|

For

a while now, in fact, ever since the stock market touched 10k,

analysts and commentators have been tying themselves into knots

trying to figure out whether the market is vaulting too high.

The BSE Sensex has since been playing footsie with the 11k mark,

but valuations still seem just about right-it's a Goldilocks market.

However, with the Sensex price-earnings (P-E)

multiple reigning at about 20, experts advise caution-not so much

because the P-E ratio is too high, but because markets by nature

are cyclical. After all, we have had three consecutive years of

high returns and now, as interest rates inch higher, we could

be looking at the beginning of the end of the consumption-led

boom. Right now, though, stocks seem in no mood to listen.

While cautious investors will be selling

now and salting away the profits, the ambitious ones still want

to play the field. Or, they might have missed the rally, but now

want a piece of the action. For such investors, it's frustrating

to see how expensive the market has become. They cannot take part

in the frenzied buying that's going on at the counters of frontline

stocks, and realise it will be foolish to look at penny stocks.

What then?

What few people realise is that the market

still has some good, fundamentally strong stocks going at fair

prices. These have, for various reasons, not participated in the

rally. They offer both a good opportunity for long-term capital

appreciation and carry minimum downside risk. Some have listed

recently and are trying to adjust to a market that always demands

more, and are, hence, facing short-term blips. Some are frontline

stocks with high dividend yields, which have been subdued in the

last one-and-a-half months despite the almost 10 per cent rise

in the Sensex. There are the turnaround stories, which will take

a while to make their mark; and then there are the upcoming IPOs

(initial public offerings) from potential blue chips like Reliance

Petroleum, Deccan Airways and Sun TV.

BT Money went fishing in these turbulent waters

to hook some of the best deals for you. Take a look.

Listing and After: After the Maruti Udyog

IPO in 2003, investing in IPOs has been seen as a safe bet. Several

scrips gave 25 per cent returns on the day of listing. Of late,

though, the IPO market has not been quite so accommodating. In

the recent past, quite a few aggressively priced IPOs have taken

a drubbing immediately after listing. And investors are being

cautioned to stay away.

According to primary market experts, a new

trend is emerging-that of investing in newly listed IPOs. This

is seen as a much safer bet. There are, at present, quite a few

freshly listed stocks that are trading below their offer prices

and trailing the broader indices, although nothing much has changed

either in the company or the industry.

Analysts suggest that if you have a long-term

horizon, these stocks definitely look to be up for grabs (see

table: Distress Buys). S. Ramesh, Executive Director (Equity Products)

at Kotak Mahindra Capital, says: "In a bull market, there

are situations when the pricing tends to be aggressive, which

sometimes doesn't offer immediate gains, but investors who stay

invested for a slightly longer term get the returns."

Ideally, before buying such stocks, investors

should either study the company or ask their financial advisor

why they have dropped below the offer price. Says Ramesh: "If

it is because of a general market trend and not because of the

fundamentals, there is no harm in buying such stocks."

|

"Don't invest blindly

in divident yield stocks. The dividends should be sustainable

in future"

Asit Koticha

MD & CIO, Ask Raymond James |

Take a look at Jet Airways. In the first nine

months of 2005-06, Jet saw a 30 per cent rise in turnover although

profits were hit severely by soaring fuel prices and lease rentals.

But Jet's long-term story is still intact-with air traveller numbers

increasing and its global expansion on track. Equity research

firm indiainfoline.com says in its research report: "The

company's SAARC operations are profitable, Mumbai-London is progressing

towards break-even, while Mumbai-Singapore turned profitable within

seven months of operations."

The airline's income from cargo is also on

the rise. In the October-December quarter of 2005-06, cargo income

stood at $19.5 million (Rs 87.75 crore) compared to $10.75 million

(Rs 48.38 crore) in the corresponding period of the previous year.

The Sahara deal, although now in limbo, may offer additional infrastructure

to Jet in terms of aircraft, parking slots and pilots. Analysts

say Jet should be able to better rationalise its routes and get

access to new passengers in days to come. Its stock, which was

issued at Rs 1,100, listed at a premium of 18 per cent at Rs 1,304

per share on March 14, 2005 and is now ruling at Rs 949 levels.

Our take: it looks attractive at that price.

GVK Power & Infrastructure, the holding

company of the GVK Group's power business, is another such example.

The IPO received overwhelming response from investors, being oversubscribed

25 times. However, gvk's stock, which touched a high of Rs 368

soon after listing (offer price: Rs 310) is today trading at Rs

255. While fuel availability is a risk, analysts point out that

GVK has a track record of timely project implementation, which

should make it a good buy even today.

Sure Shot Gains: Obviously, not all IPOs

are going to fall on their faces after listing. There are quite

a few companies with terrific track records and huge potential

that will almost certainly list at a premium. In the recent past,

IPOs that have given smashing returns include wind energy player

Suzlon, which has returned 362 per cent since its IPO in September

2005, Shree Renuka Sugar (295 per cent since October 2005), logistics

player Gateaway Distipaks (260 per cent since April 2005), IVRCL

Infrastructure (236 per cent since March 2005) and Educomp Solutions

(236 per cent since December 2005).

Though IPO ratings have not really captured

anybody's imagination, Sushil Muhnot, Managing Director, IDBI

Capital Market Services, advises investors to look at the industry

outlook, followed by the management track record and the company's

fundamentals before investing. "Investors should look at

whether the industry is growing, the company's competitive advantages

and future earnings capacity, the international competition, and

the track record of the promoters." (See Up For Grabs).

UP FOR GRABS

In the coming months, some marquee

names are coming up with IPOs, giving you a chance to grab

a piece of the action. |

RELIANCE PETROLEUM

It is setting up a 29 million tonnes per annum refinery at

an estimated cost of Rs 27,000 crore, and production is expected

to start from December 2008. The Reliance Group has an excellent

track record of rewarding shareholders, and if all goes well

this time won't be any different. Reliance Petro has made

a private placement at a price of Rs 60 per share

DEVELOPMENT CREDIT BANK

The private bank promoted by the Aga Khan Trust is coming

out with a Rs 300 crore issue. For fiscal 2006, the bank

has Rs 3,800 crore deposits and Rs 2,000 crore advances.

Yes Bank, its peer, had an offer price of Rs 45 and is Rs

90 today

SUN TV

It is the leading Chennai-based TV channel run by Kalanithi

Maran and the largest television broadcaster in all the

four southern states. For the quarter ended March 2005,

Sun TV generated revenues of Rs 301 crore and net profits

of Rs 76 crore. Sun TV has fixed a price band of Rs 730

to Rs 875 per share

DECCAN AVIATION

The country's first budget airline started by Captain G.R.

Gopinath is giving established airlines quite a run for

their money. With a dozen aircraft on board, and more on

the way, this no-frills airline's public issue will be worth

looking at

MULTI COMMODITY EXCHANGE

An arm of Jignesh Shah's Financial Technologies, it offers

a futures trading platform in the commodity space. It covers

over four dozen commodities like chana, gur, soy, gold,

etc. With commodity trading now attracting quite a bit of

attention, this new issue is bound to stir interest

|

| |

BACK IN THE BLACK

Take a look at some of these companies,

which have clawed their way back into the reckoning after

a period of gloom. |

CENTURION BANK OF PUNJAB

This 10-year-old private bank is today on a strong growth

path, having come through a period of heavy losses. With Sabre's

Rana Talwar at the helm, Centurion has hit the road running,

with net profits of Rs 25 crore and net non-performing assets

of just 2.5 per cent

PETRONET LNG

The country's first greenfield LNG regasification terminal

(capacity: 5 million tonnes per annum) at Dahej, Gujarat,

has turned profitable in 2005-06. Promoted by four oil PSUs,

Petronet has generated a net profit of Rs 118.77 crore in

the first three quarters of 2005-06, against a net loss

of Rs 28.44 crore in 2004-05

GOA CARBON

Part of the Rs 1,100-crore Goa-based Dempo Group, this company

is back in the black, and posted a net profit of Rs 1.23

crore for the first nine months of 2005-06, compared to

a net loss of Rs 66 lakh in the corresponding period of

the previous year

|

Liquid, Safe, Reliable: If you are totally

risk averse, and will look only at industrial biggies like the

Tatas and Birlas or frontline stocks like ITC and ONGC for your

portfolio, the best way to locate such stocks is to calculate

dividend yields. Analysts use this formula: dividend per share

multiplied by 100 and divided by the market price per share.

The best part? You get these returns by staying

invested for a very short term. You could, for instance, stay

in a stock for just four months and earn a dividend yield of 4

per cent-that works out to annualised returns of 12 per cent,

which is much higher than bank deposits or even post office savings.

While high dividend yield stocks are a good protection in a falling

market, if and when the market does go up, they also offer good

scope for capital appreciation. "One shouldn't blindly invest

in dividend yield stocks. The dividends should be sustainable

in future," cautions Asit Koticha, MD & CIO, ask Raymond

James.

|

"Look at the industry's

competitive advantages, future earning capacity and promoters'

record "

Sushil Muhnot

MD, IDBI Capital Market Services |

Analysts suggest that apart from dividend

yields, there are other factors like low price-to-book value and

market capitalisation-to-sales ratio that should be taken into

account before buying such stocks. In fact, you can also spot

good dividend yielding stocks in the portfolios of mutual funds,

since many funds in the past have launched dividend yield schemes

like the Tata Mutual Fund and Birla Mutual Fund.

Always Valuable: For those of you who are

willing to take a little bit more risk while still staying in

the index universe, the next best route is to spot the good, solid

stocks that have, for various reasons, underperformed the index

in this rally (see table: The Rise And The Fall). These index

stocks have trailed the benchmark index, but does that mean they

are weak buys? On the contrary, their fundamentals remain very

strong. Examples: stocks like ICICI Bank and Ranbaxy. Not only

are they in fast growing industries like banking and pharma, they

are the leaders in their respective areas. Both have posted strong

profits growth, of 24 per cent and 97 per cent, respectively (third

quarter 2004-05 to third quarter 2005-06). You can't go far wrong

with such stocks, and buying them at declines is what you should

be waiting for.

The Renaissance: There was a time when shareholders

told Ratan Tata to close down Tata Motors. And an IDBI restructuring

report in the late 90s said sail (Steel Authority of India) was

dead. Today, not only are both alive and kicking, but are laughing

all the way to the bank. There are many more such turnaround stories

around. They may have been left behind in the bull run, but this

is the time to buy them, and wait patiently till they find their

place in the sun.

The upturn in the commodities market, the

buoyant growth in the overall economy and drastic restructuring

have lifted the fortunes of many companies in the last three years

(see box: Back In The Black). Whether in iron and steel, chemicals,

paper, tea, glass, or FMCG, the turnaround bug has bitten a lot

of companies. Examples: Assam Company, Apeejay Tea, Titan Industries,

Andhra Petro, Raman Newsprint and Everest Industries.

For avid investors, therefore, it seems there's

no such thing as a bad time to go fishing. What's important is

to find out which fish you should be catching in these waters.

Cities

Of Joy

As the realty boom spreads to Tier II cities,

see if it's time to perk up your property portfolio.

By Rahul Sachitanand

|

|

COIMBATORE

|

|

|

INDORE

|

Want

a piece of land in Mumbai or Bangalore? Well, prices have zoomed

100 per cent or even more in some cases, and things look too hot

to handle (see Building A Bubble? elsewhere in the issue). That's

no reason, though, to keep realty out of your portfolio. What

you have to do is shift your sights and start looking at smaller

cities and non-metros. Developers and realtors say land rates

and rentals there are significantly lower and investors can buy

prime real estate for a fraction of what they would pay in metros.

"Prime real estate in central Mysore,

for example, costs as little as a fifth (per sq. ft) of what it

does in Bangalore. As companies such as Infosys and Wipro set

up base here, we expect significant growth over the next two years,"

says Jagdish Babu, CEO, Sankalp Group, a Mysore-based real estate

firm.

As an investment vehicle, real estate has

moved right to the top of the class. Over the past 12 months,

returns from real estate have been around 30 per cent, competing

closely with gold that gave 30-35 per cent and equity 40 per cent.

Returns from safe instruments like bank fixed deposits, on the

other hand, were between 4 and 6.5 per cent. It's no exaggeration

to say that investing in real estate today could be one of the

best ways to grow your money, provided you are comfortable with

the higher risk and illiquid nature of the investment.

LANDING SOFTLY

Real estate investment is risky.

Caveat emptor. |

»

Ensure the builder/developer/seller has clear title

and possession. Let your lawyer cross-check all the paperwork

» All

approvals should be in hand-panchayat, municipality, electricity

and water boards, etc

» Check

the area's master plan. How the area develops will affect

resale values

» Make

sure the building plan is sanctioned. Don't allow the builder

to make any deviations, even if he promises that they can

be regularised later

» Check

the developer's reputation and track record. Speak to other

buyers

» Check

contract for delay clauses and cost over-runs

» Ask

the developer for a building quality warranty

» When

buying land for the long term, put up fencing to avoid encroachment

» Plots

without approach roads are difficult to resell

» Use

holding time to develop your plot-put up fencing, water and

electricity connections, etc. This improves your asking price

|

Gold prices may have peaked, say traders and

exporters, and future growth is likely to be muted. Experts predict

a 10-15 per cent returns on gold over the next 12 months. And

though equity has been rocketing skywards, analysts expect the

market to be range-bound between 10,000 and 11,000 going forward.

This makes real estate a real contender for a place in your portfolio,

especially since you are assured a regular income (from rentals)

plus capital appreciation.

One of the risks in real estate investment

is to buy in over-priced metros or over-valued suburbs, where

prices are already at unrealistic levels. The chances are high

that rates might either fall or plateau in the coming months.

One way to neutralise this is to buy land outside the metros.

According to realtors, real estate in smaller towns has appreciated

significantly already, but there is still room for growth.

Of course, it will come with attendant problems.

How will you monitor your investment? Are you going to be able

to visit this city often enough to keep an eye on the tenants

in your flat or your plot of land? Squatters are a very real problem,

and if you are going to hire caretakers, make sure you factor

that into your cost of investment. Most people usually buy land

in towns where they already have friends or family, so that they

can tap them for help. But if you can solve the logistics issues,

opportunities are available aplenty.

|

|

CHANDIGARH

|

| There is now enough internal demand in

small towns—you don't have to wait indefinitely to find

buyers |

"Land prices in small towns like Coimbatore

have gone up by at least 50 per cent," says C. Subba Reddy,

CEO, Ceebros Property Management. High-potential areas in Coimbatore

include Race Course, R.S. Puram, Peelamedu and Vadavalli. On Mysore's

outskirts, Brigade Developers' new development, Brigade Splendour,

on the Lalita Mahal Road, has apartments selling for around Rs

75 lakh. Mysore, which until 24 months ago was a city of independent

and spacious bungalows, is transforming rapidly into the next

big destination in Karnataka. "Infosys and Wipro have invested

heavily in Mysore and several other home-grown companies, too,

are beginning to expand here," says Sankalp's Babu. Mysore

isn't alone in attracting attention from it biggies. Visakhapatnam

will soon house a 50-acre Satyam campus and is already a base

for global financial services giant HSBC's BPO (business process

outsourcing) operations; TCS and Wipro have also been allotted

land here. And evidently housing, retail and other developments

follow close on the heels of such interest.

In fact, administrative bodies in sec B towns

like Nagpur are trying to woo investors with overhauled civic

set-ups. Says a senior executive with Persistent Systems, a leading

provider of outsourced software product development services:

"There has been a noticeable clean-up in the city, there

are new concrete roads and encroachments have been removed."

DLF Developers has set up a Rs 240-crore, 800,000-sq. ft it park

in the city, and a company representative says: "Industries

like it act as catalysts in these small towns and draw in large

realtors."

GET YOUR SUMS RIGHT

Buying a flat is a costly affair.

Keep your abacus at hand. |

| Knowing real

estate is a great investment and being able to do something

about it are two entirely different things. That's because

this is a very expensive investment avenue, and it usually

needs long gestation periods before it yields returns. You

have to, first, be able to cough up the lump sum you need

to buy a flat and, secondly, be prepared to lock it up for

many years. On the other hand, you get steady rental income

plus capital appreciation. And tax breaks on housing loans,

coupled with low interest rates, make real estate investment

especially attractive today.

As a large-scale investment, it needs a lot of planning.

Before you apply for the loan, make sure you have enough

for the down payment. You might have to break your fixed

deposits, withdraw money from your PF account or take a

loan on your life insurance polices.

And there are always hidden components to buying a flat

or service apartment. For instance, have you factored in

water and monthly maintenance charges? Or an interest-free

security deposit? Then there are registration and stamp

duties, which add up to a hefty sum. Factor all this into

your costs before taking the plunge.

|

Earlier, people hesitated to go to small towns

due to a lack of connectivity, but this has improved significantly

over the last few years, with toll roads, the spread of broadband

and the expansion of large real estate developers into these towns.

"If you buy land or an apartment in these towns, you don't

have to wait indefinitely to find a buyer. There is now demand

being generated internally to make this a viable investment,"

says Brigade's Jaishankar.

Realtors argue that the 30 per cent growth

in it and the overall 8 per cent growth in the economy will lead

to a real estate boom in these emerging towns a few years down

the road. Most large companies are today talking about keeping

several hundred employees in these locations. In Vizag, Satyam

plans to hire some 5,000 people over the next few years, while

Infosys has nearly 2,000 employees in Mysore. Real estate consultancy

Jones Lang LaSalle estimates a demand for over 1 million sq. ft

in Tier III towns over the next couple of years.

|

|

MYSORE

|

While real estate agents may be a dime a dozen

in these cities (Nagpur reportedly has 300), investors need to

be cautious when buying land here. "The growth of the real

estate market and the presence of large developers has made investing

in Bangalore much easier than in, say, Mysore or Mangalore,"

says Jaishankar. Despite the growing market in these towns, realtors

recommend that people buy and hold land or an apartment for a

few years before cashing out. "The growth curve is just beginning

in these towns and it will take a few years before it peaks. So,

while it may be a great time to buy property, investors need to

be prepared to wait for at least a few years to make the most

of the opportunity," points out Reddy.

NEWS ROUND-UP

Waiting

In The Wings

Low on valuation, high on assets-PSU banks

look to be the dark horses in this market.

Private

sector banks may hog the limelight when it comes to services and

hype, but the good old public sector ones still rule the credit

advances market with a share of close to 80 per cent. With interest

rates rising again, the focus is back on SMEs (small and medium

enterprises) and non-metro retail markets, and public sector banks

are better placed to tap this opportunity. "We are positive

on the public sector bank universe as a whole due to its undervaluation,

lower P-Es and higher returns on equity," says equity research

firm Edelweiss Capital.

Punjab National Bank has the largest composition

of low-cost deposits (48.5 per cent). Its focus on maintaining

yields on its advances portfolio, its blend of SME, retail, corporate

and agriculture clientele, and its high interest margins (3.5-4

per cent) make it look good. Says Pankaj Namdharani, Investment

Analyst at SPA Securities: "PNB's asset quality is very good

and we expect the price to touch Rs 600 over a period of two years."

Union Bank of India is trading at 1.25 times

2006-07 estimated book value. "This stock is undervalued,

considering the 21-23 per cent return on equity (RoE)," says

Edelweiss Capital. Analysts think the bank will be able to maintain

its high RoEs even after its recent equity dilution.

Syndicate Bank is another dark horse that

looks attractive in the short- to medium-term. Last week, it became

the first public sector bank to launch a BPO to optimise surplus

human resources. In the December quarter, the bank has returned

to the black with a net profit of Rs 187.88 crore as against a

loss of Rs 78.11 crore (mostly treasury loss) in the corresponding

period the previous year. "The only looming danger is the

rising loan book (advances) in the banking space, which could

breed non-performing assets," says Asit Koticha, MD &

CIO, ASK Raymond James. Meanwhile, an interim dividend of 15 per

cent is on the way for the bank shareholders.

-Anand Adhikari

Cover All Or Else

Finding it tough to get your old car

insured? Call IRDA.

|

| Old wheels: Drive carefully for your

own sake |

Although

IRDA (insurance regulatory development authority) has categorically

announced that companies cannot refuse any vehicle owner third

party insurance cover, the question remains: will the private

sector toe the line? These companies are notorious for turning

away any customer who even smells of risk; this not only discriminates

against customers, but also burdens public sector insurers, who

claim 150 per cent outgo in the third party segment.

Private insurance cover is easy when you

first buy a vehicle because that's the low-risk stage. But after

the second year, you will not get a renewal notice even if your

insurance is comprehensive and not just third party cover. Never

mind old vehicles, private insurers will not touch certain brands

like Bajaj Pulsar, which they classify as 'youth' bikes and, thus,

accident-prone. Owner-driven vehicles that have crossed five years

cannot get cover, and beware if there is change of ownership;

even if the vehicle is just two years old, you can't get insurance.

And of course tractors, commercial vehicles, taxis and vintage

cars are taboo. In fact, private companies have even stopped agent

commissions for vehicles that are not new.

"While the public sector is also reluctant,

it does not turn away customers," points out an agent. Of

course, the public sector loads the premium i.e., levies the additional

charges, but with no choice, customers have to make do. In fact,

agents are forming networks to service clients. So, after the

first year, the Royal Sundaram agent will pass the client on to

his National Insurance friend for renewed cover.

Royal Sundaram Managing Director Antony Jacob

says, however, that his company provides third party cover to

all vehicles, including old ones. Says Jacob, "Royal Sundaram

supports IRDA's initiative as it is a customer-oriented measure."

Till other companies respond similarly, you can, for now, at least

take your complaint to IRDA for redress. Since the onus of proof

is on you, make sure you have some written communication to show.

-Nitya Varadarajan

|

| House that: It pays to invest in service

apartments |

At Your Service

Here's a developer offering guaranteed

returns on your realty investment.

Just

investing in a flat is so passe. Enter service apartments, those

five-star places you can lease out to MNC bosses at sky-high rentals.

If you're tempted by the concept, here's the latest twist in how

this investment idea can be milked. Allied Investments and Housing,

a Chennai-based developer building 60 such apartments in an upmarket

part of town, is offering a new investment variant.

You buy the apartment outright from Allied

Investments, but lease it right back to the company (self-occupation

is not an option). The lease ensures you a minimum guaranteed

return of 8-9 per cent on your investment, whether or not Allied

succeeds in finding a tenant. While Allied takes on the onus of

finding you a lessee, it also takes 30 per cent of the rental

towards maintenance expenses like electricity, water, marketing

fee, etc.

So, if you invest in the smallest apartment,

a 650-ft studio for Rs 35 lakh, you are guaranteed about Rs 23,000

per month (8 per cent per annum), or if there's a tenant, you

stand to get roughly Rs 2,000 per day minus maintenance, which

works out to about Rs 42,000 per month (roughly 14 per cent).

It's a long-term contract-you sign up for 10 years. After that,

if you want out, you can either re-sell the flat to Allied Investments

or to somebody else willing to buy the 'lease' option.

You can invest more-Rs 48 lakh for a 900-sq.

ft flat, or even Rs 68 lakh for a 1,500-sq. ft one. Bookings and

rentals will be transparent and posted online, says Mohammed Arshad,

Director, Allied Investments, adding that his studio apartments

are sold out. Talk of realty reigning.

-Nitya Varadarajan

SMARTBYTES

Won't Be Smooth Sailing

Two things have happened to put a smile on steel-makers'

faces. First, the bull run is sweeping all stocks to new highs;

and secondly, global steel prices have risen in the past two weeks

by about $120 (Rs 5,400). A big gainer is SAIL; the stock has surged

almost 50 per cent in the past 10 weeks to around Rs 80. This, even

though net profits fell 55 per cent in the December 2005 quarter

(year-on-year). Most of the push comes from the price hike, which

is vital for SAIL, which has high operational costs. Earnings will

firm up after the March quarter, says Kunal Kalra of Parag Parikh

Financial Advisory, but SAIL's EPS (earnings per share) will not

climb too high. Meaning: sell. First Global Director Devina Mehra

says: "There is not too much steam left in the stock." The present

rally makes optimists of most investors, but you're unlikely to

get a better price for SAIL in the near future.

-Krishna Gopalan

|

| Star Health's Jagannathan: Expect more |

Move Over, Mediclaim

Low-fuss settlement, competitive premiums,

old age concessions... can the country's first standalone medical

insurance company offer all this? More, insists V. Jagannathan,

Chairman, Star Health and Allied Insurance. With health insurance

a loss-making portfolio, general insurers at present are giving

customers quite a run-around. Star Health is a pure-play, cross-subsidisation

won't be an issue, and you can expect more amenable services at

reasonable rates. Star will launch five policies in end-April,

and will soon expand its range, offering cover up to age 65 with

no fuss. Its post-65 cover, however, will be loaded. Also, pre-existing

conditions will be insured after three claim-free years. "A team

of 50 in-house doctors will manage three-four claims per day,"

says Jagannathan. These doctors will also accompany customers

during hospital admissions and discharges, so that's goodbye to

inflated claims.

-Nitya Varadarajan

Heady

Times, Heady Returns

Most mutual funds gave fantastic returns during

the just-ended quarter.

A BT-MutualFundsIndia.com report.

It

has been an amazing quarter-the sensex breached the 10k and the

11k marks, and also overtook the Dow Jones index. It touched 10k

on February 6, 2006, and 11k just 29 days later. Unabated FII

(foreign institutional investor) inflows, a good Budget and the

strong economic outlook steered the Sensex from 9,390 in early

January 2006 to 11,279 by the end of the quarter. The Sensex and

the NSE Nifty have returned 20.11 per cent and 19.92 per cent,

respectively, during this period. FIIs purchased Rs 17,954 crore

worth of stocks, a 68 per cent increase over the previous quarter.

Mutual funds (MFs), which were sellers of equity in January and

February, turned buyers again in March, making net investments

of Rs 2,624 crore by the end of the quarter. It

has been an amazing quarter-the sensex breached the 10k and the

11k marks, and also overtook the Dow Jones index. It touched 10k

on February 6, 2006, and 11k just 29 days later. Unabated FII

(foreign institutional investor) inflows, a good Budget and the

strong economic outlook steered the Sensex from 9,390 in early

January 2006 to 11,279 by the end of the quarter. The Sensex and

the NSE Nifty have returned 20.11 per cent and 19.92 per cent,

respectively, during this period. FIIs purchased Rs 17,954 crore

worth of stocks, a 68 per cent increase over the previous quarter.

Mutual funds (MFs), which were sellers of equity in January and

February, turned buyers again in March, making net investments

of Rs 2,624 crore by the end of the quarter.

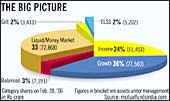

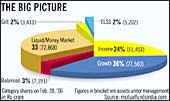

The MF industry's assets under management

(AUM) crossed Rs 2,00,000 crore, and stood at Rs 2,17,464.93 crore

at the end of the quarter. Diversified funds delivered impressive

returns (category average: 19.78 per cent), while ELSS (equity-linked

savings schemes) and equity-oriented balanced schemes were the

next best performers, giving average returns of 18 per cent and

15 per cent, respectively. The performance of the new funds (NFOs)

launched in the quarter has also been good, with average three-month

returns of 20.84 per cent.

Growth funds retained their charisma (see

The Big Picture) and till end-February, accounted for assets of

Rs 77,560 crore, 36 per cent of the total industry corpus. Liquid

and income funds came second, with AUMs at Rs 72,868 and Rs 51,453

crore, respectively. Liquid and balanced funds reported 16 per

cent and 2.3 per cent rise in corpus over the previous quarter,

but gilt and debt funds were out of favour, showing negative growth

of 8 per cent and 3.56 per cent, respectively.

NFOs: Nineteen schemes were launched this

quarter in the growth category. In the open-ended category, there

were five growth schemes and two ELSS, while the close-ended category

saw 20 income and two equity schemes.

AUMs: The industry AUM for the quarter increased

by Rs 18,608 crore, up from Rs 1,98,856 crore to Rs 2,17,464.93

crore. Standard Chartered MF witnessed the highest increase of

43 per cent, from Rs 8,252 crore to Rs 11,813 crore, while HSBC

MF added 40 per cent. Benchmark MF reported the highest fall of

68.3 per cent from Rs 3,041.74 crore to Rs 961 crore and ING MF

fell by Rs 901 crore. Reliance MF, with a Rs 16,859-crore corpus,

might soon surpass Prudential ICICI MF, the largest private AMC

(corpus: Rs 21,366 crore on February 2006).

Other trends: NFOs dominated the quarter.

Reliance Equity, of course, created history with a record mobilisation

of Rs 5,700 crore from 9.29 lakh investors. SBI Bluechip came

next, collecting Rs 2,850 crore. If this pace continues, the industry

is expected to surpass its previous year's collection of Rs 25,334

crore through new fund offers. This is a healthy sign for the

capital market, which is currently dominated by FIIs.

Close-ended funds: In the debt category,

FMPs (fixed maturity plans) continued to attract investors with

their predictable returns and tax advantages. Budget 2006 proved

friendly, with several measures calculated to put the zing back

into the industry.

Scheme Returns: Diversified funds posted

average returns of 19.78 per cent during the quarter, much higher

than last quarter's returns of 8.45 per cent. Tata Infrastructure

Fund topped the charts with returns of 32.99 per cent; the Sensex

returned 20.02 per cent over the same period.

The corpus of ELSS funds surged, as investors

scampered to make their tax-saving investments. These funds gave

average returns of 18.01 per cent. Principal Tax Savings Fund

was the topper here, giving 26.96 per cent while Principal Tax

Saver came next with returns of 24.56 per cent.

Balanced funds: Can Balanced II (24.09 per

cent) led the pack; the benchmark crisil Balanced Fund Index posted

10.67 per cent compared to the category average of 15.34 per cent.

In fact, the leading balanced funds have delivered returns on

par with the top ELSS schemes.

The average returns for liquid funds were

1.38 per cent; LICMF Liquid topped the charts here with returns

of 1.60 per cent. The fund has an expense ratio of 0.5 per cent,

which is lower than the category average. Prudential ICICI GFTP

Fund emerged as the top performer among gilt funds with returns

of 1.84 per cent. The category failed to generate good returns

due to the lacklustre performance of the debt market during the

quarter. The benchmark I-Sec Composite Index delivered returns

close to 0.17 per cent.

Among monthly income plans (MIPs), LIC MIP

topped with quarterly returns of 6.84 per cent, compared to the

category average of 3.32 per cent.

The category average returns for income plans

was a dismal 0.57 per cent; here, Chola Income Plus Fund returned

3.39 per cent. The benchmark CRISIL Composite Bond Fund Index

registered a meagre 0.07 per cent returns for the same period.

In the sector fund category, JM Basic Fund topped with returns

of 31.15 per cent, while FMCG Funds gave a category average of

19.36 per cent; pharma gave 13 per cent and JM Healthcare Sector

Fund topped the rankings with 13.18 per cent returns. Infotech

Fund posted average returns of 12.25 per cent. Banking funds were

the only dampener, delivering negative returns of 0.25 per cent.

Going Forward: Buoyed by a phenomenal rise

in stock market indices, mutual funds have rewarded investors

handsomely. Existing funds have given phenomenal returns while

a plethora of new funds have garnered huge investments. The low

penetration of mutual funds in India, the strong outlook on the

economy and the opening up of newer investment avenues like commodities

and gold mean the industry has great potential to break new ground.

For investors, the buzzword continues to be caution. They should

assess their risk-return profile carefully, ignore short-term

slumps and take informed decisions. Investors with a long-term

horizon should take a risk with equity but in a disciplined manner.

All in all, an action-filled quarter.

Negative

Numbers

Careful research into company fundamentals

is doubly important in a rampant bull market.

Heard of tyche

peripheral or goldcrest finance? neither had we, till we found

that their prices had appreciated up to 117 per cent in less than

three months, even as the companies posted steady losses.

While smart investors will not, hopefully,

buy unknown stocks, what about frontline ones like Tata Steel

or Zee Telefilms? Their financials are nothing to write home about,

but their stock prices have been rising steadily. Says Rajesh

Boghani, Dealer, Parag Parikh Securities: "The market is

chasing momentum stocks, ones they expect will deliver."

Tata Steel's net profit has fallen 15 per

cent (December 2005 quarter) and Zee Tele's 11 per cent, but the

stock prices have surged 20 per cent and 44 per cent, respectively,

in the past nine weeks. Shipping Corporation's price is also rising

on expectations of freight rate hikes. The Tata Steel scrip is

moving on talks of firming steel prices and further investments

in infrastructure, and Zee Tele's on reports of ad rate hikes

and implementation of CAS.

Time to buy? Step carefully, say analysts.

While it's true that Tata Steel's financials have been impacted

by externals like demand slowdown in China, there's little upside

for the stock from a short- to medium-term perspective. And Zee

Tele's, at around Rs 235, already discounts future earnings. Again,

regarding Shipping Corporation, R. Sreesankar of IL&FS Investsmart

warns the rate hike might not be sustainable as new vessels will

enter the market.

The market obviously loves all stocks today,

but that's no reason to abandon caution.

-Mahesh Nayak

Value-picker's Corner

ALOK INDUSTRIES; PRICE: RS 71

Integrated textiles player Alok Industries' revenues

and net profits have grown at 28 per cent and 31 per cent (compounded

annually), respectively, over the last four years. With a Rs 2,300-crore

capex plan underway in home textiles and apparel; plus increased

orders from clients like GAP, Wal-Mart and JC Penny; and with

domestic retailing plans, revenues should zoom. The captive power

plant under construction should reduce input costs and also cushion

fluctuating cotton prices. IDBI Capital predicts profit growth

at 38 per cent over the next three years, but the stock price

might take time to respond, so buy for the long term. Over the

next 15 months, analysts expect Alok to touch Rs 95.

-MN

Trend-spotting

Following

the easing of norms in the Budget, Franklin Templeton has launched

the first scheme investing in overseas securities, while UTI Mutual

Fund has filed its Titan scheme to invest in Dow Jones scrips. However,

the history of overseas investments is not too encouraging. Principal

PNB's Global Opportunities Fund returned 17 per cent last year (29

per cent since its 2004 launch) compared to 66 per cent from diversified

equity funds. Of course, PNB had investment restrictions, but the

fact is the action is now in India. With foreign institutional investors

pumping money into Indian equity, overseas investments diversify

risk, but Indian securities are probably more lucrative. Plus, managing

currency fluctuations will be a major concern for such funds. Following

the easing of norms in the Budget, Franklin Templeton has launched

the first scheme investing in overseas securities, while UTI Mutual

Fund has filed its Titan scheme to invest in Dow Jones scrips. However,

the history of overseas investments is not too encouraging. Principal

PNB's Global Opportunities Fund returned 17 per cent last year (29

per cent since its 2004 launch) compared to 66 per cent from diversified

equity funds. Of course, PNB had investment restrictions, but the

fact is the action is now in India. With foreign institutional investors

pumping money into Indian equity, overseas investments diversify

risk, but Indian securities are probably more lucrative. Plus, managing

currency fluctuations will be a major concern for such funds.

-MN

|

It

has been an amazing quarter-the sensex breached the 10k and the

11k marks, and also overtook the Dow Jones index. It touched 10k

on February 6, 2006, and 11k just 29 days later. Unabated FII

(foreign institutional investor) inflows, a good Budget and the

strong economic outlook steered the Sensex from 9,390 in early

January 2006 to 11,279 by the end of the quarter. The Sensex and

the NSE Nifty have returned 20.11 per cent and 19.92 per cent,

respectively, during this period. FIIs purchased Rs 17,954 crore

worth of stocks, a 68 per cent increase over the previous quarter.

Mutual funds (MFs), which were sellers of equity in January and

February, turned buyers again in March, making net investments

of Rs 2,624 crore by the end of the quarter.

It

has been an amazing quarter-the sensex breached the 10k and the

11k marks, and also overtook the Dow Jones index. It touched 10k

on February 6, 2006, and 11k just 29 days later. Unabated FII

(foreign institutional investor) inflows, a good Budget and the

strong economic outlook steered the Sensex from 9,390 in early

January 2006 to 11,279 by the end of the quarter. The Sensex and

the NSE Nifty have returned 20.11 per cent and 19.92 per cent,

respectively, during this period. FIIs purchased Rs 17,954 crore

worth of stocks, a 68 per cent increase over the previous quarter.

Mutual funds (MFs), which were sellers of equity in January and

February, turned buyers again in March, making net investments

of Rs 2,624 crore by the end of the quarter. Following

the easing of norms in the Budget, Franklin Templeton has launched

the first scheme investing in overseas securities, while UTI Mutual

Fund has filed its Titan scheme to invest in Dow Jones scrips. However,

the history of overseas investments is not too encouraging. Principal

PNB's Global Opportunities Fund returned 17 per cent last year (29

per cent since its 2004 launch) compared to 66 per cent from diversified

equity funds. Of course, PNB had investment restrictions, but the

fact is the action is now in India. With foreign institutional investors

pumping money into Indian equity, overseas investments diversify

risk, but Indian securities are probably more lucrative. Plus, managing

currency fluctuations will be a major concern for such funds.

Following

the easing of norms in the Budget, Franklin Templeton has launched

the first scheme investing in overseas securities, while UTI Mutual

Fund has filed its Titan scheme to invest in Dow Jones scrips. However,

the history of overseas investments is not too encouraging. Principal

PNB's Global Opportunities Fund returned 17 per cent last year (29

per cent since its 2004 launch) compared to 66 per cent from diversified

equity funds. Of course, PNB had investment restrictions, but the

fact is the action is now in India. With foreign institutional investors

pumping money into Indian equity, overseas investments diversify

risk, but Indian securities are probably more lucrative. Plus, managing

currency fluctuations will be a major concern for such funds.