|

| Bhakra Dam: The Green Revolution's great

enabler |

1963

The Green Revolution

The Bhakra dam-enabled green revolution gave

India food security and broke the back of Malthusian fatalism.

So

many years on, it's easy to forget the thrill that gripped India

on October 22, 1963, when the Bhakra Dam was commissioned. It was

a winning moment-a moment of conquest. Conquest of hunger-or at

least the fatalism with which India's millions were thought to be

at the mercy of this scourge.

The Dam, built on the Sutlej river, was a key

enabler of the Green Revolution led by the legendary M.S. Swaminathan.

Back then, in 1967, India was nowhere close to food self-sufficiency,

and poor agricultural performance was often brushed off as some

kind of grim Malthusian inevitability. Population growth had to

outstrip food output, and population was the variable that had to

be controlled-fast.

Today, of course, scientific farming has got

the better of the Malthusian nightmare. From some 75 million tonnes

of foodgrain output, India managed to hit 131 million tonnes in

1978-79-through waste-free irrigation, better yielding grain varieties

and better farming techniques. Today, the figure nudges the 200-million

mark. "In countries where more than 50 per cent of the population

depends on agriculture," notes Swaminathan, currently Chairman,

M.S. Swaminathan Research Foundation, "agricultural progress

is the safety-net against hunger and poverty."

His next great hope: an eco-friendly Evergreen

Revolution. Today, the spirit of defying doomsayers continues, and

India can become a major food supplier to the world-if the WTO gives

the country a fair chance.

1970

Operation Flood

A marvel of rural networking and supply-chain

efficiency, it turned India milk sufficient.

|

| The National Milk Grid: 9.3 million

dairy farmers strong by the end of the programme |

Operation flood

was India's first triumph of network management on such a vast scale.

Launched in 1970 with the redoubtable Dr Verghese Kurien at the

helm of the National Dairy Development Board (NDDB), the basic idea

was to organise Indian dairy farmers into self-managed village cooperatives,

made commercially viable by a larger programme to absorb excess

milk into a National Milk Grid, created to service consumers in

over 700 towns and cities.

Modern dairy methods, accompanied by efficient

milk-flow management, Kurien knew, could reduce seasonal supply

variation, stabilise milk prices and also ensure that the farmers

got their due.

The first challenge, as Dr Kurien recalls,

was getting management talent. "In 1965," he says, "I

approached J.R.D. Tata to supply me with six managers who could

work with me for a year, because I said that industrial development

can only proceed in India if it rests on a solid agricultural base.

But the Tatas fumbled the ball. So I had to set up the IRMA in 1979

in Anand, which produces 80 Kuriens a semester."

It took a few years, but when the ball was

set rolling, there was no looking back. As a direct result, India's

per capita milk consumption rose from 111-gm per day in 1973 to

202 gm per day in 1998. By 1994, India had moved from milk-deficient

status to milk surplus.

By the end of the programme, in 1996, the network

had nearly 9.3 million dairy farmers registered with some 75,000

local cooperatives, supplying milk to 170 milksheds.

1974

Bombay High

This offshore rig struck oil just a few

months after the 1973 oil shock.

It was a high,

undeniably. On February 19, 1974, the country's Oil & Natural

Gas Commission (ONGC) hit a major oil and gas field off the coast

of Bombay. Take a look at the date again. This was just six months

after the Oil Shock of 1973, with crude oil prices trebling to bloat

India's oil import bill. Bombay High was a grand relief, with Sagar

Samrat spurting out India's own black gold. The rig has drilled125

wells over the years. Till April 1998, the field had produced 2.4

billion barrels of oil and 177 billion cubic metres of gas.

1970s

TCS Exports Software

The business that was to change world

perceptions of Indian technical competence, and kick off the race

for software supremacy.

|

| F.C. Kohli: The visionary focussed on

software exports in the 70s |

People knew little

about computers, let alone software services, when Tata Consultancy

Services (TCS) began operations in 1968 under the leadership of

F.C. Kohli, a man aeons ahead of his time. In 1972, this low-profile

unit of Tata Sons got its first overseas order, from the City of

Detroit Police Department and then another...and another. Over the

1970s, TCS' exports grew...and grew.

Today, the world looks to India as a reliable

source of highly-skilled software services. Not just for one-off

task execution programmes, but increasingly also end-to-end solutions-which

require a conceptual level understanding of the client's competitive

edge. The brand 'Indian software' has been sold, and TCS gets much

of the credit for breaking perceptual barriers overseas.

TCS, now on the verge of becoming a billion-dollar

company, is busy extending itself across the globe. Says S. Ramadorai,

Managing Director, "You need to have reach as a global company...

reach to be close to the customers, reach to be visible, reach to

deliver solutions, reach to leverage the offshore capabilities,

reach to attract some talent within the local community." It's

a vision that has created an entire industry. An industry that's

ready to stand up and be counted as world-class.

1978

Going Global

AV Birla Group's palm oil refinery in

Malaysia topped world charts.

|

| Pan Century Edible Oils: Building on

a natural advantage |

Corporate India

was globalising before globalisation became a buzzword. In 1978,

the Aditya Vikram Birla group planted its flag in Malaysian soil-with

the setting up of Pan Century Edible Oils. Since then, it has become

the world's largest single-location palm oil refinery. The plant

currently processes over 1 million tonnes of palm oil.

Why Malaysia? Simple. The natural advantage

of raw material availability. The group's current chief, Kumar Mangalam

Birla, should be proud.

1983

Cricket World Cup

No abstract victory this; it was a collective

moment of obvious triumph. For millions together-live on TV.

|

| India lifts the World Cup at Lord's: Winning

against impossible odds |

The pulse races,

the breath shortens, and the fist pounds the air. A reflex. A rush

of blood. A victory. June 25, 1983. A collapse of the last West

Indies wicket; and the World Cup in India's grasp.

Never had a team made the London bookies eat

their hats (along with their odds-billed at 66-to-1 against India)

with such joyous abandon. West Indies was the terror team of the

time, reigning World Champion ever since the Cup began-but a twist

here, some magic there, and India won!

Almost two decades later, the significance

of that 1983 victory at Lord's is still to fully sink in. And we're

not just talking about the mega-boost to the Indian morale. That

goes without saying.

"For the first time," says team captain

Kapil Dev, in retrospect, "cricket united the country."

It also gave the country a sense of global confidence. A certain

bounce in the stride.

Cricket used to be an Englishman's game, also

played by a few others as a colonial legacy in a few odd parts of

the world. Today, cricket is an Indian game, also played by its

originators on some cold faraway island. The game's centre of gravity

has shifted to India. Just look at the numbers. An overwhelming

share of the money the game attracts globally, is from here.

The 2003 World Cup, to begin soon in South

Africa, has three of the four main sponsors (Pepsi, LG, Hero Honda

and South African Airways) looking to the Indian market for returns

on their investment. That's how it is. Create a Great Eyeball Trap,

and the world beats a path to your door. Such is the game's appeal

that marketers wouldn't know what to do without it.

|

| Deals on wheels: Cost-efficiency is

everything |

1986

Hero Becomes Number One

Low costs gave Hero volumes, and volumes,

low costs.

In 1986, hero cycles

became the world's largest maker of bicycles. The formula? High

volume, low costs. Today, it cranks out 19,000 cycles every day.

The group's JV with Honda has repeated the model for motorcycles,

selling over 1.5 million units a year. Pawan Munjal, Managing Director,

Hero Honda Motors, attributes the success to "our customer-centric

approach and efficient management of resources and skills".

|

| Value-for-money: For 250 million customers |

1989

The World's Largest-Selling Soap

Nirma's yellow powder-a mass-market phenomenon.

In 1969, when Karsanbhai

Patel launched Nirma, he couldn't have imagined it would become

the world's highest-tonnage (500,000 tonnes in 1987-88) detergent

in just under 20 years. And it gave him, in his own words, "a

deep sense of satisfaction from the fact that value-for-money offerings

from Nirma could convert luxuries into necessities for the Indian

Common Consumer." Nirma still sells over 800,000 tonnes of

detergent every year.

1991

Licence Raj Dies

In a stroke, decades of misguided economy

policy were abandoned to allow market forces in.

|

| Manmohan Singh: Defining India's new

tryst with destiny |

The euphoria in

jeejabhoy Towers, which houses the Bombay Stock Exchange, had to

be experienced to be believed. People were literally being swept

by waves of joyous heads thronging the building. The din was too

uproarious to hear anything the man on the TV screen was saying.

It didn't matter anymore. The deed had been done. The Licence Raj

had been pronounced dead.

The day was July 24, 1991, and the man on TV

was Manmohan Singh, the then Finance Minister. "India stands

at the crossroads. The decisions we take and do not take, at this

juncture, will determine the shape of things to come for quite some

time," the man had said, casting aside decades of misplaced

faith in the mixed economy, short-hand for a command economy with

a handful of privileged licence-holders. At long last, competition

had been allowed in, and the Iron Hand of the state had been replaced

as resource allocator-in-chief by the Invisible Hand of the market.

Yet, reforms remain incomplete. As one observer

put it, the early reforms were sneaked past the Indian electorate,

but now, the free market idea must be sold to the people.

1992

Reliance Raises Global Money

Reliance's GDR opened up the promise

of foreign capital for Indian business.

|

| Dhirubhai Ambani: Global dreams realised |

In the isolated

old days, investors in Manhattan skyscrapers wouldn't have bothered

betting on an Indian business to save their nuts. India was simply

off their map. So it was a momentous occasion when, in May 1992,

Reliance Industries raised funds-in hard dollars, no less-from the

international capital market.

And these were not some foreign investors trying

to take control of a 'third world' bsuiness, but actual investors

counting on the Ambanis to enrich them. A global $150 million vote

of confidence, so to speak, in Reliance's quest for world-scale

capacities (in polypropylene, for example).

The instrument was the Global Depository Receipt

(GDR), which represents the dollar value of the firm's underlying

equity. Since then, some 60 Indian companies had raised over $6.5

billion via GDR issues. Foreign capital is now within reach-at last.

1996

India As A BPO Centre

GE picks India as its Business Process Outsourcing

(BPO) centre.

|

| The world's back-office: Near you |

It has become a

wave already. It was in 1996 that GE, scouting for a low-cost base

to source its back-office business processes to, zeroed in on Gurgaon,

a suburb of Delhi just South of the capital in Haryana. Recalls

Pramod Bhasin, President, GECIS: "When we started, we had no

set business models to follow, no prior experience... all we had

was a vision and a huge amount of enthusiasm and energy to make

it work."

From an employee base of 600, GE's call centre

now has more than 12,000 today, and the company's intense training

systems have spread far and wide-as more and more business process

outsourcing centres mushroom by the month. India is becoming the

world's back office.

1998

Sundaram Clayton Wins Deming Medal

The first-ever Indian firm to win the

world's most prestigious award for quality.

|

| Total quality: Means, not an end at

TVS Group's Sundaram Clayton |

For years, analysts

would groan about India's poor quality reputation, with the 'it's

ok' attitude as their prime suspect. And then, along came Sundaram

Clayton, and won the Deming Prize for quality. On November 14, 1998,

the company's CEO Venu Srinivasan received the prize instituted

in 1951 by the Union of Japanese Science and Engineering (JUSE)

in honour of the quality guru W. Edwards Deming. And from then on,

the country has been whinging less, and working more-towards quality.

Sundaram Clayton, part of the Chennai-based

TVS Group, makes air and vacuum braking products for vehicles, among

other things. Thanks to the rigour with which its brakes division

had applied systems of company-wide quality control (CWQC), it became

the first Indian company ever to bag the award. And the company

hasn't rested on its laurels. "Excellence is a moving target,"

says Srinivasan, "and when we received the Deming prize in

1998, we moved on-as this was the start of the TQM journey and not

the end... the prize is just a ticket to the journey." For

the record, in 2002, Sundaram Clayton won the Japan Quality Medal,

a honour reserved for the best of Deming awardees.

1999

Infy Lists On Nasdaq

For Infosys, raising foreign capital

was not the idea. By listing on Nasdaq, it got itself a currency

(stock) to hire top talent and make acquisitions across the world.

|

|

|

|

| Infosys' now CEO Nandan Nilekani

(top, right) at NASDAQ: Infy goes down the wire |

It was another

day in cyberspace, with zillions of 0s and 1s zipping up and down

the information superhighway. But for India, March 11, 1999, was

not just another day in cyberspace. It was the day that somebody

sitting in some remote corner of the world could log on to his computer,

hit a few keys, and buy himself a part of India's premier software

exporter, Infosys Technologies.

That was the day that Infosys' share began

trading on America's premier online stock exchange, Nasdaq. The

event was beamed live from New York to giant video-screens on a

basketball court at the Infosys' Bangalore campus. "This is

a small step for Nasdaq but a giant leap for Infosys and the Indian

software industry," said Chairman N.R. Narayana Murthy from

New York. It was a rare moment of exultation for a man who is otherwise

given to understatement as his style.

Within two hours of active trading, the US-listed

Infy share touched $50, up $12.88 from the listing price of $34.

The share closed the trading day (!) at a healthy $46.88. The company

was pleased. But not for the reasons you might imagine.

At last, it had a 'currency' to recruit global

talent (via dollar stock ops) and make overseas acquisitions (via

all-stock deals). Just accessing funds, in itself, was not the idea.

Explains Nandan Nilekani, CEO, Infosys Technologies, "Our decision

to list on Nasdaq was based on the belief that it would help us

build a strong global brand and attract a wider pool of investors

as well as the best employees from all over the world."

Indeed, the Infosys brand has got a boost.

Customers prefer doing business with firms that they know are subject

to the rigours of GAAP-standard financial disclosure, not to mention

the intense scrutiny of global investment analysts. Even otherwise,

for a company started in 1981 with just $250 as capital, it was

quite some moment. Infosys now commands a market value of more than

$2 billion, and symbolises the aspirations of Indian firms that

are thinking global.

2000

Tata Tea Buys Tetley of UK

Big fish swallow small fish. But again, not

always. India's own Tata Tea took over the UK's Tetley, to become

the world's second largest tea marketer.

|

|

| Global market play: For people who need

adrenalin |

Business has a

certain Darwinian logic to it. A logic that kept Indian business

fearful of the Big Bad World overseas, where large corporations

with multi-billion dollar outlays could crunch anything of Indian

origin out of existence.

Well, here's some news. Sometimes, the small

get to swallow the big. On February 27, 2000, humble little homegrown

Tata Tea snapped up Tetley of UK, a company thrice its size, for

a tidy sum of £274 million (Rs 2,117.05 crore).

Says Homi R. Khusrokhan, Managing Director,

Tata Tea, "The acquisition of Tetley has catapulted Tata Tea

into the league of a new emerging breed of Indian Transnational

Companies who realise that, sooner rather than later, the world

has to be their marketplace."

It was a lot of money, and the deal involved

the setting up of a fully-owned special purpose vehicle (SPV) in

the UK-with £70 million (Rs 540.85 crore) of equity, and an

unbelievable £200 million-odd (Rs 1,545.3 crore) in debt.

Some analysts even think that the Tata group got carried away by

the glory of the moment, and overpaid (rival bids were lower). The

Tatas even had to inject an additional £30 million (Rs 231.8

crore) into the SPV in 2001.

But in pure factual terms-of an acquisition

made-it was certainly a winning moment. The largest cross-border

acquisition made by an Indian company, ever. And a move that turned

Tata Tea into a global marketer of tea overnight, and the world's

No. 2, after Unilever. In one shot, Tata Tea's consolidated turnover

stands at Rs 3,073 crore for 2001-02.

Moreover, the company not only has access to

a global market (that Tetley addresses), but also a global tea-leaf

procurement system perfected over the years and a vast portfolio

of innovative products, including dripless teabags, herbal teas

and flavoured teas (with flavours as exotic as black currant, strawberry,

apple and cinnamon). The challenge now is to show that Indian marketing

minds are as good as any, in addressing the bewildering diversities

of the world.

To be sure, Tata Tea's move hasn't sent Unilever

into a cold sweat. Tata is at best a distant contender for global

leadership. Its worldwide marketshare stands at around 4 per cent,

against Unilever's 10 per cent. But the company has an aggressive

plan to shake up the tea business worldwide, and stack up the volumes.

But developing markets overseas, or even shifting them in any significant

way to favour the company, can cost huge sums of money.

The big question is whether the Tata group

has the resources to play a global game. The outcome of this test

case could determine how ambitious Indian companies want to be-as

global marketers.

2001

Lagaan Takes Bollywood Abroad

Lagaan's overseas run could mark the

beginning of Bollywood's grab for global eyeballs.

|

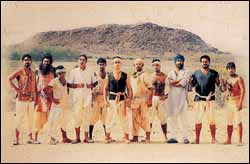

| The Lagaan XI: Oscar or not,

the Ashutosh Gowarikar movie succeeded in putting Bollywood

on the global map |

What would be the

winning moment for this one? The day- March 24, 2001-that Ashutosh

Gowarikar's cricket tale 'Lagaan' was nominated for the Best Foreign

Film award at the Oscars? The Friday it opened to packed theatres

in India? Or the moment the audience erupted at the cinematic climax?

A bloodless Indian victory. Against impossible odds (11 clueless

dhoti-clad villagers, against 11 accomplished Anglo-Saxons). And

do-or-die stakes (thrice the tax on losing, no tax on winning).

The nail-chewing went all the way to la, for

an Oscar. Alas, Bollywood couldn't pull off a last-minute stunt

this time round. Oscar or no Oscar, what the Lagaan victory symbolises

is Bollywood's ambition to go global, and play on the same celluloid

field as Hollywood. For the same eyeballs. If a rustic fantasy could

impress American critics, and even draw some $2 million (Rs 9.6

crore) at the US and UK box offices, why not other films?

"A nation is poor when it stops dreaming,"

says Mahesh Bhatt, film-maker, "and Lagaan has rekindled dreams."

The Indian film industry actually sells more tickets than the American

industry (3.6 billion, to 2.6 billion), but its value realisation

remains pathetically low. Targeting the world market could change

all that. The Indian market is estimated at only $850 million (Rs

4,096 crore), while the world market is placed at over $50 billion

(Rs 24,09,500 crore). Convergence won't be easy, though.

To enchant global audiences with its unique

idiom, Bollywood will have to retain its local essence while adapting

itself to the pulse of la. The watchword will be universalisation.

|