|

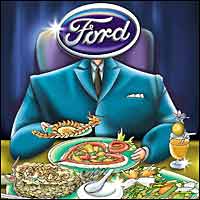

| Bon Appetit: Ford India can, if it so

desires, leverage India's FTA with Thailand to import components.

The country is a big manufacturing base for Ford |

There's

a lot to be said for Free Trade Agreements (FTAs). They allow countries

to break out of the stifling rut of having to negotiate trade details

on a commodity-by-commodity basis and provide for duty-free entry

of all goods except those on a negative list (this is usually short).

The consequent benefits are significant: a larger inflow of foreign

capital, integration of trade- and economic-policies, maybe the

creation of a formidable economic and diplomatic bloc. FTAs usually

render local industries globally competitive: after all, in the

absence of tariff barriers, industries have nothing, other than

their own efficiency, to protect them from the onslaught of imports.

So, why are Indian companies opposed to FTAs?

The answer may be found in the experiences

of the Indian edible oil (circa 1991) and tea (circa 1999) industries.

India's bilateral treaty on trade with Nepal (signed in 1991), later

modified into a FTA, effectively killed the local edible oil industry.

While Indian manufacturers paid an import duty of 65 per cent on

crude palm oil, the basic raw material, Nepalese ones could import

palm oil at zero duty. Predictably, the Indian companies couldn't

compete with Nepalese ones on price; several went belly up; and

while the playing field was levelled some when the FTA was renewed

in 2001, the damage had been done. The Indo-Sri Lankan Trade Agreement,

signed in December 1999, wreaked havoc on several tea planters in

South India despite the government limiting the quantum of tea that

could be imported into India to 15 million kilograms a year.

What's really attracted India Inc.'s ire is the Free Trade Agreement

the country signed with Asian tiger Thailand on October 9, 2003.

Thailand is a manufacturing or sourcing hub (or both) for Ford Motor

Company, Toyota, Honda Motor Co, and General Motors. The FTA is

certain to bring down costs for some car makers. ''The FTA with

Thailand is definitely going to have an adverse impact on carmakers

in India, especially the Japanese manufacturers,'' says K. V. Shetty,

President, Automobile Manufacturers Association of India. "It

will make launching a car in India cheaper because you can start

from a low level of localisation," says an exec at one car

maker, "but to make money in the long run, all of us have to

localise."

The argument for localisation, however, isn't

as strong as it once was: Thailand boasts the biggest auto-component

manufacturing base in all Asia (with the exception of Japan) and

it is mere three days sail from Chennai. With duties gone, carmakers

may well find it less-expensive to source components from Thai companies

than from Indian ones. If that happens, the Indian auto-component

industry could find itself out on a limb: the sudden loss of marketshare

in the domestic market could well put paid to its global aspirations.

The automotive sector isn't the only one likely

to be affected: the experience of the Aditya Birla Group have proved

that Thailand is a cost-effective manufacturing base and the FTA

may just channel fresh investments in the Indian manufacturing sector,

which is just beginning to look up, to that country. Indian companies,

especially those eyeing global markets, could well opt for Thailand

over India when it comes to fresh manufacturing investments.

The FTA with Thailand isn't the only irritant

for India Inc.; industry is as worried about India's Comprehensive

Economic Co-operation Agreement with Singapore. The island city-state,

fear analysts, is a global logistics hub and companies based there

could build a sustainable business out of just repackaging imports

and selling them in India.

Free Trade is the way of the future, but India's

rash of FTAs could have been better timed: India Inc. has just come

to grips with the dynamics of the open market and it would be a

pity if its new-found confidence is laid waste by some badly-timed

initiatives in economic diplomacy. Still, there's one school of

thought-and this writer subscribes to it-that being thrown into

the deep-end is as good a way as any to learn to swim. After all,

2010, when India will enter into FTAs with the six countries that

are part of the association of South-East Asian nations, China,

South Korea, and Japan, isn't that far away.

-additional reporting by Kushan Mitra

Wrong

Number

First, the good news:

as on December 31, 2003, India has 28 million mobile subscribers.

The break-up: 21.9 million GSM users and 6.1 million, CDMA ones.

That's a mobile teledensity of 2.8 per cent, up from 0.33 per cent

in 2000. Now, for the bad news: the actual number could be significantly

lower. Most GSM users, some 18.6 million, use pre-paid cards (CDMA

pre-paids are yet to be launched). And average churn in the pre-paid

segment is around 4.5 per cent. Since pre-paid cancellations are

taken into cognisance by telcos only after 90 days, India's mobile

telephony base could well be overstated by the same amount, or 1.26

million subscribers. One analyst alleges that some large telcos

overstate their numbers. The Cellular Operators Association of India

(COAI), which collates and put out the numbers, reserves the right

to audit figures submitted by its members, but it generally takes

them at face value. Everyone, you see, loves good news.

-Sahad P.V.

Tuggaisms

101

Lessons business can learn from Steve Waugh.

|

| W is for Waugh: And for winning |

It

wasn't altogether surprising in cricket-mad India that corporate

leadership and team building lessons being offered by John Buchanan,

the Australian cricket team's coach, found several takers. Buchanan

takes these sessions seriously; why, an intermediary even wrote

to this magazine enquiring whether it would like to feature a regular

column on the two subjects by the man.

With no disrespect to Mr B, the one Australian

cricketing personality India Inc. (and, for that matter, CEOs and

execs across the world) can learn something from is the recently

retired captain of the country's test cricket team, Steve Waugh.

Enough has been said about how Waugh transformed Test cricket, but

the facts are impressive enough for this writer to present them

again: when Waugh took over as captain of Australia towards the

end of the 1990s, Test cricket was a slow, boring game of interest

largely to purists and statisticians; Waugh changed that by encouraging

his batsmen to score at more than four runs an over (once considered

fast-enough in the abbreviated version of the game) and his bowlers

to relentlessly attack the opposition. It helped that Australia

had some fine cricketers, but even discounting that Waugh's captaincy

record was close to unbelievable: 41 wins in 57 Tests (a staggering

72 per cent).

As the number indicates, Waugh changed the

business of Test cricket and other ancillary businesses: crowds

soared, as did television viewership ratings and advertising rates;

the cricket boards of various countries realised that they could

make money from Test cricket too; and an entire generation of cricket-followers

rediscovered the longer version of the game. Today, if the Indian

and South African Test cricket teams are any indication, more countries

play five-day cricket the Waugh way. The business, then, can only

get better. In effect, Waugh wasn't just a great cricketer, he was

(and he may not know this) a revolutionary whose idea changed an

entire industry. The point to ponder for businesses: if an individual

and an idea could do this in as mature an industry as test cricket,

what can they do elsewhere?

PRIMER

V Is For Vague

|

| TVS Centra: V is in vogue |

It seems to be an unwritten

rule among carmakers that every vehicle coming off their lines needs

to sport an acronym that is either appended to the brand as an afterthought

of sorts or referred to in all marketing communication. V, it is

clear, is the favourite letter: Honda had VTEC; Toyota has VVTI;

Maruti, Vxi; and now, TVS Motor, VTi. An exec with the Indian arm

of a multinational car major throws his hands up in mock-desperation

when queried about the Vs. "We do not have a choice. Someone

in HQ thinks up these abbreviations and it looks like they like

V." For the record, VVTI expands as 'Variable Valve Technology-intelligent',

VTEC as Variable Timing and Emission Control, and VTI, Variable

Timing-intelligent (note: One V less than Toyota). However, no one

quite knew what Vxi expands into. Ford India's Ikon comes with a

clutch of suffixes: SXi, CLXi, EXi and the like. The company's Vice

President (Sales & Marketing), Vinay Piparsania says, "Higher

the alphabetic position, better the car in terms of specification,

sometimes performance. We use ZXi on the top-end Ikon because Z

is the last letter of the alphabet; it is the ultimate." Or

should we say vltimate?

-Kushan Mitra

Three-letter

Jinx Redux

For the second year running, the government

is aflutter over a messy three-letter initiative.

If,

in 2002-03, the question echoing through India's corridors of power

was 'To VAT or not to VAT', in 2003-04, it is 'Hath not CAS eyes,

hands, organs....' Why invoke the bard of Avon? Well, for the second

year running the government finds itself in the midst of a weepy

tragedy involving a supposedly consumer-friendly initiative that

is being slowly but surely torn asunder by villains. If,

in 2002-03, the question echoing through India's corridors of power

was 'To VAT or not to VAT', in 2003-04, it is 'Hath not CAS eyes,

hands, organs....' Why invoke the bard of Avon? Well, for the second

year running the government finds itself in the midst of a weepy

tragedy involving a supposedly consumer-friendly initiative that

is being slowly but surely torn asunder by villains.

Last year, the villainous creed comprised shopkeepers,

uninformed journalists (really!), financially-strapped state governments,

and impending elections. This year, it does greedy broadcasters,

conniving cable operators, mysterious set-top box importers and

impending elections (again!).

VAT (short for value added tax) was doomed

because it tried to take away the ability of state governments to

shore up their finances by arbitrarily raising sales taxes on products.

And CAS (conditional access system) was doomed because consumers

would have had to invest in a fairly expensive piece of hardware,

the set-top box-at around Rs 4,000, it costs around half what a

colour television set does-without being presented with a choice

in terms of choosing their cable operators.

In the one city that adopted CAS, Chennai,

just around 20,000 households have bought set-top boxes. Like VAT,

CAS is essentially a good thing. It helps consumers, broadcasters,

and advertisers.

The good news is, neither legislation is completely

dead. VAT has just been put off, hopefully until just after the

general elections.

If three-quarters of the world can implement

VAT, there is no reason India has to live with 25 different tax

regimes. And the Telecom Regulatory Authority of India (TRAI), to

which the government has just referred the CAS imbroglio may well

be able to sort things out. Regulator Pradip Baijal, after all,

managed to find a resolution of sorts to India's telecom tangles.

-Kushan Mitra

CHEER

Good News, Lots Of It

»

The Indian economy grows 8.2 per cent in the second

quarter of 2003-04. Estimates suggest 7.2 per cent-plus is a possibility

in 2003-04 and 6.5 per cent-plus in 2004-05. »

The Indian economy grows 8.2 per cent in the second

quarter of 2003-04. Estimates suggest 7.2 per cent-plus is a possibility

in 2003-04 and 6.5 per cent-plus in 2004-05.

»

The Indian PC market grows by 32 per cent in the

first half of 2003-04, touching 1.25 million units. Projections

for the entire fiscal year 2003-04: 3 million units.

»

India's mobile telephony base touches 28 million

at the end of 2003. Target for end-2004: 50 million-plus.

»

India's passenger car companies are estimated

to get a bit closer to that magical million-cars-a-year market.

Estimate for 2004: 900,000 to a million.

»

The sub-continent moves a step closer to peace

with India and Pakistan making serious efforts to put their differences

aside.

»

The Supreme Court provides a fillip to the disinvestment

process by saying the government's stake in Hindustan Zinc, Shipping

Corporation of India, and Hindustan Copper can be sold since these

companies weren't created by Acts of Parliament.

»

The Indian cricket team draws a test series 1-1

with Australia but is the clear winner on points.

-Ashish Gupta

|