|

|

| Cell phone in villages: It's competition

that did the trick |

As

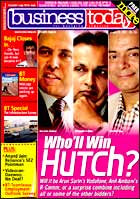

business today went to press, some of the biggest global telecom

operators were engaged in a battle to gain control of Hutchison

Essar, India's fourth-largest mobile phone services provider.

There was Britain's Vodafone, the world's #1 cellular phone company

(if its proportionate share in partners and subsidiaries is included;

otherwise China Mobile is the largest standalone operator), leading

the pack of likely winners, but there were other serious contenders,

including Anil Ambani's Reliance Communications, the Hindujas

(who incidentally were telecom operators in India but sold out

early on to Li Ka-shing's Hutch), and the Ruias, Hutch's one-third

partner, who will want to extract the best possible price, one

way or another, for themselves.

In this scramble for an 'Indian' telecom

company, with more than 22 million subscribers, there's a lesson

waiting to be learnt by marketers. That, when something looks

like a chicken-and-egg situation (can't drop prices till volumes

pick up and volumes won't pick up unless prices are dropped first),

it often helps to do right by the consumer. And that invariably

means giving the consumer a great deal on the product or service.

That's what India's new private sector telecom operators did,

when they steadily dropped cellular phone rates from nearly Rs

17 a minute to Re 1 or less now across India. With the result,

millions of Indians-plumbers, farmers, casual labourers-are able

to afford mobile phones, making India the fastest growing market

in the world.

Now, it may not be possible for other industries

to straightaway follow suit. Unlike telecom, where fixed or 'sunk'

costs are very high and variable costs relatively low, manufacturing

industries must incur additional variable cost every time they

sell an extra bar of soap or a two-wheeler. Yes, there is something

like the economies of scale in manufacturing, but it doesn't quite

work like the use-it-or-lose-it 'capacity' in telecom or even

aviation. For every second of talk time or seat in a flight that

goes unsold, there's a loss to the bottom line. Ergo, there's

a lot of sense in offering seats or long-distance calls for Re

1. In manufacturing, it actually makes more sense not to overproduce,

since there's the issue of inventory cost and obsolescence.

That said, it's evident that there's only

one way to unlock value in India's huge consumer base and that

is by focussing as much on affordability as profits. Like the

Hutch Essar episode reveals, when there's robust demand investors

will follow (policymakers would also do well to draw a lesson

from India's telecom experience and let competitive forces prevail).

No doubt, in this particular case it's a foreign investor (Li)

who'll laugh all his way to the bank, but if other investors figure

out that there's money to be made in India, they will make a beeline

too. So, extreme 'target pricing' is what marketers in India may

need to succeed.

Policy Potholes

|

|

| Infrastructure sector: A

roadblock in India's growth story |

Rarely

does a public platform include the presence of the Union Finance

Minister, Union Power Minister and a private developer. Equally

rarely does the government broker a private power project at a

competitive tariff. December 28, 2006 saw both happen, when the

4,000 mw Sasan and Mundhra power projects were awarded to private

sector. Certainly good news for the infrastructure sector, where

growth has been lacking and which has become a principal villain

in the otherwise satisfactory economic growth story. But fact

remains that such events might recur at the frequency of the Haley's

comet unless reforms are undertaken through an institutional framework.

Else delivery, efficacy, monitoring and scope suffer-the very

problem facing the existing central power reform schemes.

There is no denying that the power sector

reform programme is far more difficult to implement than that

in the roads sector, since the former falls in the concurrent

list-the State has an equal if not greater say in sector governance.

That said, the roads sector programme has also suffered in the

recent past and it is only now that the pace of award of contracts

has gone up. Evidently, one of the main challenges is in tweaking

the states' machinery. For that the Centre should initiate programmes

with the state to ensure greater movement of civil servants across

levels. Such a measure will offer greater resistance to the agenda

of errant politicians, who often delay projects to shore up their

vote bank.

Hastening the pace of infrastructure development

is not enough-prioritisation across various segments based on

merit is equally important. That, unfortunately, suffers on account

of the populism measures that the Central policies reflect. Here's

an example: The Central government is investing in both dedicated

freight corridors and highways across the country. Fact remains

that traffic flow in both these modes is determined by costs.

While fuel costs (a significant part of the total transport cost)

in the roads is subsidised by other sector (diesel is sold at

below market prices, resulting in a subsidy of over Rs 20,000

crore per annum), the electricity used by locomotives to haul

cargo, subsidises other segments of consumers. Such distortions

need to be removed to ensure a healthy development of the infrastructure

sector, especially since private participation is being encouraged

in the sector.

Let's Do It Ourselves

|

| Manmohan Singh (R) to NRI's:

Invest as well as engage |

Why

is it that we, as a nation, always look abroad for help? Addressing

the Pravasi Bharatiya Divas, Prime Minister Manmohan Singh asked

non-resident Indians (NRIs) to invest not just money, but also

engage with the country "intellectually,

socially, culturally and emotionally". That is all very well

and if people want to connect with the country of their origin

in myriad ways, they are welcome, and should be encouraged, to

do so. But we should bear in mind that such interventions can

only add small doses of incremental ballast to efforts undertaken

by Indians resident in this country. Also, why just NRIs? There's

an urgent need for residents to also connect "intellectually,

socially, culturally and emotionally" with their motherland.

That's because the heady growth figures are

making urban India increasingly oblivious to the country's soft

underbelly. India's social infrastructure is practically non-existent

outside of the big cities-the poor do not have access to justice;

public infrastructure in education and healthcare has broken down

in most parts of the country; and a majority of Indians still

do not have access to proper sanitation and safe drinking water.

As India rapidly transitions from a Third World basket case to

a First World wannabe, these are issues that need to be addressed

on a war footing. And domestic initiative must be at the core

of this programme.

Does that mean NRIs have no role to play

in India's development? They do. The success of this community

in the West-and particularly in Silicon Valley-has played a major

role in changing the world's perception of India. Influential

Indians, especially in the US, have successfully used their clout

to sell their country of origin in their adopted country. The

benefits of this should not be underestimated. When was the last

time you heard of India and "begging bowl" being mentioned

in the same context? Yet, this connection was actually a given

even two decades ago. A large part of the credit for this transformation

should go to the image that NRIs have been able to project for

themselves and, by extension, India.

All these are issues that planners should

keep in mind while wooing NRIs. Yes, many of them do feel an emotional

bonding with India, but emotions cannot be a sound basis for making

investment decisions. At the end of the day, it is not cultural

connect but return on investment that drives the flow of investment

dollars. Those will come in larger quantities only when India

can provide a playing field that is at par with the best in the

world. And that can only be done by people resident in this country.

|