|

Promise

and potential, as anyone associated in anyway with the stock markets

will tell you, are the things that make the world (or at the very

least, stock market indices) go around. For four years, Business

Today has been tracking promise and potential in a very tangible

way, through a listing of 20 companies that merit watching. BT's

editors and reporters meet venture capitalists, execs at private

equity firms, headhunters, CEOs and consultants to compile a shortlist

of companies. The final list of 20 is arrived at after several

rounds of validation. The result is an eclectic list of companies

large and small, listed and unlisted, and across a variety of

industries. Then, it's variety that makes it fun.

Sahad P.V.

AIR

DECCAN

G.R. Gopinath/Managing Director

The Life Option

In

August 2003, Captain G.R. Gopinath, the Managing Director of Air

Deccan, a company with a workforce of three and a fleet of one

(a turbo-prop, if you must know), announced his wannabe low-cost

airline's maiden flight, from Bangalore to Hubli (a large city

in Northern Karnataka that wasn't, until then, connected by air).

Today, Air Deccan employs 1,300, has a fleet of 24 aircraft including

seven new Airbus A320s, operates 140 flights a day, and would

have flown some four million passengers in 12 months by the time

this year ends. Along the way, the company has engendered a low-cost

airline revolution in India; three more low-cost airlines are

already in the air and some 12 are waiting to take wing. And in

this, its second full year of operation, it has turned profitable

(analysts expect Air Deccan to close this year with Rs 1,000 crore

in revenues; the company itself isn't willing to share any numbers

as it is in the quiet period in a run-up to its initial public

offering). In

August 2003, Captain G.R. Gopinath, the Managing Director of Air

Deccan, a company with a workforce of three and a fleet of one

(a turbo-prop, if you must know), announced his wannabe low-cost

airline's maiden flight, from Bangalore to Hubli (a large city

in Northern Karnataka that wasn't, until then, connected by air).

Today, Air Deccan employs 1,300, has a fleet of 24 aircraft including

seven new Airbus A320s, operates 140 flights a day, and would

have flown some four million passengers in 12 months by the time

this year ends. Along the way, the company has engendered a low-cost

airline revolution in India; three more low-cost airlines are

already in the air and some 12 are waiting to take wing. And in

this, its second full year of operation, it has turned profitable

(analysts expect Air Deccan to close this year with Rs 1,000 crore

in revenues; the company itself isn't willing to share any numbers

as it is in the quiet period in a run-up to its initial public

offering).

"Even if I am able to convert 5 per

cent of the 800,000-1 million people who use Indian Railways every

day to fly Air Deccan, I will realise my dream of selling one

billion seats a year," says Gopinath, who will add one aircraft

to Air Deccan's fleet every month for the next 76. Already, he

claims, "40 per cent of the people who fly us are first time

fliers". Scale and profits have meant recognition. Last month,

Warwick Brady, a longtime employee of Ryanair (the world's best-known

low-cost airline) signed on as coo of Air Deccan. "Our head

of maintenance is from GE and controller of operations from (another

international low-cost airline) Jet Blue," laughs the captain.

"People have realised this is where the action is."

The buzz on Deal Street is that Air Deccan will raise between

$200 million and $250 million (Rs 800-1,100 crore) in early 2006

to fund its growth. Gopinath would rather not comment on the timing

and the amount but admits that an issue is very much in the offing

and that the company will probably spread its wings to West Asia

and India's neighbours after that. Can Air Deccan become a regional

low-cost airline for this part of the world? Well, no one thought

it could succeed in India, and it has.

Venkatesha Babu

BILCARE

Mohan Bhandari/Managing Director

The Magic Pill (Pack)

It

isn't just Indian pharmaceutical majors that have global aspirations.

Bilcare, a company that develops and manufactures packaging for

pharma companies, has them too. "Our strategy is all about

increasing capacities and addressing challenges faced by pharma

companies worldwide," says Mohan Bhandari, Managing Director,

Bilcare. Already, the company that closed 2004-05 with Rs 165

crore in sales (it expects to grow by 30 per cent in 2005-06)

has founded an eponymous subsidiary in Singapore, and acquired

Proclinical Inc, a us-based packaging firm that boasts the likes

of Astra Zeneca and Johnson & Johnson among its customers.

"Apart from being the largest market, the us is also the

fastest growing (for pharmaceutical packaging) at 15 per cent

plus," explains Bhandari. It

isn't just Indian pharmaceutical majors that have global aspirations.

Bilcare, a company that develops and manufactures packaging for

pharma companies, has them too. "Our strategy is all about

increasing capacities and addressing challenges faced by pharma

companies worldwide," says Mohan Bhandari, Managing Director,

Bilcare. Already, the company that closed 2004-05 with Rs 165

crore in sales (it expects to grow by 30 per cent in 2005-06)

has founded an eponymous subsidiary in Singapore, and acquired

Proclinical Inc, a us-based packaging firm that boasts the likes

of Astra Zeneca and Johnson & Johnson among its customers.

"Apart from being the largest market, the us is also the

fastest growing (for pharmaceutical packaging) at 15 per cent

plus," explains Bhandari.

Packaging plays a crucial role in the pharmaceutical

business. At one level, the packaging has to ensure that the drug

remains in a hermetically sealed environment for a fairly long

period of time (most drugs have a long shelf life) without losing

its efficacy. At another, packaging innovations often play a part

in the adoption, usage and success of a drug. Bhandari offers

the instance of a pack Bilcare developed for Shelcal, a calcium-based

drug launched by Elder Pharma, which helped the latter increase

sales by almost 20 per cent. Shelcal was a success but Elder wasn't

reaping the rewards it should have been; counterfeiters had their

own versions of Shelcal out. Bilcare, Bhandari claims, developed

a package for Shelcal that wasn't just high-quality, but also

difficult to counterfeit. Ergo, R&D plays just as critical

a role in the pharma packaging business as it does in pharma itself.

Apart from tapping the Asian and North American

markets, Bilcare is also considering a foray into Europe and Latin

America and getting a foot into the emerging biotech and life

sciences space. Bilcare works with companies to understand the

drug, its benefits and its delivery mechanism before developing

a package, and then manufactures it, and Bhandari believes this

"integrated business model" is the company's unique

selling proposition. Form, it would appear, matters as much as

content in pharma.

-Krishna Gopalan

CAVINKARE CAVINKARE

C.K. Ranganathan/Chairman and Managing Director

The Other FMCG Major

In India's hyper-competitive

fast moving consumer goods industry, any company that has been

able to consistently stand up to behemoth Hindustan Lever Limited

is sure to attract attention, fill reams of column space, and

be described by terms such as giant-killer and ambitious upstart.

CavinKare (formerly Beauty Cosmetics, and renamed, perhaps as

a play on founder C.K. Ranganathan's initials and on Calvin Klein)

is all that; only, with revenues of Rs 400 crore today and targeted

revenues of Rs 1,200 crore by 2008, the company, whose Chic is

the second-largest shampoo brand in the country (in terms of volumes

sold), is no longer small and no longer regional in terms of its

reach. Today, ck products are available in Sri Lanka, Nepal, Singapore,

Malaysia, Myanmar, Indonesia and West Asia; Ranganathan is busy

assessing the potential of the African market; and CavinKare has

formed an alliance with a contract manufacturer in Bangladesh

to tap that market.

Then, there is the company's plans for the

foods business, which it entered in November 2003 with the acquisition

of Ruchi Agro Foods, an Andhra Pradesh-based company that was

largely in the business of pickles. By January next year, says

Ranganathan, the pickles and the other products the company has

launched (masalas, ready-to-cook mixes and the like) will be available

nationally. Soon after that, he adds, the foods business will

go global by entering the US and the UK markets. "Every year,

we will come out with five to six new products in both segments

(personal care and foods)." And become less of an upstart.

-Nitya Varadarajan

CENTURION

BANK

Shailendra Bhandari/Managing Director

Sharp Turnaround

It

has perhaps been among the most interesting turnarounds in the

banking sector. Centurion Bank, whose story seemed all but over

a couple of years ago, is today in the news for its merger with

Bank of Punjab. Centurion Bank itself was taken over in mid-2003

by a combine comprising Sabre Capital (founded by former Standard

Chartered ceo Rana Talwar who is now Centurion's Chairman) and

Bank of Muscat; a fresh infusion of capital and a focus on operating

efficiencies turned it around. Ironically, Bank of Punjab finds

itself in a position similar to that of Centurion at the time

of its acquisition, and most of its problems can be addressed

through a fresh infusion of capital. The merger, apart from doing

this, will also put Centurion on the fast track. The merged entity

will be called Centurion Bank of Punjab and its Managing Director

Shailendra Bhandari is upbeat about where the bank is headed.

"The primary thrust will continue to be retail," he

says. "Over the next five years, there could also be inorganic

growth." The emphasis on retail shouldn't surprise anyone;

Centurion disburses 40,000 loans for two-wheelers every month

(a fifth of all loans for two-wheelers disbursed). It

has perhaps been among the most interesting turnarounds in the

banking sector. Centurion Bank, whose story seemed all but over

a couple of years ago, is today in the news for its merger with

Bank of Punjab. Centurion Bank itself was taken over in mid-2003

by a combine comprising Sabre Capital (founded by former Standard

Chartered ceo Rana Talwar who is now Centurion's Chairman) and

Bank of Muscat; a fresh infusion of capital and a focus on operating

efficiencies turned it around. Ironically, Bank of Punjab finds

itself in a position similar to that of Centurion at the time

of its acquisition, and most of its problems can be addressed

through a fresh infusion of capital. The merger, apart from doing

this, will also put Centurion on the fast track. The merged entity

will be called Centurion Bank of Punjab and its Managing Director

Shailendra Bhandari is upbeat about where the bank is headed.

"The primary thrust will continue to be retail," he

says. "Over the next five years, there could also be inorganic

growth." The emphasis on retail shouldn't surprise anyone;

Centurion disburses 40,000 loans for two-wheelers every month

(a fifth of all loans for two-wheelers disbursed).

That, of course, is only one side of the

story. The merger with Bank of Punjab will help Centurion tap

sectors such as small and medium enterprises (SMEs) and agriculture.

The merger has a rationale on the geographical front too; Bank

of Punjab is very strong in the North while Centurion Bank's base

is the South and West. "Together, we will have about 240

branches with just a limited overlap," says Bhandari. He

adds that the merged entity will foray into areas like credit

cards and retail broking, admitting candidly that while the bank

is unlikely to become the largest entity in either, it will have

a significant presence in both.

-Krishna Gopalan

DQ

ENTERTAINMENT DQ

ENTERTAINMENT

Tapaas Chakravarti/CEO

Animation Hypermart

Animation has

been touted as the next big thing in India for some time; gaming

is the new kid on the block in the next-big-thing firmament. Yet,

it isn't merely its presence in the two areas that earns the Hyderabad-based

DQ entertainment (DQE) entry into this listing (for the record,

the company also offers pre- and post-production services). What

does is the other things the company is doing. "DQ Entertainment

has to expand its revenue stream with natural forward and backward

linkages," says Tapaas Chakravarti, CEO, DQE.

That spans everything from software for gaming

consoles, mobile-gaming and animated TV series (for children)

to distribution, licensing and merchandising of its own work and

that whose (content) rights it has acquired, to a joint venture

with two large studios to co-produce content. That's a significant

leap forward for a company that started life in the business of

it consulting (its heritage is evident in the fact that it has

implemented a proprietary enterprise resource package for production

planning across its eight development facilities in India, two

in China and one in the Philippines).

With private equity and venture investments

of $9 million (Rs 39.6 crore) from a clutch of companies including

IFC, TDA capital, GW capital and ilabs, and long-term contracts

from the likes of Disney, Sony, NBC universal, PBS kids and Mike

young productions, DQE claims it is on its way to becoming the

world's largest animation outsourcing and co-production firm.

By 2008, says Chakravarti, the company's

revenues will nudge the $100 million mark (Rs 440 crore; he is

unwilling to disclose current revenues). A significant part of

that will come from a foray that it has just made into distribution-it

has started distributing in India some of the animation series

it produces for customers in other countries such as the us, Canada,

France and Spain and some 22 series produced by other global firms

for which it has acquired rights-and co-production (DQE has invested

$10 million or Rs 44 crore in a joint venture that will create

and hold rights to new animation series). That's more than animation

the way the rest of the industry sees it.

-E. Kumar Sharma

GEOMETRIC

SOFTWARE

Manu Parpia/Managing Director

The Shape Of Things To Come

Eleven

years after it was spun off from the Godrej Group, and four years

after a particularly bad financial performance, Geometric Software

looks every inch a company for the future. One reason for that

is the business it is in, the happening area of product lifecycle

management (PLM). Unlike other next big things, PLM is one of

the current big (fine, reasonably big) things in the technology

space. It is about the management of products from their initial

concept, through design, launch and production to their eventual

obsolescence. At one time, PLM was all about computer-aided design

(cad) and computer-aided manufacturing (cam), the two businesses

that Geometric started off with (hence the name; cad and cam are

geometry-based work); today it includes several other things such

as electronic design automation (EDA), maintenance, and computer

aided production engineering (CAPE). Essentially, PLM reduces

the time to market and is something that can be applied across

sectors, from auto to aerospace, from ship-building to financial

services. Eleven

years after it was spun off from the Godrej Group, and four years

after a particularly bad financial performance, Geometric Software

looks every inch a company for the future. One reason for that

is the business it is in, the happening area of product lifecycle

management (PLM). Unlike other next big things, PLM is one of

the current big (fine, reasonably big) things in the technology

space. It is about the management of products from their initial

concept, through design, launch and production to their eventual

obsolescence. At one time, PLM was all about computer-aided design

(cad) and computer-aided manufacturing (cam), the two businesses

that Geometric started off with (hence the name; cad and cam are

geometry-based work); today it includes several other things such

as electronic design automation (EDA), maintenance, and computer

aided production engineering (CAPE). Essentially, PLM reduces

the time to market and is something that can be applied across

sectors, from auto to aerospace, from ship-building to financial

services.

The second is its business model. Being too

small to effectively approach end-users, Geometric partners large

software firms in the PLM space such as Dassault Systems, becoming,

as Harit Shah, an analyst with Mumbai-based equity research firm

Quantum Information Services puts it, "an extended R&D

arm for such firms". In 2004-05, 60 per cent of the company's

revenues of Rs 173.3 crore (net profit: Rs 27.4 crore) came from

software companies and 40 per cent from direct sales to the end-user

segment (of which half came from the automobile sector). And between

2000-01 and 2004-05, the company's revenues have grown at a compounded

annual growth rate (CAGR) of 29.9 per cent; net profit, 25.3 per

cent. Now, says Manu Parpia, Managing Director, Geometric, the

company is of a size where it can target end users. "In the

next three years, 60 per cent of revenues will come from end users."

Profitability remains an issue and Geometric has already revised

its guidance (downwards) twice in 2005-06, but as Quantum's Shah

puts it, "it takes time to scale up". "Given that

most other companies this size in the IT sector are either being

acquired or going out of business, Geometric is doing well,"

he adds. That it is.

-Priya Srinivasan

GVK

BIOSCIENCES GVK

BIOSCIENCES

G.V. Sanjay Reddy/CEO

The Bio-supermarket

Back in 2002,

when India woke up to the possibilities of bioinformatics (essentially,

the use of computers to extract and analyse biological, and especially

genetic data), GVK biosciences was among the first companies to

enter the space. Apart from offering bioinformatics services,

it set out to train people in the science (for some time in 2002

it looked as if bioinformatics schools would supplant computer

ones).

Since then, the company has added several

services to its bouquet: medicinal and process chemistry, clinical

trials, clinical data management, bio-availability and bio-equivalence

(BA and be) studies, even it and it-enabled services targeted

at pharma companies.

GVK wouldn't share numbers with BT, but the

buzz in Hyderabad is that its revenues and profits have grown

at an average of 150 per cent since inception. "I find them

in an aggressive growth phase," says Deepanwita Chattopadhyay,

CEO, ICICI Knowledge Park, where the company's laboratory has

grown in size from 3,000 sq. ft to 14,000 sq. ft over the past

two years. For much of those two years, GVK was content to remain

in the shadows (the company is still low-profile, almost regimentally

so). If something has changed, it is the fact that D.S. Brar,

the high-profile former CEO of Ranbaxy Laboratories, chose to

join the board of GVK as Chairman in July, 2004. His very presence

seems to have helped the company attract new clients (12 of the

world's 20 largest pharma firms are its clients) and employees

(it has 800 right now and 85 per cent of that number is scientists).

And if something has changed, it is the fact that India now has

a product patent regime in place, making it easy for multinationals

to outsource research work (even manufacturing) to Indian firms.

GVK Biosciences (the group has no other interests in the lifesciences

space), which offers an integrated research platform and is entering

into partnerships with clients to share intellectual property,

definitely stands to gain from that.

-E. Kumar Sharma

INDIAN

RAYON

Sanjeev Aga/Managing Director

More Is More

Indian

Rayon, soon to be renamed Aditya Birla Nuvo, has always been a

diversified company. Over the past five years, the company's portfolio

of businesses has got even more diverse: since 2000, it has acquired

Madura Garments (and brands such as Van Heusen and Louis Philippe),

PSI Data Systems, Transworks (a BPO firm) and, recently, a large

equity stake in Idea Cellular (in which its holding and that of

other companies belonging to the Aditya Birla Group add up to

a little over 50 per cent). It also entered the insurance business

through a joint venture with Canada's Sun Life. "In four

words, Indian Rayon will become a 'diversified high growth company',"

says Sanjeev Aga, Managing Director. Today, the new businesses

account for a little over half of the company's consolidated revenues;

over the next five years, this proportion is expected to increase

to 75 per cent. Eventually, says Kumar Mangalam Birla, Chairman,

Aditya Birla Group, there will be two groups of businesses within

Indian Rayon. "There will be the value businesses, which

are the brick-and-mortar businesses throwing up cash but where

growth opportunities are limited, and the high growth businesses,

which are garments, financial services, BPO, telecom, mutual funds

and insurance," he explains. Seen from that perspective,

the recent mergers of Indo-Gulf and Birla Global into Indian Rayon

are strategic plays. "Birla Global's financial services business

includes mutual funds distribution and insurance advisory but

not insurance, which is Indian Rayon's business," points

out Aga. And, "the cash generation of Indo-Gulf is sub-optimally

employed; if it comes into Indian Rayon, this money can be invested

in telecom and financial services, which hopefully will give faster

returns", he adds. Over time, the Indian Rayon story could

turn out to be one of diversifying sensibly into high-value businesses

successfully while making the most of traditional businesses.

When the recent restructuring was announced, the majority opinion

among analysts was that it was a 'value-neutral' move. It could

well be that it was a value-enhancing one. Indian

Rayon, soon to be renamed Aditya Birla Nuvo, has always been a

diversified company. Over the past five years, the company's portfolio

of businesses has got even more diverse: since 2000, it has acquired

Madura Garments (and brands such as Van Heusen and Louis Philippe),

PSI Data Systems, Transworks (a BPO firm) and, recently, a large

equity stake in Idea Cellular (in which its holding and that of

other companies belonging to the Aditya Birla Group add up to

a little over 50 per cent). It also entered the insurance business

through a joint venture with Canada's Sun Life. "In four

words, Indian Rayon will become a 'diversified high growth company',"

says Sanjeev Aga, Managing Director. Today, the new businesses

account for a little over half of the company's consolidated revenues;

over the next five years, this proportion is expected to increase

to 75 per cent. Eventually, says Kumar Mangalam Birla, Chairman,

Aditya Birla Group, there will be two groups of businesses within

Indian Rayon. "There will be the value businesses, which

are the brick-and-mortar businesses throwing up cash but where

growth opportunities are limited, and the high growth businesses,

which are garments, financial services, BPO, telecom, mutual funds

and insurance," he explains. Seen from that perspective,

the recent mergers of Indo-Gulf and Birla Global into Indian Rayon

are strategic plays. "Birla Global's financial services business

includes mutual funds distribution and insurance advisory but

not insurance, which is Indian Rayon's business," points

out Aga. And, "the cash generation of Indo-Gulf is sub-optimally

employed; if it comes into Indian Rayon, this money can be invested

in telecom and financial services, which hopefully will give faster

returns", he adds. Over time, the Indian Rayon story could

turn out to be one of diversifying sensibly into high-value businesses

successfully while making the most of traditional businesses.

When the recent restructuring was announced, the majority opinion

among analysts was that it was a 'value-neutral' move. It could

well be that it was a value-enhancing one.

-Krishna Gopalan

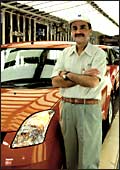

MARUTI

UDYOG LIMITED MARUTI

UDYOG LIMITED

Jagdish Khattar/Managing Director

Four Wheels Good

In 2000-01, when

Maruti Udyog made a net loss of Rs 269 crore on revenues of Rs

9,253 crore, some saw it as the beginning of the end for what

was then India's largest car maker. In 2003, when the company

made an initial public offer (IPO) with shares priced at Rs 125,

some equity analysts considered the price high. Circa October

2005, Maruti continues to be India's largest car maker (it has

sold 262,406 cars in the first six months of 2005-06; it earned

revenues of Rs 13,734 crore in 2004-05); it has a portfolio of

11 brands, the largest among any company selling cars in India;

it has a 54.5 per cent share of the market; it has plans to invest

some Rs 6,000 crore over the next five years; and its stock is

trading at a healthy Rs 558.10 as this article goes to press.

If Jagdish Khattar, the company's managing

director, looks happy (he does, especially when asked about the

competition), it is because he has reason to be: in a six-year

stint, he has overseen several successful launches, increased

efficiencies and reduced costs, upgraded the dealer network, launched

a successful used-cars initiative, and been rewarded with another

three-year term at the top for his efforts.

Over the next five years, the company plans

to launch five new models; then, there is the new plant it is

setting up through a JV with parent Suzuki Motor Corp. that will

eventually produce a quarter of a million cars a year. By 2007

(which is when some of the new capacity will go on-stream), the

company will make a serious play in the diesel car segment, which

constitutes around a fifth of the total car market (Maruti has

an insignificant presence in this segment today). And taking a

leaf from its own book (it worked closely with its large vendors

to reduce costs and improve quality), the company, says Khattar,

is "going to Tier-II vendors to improve the quality of the

products they supply to Tier-I vendors and bring down costs".

That should address the concerns of analysts such as Kalpesh Parekh

of ask Raymond James who believes that although Maruti is a "company

to watch out for, its margins will continue to be under pressure".

-Swati Prasad

MIDAS

COMMUNICATION TECHNOLOGIES

Shirish Purohit/Managing Director

Bits To Gold

The

term wireless in local loop (WLL) may have entered public consciousness

in the late 1990s with the fight between India's CDMA and GSM

lobbies, but it was actually popularised almost a decade earlier

by a Chennai-based start-up. Midas Communication Technologies

was the name of the company; it was founded by some alumni of

the Indian Institute of Technology, Chennai, in association with

the school's TeNet Group (founded by Professor Ashok Jhunjhunwala,

this has incubated several companies, including Midas); and it

set out to license, a la Qualcomm, a technology called cordect

(where DECT stands for digital enhanced cordless telecommunications)

that the good professor had come up with. cordect remains an ideal

technology (for telcos and internet service providers) seeking

to connect remote regions with a scattered population and although

it never really took off in India (from a telecom mainstream point

of view) it is quite popular in several Asian markets. Along the

way, Midas has ventured into the manufacture of cordect equipment;

it has also merged another TeNet incubated firm Banyan Networks

(an early broadband technology firm) with itself. The company

is hoping that Citius, its broadband technology offering that

allows companies to provide broadband through existing cable (television)

networks, will help it enter the big league (its current revenues

are in the region of Rs 400 crore). With technology solutions

for broadband access through cable, DSL (digital subscriber line),

even Wi-Max (Wi-Fi, over a much larger region, say an entire city),

says Shirish Purohit, Managing Director, Midas, the idea is to

"reach customers through every entry point". India's

broadband policy envisages that the country will have 50 million

broadband users by 2010. Those who believe that target is achievable

will have no problems with Midas' ambitions of becoming a $1-billion

(Rs 4,400-crore) company by 2010. The

term wireless in local loop (WLL) may have entered public consciousness

in the late 1990s with the fight between India's CDMA and GSM

lobbies, but it was actually popularised almost a decade earlier

by a Chennai-based start-up. Midas Communication Technologies

was the name of the company; it was founded by some alumni of

the Indian Institute of Technology, Chennai, in association with

the school's TeNet Group (founded by Professor Ashok Jhunjhunwala,

this has incubated several companies, including Midas); and it

set out to license, a la Qualcomm, a technology called cordect

(where DECT stands for digital enhanced cordless telecommunications)

that the good professor had come up with. cordect remains an ideal

technology (for telcos and internet service providers) seeking

to connect remote regions with a scattered population and although

it never really took off in India (from a telecom mainstream point

of view) it is quite popular in several Asian markets. Along the

way, Midas has ventured into the manufacture of cordect equipment;

it has also merged another TeNet incubated firm Banyan Networks

(an early broadband technology firm) with itself. The company

is hoping that Citius, its broadband technology offering that

allows companies to provide broadband through existing cable (television)

networks, will help it enter the big league (its current revenues

are in the region of Rs 400 crore). With technology solutions

for broadband access through cable, DSL (digital subscriber line),

even Wi-Max (Wi-Fi, over a much larger region, say an entire city),

says Shirish Purohit, Managing Director, Midas, the idea is to

"reach customers through every entry point". India's

broadband policy envisages that the country will have 50 million

broadband users by 2010. Those who believe that target is achievable

will have no problems with Midas' ambitions of becoming a $1-billion

(Rs 4,400-crore) company by 2010.

-Nitya Varadarajan

NATIONAL

THERMAL POWER CORPORATION NATIONAL

THERMAL POWER CORPORATION

C.P. Jain/Chairman and Managing Director

Power To The People

These days, everyone

who meets with C.P. Jain, the Chairman and Managing Director of

NTPC, wants to know about the Dabhol Power Company (or Ratnagiri

Gas & Power as it has been renamed), in which the public sector

behemoth owns a 28.3 per cent stake, and whose plant (which has

remained shut for four years) it is trying to revive. The man

himself is, quite frankly, amused. "In the context of our

overall existing capacity (23,935 mw) and future programmes (a

doubling of capacity in the next seven years), Dabhol is just

a 2,150-mw facility," he says, with the quiet confidence

that comes with heading one of the world's 10 largest power generating

firms.

The correlation between economic growth and

power generation and consumption is a linear one, and if the Indian

economy continues to grow at an average of 7.5 per cent-plus over

the next five years, the country will need much, much more power

than the 1.18 lakh mw it currently produces. That could explain

NTPC's capacity-doubling initiative that will see an investment

of Rs 90,000 crore over the next seven years. And thanks to an

agreement hammered out between the company, the Union government,

the governments of various states and the Reserve Bank of India

(RBI) in April 2002 that converts outstanding dues of Rs 17,000

crore from the State Electricity Boards (SEBs; most SEBs do not

pay on time; some do not pay at all) into interest-bearing bonds,

the company's realisation has increased to 100 per cent from the

73 per cent it was at in 2001-02.

Meanwhile, NTPC is doing what power companies

all over the world are doing, diversifying its fuel mix (including

a venture into nuclear power that should bear fruit by the turn

of this decade, and an increased emphasis on hydel power that

should kick in by 2008), striking long-term contracts to reduce

the average cost of fuel and working towards acquiring its own

coal mines (coal accounts for 86 per cent of its fuel consumption).

At Rs 1.52 a unit, NTPC's cost of power is among the lowest in

the country and Jain admits that it will be a challenge to hold

it at that level for long. "Last year, the overall price

increase (we effected) was 5 paise," he says. "The increase

in fuel cost was 10 paise but we pruned 3 paise through efficiency-enhancement

measures (and another 2 paise was cut by the regulator)."

When the CEO of a Rs 24,992-crore (overall revenues in 2004-05)

company speaks in terms of paise, you know you are on to a good

thing.

-Kumarkaushalam

RICO

AUTO

Arvind Kapur/Managing Director

Made For The World

Gurgaon-based

Rico auto is in this list not because it is the largest supplier

of components to Hero Honda Motors and Maruti Udyog. The Rs 598-crore

group, which manufactures more than a dozen products like clutch

assemblies, brake panels and wheel hubs, figures here for the

global play it is gearing up for. "We are working on all

major models being planned by some of the big global auto companies,"

says Arvind Kapur, Managing Director, Rico, speaking to bt from

Germany where he is visiting as part of a delegation from India's

Auto Component Manufacturers Association (ACMA). The delegation

is to visit BMW the following day, he says, then Audi and Mann,

and none of the three buys from Rico right now (others like Ford,

General Motors, Cummins, Matsuka and Delphi do). "Our growth

is going to come from exports," gushes Kapur, indicating

that exports will increase from 7.2 per cent of sales to a fifth

by 2008 (by which time revenues will touch Rs 1,300 crore). "By

being export-driven, Rico is trying to derisk itself from an over-dependence

on Hero Honda and Maruti," says Piyush Parag, an analyst

at Mumbai-brokerage Sharekhan who, in a report he put out last

month, issued a 'buy' call on Rico, with a one-year price target

of Rs 157 (current price of stock: Rs 90.60 on October 14). Gurgaon-based

Rico auto is in this list not because it is the largest supplier

of components to Hero Honda Motors and Maruti Udyog. The Rs 598-crore

group, which manufactures more than a dozen products like clutch

assemblies, brake panels and wheel hubs, figures here for the

global play it is gearing up for. "We are working on all

major models being planned by some of the big global auto companies,"

says Arvind Kapur, Managing Director, Rico, speaking to bt from

Germany where he is visiting as part of a delegation from India's

Auto Component Manufacturers Association (ACMA). The delegation

is to visit BMW the following day, he says, then Audi and Mann,

and none of the three buys from Rico right now (others like Ford,

General Motors, Cummins, Matsuka and Delphi do). "Our growth

is going to come from exports," gushes Kapur, indicating

that exports will increase from 7.2 per cent of sales to a fifth

by 2008 (by which time revenues will touch Rs 1,300 crore). "By

being export-driven, Rico is trying to derisk itself from an over-dependence

on Hero Honda and Maruti," says Piyush Parag, an analyst

at Mumbai-brokerage Sharekhan who, in a report he put out last

month, issued a 'buy' call on Rico, with a one-year price target

of Rs 157 (current price of stock: Rs 90.60 on October 14).

-Sahad P.V.

STATE

BANK OF INDIA STATE

BANK OF INDIA

A.K. Purwar/CEO

The Biggest Of Them All

India's largest

commercial bank (deposits: Rs 3,76,141 crore till June 30, 2005),

State Bank of India, is plagued by several ills that usually come

with size or being government-owned. For one, its very size makes

it difficult for the bank to be nimble. Then, constraints over

how much it can pay its people ensure that it loses out to not

just foreign banks but Indian private sector ones in the fight

for talent. And mandatory lending to priority sectors and investments

in rural areas means that it can never be driven purely by profit-considerations.

Strangely enough, size, reach and government-ownership

are the very things that make it the only bank in this year's

listing of 20 Companies to Watch.... Government-ownership (despite

the said government's articulated stance of non-interference in

the financial services sector) translates into credibility, from

the P.O.V of customers, partners and regulatory authorities in

countries where SBI is trying to establish a presence (it recently

acquired a 76 per cent stake in Kenya's Giro Commercial Bank and

51 per cent of Mauritius' Indian Ocean International Bank). The

bank's Chairman A.K. Purwar expects overseas operations to account

for 15 to 20 per cent of SBI's profits in the next two years (they

account for 5-6 per cent today). "Tapping into the savings

of the growing and wealthy Indian population in countries of Asia

and Africa is a good way to increase its business," says

a Mumbai-based analyst. And size (think 9,000 branches, 51 offices

outside India, 5,000 ATMs, and a net profit of Rs 4,304.52 crore

in 2004-05) is the bank's core strength. "The large network,

the huge customer base, the big balance sheet, all this allows

SBI to increase its exposure to all kinds of businesses to keep

the growth momentum going," says Rajat Rajgriha, a banking

analyst and Head, Research, Motilal Oswal Securities.

In many ways, 2006 could well be the year

when it all comes together for the 200-year-old bank and not because

of the in-your-face advertising campaign it has just launched.

The bank, its seven associates, and its eight non-banking subsidiaries

(such as SBI Capital Markets, SBI Life Insurance and SBI Securities)

stand to benefit from increased economic activity. And SBI itself

is almost unrecognisable from its earlier self: it has embarked

on a large initiative to it-enable most of its branches; it has

created new business units that will focus on small and medium-sized

enterprises, personal banking, agriculture and government, all

segments that Purwar believes will be future growth engines. The

bank has also created a Stressed Assets Management Group to monitor

and maintain credit quality of loans, improve credit appraisals

and risk management practices, and become more aggressive on recoveries.

All these are part of Project Vijai, Purwar's gameplan to make

SBI one of Asia's Top 5 and the world's Top 50 banks by 2008.

That would be something.

-Ashish Gupta

SYMPHONY

SERVICES

Gordon Brookes/ President & CEO

The Techie's Techie

Two

years from now, a third of symphony's revenues will come from

business analytics, one of the possible next big things (there

are several) in the software industry. A technological probability,

however, isn't the reason for the company's presence in this listing.

Rather, a business reality is. The Indian it services industry

is built on the premise that the software that runs enterprises

(a Wachowskian thought but one that is rapidly emerging the norm

rather than the exception) can be developed less expensively in

countries such as India than in the places where these enterprises

are based, say, the us, Europe or Japan. Symphony has just extended

that strand of reasoning to its logical end: the software that

goes into (software) products can be developed less expensively

in India, and given the urgencies of the technology marketplace,

not too many software product firms may have the resources to

develop captive facilities (read: owned offshore software development

centres) in countries such as India. Two

years from now, a third of symphony's revenues will come from

business analytics, one of the possible next big things (there

are several) in the software industry. A technological probability,

however, isn't the reason for the company's presence in this listing.

Rather, a business reality is. The Indian it services industry

is built on the premise that the software that runs enterprises

(a Wachowskian thought but one that is rapidly emerging the norm

rather than the exception) can be developed less expensively in

countries such as India than in the places where these enterprises

are based, say, the us, Europe or Japan. Symphony has just extended

that strand of reasoning to its logical end: the software that

goes into (software) products can be developed less expensively

in India, and given the urgencies of the technology marketplace,

not too many software product firms may have the resources to

develop captive facilities (read: owned offshore software development

centres) in countries such as India.

Are there companies that buy this logic?

There are, and a listing of Symphony's clients would include names

such as Autodesk, Sapient and BMC (some also have captive facilities).

"With an India plan becoming critical, companies do not want

to waste time and money with their own centres, when companies

like us can do it cheaper and faster," says Gordon Brookes,

President and CEO, Symphony Services. "In addition to pure

labour arbitrage, companies outsource to gain flexibility, access

to specialised skills and access to high-quality software development

processes," says Stephanie Moore, an analyst with Gartner,

an it consulting firm. "Although we have a significant operation

in India, we've found it beneficial to employ a hybrid approach

to augment our offshore development capabilities," adds Dayon

Kane, Director and General Manager, Legacy Business, BMC Software.

Brookes won't share Symphony's numbers, but claims the company

has been growing at an average rate of more than 100 per cent

over the past two years. That, and the fact that it is building

a 5,000-seat campus in Bangalore seem to indicate that it is on

to a good thing.

-Rahul Sachitanand

TATA

STEEL TATA

STEEL

B. Muthuraman/Managing Director

Good For The Next 50

The next 50 years

will be India's steel age. That's what B. Muthuraman, the Managing

Director of Tata Steel told this magazine a few months back, shortly

after moving from Jamshedpur, where Tata Steel is based, to a

corner-office at Bombay House, the headquarters of the Tata Group

in (where else?) Mumbai. The per capita consumption of steel,

he added, would jump from 30 kg now to around 250 kg in 25 years

and a whopping 300-400 kg in 50. In aggregate terms, that will

mean steel consumption will increase from 40 million tonnes currently

to 250 million tonnes by 2030 and 500 million tonnes by 2050.

Everything that is happening in India's steel

sector (and a lot is) should be seen from this perspective, Posco's

proposed investment of $12 billion (Rs 52,800 crore) for a 12-million

tonnes per annum (MTPA) steel plant (by 2016) in Orissa, and Mittal

Steel's $9.3-billion (Rs 40,920 crore) one for a 12-mtpa one (by

2009) in Chattisgarh. Tata Steel's proposed investment of $23

billion (Rs 1,01,200 crore) over the next 10 years to take its

capacity from 7 million tonnes now (including 2 million tonnes

that come from the acquisition of part of NatSteel's operations)

to 35 million tonnes compares well with these numbers.

Some of that money will go into upgrading

the company's existing steel plants, and some into new plants

in Iran, Bangladesh and other Asian countries. "India, thanks

to its rich mineral resources, is a good location for producing

iron and steel," says a Tata Steel spokesperson. "It

will not be foreign companies only, even Indian companies will

expand."

The company's manufacturing model (which

the spokesperson describes as de-integrated) involves producing

semi-finished steel close to the source of raw material and finished

products closer to the markets. Not surprisingly, it has indicated

that its acquisitions overseas will largely be what are termed

'downstream assets' that can source steel from the company's own

plants and convert it into value added products.

That's a model that finds favour with analysts.

"This will help Tata Steel leverage its existing facilities

in India and emerge as one of the cheapest suppliers of value-added

steel products globally and eventually emerge as a global steel

major," says Nirmalya Mukherjee, industry analyst and editor

of a leading metal journal. Well, Tata Steel has always said it

will eventually become a global company.

-Ritwik Mukherjee

TEJAS

NETWORKS

Sanjay Nayak/ Managing Director

The Network Is It

The

dotcom boom, and subsequent bust, wasn't just about dotcoms. Companies

sprung up to facilitate the creation and maintenance of high-speed

virtual highways. At one time, there were over 200 optical networking

companies feeding off the boom; then, the bust happened and most

went under, leaving behind a dozen survivors, including Bangalore-based

Tejas Networks. The company may have closed last year with just

around Rs 47 crore in revenues but as Sanjay Nayak, its Managing

Director points out, the R&D intensive products business Tejas

is in has a long gestation period. There is more going for Tejas.

Most of its revenues come from the domestic market (companies

such as Railtel and Tata Teleservices are customers), and the

Indian telecommunications market is widely reckoned to be the

most happening in the world. "The telecom boom in India has

provided a local market with access to customers," says Nayak.

And leveraging the cost advantage and its R&D skills, Tejas

hopes to forge alliances with global networking majors and equipment

makers "who will find it more attractive to source products

rather than develop it themselves", according to Nayak. That

sounds almost too easy. The

dotcom boom, and subsequent bust, wasn't just about dotcoms. Companies

sprung up to facilitate the creation and maintenance of high-speed

virtual highways. At one time, there were over 200 optical networking

companies feeding off the boom; then, the bust happened and most

went under, leaving behind a dozen survivors, including Bangalore-based

Tejas Networks. The company may have closed last year with just

around Rs 47 crore in revenues but as Sanjay Nayak, its Managing

Director points out, the R&D intensive products business Tejas

is in has a long gestation period. There is more going for Tejas.

Most of its revenues come from the domestic market (companies

such as Railtel and Tata Teleservices are customers), and the

Indian telecommunications market is widely reckoned to be the

most happening in the world. "The telecom boom in India has

provided a local market with access to customers," says Nayak.

And leveraging the cost advantage and its R&D skills, Tejas

hopes to forge alliances with global networking majors and equipment

makers "who will find it more attractive to source products

rather than develop it themselves", according to Nayak. That

sounds almost too easy.

-Rahul Sachitanand

TKML TKML

A. Toyoshima/Managing Director

Driven!

There has been

a sense of purpose (menace according to rival car makers) to the

way the world's most profitable car-maker, Toyota, has approached

the Indian market through its subsidiary Toyota Kirloskar Motor

Limited (TKML). First off, it chose not to launch a car, but a

multi-utility vehicle (MUV), the breadbox-shaped Qualis that proceeded

to emerge the leader in its segment. Then, five years and 1.42

lakh units later (a period when it quietly launched its offerings

in the C and D segments, sedans Corolla and Camry), the company

surprisingly announced that it was stopping production of Qualis

and replaced it with a mini-van-like MUV, Innova, which has sold

some 25,000-plus units to date. "The last 12 months have

been exciting and challenging for us in India," says A. Toyoshima,

Managing Director, TKML, reflecting the understatedness that one

has come to associate with the company.

In March 2005, the company hiked production

capacity at its Bidadi plant on Bangalore's outskirts to 60,000

units from 40,000 units. It now plans to make India an auto-component

hub for the global Toyota system with Toyota Kirloskar Auto Parts

and, eventually, launch a small car to enter the largest segment

of the Indian car market (70 per cent of the one-million plus

cars sold last year in India is small cars). "Our target

is to achieve 10 per cent market share by 2010," says Toyoshima.

"We are evaluating various alternatives to achieve this growth

and are looking at products in the volume segment to reach our

goal." The company denies it, but the buzz in Bangalore is

that TKML is looking out for another site for its second manufacturing

facility. Twenty-two years after Toyota first entered the market

through a joint venture with DCM to make light commercial vehicles,

the Japanese major's story may finally be unfolding.

-Rahul Sachitanand

UNITED

SPIRITS

Vijay Mallya/ Chairman

The 20-year Single-minded Obsession

When

Vijay Mallya walked into Wallace House on Kolkata's Bankshall

street on September 21, and when he, later in the day, noted the

event for posterity's sake in his own hand (seen in inset; Mallya's

photograph, however, has been shot elsewhere), he had reason to

be happy. After all, he was entering the HQ of a company he had

first tried to acquire 20 years ago in 1985. Sentiment is a good

thing. Then, in the noise about Mallya's passion for all things

fast, cars, yachts, race-horses, aircraft, his luxurious lifestyle

and his reputation for throwing the best parties money can buy,

it is easy to forget the fact that he is one smart businessman.

And his extended celebration of the acquisition of Shaw Wallace

may have more to do with what the company can do for his spirits

business than anything else. When

Vijay Mallya walked into Wallace House on Kolkata's Bankshall

street on September 21, and when he, later in the day, noted the

event for posterity's sake in his own hand (seen in inset; Mallya's

photograph, however, has been shot elsewhere), he had reason to

be happy. After all, he was entering the HQ of a company he had

first tried to acquire 20 years ago in 1985. Sentiment is a good

thing. Then, in the noise about Mallya's passion for all things

fast, cars, yachts, race-horses, aircraft, his luxurious lifestyle

and his reputation for throwing the best parties money can buy,

it is easy to forget the fact that he is one smart businessman.

And his extended celebration of the acquisition of Shaw Wallace

may have more to do with what the company can do for his spirits

business than anything else.

While United Breweries, Mallya's beer business,

has always been a major player in its segment, McDowell's, the

flagship of his spirits business, never enjoyed the same cachet.

The acquisition of Shaw Wallace and the earlier settlement with

Kishore Chhabria over Herbertsons (it is finally Mallya's alone)

should change that. This year, the 10 companies that now constitute

Mallya's spirits business will sell around 65 million cases making

it the second largest in the world (Diageo is the only player

ahead of it), earn revenues of more than Rs 3,000 crore, and control

over 55 per cent of Indian market.

And while some analysts have expressed concern

that UK may have overpaid for some of its acquisitions, Mallya

doesn't seem unduly perturbed over the Rs 1,300 crore he had to

borrow from ICICI for the Shaw Wallace deal alone. The man may

have a long-term plan for the spirits business that could make

fears over money meaningless. The first step of this plan, something

he has already initiated, is the merger of the 10 spirits companies

(companies like McDowell's, Shaw Wallace Distilleries, Herbertsons,

Triumph Distillers and Vintners, Phipson Distillery) into one

entity, United Spirits. That done, he could well take the same

route he did with the brewing business, United Breweries, which

divested 17.5 per cent of its equity to Scottish and Newcastle

for Rs 217 crore. For any company interested in an India play,

a stake, however small, in United Spirits should be worth its

weight in gold. Mallya himself would rather not disclose his plans

for the company (he refuses to speak about a possible divestment).

"We will look at potential overseas acquisitions to enhance

our share in the global markets," he says. United Spirits

may be #2 in the world, but its revenues (an estimated Rs 3,000

crore) still lag far behind the £8.9 billion (Rs 70,310

crore) that Diageo's spirits business earns. While it is likely

to stay that way for some time, the booming Indian market could

see United Spirits becoming the world's largest spirits company

(by volume).

-Venkatesha Babu

VIMTA

LABS VIMTA

LABS

S.P. Vasireddi/Chairman and Managing Director

The Offshore Story

The second wave

of Indian it, the one that started post 2000 (after the end of

the onsite-heavy y2k wave) was driven by what companies term offshore

development centres (ODCs), essentially dedicated software facilities

created by Indian it services firms for their clients outside

India. For instance, Satyam Computer Services would have an ODC

for GE, another for Caterpillar, and still another for General

Motors, among others, apart from its generic facility (think of

it as something akin to a store-within-a-store). Vimta Labs is

in the process of doing something similar in the contract-research

space in pharmaceuticals; by 2006, it will have several customer-specific

research labs up and running. "We are the first in the country

to set up an RPO (research process outsourcing) hub," says

S.P. Vasireddi, Chairman and Managing Director, Vimta. The process

will cost Rs 50 crore, occupy 200,000 sq. ft (all laboratory space)

across 10.7 acres in Genome Valley near Hyderabad, boast 40 walk-in

cold rooms, 80 safety hoods, a training school, a 5,000 sq. ft

archive centre for samples and records, and a secure data centre

and network managed by IBM that will provide remote access to

clients. "Outsourcing is the name of the game and we have

to have systems in place (to facilitate that)," says Vasireddi.

"(At the same time) we have to have a molecular research

focus," he adds. If the man's plans fructify, Vimta, which

posted a net profit of Rs 14.1 crore on a total income of Rs 52.5

crore in 2004-05, could realise his goal of figuring "among

the top 10 contract research and testing organisations in the

world by 2010". And to think Vimta began life as a single-bench

analytical lab.

-E. Kumar Sharma

WNS

Neeraj Bhargava/Group CEO

Third-party Troubadour

When

British Airways sold a majority stake in its captive business

process outsourcing (BPO) operations in India to private equity

behemoth Warburg Pincus in mid-2002, not too many people paid

too much attention to the deal. It was only in 2003-04, when the

company declared revenues of over $111 million (Rs 499.5 crore

at the then exchange rate), making it the largest third party

BPO in the country, that people sat up and took notice. In 2004-05,

with income from segments such as insurance and healthcare kicking

in, the contribution of travel services that once accounted for

all business of WNS declined to 49 per cent (on revenues of $163

million or Rs 717.2 crore). "The bottom line is that you

just have to go out there and get the customers; there is simply

no other answer," says Neeraj Bhargava, Group CEO, WNS. "We

leveraged the fact that as a captive, WNS had sophisticated processes

that helped us bag a lot of non-voice work, which accounts for

over 80 per cent of our business." That's significant, given

that most BPOs in India still bank on voice revenues. The company

may have had size on its side; it was smaller at the time of transition

from a captive to a third-party BPO, unlike, say GECIS (now Genpact).

WNS' big thrust, Bhargava says, will be in financial services,

which currently accounts for 5 per cent of revenues. Sometime

in 2006, WNS will make a public offering in the US, UK or India.

Investors must be hoping it is the last. With Warburg Pincus'

earlier track record on taking companies public (think Bharti

Tele-Ventures), this one needs to be watched. When

British Airways sold a majority stake in its captive business

process outsourcing (BPO) operations in India to private equity

behemoth Warburg Pincus in mid-2002, not too many people paid

too much attention to the deal. It was only in 2003-04, when the

company declared revenues of over $111 million (Rs 499.5 crore

at the then exchange rate), making it the largest third party

BPO in the country, that people sat up and took notice. In 2004-05,

with income from segments such as insurance and healthcare kicking

in, the contribution of travel services that once accounted for

all business of WNS declined to 49 per cent (on revenues of $163

million or Rs 717.2 crore). "The bottom line is that you

just have to go out there and get the customers; there is simply

no other answer," says Neeraj Bhargava, Group CEO, WNS. "We

leveraged the fact that as a captive, WNS had sophisticated processes

that helped us bag a lot of non-voice work, which accounts for

over 80 per cent of our business." That's significant, given

that most BPOs in India still bank on voice revenues. The company

may have had size on its side; it was smaller at the time of transition

from a captive to a third-party BPO, unlike, say GECIS (now Genpact).

WNS' big thrust, Bhargava says, will be in financial services,

which currently accounts for 5 per cent of revenues. Sometime

in 2006, WNS will make a public offering in the US, UK or India.

Investors must be hoping it is the last. With Warburg Pincus'

earlier track record on taking companies public (think Bharti

Tele-Ventures), this one needs to be watched.

-Priya Srinivasan

|

In

August 2003, Captain G.R. Gopinath, the Managing Director of Air

Deccan, a company with a workforce of three and a fleet of one

(a turbo-prop, if you must know), announced his wannabe low-cost

airline's maiden flight, from Bangalore to Hubli (a large city

in Northern Karnataka that wasn't, until then, connected by air).

Today, Air Deccan employs 1,300, has a fleet of 24 aircraft including

seven new Airbus A320s, operates 140 flights a day, and would

have flown some four million passengers in 12 months by the time

this year ends. Along the way, the company has engendered a low-cost

airline revolution in India; three more low-cost airlines are

already in the air and some 12 are waiting to take wing. And in

this, its second full year of operation, it has turned profitable

(analysts expect Air Deccan to close this year with Rs 1,000 crore

in revenues; the company itself isn't willing to share any numbers

as it is in the quiet period in a run-up to its initial public

offering).

In

August 2003, Captain G.R. Gopinath, the Managing Director of Air

Deccan, a company with a workforce of three and a fleet of one

(a turbo-prop, if you must know), announced his wannabe low-cost

airline's maiden flight, from Bangalore to Hubli (a large city

in Northern Karnataka that wasn't, until then, connected by air).

Today, Air Deccan employs 1,300, has a fleet of 24 aircraft including

seven new Airbus A320s, operates 140 flights a day, and would

have flown some four million passengers in 12 months by the time

this year ends. Along the way, the company has engendered a low-cost

airline revolution in India; three more low-cost airlines are

already in the air and some 12 are waiting to take wing. And in

this, its second full year of operation, it has turned profitable

(analysts expect Air Deccan to close this year with Rs 1,000 crore

in revenues; the company itself isn't willing to share any numbers

as it is in the quiet period in a run-up to its initial public

offering).  It

isn't just Indian pharmaceutical majors that have global aspirations.

Bilcare, a company that develops and manufactures packaging for

pharma companies, has them too. "Our strategy is all about

increasing capacities and addressing challenges faced by pharma

companies worldwide," says Mohan Bhandari, Managing Director,

Bilcare. Already, the company that closed 2004-05 with Rs 165

crore in sales (it expects to grow by 30 per cent in 2005-06)

has founded an eponymous subsidiary in Singapore, and acquired

Proclinical Inc, a us-based packaging firm that boasts the likes

of Astra Zeneca and Johnson & Johnson among its customers.

"Apart from being the largest market, the us is also the

fastest growing (for pharmaceutical packaging) at 15 per cent

plus," explains Bhandari.

It

isn't just Indian pharmaceutical majors that have global aspirations.

Bilcare, a company that develops and manufactures packaging for

pharma companies, has them too. "Our strategy is all about

increasing capacities and addressing challenges faced by pharma

companies worldwide," says Mohan Bhandari, Managing Director,

Bilcare. Already, the company that closed 2004-05 with Rs 165

crore in sales (it expects to grow by 30 per cent in 2005-06)

has founded an eponymous subsidiary in Singapore, and acquired

Proclinical Inc, a us-based packaging firm that boasts the likes

of Astra Zeneca and Johnson & Johnson among its customers.

"Apart from being the largest market, the us is also the

fastest growing (for pharmaceutical packaging) at 15 per cent

plus," explains Bhandari. CAVINKARE

CAVINKARE It

has perhaps been among the most interesting turnarounds in the

banking sector. Centurion Bank, whose story seemed all but over

a couple of years ago, is today in the news for its merger with

Bank of Punjab. Centurion Bank itself was taken over in mid-2003

by a combine comprising Sabre Capital (founded by former Standard

Chartered ceo Rana Talwar who is now Centurion's Chairman) and

Bank of Muscat; a fresh infusion of capital and a focus on operating

efficiencies turned it around. Ironically, Bank of Punjab finds

itself in a position similar to that of Centurion at the time

of its acquisition, and most of its problems can be addressed

through a fresh infusion of capital. The merger, apart from doing

this, will also put Centurion on the fast track. The merged entity

will be called Centurion Bank of Punjab and its Managing Director

Shailendra Bhandari is upbeat about where the bank is headed.

"The primary thrust will continue to be retail," he

says. "Over the next five years, there could also be inorganic

growth." The emphasis on retail shouldn't surprise anyone;

Centurion disburses 40,000 loans for two-wheelers every month

(a fifth of all loans for two-wheelers disbursed).

It

has perhaps been among the most interesting turnarounds in the

banking sector. Centurion Bank, whose story seemed all but over

a couple of years ago, is today in the news for its merger with

Bank of Punjab. Centurion Bank itself was taken over in mid-2003

by a combine comprising Sabre Capital (founded by former Standard

Chartered ceo Rana Talwar who is now Centurion's Chairman) and

Bank of Muscat; a fresh infusion of capital and a focus on operating

efficiencies turned it around. Ironically, Bank of Punjab finds

itself in a position similar to that of Centurion at the time

of its acquisition, and most of its problems can be addressed

through a fresh infusion of capital. The merger, apart from doing

this, will also put Centurion on the fast track. The merged entity

will be called Centurion Bank of Punjab and its Managing Director

Shailendra Bhandari is upbeat about where the bank is headed.

"The primary thrust will continue to be retail," he

says. "Over the next five years, there could also be inorganic

growth." The emphasis on retail shouldn't surprise anyone;

Centurion disburses 40,000 loans for two-wheelers every month

(a fifth of all loans for two-wheelers disbursed).  DQ

ENTERTAINMENT

DQ

ENTERTAINMENT  Eleven

years after it was spun off from the Godrej Group, and four years

after a particularly bad financial performance, Geometric Software

looks every inch a company for the future. One reason for that

is the business it is in, the happening area of product lifecycle

management (PLM). Unlike other next big things, PLM is one of

the current big (fine, reasonably big) things in the technology

space. It is about the management of products from their initial

concept, through design, launch and production to their eventual

obsolescence. At one time, PLM was all about computer-aided design

(cad) and computer-aided manufacturing (cam), the two businesses

that Geometric started off with (hence the name; cad and cam are

geometry-based work); today it includes several other things such

as electronic design automation (EDA), maintenance, and computer

aided production engineering (CAPE). Essentially, PLM reduces

the time to market and is something that can be applied across

sectors, from auto to aerospace, from ship-building to financial

services.

Eleven

years after it was spun off from the Godrej Group, and four years

after a particularly bad financial performance, Geometric Software

looks every inch a company for the future. One reason for that

is the business it is in, the happening area of product lifecycle

management (PLM). Unlike other next big things, PLM is one of

the current big (fine, reasonably big) things in the technology

space. It is about the management of products from their initial

concept, through design, launch and production to their eventual

obsolescence. At one time, PLM was all about computer-aided design

(cad) and computer-aided manufacturing (cam), the two businesses

that Geometric started off with (hence the name; cad and cam are

geometry-based work); today it includes several other things such

as electronic design automation (EDA), maintenance, and computer

aided production engineering (CAPE). Essentially, PLM reduces

the time to market and is something that can be applied across

sectors, from auto to aerospace, from ship-building to financial

services. GVK

BIOSCIENCES

GVK

BIOSCIENCES Indian

Rayon, soon to be renamed Aditya Birla Nuvo, has always been a

diversified company. Over the past five years, the company's portfolio

of businesses has got even more diverse: since 2000, it has acquired

Madura Garments (and brands such as Van Heusen and Louis Philippe),

PSI Data Systems, Transworks (a BPO firm) and, recently, a large

equity stake in Idea Cellular (in which its holding and that of

other companies belonging to the Aditya Birla Group add up to

a little over 50 per cent). It also entered the insurance business

through a joint venture with Canada's Sun Life. "In four

words, Indian Rayon will become a 'diversified high growth company',"

says Sanjeev Aga, Managing Director. Today, the new businesses

account for a little over half of the company's consolidated revenues;

over the next five years, this proportion is expected to increase

to 75 per cent. Eventually, says Kumar Mangalam Birla, Chairman,

Aditya Birla Group, there will be two groups of businesses within

Indian Rayon. "There will be the value businesses, which

are the brick-and-mortar businesses throwing up cash but where

growth opportunities are limited, and the high growth businesses,

which are garments, financial services, BPO, telecom, mutual funds

and insurance," he explains. Seen from that perspective,

the recent mergers of Indo-Gulf and Birla Global into Indian Rayon

are strategic plays. "Birla Global's financial services business

includes mutual funds distribution and insurance advisory but

not insurance, which is Indian Rayon's business," points

out Aga. And, "the cash generation of Indo-Gulf is sub-optimally

employed; if it comes into Indian Rayon, this money can be invested

in telecom and financial services, which hopefully will give faster

returns", he adds. Over time, the Indian Rayon story could

turn out to be one of diversifying sensibly into high-value businesses

successfully while making the most of traditional businesses.

When the recent restructuring was announced, the majority opinion

among analysts was that it was a 'value-neutral' move. It could

well be that it was a value-enhancing one.

Indian

Rayon, soon to be renamed Aditya Birla Nuvo, has always been a

diversified company. Over the past five years, the company's portfolio

of businesses has got even more diverse: since 2000, it has acquired

Madura Garments (and brands such as Van Heusen and Louis Philippe),

PSI Data Systems, Transworks (a BPO firm) and, recently, a large

equity stake in Idea Cellular (in which its holding and that of

other companies belonging to the Aditya Birla Group add up to

a little over 50 per cent). It also entered the insurance business

through a joint venture with Canada's Sun Life. "In four

words, Indian Rayon will become a 'diversified high growth company',"

says Sanjeev Aga, Managing Director. Today, the new businesses

account for a little over half of the company's consolidated revenues;

over the next five years, this proportion is expected to increase

to 75 per cent. Eventually, says Kumar Mangalam Birla, Chairman,

Aditya Birla Group, there will be two groups of businesses within

Indian Rayon. "There will be the value businesses, which

are the brick-and-mortar businesses throwing up cash but where

growth opportunities are limited, and the high growth businesses,

which are garments, financial services, BPO, telecom, mutual funds

and insurance," he explains. Seen from that perspective,

the recent mergers of Indo-Gulf and Birla Global into Indian Rayon

are strategic plays. "Birla Global's financial services business

includes mutual funds distribution and insurance advisory but

not insurance, which is Indian Rayon's business," points

out Aga. And, "the cash generation of Indo-Gulf is sub-optimally

employed; if it comes into Indian Rayon, this money can be invested

in telecom and financial services, which hopefully will give faster

returns", he adds. Over time, the Indian Rayon story could

turn out to be one of diversifying sensibly into high-value businesses

successfully while making the most of traditional businesses.

When the recent restructuring was announced, the majority opinion

among analysts was that it was a 'value-neutral' move. It could

well be that it was a value-enhancing one. MARUTI

UDYOG LIMITED

MARUTI

UDYOG LIMITED The

term wireless in local loop (WLL) may have entered public consciousness

in the late 1990s with the fight between India's CDMA and GSM

lobbies, but it was actually popularised almost a decade earlier

by a Chennai-based start-up. Midas Communication Technologies

was the name of the company; it was founded by some alumni of

the Indian Institute of Technology, Chennai, in association with

the school's TeNet Group (founded by Professor Ashok Jhunjhunwala,

this has incubated several companies, including Midas); and it

set out to license, a la Qualcomm, a technology called cordect

(where DECT stands for digital enhanced cordless telecommunications)

that the good professor had come up with. cordect remains an ideal

technology (for telcos and internet service providers) seeking

to connect remote regions with a scattered population and although

it never really took off in India (from a telecom mainstream point

of view) it is quite popular in several Asian markets. Along the

way, Midas has ventured into the manufacture of cordect equipment;

it has also merged another TeNet incubated firm Banyan Networks

(an early broadband technology firm) with itself. The company

is hoping that Citius, its broadband technology offering that

allows companies to provide broadband through existing cable (television)

networks, will help it enter the big league (its current revenues

are in the region of Rs 400 crore). With technology solutions

for broadband access through cable, DSL (digital subscriber line),

even Wi-Max (Wi-Fi, over a much larger region, say an entire city),

says Shirish Purohit, Managing Director, Midas, the idea is to

"reach customers through every entry point". India's

broadband policy envisages that the country will have 50 million

broadband users by 2010. Those who believe that target is achievable

will have no problems with Midas' ambitions of becoming a $1-billion

(Rs 4,400-crore) company by 2010.

The

term wireless in local loop (WLL) may have entered public consciousness

in the late 1990s with the fight between India's CDMA and GSM

lobbies, but it was actually popularised almost a decade earlier

by a Chennai-based start-up. Midas Communication Technologies

was the name of the company; it was founded by some alumni of

the Indian Institute of Technology, Chennai, in association with

the school's TeNet Group (founded by Professor Ashok Jhunjhunwala,