|

Picture

this scenario: unholy cow is a thriving restaurant in uptown Mumbai,

doing a brisk turnover of, say, Rs 25 crore annually. One fine day,

the owner walks up to you and offers to sell it to you for Rs 40

crore. You tell him you will think it over. A few days later the

owner is back again, this time with an offer of Rs 60 crore. His

reason for upping the price is that restaurants serving beef steaks

have become the rage with the city's glitterati. You aren't convinced

and send him on his way. A few days later the proprietor is once

again back at your doorstep, this time with terror and alarm written

all over his face. Apparently, a fundamentalist group from a village

in northern India has descended on his restaurant, broken a few

panes and plates, and threatened to put him out of business for

serving beef. Distressed owner feels the end is near for his successful

business, and puts a price tag of Rs 15 crore on it. You sniff a

bargain here, and tell him it's a deal. The way you look at it is

that the fundamentalist louts aren't going to hang around for ever,

and once this short-term blip passes, people will once again queue

up for beef steak, ensuring the long-term profitability of the restaurant.

No, this story isn't an attempt to convince

you about the feasibility of the restaurant business (or the virtues

of eating beef). Rather, it's a stab at explaining the way stock

markets behave-to be more precise, how the Indian markets are behaving

currently, why the indices have been slipping over the past fortnight,

why it is no reason to panic, why, in fact, such a fall is healthy,

and how you could take advantage of the current dip in stock prices.

Since the benchmark index, the Sensex, has crashed by roughly 600

points since its peak of 6,696, the question on thousands of investors'

lips is: Is the bull run over? It's not. Sure, there are a few humps

to be crossed in the short term, but that doesn't mean that-like

the restaurant owner-you should consider cashing your chips. That

may mean you are kissing goodbye the prospect of further profits.

For, the markets are just correcting themselves, and if you stumble

upon many more like our distressed restaurateur in the market offering

to sell their stock (at a lower price), just go ahead and pick up

the bargains. For, as Motilal Oswal, Chairman and MD, Motilal Oswal

Securities, puts it: "Corrections are good for the long-term

health of the market. It has to consolidate now before the next

bullish phase."

Having said all that, don't expect the indices

to start shooting to the skies once you finish reading this piece.

A bout of volatility in the short term is on the cards, but the

shortest point is that the long-term fundamentals of the India story

are still intact, and the Sensex is poised for even higher levels

(higher than 6,600) in the not-so-distant future. "The Sensex

should move towards the 7,000 levels by November 2005," says

Andrew Holland, Chief Administrative Officer and Executive Vice

President (Research), DSP Merrill Lynch. "It should reach 7,200

by the year-end," adds Deven Choksey, Managing Director, K.R.

Choksey Securities. Here are five reasons why these gentlemen are

so bullish, and why it wouldn't hurt you to put on your investing

cap (and bull horns).

#1

Valuations are still favourable

|

"Consumption in India

will increase manifold due to demographic changes"

Amitabh Chakraborty

VP (Private Client Group)/Kotak Securities |

The difference between the current Sensex highs

and the peaks hit by the benchmark index of the Bombay Stock Exchange

(BSE) in 1992 or 2000 is that valuations in those years had soared

to astronomical levels. Not so today. Current valuations, of around

13 times projected earnings for the year ended March 2005, are almost

comparable with what stocks were valued at in 2002, when the Sensex

was hovering in the 3,000 range. To reinforce this point, in 2004

the Sensex moved by only 10 per cent, even as corporate earnings

surged by a remarkable 21 per cent.

That valuations are in the healthy zone isn't

backed just by historical data. Sure, when you compare India to

other emerging Asian markets like Korea, Thailand and the Philippines,

you may get the feeling that stock prices are a bit stretched. But

then, as Holland of DSP Merrill Lynch says: "You should also

note that economic and earnings growth is much quicker in India

than in most other emerging markets." The bottom line: If valuations

of Indian shares have gone up a few notches, that run-up is pretty

much justified. After all, India is the second-fastest growing economy

in the world, right?

#2

The breadth of the Indian markets is increasing

rapidly

Thanks to the recent IPO boom, we have some

extra-large-cap stocks, in the $5-billion (Rs 22,000-crore) range,

listed on the stock exchanges. For instance, the number of such

companies with a $5 billion-plus market cap has gone up from just

four in 2001 to 14 today. Similarly, in the $1-5 billion market

cap bracket, the number has more than doubled from 25 to 67 over

the same period. Indeed, the listing of large-cap companies like

ONGC, TCS and NTPC, to name just three, is increasing the breadth

of the market, thereby making the market more attractive for large

and long-term investors. What's more, these large listings are yet

to get reflected in the global indices (like Morgan Stanley Capital

Index) and hence India's current weightage doesn't do justice to

its market cap or free float. That is one reason why most FIIs are

overweight (compared to these benchmarks) on India now. With more

and more mega-size listings expected (Jet, BSNL, possibly Reliance

Infocomm, Hutch, Sony Entertainment and Sun TV in the private sector,

and possibly Power Grid Corporation and Power Finance Corporation

in the public sector), Indian markets can only get broader, providing

foreign investors with many more opportunities to park their money.

"India is no more a tiny place that global investors can ignore,"

says Manish Chokhani, Director, Enam Securities.

|

"The market has to consolidate

now before the next bullish phase"

Motilal Oswal

Chairman and Managing Director/Motilal Oswal Securities |

#3

Indians are consuming more, even as businesses

look outward for growth

If the Indian economy is, er, shining, it's

thanks in a large part to the contribution from industry, much of

which is riding on the domestic growth story. "Consumption

in India will increase manifold in the years to come due to the

demographic changes (the percentage of the youth in the population

is increasing)," points out Amitabh Chakraborty, Vice President

and Head of Research (Private Client Group), Kotak Securities. What's

more, it's not just the metros and mini-metros that are the playing

fields for a retail-led boom; the action is trickling into semi-urban

centres and smaller towns. What's also encouraging is that even

as Indians consume more, domestic companies in sectors like automobiles,

textiles, pharmaceuticals and information technology are looking

overseas for growth-not just in terms of direct exports, but also

by setting up or acquiring capacities in foreign markets. Result?

Unlike many emerging markets, the Indian growth story appears to

be benefiting from a healthy balance of domestic consumption and

export-driven growth, thereby making it less dependent than most

on the US. As a result, India is a great opportunity for investors

wanting to diversify away from the US economic cycles.

#4

The investment cycle has only just begun

After years of waiting, watching and belt-tightening,

Indian companies in various sectors ranging from cement to hotels

to commercial vehicles to steel are blueprinting expansion plans,

thereby signalling the beginning of a long-term cycle of capital

expenditure, which could go on for at least five-seven years. At

the same time, infrastructure investments in ports, highways, telecom,

oil and gas, and power are picking up steam, propelled in no small

measure by a reforms-committed government.

"With the capex cycle, industrial activity

will pick up and consumption (both industrial as well as retail)

will go up and it is very good for the economy," says Oswal

of Motilal Oswal Securities. DSP Merrill Lynch estimates that total

investment spend in the country will increase from $120 billion

(Rs 5,28,000 crore) in 2004 to $208 billion (Rs 9,15,200 crore)

by fiscal 2007. And don't forget that as a consumer benefiting from

the housing sector boom-triggered a few years ago by low interest

rates and greater affordability-you too will be doing your bit in

fuelling economic growth. For, when you buy a house you buy the

economy-be it steel, cement, electrical appliances, white goods,

furnishings, the works.

#5

Indians are still grossly under-invested in

equities

Dalal Street may appear more bustling these

days, but that means little if you consider that the overall equity

exposure of Indian retail investors is less than 1 per cent of their

total investments. Stock market excesses, scams and scandals of

the past, coupled with years of stagnation haven't exactly helped

in attracting Indians to equity. What also doesn't help matters

is that Indian investors typically enter only when they're very

sure, which means that the market would have already gained 50 per

cent by then, and they begin to dump their portfolio at the slightest

provocation, chastened of course by past crashes. "us investors

have lived through an 18-year bull market and, therefore, are attuned

to buying on dips. Indian investors conversely sell on every rise

since they have never seen any sustainable rally due to the excesses

of 1992. And that explains why more and more share ownership is

moving to foreign hands now," says Chokhani of Enam. Now, however,

with other assured return tax-free products drying up (RBI Relief

Bonds have gone, and the future of PPF is also under a cloud), Indian

investors have no option but to invest in the stock market. Other

factors will also contribute in increasing Indian ownership: For

instance, with more and more young people getting into the investing

class, the risk appetite also will increase. "The young will

be ready to take higher risk," says Chakraborty. Other long-term

monies, like pension funds, are also expected to enter the stock

market soon. If our market holds on to higher levels for a reasonable

time-and there's little reason why it won't-a bull market based

on Indian public ownership will commence. By then, fears of "hot

money" fleeing the country won't count for much, and hopefully

Indian investors will be more attuned to corrections than crashes.

-additional reporting by Priyanka

Sangani

| For A Few Dollars More |

| How "hot"

are the flows from foreign investors? Is the FII tribe a bunch

of fair-weather friends who are inclined to cash out when the

going's good, leaving the Indian market in the lurch? Even as

domestic investors wrestle with such doubts about the apparent

fickle punting habits of the pin-striped moneybags, the immediate

reason for the ongoing stock market correction may lie someplace

else. The fall in the Sensex indeed might have plenty to do

with the release of the minutes of the last US Fed meeting,

during which it was stated that interest rates were still too

low "to keep inflation stable". For good measure,

another comment (from Atlanta Fed president Jack Guynn) that

the US Fed has never pledged to raise interest rates only at

a "measured" pace (which hints at faster rate increases)

has also contributed to the FII outflow. To be sure, as the

accompanying chart indicates, in the past too sudden movements

of US interest rates have invariably rattled the Sensex (as

well as most emerging markets).

Here's why rising US interest rates can spook the Indian

market: A bigger US rate increase now will halt the weakening

of the US dollar, at least in the short term. And there are

a lot of funds that try to gain from this short- term movements.

"Just after the US election, there was a lot of apprehension

regarding the dollar due to the twin US deficits (fiscal and

trade deficit). And there was near consensus that the dollar

will weaken and that explains the huge inflow of money into

the Asian market (including India) during November-December,"

says Andrew Holland of DSP Merrill Lynch.

Now, with hints being thrown all around that the dollar

could appreciate, FIIs are picking up the cue and heading

to the West.

Yet, these outflows are little cause for long-term concern,

and could in fact be a blessing. "The US interest rate-induced

money (out)flows are short term in nature. Corrections like

this will throw out the weak and short-term hands from the

market and are, therefore, good for the long-term health of

the market. This should be used as a buying opportunity,"

says Manish Chokhani, Director, Enam Securities. So be it.

|

| |

| Relax, It's Just The January

Effect |

| It's a new year

ritual that plays out every year: Local operators build up huge

positions-these days mostly in the futures and options segment-on

the expectation that foreign institutional investors will buy

stock like there's no tomorrow, flush as they are with "new

year allocations". This results in a massive build-up of

outstanding positions in November and December. December 2004

was no exception. As Arvind Shah, Manager, IDBI Capital Markets,

points out: "The outstanding position usually starts at

around Rs 6,000 crore (at the beginning of a cycle), and climbs

up to Rs 12,000 crore before coming down. But by the first week

of January, it had already reached a level of Rs 15,000 crore

(in any other month it would typically have been around Rs 8,000

crore).

It's this rather illogical anticipation that inevitably

results in a significant correction in the New Year's first

quarter. Sense duly dawns on the operators, who, lacking the

staying power, have little option but to sell when the expected

provisioning of foreign money doesn't take place. After all,

FII allocations happen all year round, and there's no reason

on earth why the New Year should be greeted with a heavy shower

of greenbacks.

The foreign investors for their part have now begun to predict

operator behaviour pretty well. "They have started understanding

the nitty-gritty of the Indian market mechanism," says

Nischal Maheswari, Head of Private Clients, Edelweiss Capital.

The FIIs use the correction as an opportunity to mop up relatively

cheap stock and make a killing. Maybe you could too.

|

| |

| Hello, Good Buys |

| If you are as convinced

about the sustainability of the bullish trend over the longer

term as we are, you should be identifying good buys-stocks that

still have value locked in them. Now, BT isn't a tip-sheet by

any yardstick, so the best we can do is identify sectors with

bright prospects, from which you could pick and choose (the

stocks mentioned are only indicative of the market appetite,

not recommendations).

CEMENT:

The infrastructure development story is finally beginning

to be scripted, and coupled with the robust demand from the

housing sector (on the back of rising incomes), cement is

indeed set for boom times. Further consolidation in this hitherto-fragmented

industry (witnessed last fortnight when the world's second-largest

cement player, Holcim, got a few of its fingers into the ACC

pie) will provide an added impetus to this sector. "We

are positive on cement and all mainline cement stocks led

by ACC (price as on January 20: Rs 341. Price/earnings: 21.2),"

says Sandeep Nanda, Head of Research, Sharekhan. Cement prices

have risen sharply over the past six months and are expected

to sustain adding to the companies' bottom lines. Analysts

expect a robust 9 per cent cumulative annual demand growth

over the next three years. CEMENT:

The infrastructure development story is finally beginning

to be scripted, and coupled with the robust demand from the

housing sector (on the back of rising incomes), cement is

indeed set for boom times. Further consolidation in this hitherto-fragmented

industry (witnessed last fortnight when the world's second-largest

cement player, Holcim, got a few of its fingers into the ACC

pie) will provide an added impetus to this sector. "We

are positive on cement and all mainline cement stocks led

by ACC (price as on January 20: Rs 341. Price/earnings: 21.2),"

says Sandeep Nanda, Head of Research, Sharekhan. Cement prices

have risen sharply over the past six months and are expected

to sustain adding to the companies' bottom lines. Analysts

expect a robust 9 per cent cumulative annual demand growth

over the next three years.

COMMODITIES:

Consumption growth across a range of commodities is expected

to gather steam in China and India, as per capita incomes

shoot up in these two countries (which account for 40 per

cent of the world's population). Prices of metals, petrochemicals

and sugar, to name just three, have been surging for some

time now. Steel prices have been firm, and are expected to

remain that way over the long term. Commodities stocks that

look attractive include Tata Steel (Rs 352, 7.1), Sail (Rs

55, 5.2), Hindalco (Rs 1,259, 13.5), and Hindustan Zinc (Rs

141, 12.2). A few words of caution, though: Restrict commodities

to a small part of your portfolio since they are inherently

volatile in nature, unless of course you can stomach volatility. COMMODITIES:

Consumption growth across a range of commodities is expected

to gather steam in China and India, as per capita incomes

shoot up in these two countries (which account for 40 per

cent of the world's population). Prices of metals, petrochemicals

and sugar, to name just three, have been surging for some

time now. Steel prices have been firm, and are expected to

remain that way over the long term. Commodities stocks that

look attractive include Tata Steel (Rs 352, 7.1), Sail (Rs

55, 5.2), Hindalco (Rs 1,259, 13.5), and Hindustan Zinc (Rs

141, 12.2). A few words of caution, though: Restrict commodities

to a small part of your portfolio since they are inherently

volatile in nature, unless of course you can stomach volatility.

BANKING:

It continues to be a favourite with institutional investors

on the back of continued credit demand supported by an increase

in capital expenditure and infrastructure outlay. "We

are upbeat on the sector on the back of credit growth, both

retail and corporate, as well as stringent efforts put in

by banks towards improving asset quality," says Ambareesh

Baliga, Vice President and Head of Research, Karvy Stock Broking.

Banks are clearly in focus as they shed their dependence on

treasury income for growth. The demand for consumer credit

business remained upbeat. Retail, which contributed 21.5 per

cent of the total outstanding loans in the last financial

year, still remains the major driver. Another significant

driver is the flurry of acquisitions expected in the PSU space.

Stocks in focus: HDFC Bank (Rs 511, 23.7), SBI (Rs 576, 7.7),

and ICICI Bank (Rs 346, 13.8). BANKING:

It continues to be a favourite with institutional investors

on the back of continued credit demand supported by an increase

in capital expenditure and infrastructure outlay. "We

are upbeat on the sector on the back of credit growth, both

retail and corporate, as well as stringent efforts put in

by banks towards improving asset quality," says Ambareesh

Baliga, Vice President and Head of Research, Karvy Stock Broking.

Banks are clearly in focus as they shed their dependence on

treasury income for growth. The demand for consumer credit

business remained upbeat. Retail, which contributed 21.5 per

cent of the total outstanding loans in the last financial

year, still remains the major driver. Another significant

driver is the flurry of acquisitions expected in the PSU space.

Stocks in focus: HDFC Bank (Rs 511, 23.7), SBI (Rs 576, 7.7),

and ICICI Bank (Rs 346, 13.8).

ENGINEERING:

Engineering sector is a play on economic growth as well

as the Indian resurgence in manufacturing outsourcing. Companies

like ABB (Rs 930, 29.7), Siemens (Rs 1293, 27.4) and Kirloskar

Oil Engines (Rs 415, 10.8) would benefit from the local capital

expenditure boom. ENGINEERING:

Engineering sector is a play on economic growth as well

as the Indian resurgence in manufacturing outsourcing. Companies

like ABB (Rs 930, 29.7), Siemens (Rs 1293, 27.4) and Kirloskar

Oil Engines (Rs 415, 10.8) would benefit from the local capital

expenditure boom.

-Shilpa Nayak

|

| |

The New FIIs On D-Street

Surprisingly, most of them aver they are

here for the long term. |

|

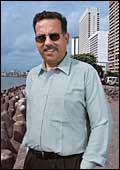

| FMG Inc. Kahm: Betting on India

in the long term |

Foreign institutional investors

(FIIs) are both feared and loved on Mumbai's Dalal Street, home

to the stock exchange. Loved because when they come, stocks

soar and investors rejoice. Feared because when they do leave,

the stock market collapses, smothering in its debris millions

of investors. But guess what? The FII investment may gradually

be ceasing to be the feared "hot money".

Last year, FIIs pumped in an unprecedented $8.5 billion

(Rs 37,400 crore) in Indian stocks, sending the bellwether

30-stock Sensex soaring past the 6,600 mark (it's now down

to about 6,100 points). A lot of them plan to stay invested

in the long term. Better still, a rash of new India-focussed

funds is actually looking at mid-cap companies and private

equity deals in listed companies (see For A Slice Of The Pie).

Gushes Jon Thorn, MD, India Capital Fund (Hong Kong), with

$150 million (Rs 660 crore) under management: "India

is the best long-term story in the world."

FOR A SLICE OF THE PIE

Here's a look at what some of the

new FII funds plan in India. |

Matterhorn Group/US

Fund size: $100 m by Feb-end 2005

India strategy: With former Morgan Stanley wiz

Vinod Sethi as a partner, the fund is sharply focussed

on a dozen companies with market cap between $1 million

and $1 billion

Naissance Capital/Switzerland

Fund size: $100 m

India strategy: Its Naissance Jaipur fund, to be launched

next month, will focus on mid-cap stocks. Naissance's

Managing Director is James Breidling

Voyager Investment Advisors/US

Fund size: $50 million

India strategy: It has a private equity investment approach

to listed companies that are well positioned to capitalise

on the growing economy. Key man: Shiv Puri, its MD

FMG Inc./Bermuda

Fund size: $15 million

India strategy: Being a fund of funds, FMG India Fund

has three managers investing long term and four who

manage hedge funds. Headed by Johan Kahm, it is focussed

on small and large caps

EM Capital/US Fund

size: Not available

India strategy: Its fund is to be launched shortly,

but EM Capital is clear on its investment targets: These

will be second and third-tier companies. CEO: Seth R.

Freeman

Monsoon Capital/US

Fund size: Not available

India strategy: Its Monsoon India Inflection Fund will

focus on high-growth, mid-cap companies. In the last

two months, Monsoon India Fund has invested in IT services,

pharma and capital goods.

MD: Gautam Prakash

|

Ever since Goldman Sachs put out its first BRIC report (on

Brazil, Russia, India and China) in 2003, India has been taken

seriously by investors. The focus is the economy's fundamentals:

It's the second-fastest growing big economy, domestic consumption

is growing, exports of IT services and manufacturing goods

are clipping, competitive labour market is being tapped by

companies elsewhere in the world, and the stock market is

attractively valued compared to those of the US and Europe.

Notes Balanced View, a Balance Equity Broking newsletter:

"...Virtually everyone with some risk capital would want

to explore (emerging) market(s) through the hedge fund route."

India does not allow hedge funds to invest directly in the

stock markets (hedge funds are considered risky), but they

are allowed to invest via participatory notes (P-notes) and

FII sub-accounts, which have zoomed. Last year, SEBI registered

146 new FIIs and 456 new sub-accounts, taking the tally of

total FIIs to 648 and that of sub-accounts to more than 1,800.

Mid-caps and long-term seem to be new FII buzzwords. Consider

Monsoon Capital, a registered FII sub-account with Kotak Mahindra

UK. Its Monsoon India Inflection Fund will invest in high-growth

mid-caps, also via private equity deals if need be. Says Gautam

Prakash, MD, Monsoon Capital: "Since the fund has a two-year

lock in period, we are taking long-term bets with a buy-and-hold

approach." Even hedge funds like Naissance Capital are

bullish on mid-caps.

But different FIIs have different strategies. Some want

mid-caps, others large caps; some want to invest in IT and

pharma, and yet others in automobiles and infrastructure.

The good news in all this is that they are looking at India

from a long-term perspective. Says Johan Kahm of FMG Inc:

"Long term, the Indian market should perform at least

three times as well as the western stock markets." Amen.

-Roshni Jayakar

|

| |

| It's A

Correction, Not A Crash |

|

| ICICI Securities' C.K. Narayan: A

correction is normal |

If the sensex slips below 6,000

or even plunges to 5,500, that's the end of the Great Indian

Rally, right? Wrong. Just remember, the bull run that's under

way has resulted in a gain of some 2,000 points-right from 4,600

to 6,600-and a correction of even a 1,000 points shouldn't get

your suspenders in a twist. Just hear out the technical analysts.

"It's normal to have a correction of even 50 per cent in

an uptrend such as this one," avers C.K. Narayan of ICICI

Securities. Hormuz Maloo of Geojit Securities adds: "We

are now in an intermediate-term correction." And Mitesh

Thacker of Kotak Securities' Private Client Group expects the

correction to last for "another three-four weeks".

The short point is that the indices can slip further from

here, albeit temporarily. If you want to know by exactly how

much, Thacker offers that "the first major support will

come at a 38.2 per cent retracement level". Duh? Well,

that simply means that the Sensex could fall by 38.2 per cent

of the previous rally, which works out to the 5,920-5,950

level. Another significant long-term support level is in the

5,500-5,600 range. To put it simply, the markets are correcting

themselves. They aren't crashing.

|

|