|

That

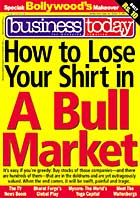

the great Indian bull is alive (in fact just born, some would

aver) and snorting its way towards the 16,000 or 18,000 or 25,000

Sensex high point-depending on who you listen to-would have been

infinitely easier to believe if Dalal Street's universe was confined

to just 30 Sensex stocks, and perhaps a handful of mid-caps that

appear best placed to pole-vault into the elite space in three

to five years. But then that's wishful thinking, and markets everywhere

in true democratic fashion provide sanctuary to all-cats and dogs

included. Now, the Finance Minister may be sleeping peacefully

at night, assuring himself that the valuations of the benchmark

indices are still under the top. But should he be doing a double-take

if the cream of the stock markets begins suddenly diverging away

from the rest of the pack, which often indicates a bull market

is in its final stages? That

the great Indian bull is alive (in fact just born, some would

aver) and snorting its way towards the 16,000 or 18,000 or 25,000

Sensex high point-depending on who you listen to-would have been

infinitely easier to believe if Dalal Street's universe was confined

to just 30 Sensex stocks, and perhaps a handful of mid-caps that

appear best placed to pole-vault into the elite space in three

to five years. But then that's wishful thinking, and markets everywhere

in true democratic fashion provide sanctuary to all-cats and dogs

included. Now, the Finance Minister may be sleeping peacefully

at night, assuring himself that the valuations of the benchmark

indices are still under the top. But should he be doing a double-take

if the cream of the stock markets begins suddenly diverging away

from the rest of the pack, which often indicates a bull market

is in its final stages?

Now, that may be tough to believe, against

a sanguine background of rapid economic growth, comfortable double-digit

earnings surges, and rampant liquidity. Yet, a classical sign

of a late-stage bull run is when market breadth-the ratio of advancing

stocks to declining ones is one good indicator of that-goes awry;

this typically happens once the cats and dogs, fuelled by greedy

money, shoot through the roof, bag outlandish values (P/Es of

1,000, anybody?), and eventually come crashing down.

Last fortnight, even as the Sensex and the

Nifty continued their upward journey, their mid-cap and small-cap

brethren were finding it difficult to keep pace. On the last day

of September, for instance, the advance-decline ratio was skewed

at closing at 1:5, with just 424 stocks ending higher and 2,101

closing lower. Whilst the Sensex didn't lose ground, the BSE Mid-cap

and BSE Small-cap indices came down a notch. On September 28,

the divergence was even more glaring: Even as the Sensex gained

almost nearly a percentage point to close in the 8,600 region

for the first time in its history, losers outpaced gainers on

the BSE by a 1.8:1 ratio.

If this trend of weakening market breadth

continues-and it might well for some time to come, given the heady

levels to which thousands of small-caps and a handful of mid-caps

have been driven to-it can point only to one thing: Without breadth,

the markets may choke. A significant correction is on the cards.

Miles To Go Yet

|

| The economy's growing: But the roads

are as bad as ever |

If

last fortnight's magic number was 8.5 per cent (that was the Centre

for Monitoring Indian Economy's estimate of the industrial growth),

then this fortnight's is 8.1 per cent, the Central Statistical

Organisation's (CSO) estimate of the economy's growth rate in

the April-June quarter. There's no denying the feel-good value

of this number: at one level, it reassures foreign investors (both

direct and portfolio) that the India story is still very much

on. At another, it seems to back the increased valuations of Sensex

stocks. And at still another, it can be interpreted as an indication

that the government and the Finance Minister of the day are doing

a good job.

If there is cause for concern (and there

is, just a little bit), it stems from CSO's track record of revising

its own data. And, it comes from the detail that the agriculture

sector grew by a mere 2 per cent in the April-June quarter this

year, much lower than the 3.8 per cent it had grown by in the

same quarter in 2004-05. In the years the Indian economy has done

well, the agriculture sector has been an out-performer. It may

be premature to reach (attractive as it may sound), on the basis

of a quarter's data, the conclusion that the Indian economy is

finally breaking free of its dependence from agriculture.

The real issue concerns our ability, as a

people, to celebrate this achievement without forgetting that

there is still a whole lot of work to be done. India may be the

flavour of the season as far as foreign investors are concerned,

but it is a minnow when compared to China in terms of exports,

one sure measure of an economy's competitiveness and success.

And the real issue concerns this government's willingness to think

really long-term (China, for instance, is shopping for $50 billion

or Rs 2,20,000 crore worth of nuclear reactors in an effort to

improve its power situation) and do the kind of things it has

to. Then, talk of labour-reforms and the need to improve infrastructure

is boring. That of an 8.1 per cent growth isn't.

Digital Generation

|

| More than a laptop: India should go

back to wooing MIT |

Whenever a new technology

comes along, there are inevitably more critics than believers.

The steam engine, the radio, the telephone were all met with scepticism

when first introduced to the world. (In fact, the inventor of

the steam engine, James Watt, himself did not think it was possible

to make pistons and cylinders that did not leak under high pressure.)

Yet, time has always proved the critics wrong and the believers,

right. So, we hope, will be the case with MIT technology don,

Nicholas Negroponte's plans of building and supplying $100 (Rs

4,400) laptops to school children across developing countries.

If there's any innovation that has the potential to give the mass

of world's poor, under-privileged, and under-fed children a chance

at life, it could well be this. Why?

There are several issues that Negroponte's

$100 laptop promises to stitch together quite nicely. One is,

of course, the future of our society itself. It is safe to say

that it will only get more digital in years to come. Therefore,

anyone who is not computer savvy will be relegated to low-tech-hence,

low-end-jobs that don't fetch much. By making an entire generation

computer literate early on, the low-priced laptop could possibly

ensure their future in the workplace. Agreed, a laptop is only

a tool of learning and not learning itself. But it is a powerful

tool in making the process of learning far more engaging and interactive

than it currently is for millions of poor children. Imagine, for

a moment, that you are a 10-year-old living in a village that

has no electricity. Ordinarily, your learning is limited to daylight,

unless you are motivated enough to study by the candlelight. Now,

imagine again, along comes a laptop that requires no electricity

(its battery can be charged manually) but has all the features

of a regular laptop, except a gargantuan hard disk. Suddenly,

the process of learning, and the content itself, becomes much

richer. The chances of a poor child being genuinely interested

in studying all the way up to high school or college are brighter.

Because Negroponte's project holds so much

promise, it must not fail. A low-priced personal computer has

long been the quest of hardware manufacturers around the world,

including India, where the handheld Simputer made its debut not

too long ago. But the technology adventurers have been tripped

up repeatedly. As they've discovered, price is not the only thing

that consumers look for; rather, they look for value. That means

software in local languages, applications that are suited to local

needs and, most of all, internet connectivity. Fortunately, the

MIT professor has Google, AMD and Red Hat on his side. It's in

their interest that the digital market explodes.

|

T

T