|

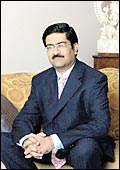

| AVB Group's Birla: Tapping retail success

|

With

some of India's biggest conglomerates-the Tatas, Reliance and

Bharti-unfolding their game plan for organised retailing, it was

only a matter of time before the Rs 40,000 crore A.V. Birla Group

got into the thick of the action. The group, which recently floated

its retail arm, Aditya Birla Retail, has made its first move by

buying over Trinethra Super Retail, a multiple retail store based

in the South. The acquisition will give the A.V. Birla Group control

over Trinethra's 170 outlets that are spread across Andhra Pradesh,

Karnataka, Tamil Nadu and Kerala. The stores have an average size

of around 2,500 square feet. Trinethra bought over Bangalore-headquartered

Fabmall India's chain of convenience stores about two years, which

will now enter the A.V. Birla fold.

For the Birlas, this acquisition will be

a useful starting point as far as a full-fledged retail foray

is concerned. The group has decided that it will go in for a JV

with a foreign partner and the rollout of the first store is expected

to take place over the next 7-8 months. "This acquisition

demonstrates our intent to be one of the leading players in Indian

retail. We will commit the necessary resources in terms of funds,

efforts and people to build a long-term and sustainable retail

business," says A.V. Birla Group Chairman Kumar Mangalam

Birla.

While the deal size has not been made public,

Trinethra is expected to hit a turnover of Rs 350 crore (annualised)

by March 2007, which will be double the previous year's turnover.

The A.V. Birla Group has acquired a 90 per cent stake in Trinethra

while the balance will remain with India Value Fund (IVF), which

held 80 per cent prior to the deal. IVF is run by private equity

fund GW Capital, which has investors like GW Capital's CEO, Gary

Wendt, HDFC, Ambit Corporate Finance and IDBI. IVF's holding in

Trinethra was bought from ICICI Ventures. "The value that

Trinethra brings to the table is its strong footprint. By the

end of this year, Trinethra should be touching a number of 200

stores," says Trinethra CEO Pranab Barua.

Clearly, there appears to be space in the

fledgling segment of organised retailing for all the big players.

After all, organised retailing is just 3 per cent of the entire

Indian retail pie, and by 2010, Citigroup predicts that this pie

will be worth $284 billion (Rs 12,78,000 crore)-currently it is

estimated at $225 billion (Rs 10,12,500 crore)-with the organised

slice accounting for $29 billion (Rs 1,30,500 crore).

-Krishna Gopalan & E. Kumar Sharma

Dark

Cloud Ahead

Q3 results for the IT services sector will

be subdued.

Results

of the IT services bellwethers typically set the trend for stock

prices every quarter. This time around, for the third quarter,

the prognosis doesn't look good, thanks in the main to the rupee's

3 per cent appreciation against the dollar. According to analyst

estimates from four leading brokerage houses-Merrill Lynch, ask

Raymond James, Motilal Oswal and Batlivala & Karani- the top

tier, comprising Infosys Technologies, TCS, Wipro, Satyam Computer,

HCL Technologies and Tech Mahindra, is likely to post a 5 per

cent increase in net profit and a 7.3 per cent rise in revenues.

The corresponding figures for the second quarter are 13 per cent

and 18 per cent, respectively. Says Sandeep Shah, an equity analyst

with Motilal Oswal Securities: "A rising rupee, wage bill

and stable billing rates will also have a negative impact on operating

profits."

However, companies that generate significant

revenues from Europe-like Mastek, Tech Mahindra and Infotech Enterprises-are

better placed as the rupee has depreciated against the pound and

the euro.

-Mahesh Nayak

Transmitting

Value

Bharti is in talks to offload a stake

in its towers business.

There's

value locked in telecom towers-that's what India's cellular operators

have realised. Bharti Airtel has plans to hive off its wireless

towers (which are used to transmit cellular telephony signals)

into a separate company, Reliance Communications (R-Comm) is spinning

its infrastructure into a fully-owned subsidiary, and the Essar

group, which holds 33 per cent in mobile operator Hutchison-Essar,

has created Telecom Tower & Infrastructure to construct telecom

towers, which will be leased out to private operators. There's

also GTL Infrastructure, which is rolling out a pan-India network

of 6,700 towers at a cost of Rs 2,030 crore.

According to T.V. Ramachandran, Director

General COAI, the number of towers could be well over 300,000

towers if the present level of sharing does not increase, and

the asset base of the Indian telecom infrastructure market alone

could be worth over Rs 75,000 crore by 2010. Currently, there

are more than 90,000 cellular towers, and another 200,000 will

be needed in two years. By hiving off the tower business as a

separate company/subsidiary, telecom companies stand to gain not

only from revenues generated by leasing out the passive properties

but by unlocking value for shareholders by aligning with foreign

infrastructure companies. Bharti Airtel, for instance, is in talks

with several such global majors as well as private equity funds

to sell a stake in the soon-to-be-hived-off towers company. Bharti

plans to retain a controlling stake in the proposed subsidiary.

Bharti ended 2005-06 with 20,000 towers and aims to go up to 40,000

by March 2007. Motilal Oswal has pegged Bharti's estimated net

assets at Rs 24,797 crore by March 2007. The new entity would

manage not only the existing towers but will take care of the

parent company's expansion plan. "We will continue to follow

our tenet on infrastructure sharing as we believe it leads to

significant cost savings related to towers, shelters, DGS and

air-conditioning, which account for part of our overall capital

expenditure," says Sanjay Kapoor, Joint President (Mobiles

Services), Bharti Airtel.

US-based American Towers is one of the companies

Bharti is talking to; it is also negotiating with Reliance and

Hutch for a share in their tower business. Another company that

Bharti is in talks with is Independent Mobile Infrastructure Mauritius

(IMIL), which has lined up investments worth Rs 3,000 crore for

India. Both foreign companies have applied for approval of the

Foreign Investment Promotion Board.

Meanwhile, R-Comm, with assets worth Rs.

32,281 crore (as on September 30, 2006), and with 12,000 towers

currently, will transfer the existing wireless towers (for CDMA

and GSM) and related infrastructure of the company to a 100 per

cent-owned subsidiary, Tower Company. "Henceforth, all new

towers and related infrastructure will be set up by Tower Company

(TowerCo), with independent financing, thereby reducing capex

requirements and leveraging on R-Comm's own balance sheet,"

Anil Ambani, Chairman, R-Comm, said recently in a statement.

-Pallavi Srivastava

|