|

Bull

Charge On Dalal Street Bull

Charge On Dalal Street

Fuelled by foreign money, Indian markets had

a dream run.

The Indian stockmarkets

had a dream run in 2003. The benchmark Sensex spurted from 3,377

last year to 5,699 (on December 26), a whopping gain of 2,322 points.

Since the inception of Sensex in 1979, this is the largest gain

in any calendar year. The other indices too reflect the magnitude

of the rally. The Nifty touched its all-time peak on December 26.

The huge quantities of funds from overseas

have provided the much-needed trigger. Till December 24, the FIIs

had pumped a net investment of $7.43 billion (Rs 34,432 crore) into

the Indian market. This is the biggest net FII inflow into the country

since the foreign tribe was allowed into India in 1993, and also

more than double the previous high of $3.05 billion hit in 1996.

The weakening US dollar has helped to wean away some investments

from the US. For example, the net foreign investments in US assets

dropped from $62 billion in August to $16 billion in November.

-Narendra Nathan

Let The Games Begin

All's well that ends well in the Great Indian

Telecom saga. Or is it?

|

|

|

|

| Team telecom: (L to R) Mukesh

Ambani, Rajeev Chandrasekhar, Sunil Mittal, and Asim Ghosh |

The grand finale

of the long-festering slugfest between Reliance Infocomm in one

corner and pretty much all the other mobility players in the other

corner over the Ambanis' "tainted" entry into the wireless

space came to a rather abrupt end in October when the Telecom Regulatory

Authority of India (TRAI) recommended the unification of separate

categories of telecom licences. While these recommendations are

not binding on the government, it chose to go with them. Not in

a long time has the government moved so fast-within just four days

it accepted the TRAI recommendations and for good measure the Cabinet

also nodded its approval.

The clear winner was Reliance Infocomm which,

for a payment of Rs 1,542 crore, got the right to offer unfettered

mobility across the country. On Christmas eve, the government provided

additional relief to the older mobile operators by lowering their

licence fee. It also agreed to their demand to hike the foreign

investment limit in telecom companies to 74 per cent. As a result,

the court cases stand withdrawn and the associations representing

different lobbies are planning to come together as one.

In a sense, all companies are gainers. The

biggest gainer though is the customer.

-Vandana Gombar

|

|

|

| Looking up: (L to R) Shashi

Ruia, B. Muthuraman and Sajjan Jindal |

Back From Hell

Steel is once again sexy, and might get even

sexier.

A couple of years

ago, almost every Indian wannabe steel baron-The Ruias, Mittals,

Jindals, et al-appeared down and out for the count. Steel prices

had collapsed just when their huge capacities had come on stream,

and they were on the verge of collapsing under the weight of chunky

interest charges and bloating losses. Then towards the end of 2002,

and right through 2003, steel prices maintained a northward trend.

Also coming to the aid of the steel companies was a more liberal

interest rate structure and the willingness on the part of the institutions

to restructure loans.

The buoyant demand conditions are likely to

be sustained in the current year too. That's because the global

steel sector is slowly, but surely, ironing out its overcapacity

issues, and the current oversupply situation is expected to turn

into a deficit by 2005.

-Narendra Nathan

|

| Uday Kotak: At long last |

You Can Bank On Kotak

He finally gets his licence-and dollops of respect.

Uday Kotak and

2,500-odd employees of Kotak Mahindra Group won't forget 2003 in

a hurry. After many anxious years, Kotak Mahindra was finally granted

a banking licence, making it the first non-banking financial services

company allowed by the RBI to set up a bank. On the face of it Kotak

Mahindra, the 20-year-old financial services brand had it all: Retail

assets, a customer base, a branch network, an established brand

equity, the very things other new private sector banks were so aggressively

chasing. The banking licence, however, gives Kotak something he's

been yearning for a long time: Respect.

Now that they've got all that, Kotak and his

A-team led by the likes of career banker and the bank's Executive

Director Dipak Gupta have charted out an innovative and non-traditional

business model. As somebody once said, the good things in life take

time.

-Abir Pal

| BRAND BHARAT |

| COMPANY |

PRODUCT |

| Moser Baer |

CD-ROMs |

| Tata Steel |

Flat and long products |

| Nalco |

Aluminium |

| Arvind |

Textiles |

| Bharat Forge |

Forgings and castings |

| Bajaj Auto |

Two-wheelers |

Made In India, And Proud

Of It

It isn't the end of manufacturing. It will never

be.

Towards the late

nineties, manufacturing suddenly became unfashionable, and asset

creation was considered passé, as "new" economy

businesses with suspect revenue models and illogical valuations

ruled the roost. It's a bit different now. In 2003, India emerged

as the hottest manufacturing centre in the world for cars, two-wheelers,

tractors, auto components, steel and aluminium, textiles, petrochemicals,

CD-ROMs, and what not. Delhi-based Moser Baer is one of the top

three manufacturers of CDRs in the world. Tata Steel and Nalco are

the lowest cost manufacturers of steel and aluminium, respectively,

in the world. In textiles, Arvind Mills, Welspun, Trident, and Mahavir

Spinning Mills have made a strong comeback. Pune-based auto parts

company Bharat Forge is one of the leading suppliers to auto giants

like Ford, General Motors, and Toyota, who themselves have to cut

costs to stay ahead in an increasingly competitive market by obtaining

cheaper parts from countries like India. This year, Bajaj Auto will

ship 1.5 lakh vehicles to South East Asia, Africa and Latin America,

which will take its exports from Rs 353 crore to Rs 560 crore. Long

live Indian manufacturing!

-Sahad P.V.

|

| Brian Tempest: To head Ranbaxy's global

binge |

Global Charge

India Inc. takes its first steps in its quest

to achieve global dominance.

For corporate India,

most of the action in 2003 was outside the country. Every month,

on an average, three Indian companies ventured overseas, and in

all corporate India has committed a little over $600 million in

international acquisitions. In October 2003, Reliance Infocomm made

a pitch for international undersea telecom operator FLAG Telecom

Group for $207 million (Rs 950 crore). It still awaits shareholder

approval, but once completed, it would be the second largest cross-border

deal. Ranbaxy Laboratories' acquisition of French generics company

RPG Aventis (for roughly Rs 385 crore) is the largest ever overseas

acquisition by an Indian pharma company. Wockhardt is another leading

pharma company, which lapped up CP Pharmaceuticals of the UK in

July 2003 for £10.85 million (Rs 85 crore).

-Sahad P.V.

|

| Piyush Pandey: Reflections of the feel

good factor |

Creating Growth

The ad industry records double-digit growth

after three years.

Six lions including

three golds at Cannes; a five-day jamboree at Jaipur with Ad Asia

coming back to the country after 22 years; and o&m's Piyush

Pandey selected as the President for two juries at Cannes 2004...it's

been an eventful year for Indian advertising. To cap a perfect year,

money too began pouring into the industry's coffers. Says Subhabrata

Majumder, media analyst at brokerage firm Motilal Oswal: "2003

has seen a growth of 12.5 per cent in total billings and over the

next three years the industry should grow at 15 per cent annually."

The cricket World Cup did its bit, with some

Rs 800 crore estimated to have been spent on advertising. The Reliance

Infocomm account is estimated to be around Rs 200 crore and the

government's India Shining campaign obviously added to the feel

good factor. Says Pandey, who succeeded Ranjan Kapur as Executive

Chairman of O&M: "Though we may not have seen great work

this year, clients are looking for creativity and are more demanding.''

High time they did!

-Dipayan Baishya

News Breaks Out

Media finds its own place in the sun.

The deal sizes

are smaller, the valuation less fancy, but the excitement levels

amongst investment bankers has perhaps never been as high. Globally,

media has been a favourite hunting ground for investment bankers

and deal-makers, but hardly so in India. However, 2003 saw an unprecedented

number of media deals and for a change most are not in the entertainment

segment. NDTV, separating itself from the Star TV platform, launched

two channels, also secured a valuation of $121 million and sold

9.49 per cent to Standard Chartered Private Equity for $11.5 million

(Rs 53 crore). Forced by regulations to bring down its stake to

26 per cent in Star News, Rupert Murdoch came to India scouting

for partners.

After an aborted attempt to sell the stake

to a clutch of investors, the Ananda Bazaar Patrika Group succeeded

in picking up 74 per cent in Star News for Rs 74 crore. Financial

Times, part of the Pearson Group, picked up a 13.85 per cent stake

in Business Standard for Rs 14.1 crore. Hindustan Times raised Rs

125 crore by selling 20 per cent in HT-Media, a 100 per cent subsidiary,

to Australian financial services company AMP Group Holdings.

CNBC Asia diluted its 49 per cent stake in

CNBC India to 10 per cent in favour of its programming partner TV18

and changed its name to CNBC-TV18. Last, but not least, TV Today

Network approached the market with a 25 per cent public offer (the

issue was oversubscribed 36 times). Expect the action to continue

in 2004.

-Dipayan Baishya

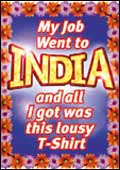

Cheap

And Best! Cheap

And Best!

Many Americans and Britishers lost their jobs

to Indians.

A glance at the

t-shirt in this picture would tell you what this story is all about.

Whilst it jobs have been moving to India for a while now, in 2003,

thousands of skilled and semi-skilled employees in the US, the UK

and parts of Europe lost their jobs to Indians, where their counterparts

cheerfully did what they used to do at a much lower cost. Protests

ruled the roost in the US, with no less than five American states

proposing bills to stop outsourcing of jobs to India. Not surprisingly,

the American reaction centred largely around legislation, what with

1,000 employees of Sun Microsystems resorting to a lawsuit against

the firm on charges of racial discrimination (in favour of Indians!)

in March. The British reaction, on the other hand, was to take to

the streets in an organised protest. An announcement by British

Telecom of their decision to move 2,000-odd call centre jobs to

India resulted in staged demonstrations outside 34 UK call centres

by the Communications Workers Union, a trade union body, early this

year. The backlash could well intensify, if you consider that 3.3

million US services industry jobs and $136 billion in wages are

expected to move offshore within the next 15 years, according to

tech research firm Forrester.

-Priya Srinivasan

Great Future For Options

The derivatives segment outstrips the cash market.

The derivatives

(futures and options) market in India came of age in 2003. It was

in June 2000, that the first tentative steps were taken with index

futures, which recorded a modest monthly turnover of Rs 35 crore

on the NSE. By June 2001, the NSE was offering index options, and

the total turnover crept up to Rs 785 crore. The growth since then

has been mind-boggling, and as of November, the derivatives segment

was doing a monthly turnover of Rs 1,92,171 crore on the NSE-well

above the turnover in the cash market. "The speed of growth

this year is really surprising," gushes Satish Menon, Chief

Operating Officer at Geojit Securities. "With investors learning

more about the nitty-gritty of options, the fear about it has gone,"

he adds.

Yet, it isn't as if the retail investor is

active in derivatives. Hardly. Thanks to SEBI putting a minimum

Rs 2 lakh limit for derivatives trading, the value of which has

since gone up to Rs 10 lakh at several counters as the market moved

up, it is largely the speculators who contributed to most of the

turnover. Perhaps 2004 will see more retail investors using derivatives.

-Narendra Nathan

|