|

Ask any CEO,

and she will tell you that creating shareholder wealth is anything

but easy. You have to be in the right industry, have the right

strategies, and the right people to execute those strategies.

Even then, there's no guarantee that you'll make your next quarter

numbers, or that investors will be pleased enough to demand more

of your company's shares. If your customer isn't trying to stiff

you, then there's a competitor waiting to undercut you. One way

or another, someone's trying to eat your lunch. Then, someone

like Business Today comes into the picture and raises the bar

farther. To be considered truly investor-friendly, it says, it

is not enough if you've outperformed your peer group. You must

outperform the BT 50 for not one or two, but three years in a

row, disclose shareholder information on time, declare quarterly

results on time, and hold the AGM on time, too. That's why, there's

no other measure of investor-friendliness like BT's Most Investor-friendly

Companies survey. That's also why not too many companies manage

to stay on our listing year after year. In fact, our third annual

listing has just one name from the previous year.

But which are these companies that have managed

to meet our tough criteria (see The Methodology on page 108) and

be crowned the 10 most investor-friendly companies? What industries

do they belong to, and are they big or small? The answer to the

first question is offered on the pages that follow. As for the

second question, the diversity among our top 10 surprised even

us. At the top of the chart is a Pune-based company that makes

engines, followed by a sugar company that went through a massive

restructuring to emerge stronger. Among the others are those that

make two-wheelers and three-wheelers, sell cement, make abrasives

and ceramics, play host, and even rent oil rigs. Our top 10 companies,

only one of which is a Sensex stock, have nothing in common, except

the fact that they try to do their best to stay focussed on one

thing: Shareholder value. Like dream stocks, they have been growing

in value (at least for the last three years), paying dividend

like EMIs, and offering bonus shares.

Here's a secret we hate telling you, but

must: You don't have to be a media-savvy company to be an investor

darling. One of our top 10 companies stubbornly refused to either

comment or let its CEO be photographed, stating that it had decided

to maintain media silence for one year. So, the good thing about

our survey is this: As long as you make obscene amounts of money

for your shareholders, we'll do our bit to let the world at large

know about your good work.

Picking Up Speed

COMPANY:

KIRLOSKAR OIL ENGINES COMPANY:

KIRLOSKAR OIL ENGINES

NAME: ATUL C. KIRLOSKAR

Chairman & Managing Director

INDUSTRY: Engineering (diesel

engines and engine components)

MOST INVESTOR-FRIENDLY MOVE:

A 1:5 stock split last year

SHARE PRICE AS ON JULY 6, 2006:

Rs 183.75

SHARE PRICE AS ON JULY 3, 2003:

Rs 26.12

Source: CMIE; adjusted stock price |

Last year, the Indian government

introduced tougher emission and noise-level norms for generating

sets. Far from complaining, Pune-based Kirloskar Oil Engines Ltd

(KOEL) moved deeper into the market to make a killing. As one

of India's oldest manufacturers of engines, generating sets and

engine bearings, koel doesn't just have a leading share of the

market, but also a technological edge. Therefore, while its smaller

competitors went back to the drawing board to develop compliant

products, KOEL used the lead to increase its sales, both in India

and regulated markets outside. Result: Overall sales jumped 21

per cent to Rs 1,395 crore and profit before tax 46 per cent to

Rs 148 crore. For the first time, too, engine sales topped Rs

1,000 crore and exports, Rs 100 crore. Despite a 1:5 split at

Rs 397.50 (that is, Rs 79.50 a share) on March 31 last year, the

KOEL stock has jumped to Rs 183.75.

Atul C. Kirloskar, the company's Chairman and Managing Director,

says last year's gains were a result of the steps taken over the

recent years. For instance, in 2000, the company moved accounting,

purchase and sales to its ERP system, making the processes not

just faster, but more transparent. "Making of the monthly

and quarterly reports became easier, the auditing was easy,"

says Kirloskar, 50. For the last few years, the board has approved

company accounts on 19th day from close of the financial year,

and shareholders have been delivered copies of the annual report

in less than three months from year-close. The stock market seems

confident of KOEL's future, not the least because booming profits

have pushed earnings per share 17 per cent to Rs 21. No wonder,

KOEL tops our list.

-Kushan Mitra

Reaping Fruits Of Restructuring

COMPANY:

E.I.D PARRY COMPANY:

E.I.D PARRY

NAME: A. VELLAYAN

Vice Chairman

INDUSTRY: Sugar

MOST INVESTOR-FRIENDLY MOVE:

Demerging fertilisers business

SHARE PRICE AS ON JULY 6, 2006:

Rs 196.55

SHARE PRICE AS ON JULY 3, 2003:

Rs 25.34

Source: CMIE; adjusted stock price |

What's better? More or less? In

the case of E.I.D Parry, less was definitely better. Until three

years ago, E.I.D was an unwieldy company, with interests in three

unrelated businesses: sugar, fertilisers and ceramics. While that,

in theory, may have helped E.I.D better survive industry cycles,

it left investors terribly confused. "Were we a fertiliser

company, a sugar manufacturer, or ceramics maker? They did not

want to invest unless they knew for sure where the money went,''

recalls A. Vellayan, Vice Chairman.

Define E.I.D is just what Vellayan did. Out went fertilisers

and ceramics, leaving the company sharply focussed on sugar. The

results were stunning: Before the restructuring in 2000-01, gross

income was Rs 1,364 crore and pat (profit after tax), Rs 44.64

crore. By 2003-04, when the impact of the overhaul was beginning

to make itself felt, the topline dropped to Rs 641 crore, but

the net profit remained strong at Rs 43.23 crore. The following

year, E.I.D's revenues jumped to Rs 819 crore, but pat rose faster

at Rs 104 crore. And last year, the company logged Rs 1,030 crore

in revenues and Rs 116 crore in net profit. What helped? Apparently,

good management. Managing Director P. Rama Babu pushed E.I.D into

sugar with a vengeance, and proved to investors that restructuring

was the right thing to do. "I had written a book on sugar

in the early 1990s that speaks of our performance today,'' he

says, not to boast, but to indicate his great confidence in the

industry. Further moves, such as backward integration into ethanol

and cogeneration, will boost E.I.D's income.

-Nitya Varadarajan

Small But Spectacular

COMPANY: SHANTHI

GEARS

NAME: P. SUBRAMANIAN

Chairman & MD

INDUSTRY: Auto ancillaries

MOST INVESTOR-FRIENDLY MOVE:

A 1:1 bonus in 2004-05

SHARE PRICE AS ON JULY 6, 2006:

Rs 66.40

SHARE PRICE AS ON JULY 3, 2003:

Rs 6.04

Source: CMIE; adjusted stock price |

It's not the biggest automotive

gear manufacturer (Bharat Gears is), it doesn't manufacture out

of industry hotspots such as Chennai, Pune or Haryana (Coimbatore

has been its home for nearly four decades now), and it is so media

shy that its founder-Chairman and Managing Director, P. Subramanian,

has almost never been photographed by any publication (That explains

why his is the only CEO picture missing in this listing). Yet,

shareholders and analysts remain steadfast in their admiration

for this company. Why? Apart from the 100 per cent dividend that

it paid out last year, Shanthi Gears has been clocking solid growth

year on year. In 2004-05, its revenues were Rs 138.54 crore and

net profits Rs 19.12 crore. Last year, the numbers were up to

Rs 184.25 crore and Rs 28.05 crore, respectively-that's a 33 per

cent growth in sales and 47 per cent jump in profits. One reason

why it has been able to keep its growth engine humming is its

quick diversification from a producer of a few types of small

gears to a well-respected manufacturer of not just gears, but

geared motors and CNC machine tools.

With the auto components market sprinting ahead at 20-25 per

cent annually, analysts believe that Shanthi Gears' growth story

may have just begun. "Shanthi Gears has a strong and diverse

product base and it is showing strong signs of growth. Its gross

profit margins (around 33 per cent) are among the highest in the

industry and this bodes well for shareholders," says

Huzaifa Suratwala, a research analyst with Emkay Share and Stock

Brokers. According to him, the company's recent $70-million (Rs

322-crore) foreign currency convertible bond (FCCB) issue also

helped boost Shanthi Gears' profile in the global market, besides

increasing liquidity in the stock. A higher profile may be just

what the company needs as it goes after the lucrative but difficult

West European market.

-Rrahul Sachitanand

A Full Pipeline To Tap

COMPANY:

ORCHID CHEM. & PHARMA COMPANY:

ORCHID CHEM. & PHARMA

NAME: K. RAGHAVENDRA

RAO

Managing Director

INDUSTRY: Pharmaceuticals

MOST INVESTOR-FRIENDLY MOVE:

A 1:2 bonus last financial year

SHARE PRICE AS ON JULY 6, 2006:

Rs 199.85

SHARE PRICE AS ON JULY 3, 2003:

Rs 118.90

Source: CMIE; adjusted stock price |

Over the last five years, k. Raghavendra

Rao and his A-team have hit the road eight times, showcasing their

drug company to global investors. The curious thing is, the roadshows

weren't always aimed at raising money. Instead, they were just

meant to "tell fund managers and other investors that it

is good to stay invested in Orchid", says the 47-year-old

founder and Managing Director. That's not all lip service. Orchid,

which is a major manufacturer of cephalosporin bulk drugs and

formulations, has consistently rewarded its shareholders with

dividends. In fact, even when its chips were down-like in 2000-01,

when it reported Rs 6.30 crore in profits on sales of Rs 425 crore-dividends

have always come to investors. "We felt that just because

of one bad year, we should not penalise shareholders," explains

Rao.

As it turned out, the following years were vastly better, and

last year's results (Rs 900 crore in revenues and Rs 83 crore

in net profit) so enthused the board that it approved a 1:2 bonus

and a 30 per cent dividend. (Promoters hold 20 per cent in the

company). Rao says the years to come will be even better. With

the required investment already on ground, "our speed has

increased by 200 per cent", claims Rao. The company has a

strong pipeline of 30 generic drugs, 19 of which have been filed

for us Food and Drug Administration approval. Until recently,

Orchid had been getting one approval a month, but now the rate

has quickened to two a month and Rao says the pace will quicken

further.

Typically, generic drugs have a small window of opportunity

because prices fall rapidly as more competitors enter the fray.

In Orchid's case, though, profit margins would be better protected

because-at least in the cephalosporin segment-no new capital expenditure

is required. Another important development for investors is that

more and more of Orchid's revenues is coming from "regulated"

markets such as North America, where competition is tougher, but

margins better. In fact, in a conference call with analysts earlier

this year, Rao said that he expected growth to be robust over

the next three years.

It's quite possible that Orchid gathers momentum. Its joint

ventures are also doing well and, in fact, the Chinese JV became

profitable in the second year of its operation. Like other stocks,

Orchid is down from its high (of Rs 399) end of April 2006. But

if Rao has it his way, then it may start climbing back to those

levels.

-Nitya Varadarajan

The Quiet Performer

COMPANY:

CARBORUNDUM UNIVERSAL COMPANY:

CARBORUNDUM UNIVERSAL

NAME: M.M. MURUGAPPAN

Chairman

INDUSTRY: Abrasives, ceramics

and electrominerals

MOST INVESTOR-FRIENDLY MOVE:

A 1:1 bonus issue in 2005

SHARE PRICE AS ON JULY 6, 2006:

Rs 129.20

SHARE PRICE AS ON JULY 3, 2003:

Rs 17.80

Source: CMIE; adjusted stock price |

Here's a stunning factoid about

Carborundum Universal, or CUMI: Since 1958, the third year of

its inception, the Murugappa group company hasn't skipped dividends

a single year. Through good and bad, it has consistently paid

out to its shareholders, and for the last 10 years, the dividends

have averaged 36 per cent of profits after tax. As on March 31

this year, the abrasives manufacturer's paid-up capital was Rs

18.67 crore, of which Rs 16.57 crore (or 89 per cent) is due to

issue of bonus shares. There have been six bonus issues in the

company's history and the latest, in 2005, doubled the capital

base from Rs 9.30 crore. By the way, CUMI also paid a special

80 per cent dividend on top of a standard dividend of 100 per

cent. The special dividend was meant to distribute profits from

sale of holdings in group companies. Says Chairman M.M. Murugappan:

"We make clear, factual and balanced statements about our

business, and that's important if we are to be investor friendly."

No doubt that's something investors like about the company,

but the bigger lure must be the fact that CUMI is the market leader

in abrasives and it has aggressive growth plans. For instance,

the company's stated goal is to "achieve global leadership

in delivering solutions in the areas of abrasives and ceramics

by 2020". (At present, exports account for just a tenth of

its total sales.) Achieving that goal involves investing in state-of-the-art

production plants, one of which is coming up near Chennai. Then,

Murugappan plans a slew of moves aimed at expansion: strategic

alliances, joint ventures, acquisitions, setting up of low-cost

production units outside of India, and investment in next generation

products that use nano technology. "We don't say much, but

we do what we say,'' quips Murugappan. Given that CUMI's market

cap is up from Rs 103 crore in March 2000 to Rs 1,250 crore on

July 6, 2006, investors believe what Murugappan says.

-Nitya Varadarajan

Building Efficiencies

COMPANY:

HIND. CONSTRUCTION CO. COMPANY:

HIND. CONSTRUCTION CO.

NAME: AJIT GULABCHAND

Chairman & Managing Director

INDUSTRY: Construction

MOST INVESTOR-FRIENDLY MOVE:

Foray into real estate and construction abroad

SHARE PRICE AS ON JULY 6, 2006:

Rs 104.85

SHARE PRICE AS ON JULY 3, 2003:

Rs 8.21

Source: CMIE; adjusted stock price |

Thanks to the boom in the country's

infrastructure and real estate industries, growth hasn't been

an issue for Hindustan Construction Company (HCC). But maintaining

profit margins has been. One of India's fastest-growing construction

companies, HCC saw its 2005-06 operating profit margins drop to

9.5 per cent from 10.8 per cent the previous year. Ajit Gulabchand,

HCC's Chairman and MD, blames it on the rush of new players in

a booming market, but says that things are improving. "With

some players leaving the industry, the bids are now 10-15 per

cent above the estimated cost of a project, and that'll help improve

margins."

Just the same, HCC, which has an order book of Rs 9,600 crore,

is focussing on boosting growth and return on investment by bringing

about greater construction efficiencies. It is also derisking

business by scouting for opportunities outside the country, and

Gulabchand reckons that in another three years, international

operations will fetch a fifth of the company's revenues. "The

intention is to become a global player," he says. That apart,

Gulabchand is increasing the thrust on real estate development.

-Mahesh Nayak

Oil's Sweetspot

COMPANY:

ABAN LOYD CHILES OFFSHORE COMPANY:

ABAN LOYD CHILES OFFSHORE

NAME: C.P. GOPALAKRISHNAN

Director (Finance) and Co. Secy

INDUSTRY: Oil & Gas

MOST INVESTOR-FRIENDLY MOVE:

Acquisition of a stake in Norwegian driller, Sinvest

SHARE PRICE AS ON JULY 6, 2006:

Rs 972.45

SHARE PRICE AS ON JULY 3, 2003:

Rs 59.24

Source: CMIE; adjusted stock price |

Of the top 10 companies on our list

last year, Aban Loyd Chiles Offshore is the only one to reappear

this year. Clearly, there's something that Aban does right. What

is it? "The company has the virtue of being in the right

industry with the right business model,'' points out Jigar Shah,

an oil & gas analyst at KRChoksey, a large Mumbai-based broking

house. Aban, which recently also featured on our Fastest Growing

Companies list, provides drilling rigs for oil exploration, and

with the sector booming, it has been on a roll too. A consistent

dividend payer, Aban has seen its topline grow from Rs 210 crore

in 2001-02 to Rs 505 crore last year. Profit before tax has shot

up from Rs 16 crore to Rs 152 crore in that time. Predictably,

Dalal Street is in love with the stock. Back in March 2002, the

stock was quoting at Rs 70.55, but by March this year, it was

at Rs 1,100-and this after a 1:5 stock split in May 2005. Aban,

it seems, has no intentions of slowing down. Its Singapore subsidiary

recently acquired a 33.76 per cent stake in a Norwegian oil drilling

company Sinvest, which, analysts say, should add to the Indian

driller's bottom line.

-Nitya Varadarajan

Firing On All Four

COMPANY:

BAJAJ AUTO COMPANY:

BAJAJ AUTO

NAME: RAJIV BAJAJ

Managing Director

INDUSTRY: Automotive

MOST INVESTOR-FRIENDLY MOVE:

Better utilistion of cash reserves

SHARE PRICE AS ON JULY 6, 2006:

Rs 2,770.40

SHARE PRICE AS ON JULY 3, 2003:

Rs 553.25

Source: CMIE; adjusted stock price |

Investors looking for reasons to

continue their love affair with India's iconic two-wheeler company,

were delivered several when the company announced its results

for 2005-06 on May 19. Compared to industry growth of 19 per cent,

Bajaj Auto's motorcycle sales surged 32 per cent to 19.1 lakh

units; revenues jumped 28 per cent to Rs 8,106 crore and net profits

soared 47 per cent to Rs 1,123.30 crore. A happy board approved

a 400 per cent dividend for shareholders, compared to 250 per

cent the previous year.

Investors know who to thank for Bajaj's stellar performance:

The young Bajaj brothers, Managing Director Rajiv and Executive

Director Sanjiv. While Rajiv has been responsible for the slew

of new motorcycles launches at Bajaj, Sanjiv has brought in greater

financial discipline. Before Sanjiv took over the finance function,

the company was pretty bad at utilising its huge cash reserves.

But these days, treasury is a big money-spinner. Last year, it

earned Rs 416.80 crore, up from Rs 383.20 the year before. Sanjiv

has also led Bajaj into insurance (with Allianz), and in just

five years, made it India's largest life insurer in terms of gross

premium income. Just the sort of thing investors love.

-Kushan Mitra

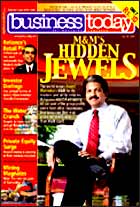

Contrarian Moves

COMPANY:

SHREE CEMENT LIMITED COMPANY:

SHREE CEMENT LIMITED

NAME: H.M. BANGUR

Managing Director

INDUSTRY: Cement

MOST INVESTOR-FRIENDLY MOVE:

Ending cross-holdings, bringing debt-equity ratio under 1

SHARE PRICE AS ON JULY 6, 2006:

Rs 775.85

SHARE PRICE AS ON JULY 3, 2003:

Rs 80.30

Source: CMIE; adjusted stock price |

The cover page of Shree Cement's

2001-02 annual report read: "Shree Cement's profit after tax dropped

94.38 per cent. The management is delighted. Why?" That was the

Shree Cement shareholder's first brush with an unusual, but clever,

tax-saving tactic that the Kolkata-based company has since been

using to good effect. "We were fortunate to have an intelligent

group of shareholders, who did not look at immediate gains," says

H.M. Bangur, reflecting on the risky move. Tax planning continues

to remain a key part of financial management at Shree. Consider:

In 2005-06, it reported a 15 per cent jump in net sales to Rs

667.69 crore over the previous year, but the net profits were

down 37 per cent because the firm chose to charge against P&L

all pre-operative expenses relating to new projects. Add the charge

of Rs 21.23 crore back to the net profit, and the bottom line

should have been Rs 39.63 crore-a 36 per cent jump. Shree now

plans to increase capacity to 20 million tonne by 2015 and that

too without increasing the capital. "Whatever we do, we will treat

our investors as partners and not as mere shareholders," promises

Bangur.

-Ritwik Mukherjee

Hospitality's Flag Bearer

COMPANY:

THE INDIAN HOTELS CO. LTD COMPANY:

THE INDIAN HOTELS CO. LTD

NAME: RAYMOND N. BICKSON

Managing Director

INDUSTRY: Hospitality

MOST INVESTOR-FRIENDLY MOVE:

Taking over the management of The Pierre in New York

SHARE PRICE AS ON JULY 6, 2006:

Rs 1,176.20

SHARE PRICE AS ON JULY 3, 2003:

Rs 262.30

Source: CMIE; adjusted stock price |

There are two reasons why investors

love Indian Hotels. One, hospitality is, of course, booming like

never before. Two, the Tata group company has been the most aggressive

of all hospitality players in the country. As promised, it has

neatly slotted its hotels into luxury, leisure and business, and

has been adding capacities in each of these categories. Over the

last two years, it has added 900 rooms, both in India and elsewhere.

Last calendar year, it took over the management of The Pierre,

a 201-room tony hotel on New York's famed Fifth Avenue. Late last

year too, it acquired another landmark hotel in Sydney, the W.

Says Raymond Bickson, Indian Hotels' Hawaii-born Managing Director:

"We look at local conditions but conduct business in a global

fashion."

Record growth in travel last year translated into an average

occupancy rate of 70 per cent and an average room rate at Rs 7,187.

Result: The cash register at Indian Hotels was ringing loud and

clear. Consolidated revenues were up 40 per cent at Rs 1,914 crore

during 2005-06 and net profits, a whopping 94 per cent at Rs 249

crore.

Over 2007 and 2008, Indian Hotels plans to add another 23 hotels,

or 2030 rooms, to its portfolio. Some of the properties will include

the Indian Hotels-owned Taj itpl in Bangalore (200 rooms) and

Ginger (earlier called IndiOne), spread over Bhubaneshwar, Pune,

and Pondicherry, among others. By March 2008, Ginger is expected

to offer 950 rooms. "I have been fortunate to have worked

in India," says Bickson, referring to the exciting times

his industry is in. His shareholders must be feeling fortunate.

-Krishna Gopalan

| THE METHODOLOGY |

| Screening

Companies listed on the BSE and the NSE, with a market

cap of over Rs 250 crore as on March 31, 2006, were selected.

This shortlist comprised 548 companies. This list was further

refined to include only those companies that outperformed

the BT 50 during the last three years, cumulatively as well

as on a year-on-year basis. This is to make sure that only

companies giving consistent returns are selected. Only 124

companies cleared this level.

There are seven parameters on the basis of which the final

list was drawn up:

Return to investors: 25 marks.

This is measured by the share price (adjusted for right/bonus,

etc.) appreciation for the last three years. Companies that

have given more than 1,000 per cent return (total and not

annualised) got the full 25 marks. Else, they were scored

on a proportional basis (applicable to other parameters

as well).

Concern of managements for investors:

75 marks. This is further divided into five

subheads and each of them carries 15 marks.

-Regular dividend distribution:

Companies with more than a 100-per cent average dividend

payout (last three years) got the full 15 marks, while the

ones below 10 per cent didn't get any. Else, they were scored

on a proportional basis.

-Declaring shareholder information

on time (the lag between the quarter-end and the

declaration date): Companies where the average gap (for

the last four quarters) is less than 10 days got the full

15 marks. And the ones where the gap is more than 25 days

got no marks. For those in the 10-25 day bracket, marks

were allocated on a proportional basis.

-Number of investor complaints:

Big companies with large shareholder bases will obviously

have more absolute complaints. So, what we have considered

is the average investor complaints (for the last four quarters)

with the public holding (in Rs crore). Companies for whom

the average investor complaints are more than 1 per Rs crore

of public holding, did not get any marks.

-Conducting the AGM on time:

Companies that have conducted the AGM within 60 days of

their year-end got the full 15 marks. Those that have waited

for more than 180 days get no marks. For in between companies,

marks were allocated on proportional basis.

-Declaring quarterly results on

time: Companies that took less than 15 days over

the last four quarters to declare results got the full 15

marks. Those that took more than 30 days got nothing.

And finally the sanity test:

Companies that scored no marks on any of the above parameters

were eliminated, and only companies with a minimum average

daily turnover of Rs 1 crore (on BSE+NSE) were considered.

|

|

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY:

COMPANY: