|

There

comes a time in the career of most CEOs when they start speaking

about reaching out, about making a difference. Philanthropy, this

isn't: Rather, it is Big Business looking hopefully at the 80 per

cent of the world's population that lives in developing countries.

Can it, the argument goes, make a market of this five billion individuals

by either improving their lot or designing products and channels

that are different? There

comes a time in the career of most CEOs when they start speaking

about reaching out, about making a difference. Philanthropy, this

isn't: Rather, it is Big Business looking hopefully at the 80 per

cent of the world's population that lives in developing countries.

Can it, the argument goes, make a market of this five billion individuals

by either improving their lot or designing products and channels

that are different?

Hewlett-Packard CEO Carleton Fiorina calls

her company's shot at this e-inclusion; Ericsson CEO Carl-Henric

Svanberg calls his company's, 'The Next Billion Customers'; and

Unilever's Indian subsidiary Hindustan Lever Limited, Project Shakti.

There are others, but the challenge remains the same: Is it possible

to sell to the poor, profitably?

India is a good place to ask this question.

Of its population of a billion-plus, nearly 700 million live in

rural and semi-urban areas. That's around 12.2 per cent of the world's

population, and a market twice as large as the US. India's National

Council of Applied Economic Research estimates that by 2006-07,

the majority of these households (68.1 million, or around 400 million

consumers) will earn between Rs 22,000 and Rs 45,000 a year-in dollar

terms that translates into a range of $489-$1,000.

In terms of profit margins, this isn't the

greatest of market opportunities; in terms of volume, it is the

mother lode. Better still, any company that cracks this market has

the opportunity to replicate its success across South Asia, Africa,

Latin America, and Eastern Europe.

Dr. C.K. Prahalad, management guru, co-author

of the best-selling Competing For The Future, and professor at the

University of Michigan, is the high priest of this movement. Prahalad's

pyramid, part of a presentation the man makes on why it makes sense

to sell to the poor, is probably burned into the brains of most

marketers.

Their effort to tap the bottom of the pyramid

is nothing short of a quest for the Holy Grail. "Ninety per

cent of the increase in purchasing power and incremental consumption

will come from the people at the bottom of the pyramid," says

K. Ramachandran, CEO, Philips India.

|

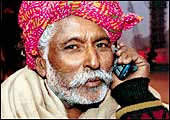

| Making inroads: HLL's strategy of piggybacking

on SHGs seems to have paid off |

There are several roads to that and over the

past few years companies have tried most out: designing products

and packaging that'll work; providing access to credit or ways to

enhance income; improving access through innovative channels of

distribution; and shaping aspirations through education and communication.

Why does a mobile phone need a screen?"

asked Ericsson's Svanberg during a visit to India in mid-2003. He

had just stated his company's desire to explore everything from

low-cost infrastructure to lower-cost mobile phones, a desire born

out of the belief that India and China, both cost conscious markets,

would contribute a sizeable chunk of the next billion mobile telephony

customers, and was responding to a follow-up question on just what

that meant.

Ericsson hasn't launched a mobile phone without

a screen (at least, not yet), but fact is, people in rural areas

can do without a screen, especially if that means a lower-cost phone.

Consumer durables major LG follows a similar

approach: for instance, the refrigerators it sells in the rural

market do not have ice trays, deodorisers, and a few other add-ons.

The impact? These cost Rs 2,000 less. Does price matter? In a market

like India, it sure does. Every time mobile telephony rates fall,

the market's circumference increases to include the next lower income

layer.

Today, India's mobile telephony rates are the

lowest in the world (and headed South); not surprisingly, the market

is expected to double every 12 months or so.

The imperative to keep cellular tariffs low

could explain Nokia's launch in 2003 of equipment that could reduce

operating costs by as much as 50 per cent. Any telco that moves

to this equipment, then, can reduce its cost-to-subscriber by 50

per cent with no impact on profitability.

Often, cost isn't the only issue. Gillette

India's research showed that 97 per cent of Indian men still preferred

the old double-edged blade to new-age twin-blade and three-blade

shaving systems. Reason? Three out of four Indian men shave without

running water; most shaving systems need to be rinsed under running

water to remove the hair; ergo, 66 per cent of Indian men who tried

out a twin-blade razor reverted to a double-edged blade.

Gillette's research centre in Boston came up

with the solution: Vector Plus, a razor with a knob that when pressed

separates the blades making it easy to remove the hair.

"This is the biggest initiative taken

by Gillette for India across the chain from R&D to product development,

testing, placement, marketing and distribution," says Manoj

Kumar, Regional Business Director, Gillette India. Vector Plus was

launched in October and Gillette India is busy pushing it through

100,000 outlets across 3,500 towns; if it does well, it will probably

be rolled out across other markets where running water is a problem

(God knows there are enough of those).

The two-wheeler and consumer durable boom in

urban India can be attributed to the emergence of consumer finance.

Pradeep Kashyap, Managing Director, Marketing And Research Team

(MART), a rural marketing consultancy, believes "this will

be one of the main reasons for an increase in sales of consumer

durables as it converts a consumer's willingness to buy into action".

Some banks do cater to semi-urban markets.

However, the reach of most banks and financial services firms is

limited. "We see a lot of opportunities in the mass market

for future growth," says Chanda Kochchar, Executive Director,

ICICI Bank, "but we need to set up a distribution network and

develop a credit delivery mechanism and bring down costs of operation

in order to penetrate these areas."

Technology could provide the answer just as

it did in the case of retail banking. By wiring their innards and

reducing transaction costs, banks such as HDFC Bank and ICICI Bank

have been able to grow at a scorching pace: in the past nine years,

the former has added 3.5 million retail customers; the latter, 6

million.

ICICI Bank is working with IIT Madras Professor

Ashok Jhunjhunwala (See Indian Innovator on page 128) to develop

an automated teller machine (ATM) that will cost just around Rs

30,000; today, one costs Rs 600,000.

The bank has already made a go of disbursing

loans through an atm at Nellikuppam, a village in Tamil Nadu (the

loans are sanctioned at the nearest branch of the bank located,

in this case, the town of Cuddalore, around 15 kilometres away);

n-Logue, a company that has been promoted by Jhunjhunwala's TeNet

Group, has wired up the village. Kochchar says the new ATM will

be "a bare bones cash dispensing machine which will help us

reach more small towns".

The emergence of self help groups (SHGs) as

micro-credit organisations is a wholly Indian phenomenon.

Typically, these are groups of 10-20 women

in rural areas who contribute Rs 10 to Rs 20 per head per month

(even per week) to create a corpus from which small loans are then

made to members at an interest rate of around 13 per cent. Andhra

Pradesh accounts for over 40 per cent of the one million SHGs present

in India.

Fast moving consumer goods major Hindustan

Lever Limited has leveraged this fact to launch Project Shakti,

an effort to harness SHGs to create entrepreneurs and, at the same

time, improve distribution efficiencies. Put simply, this involves

getting the SHG to loan money to one of its members to become a

distributor-cum-retailer of HLL products for a cluster of villages;

even HLL, arguably the company with the widest reach in India doesn't

reach most villages directly.

Today, Project Shakti covers 5,000 villages

in Andhra Pradesh, Karnataka, Madhya Pradesh, and Gujarat. By 2010,

HLL hopes to reach over 100,000 villages and 100 million rural consumers

through this route. The company's success has encouraged others

to experiment with the SHG route: TTK Prestige's Project Mahila

Prestige (in Andhra Pradesh, again), for instance, sells pressure

cookers.

More than SHGs, however, ITC's efforts to build

hybrid online-plus-offline communities of farmers (See Distribution's

Disruptive Duo on page 86), the e-choupal have proved effective

in reaching rural consumers.

As a purchaser of agricultural commodities

the company gains (in terms of cost and quality) and as sellers,

the farmers benefit (the middlemen no longer control access to markets).

Mutual economic benefit makes the concept of the e-choupal sustainable

and a clutch of companies wishing to tap rural markets is queuing

up to tap the adventitious benefit: selling their products to member

farmers. Better still, there is no reason initiatives like e-choupal

and Project Shakti shouldn't work in other markets.

|