operations, reducing costs,

and optimising its supply chain. "The plans of all these companies

are very real," explains Munesh Khanna, Managing Director,

NM Rothschild & Sons (India) Private Limited. "We (Indian

industry) are so cost conscious, and today, most input costs have

been taken care of, even the quality has improved. So, it's logical

to expand." That's just what the Indian auto industry is doing.

WHAT?

The products that are going global |

Indica Indica

The Indica is already being sold under the Rover marque in the

UK. Now, the Tata Group wants to take it to other developed

countries, including the US

Scorpio Scorpio

M&M wants to sell a quarter of the Scorpios it

makes overseas by 2005. It plans to target Ecuador, South

Africa, Middle East, China, Indonesia, Turkey and the CIS

countries by establishing assembling, even manufacturing facilities

in them

Pulsar Pulsar

Bajaj wants to vend the first motorcycle it developed

without help from partner Kawasaki in Indonesia, the Philippines,

and Brazil

Freedom Freedom

Two-wheeler maker LML is investing in joint ventures

in Colombia and Egypt that will make the Freedom, its first

home-grown motorcycle

Tata Motors' New Truck Platform

It's all very hush-hush now, but this truck, now under

development, will be sold with value-adds in developed markets

such as the US and Europe, and as a stripped-down version

in under-developed ones

Tata Motors' Rs 100,000 car

Chairman Ratan Tata's dream already has takers, such

as Senegal. Other African and Asian countries could lap it

up too

|

WHERE?

The countries Indian automakers are looking

at |

Countries in a similar

stage of economic or market development as India

South Africa, Ecuador, Egypt, Middle East, Malaysia, Sri Lanka,

Peru, Argentina, Singapore, Latin America, Mexico, Iran

Developed countries that cannot match

Indian costs

The US, the UK, Italy, Sweden, Germany, Spain, Australia,

New Zealand

Under-exploited markets

Colombia, Nepal, Zambia, Zanzibar, Zimbabwe, Bangladesh, Afghanistan

|

Quid Pro Quo?

"If we are allowing products to come in

from other countries," says Ravi Kant, Executive Director (Commercial

Vehicles), Tata Motors, "then it is in the fitness of things

that we go global as well." It isn't just a simple quid pro

quo, but yes, that's more or less what Indian companies are doing.

"In both commercial vehicles and passenger cars, Tata Motors

will seek to acquire meaningful international presence, either directly

or through regional alliances and partnerships," Ratan Tata,

Chairman, Tata Motors, had told Business Today earlier.

At the heart of such strategic intent is the

belief among Indian auto companies that the very factor that has

helped them succeed in India-a combination of high quality and low

price-can help them succeed in other markets as well. "The

Indian auto industry has gone through one of the most intense business

restructuring and cost cutting exercises seen in corporate India,"

says Jyotivardhan Jaipuria, the head of research at DSP Merrill

Lynch.

Then, there's the small matter about the world

being ready for made-in-India products. Pawan Goenka, Chief Operating

Officer (Automotive Segment), M&M, is just back from the Harvard

Business School where he was enrolled in an advanced management

programme. While at the school, he polled his class of 50 on its

perception of Indian products. The result pleased him. "Five

or six years ago, Indian products were simply not acceptable; gradually,

the perception is changing." "Indian products are increasingly

becoming acceptable (to global customers)," echoes Rajat Dhawan,

Senior Engagement Manager, McKinsey. However, Amul Gogna, Executive

Director of rating agency ICRA, believes that while Indian products

are gaining ground overseas, it will take some time before they

are universally acceptable. Why does Maruti export under the Suzuki

badge and Tata Motors under the Rover one, he asks.

Still, armed with their success in the domestic

market-M&M's Scorpio, Bajaj's Pulsar, Tata's Indica, TVS' Victor,

and LML's Freedom all fit the bill-and newfound aggression, Indian

companies are venturing forth. TVS Motor Company has been evaluating

the ASEAN (Association of South East Asian Nations) market in terms

of exports, joint ventures, even acquisitions. Pune-based Kinetic

Engineering is eyeing markets such as Indonesia, Vietnam, and Brazil.

Bajaj Auto, for its part, has a global strategy that includes going

overseas through distributors, establishing manufacturing bases,

and developing a product for foreign markets and launching it through

a joint venture (JV) partner. "On top of our priority-list

are Indonesia and the Philippines, where we want to set up manufacturing

facilities. After that, we will look at Brazil," says R.L.

Ravichandran, Bajaj Auto's VP (Business Development and Marketing),

who is spearheading its globalisation-drive.

Not every company has a global strategy that

is as ambitious as Tata Motors', Bajaj's, or M&M's. "We

are looking at small markets where there is no logic in setting

up full-fledged assembly plants," says Rakesh Jayal, Senior

Vice President, LML. In Colombia and Egypt, for instance, LML will

soon set up JVs with local firms that will take care of the assembling

and marketing. Kinetic Engineering, when it makes its move (in the

next six months or so, according to the company) will follow a similar

route. "You require a certain critical mass to set up a plant,"

says Manmohan Khera, Kinetic's Joint Managing Director. "We

could opt for a JV or a technical collaboration."

Rothschild's Khanna believes Indian companies

should be more aggressive and actively scout for acquisitions. He

points to Europe where several small- and mid-sized auto- and auto-component

companies are reeling under recessionary conditions. More than an

acquisition, however, the industry, says Goenka, desperately needs

one Indian product, any Indian product, maybe a computer, to become

a global success. Its success, he reasons, will rub off on Indian

automobiles too. Now, wouldn't it be ironic if this product happens

to be a car, UTE, truck, or motorcycle. Stranger things have been

known to happen.

|