|

For

almost 10 days, the sensex rode a rough rollercoaster all because

of one thing: the uncertainty over use of participatory notes by

foreign institutional investors (FIIs). The bellwether index fell

from a high of 6130 on January 20, 2004, to a low of 5597 three

days later, before gaining 222 points on SEBI's clarification that

P-notes could continue to be issued, except to unregulated entities

(read those based in countries with no recognised regulatory bodies).

With the result, the Sensex closed at 5816.64 on January 23, and

investors went on a three-day weekend feeling happy.

But what are P-notes? P-notes are derivative

instruments issued to foreign investors against underlying Indian

securities. Typically, the buyers are foreign investors who want

to participate in Indian equities, but have not registered as an

FII. P-notes differ from FII investment in that the choice of equities

is made by the investor and not the FII. So, it was feared that

entities barred from directly investing in Indian stockmarkets may

use P-notes as a backdoor.

SEBI's move-made to strengthen its 'know-your-investor' regime-now

makes it mandatory for FIIs who have issued P-notes to unregulated

entities to wind down their exposure. Besides, the FIIs will have

to refrain from issuing P-notes to more than one layer of investor.

Some marketmen were also scared because P-notes

had begun to account for a large chunk of FII investment. For example,

as on September 30, 2003, P-notes accounted for Rs 19,125 crore

of the total outstanding FII equity investment of Rs 77,404 crore.

But on November 30, 2003, the figure had risen to Rs 21,179 crore

compared to FII investment of Rs 84,762 crore. But with SEBI directing

FIIs to keep full details on investors and make it available on

demand, the black money problem should get taken care of.

That means the quality of money coming into

stockmarkets will only improve in the days to come, making the rally

that much stronger. Besides, transparency may help bring the small

investor back into the stockmarkets.

-Narendra Nathan

NEWSMAKER

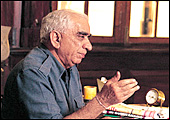

M.V. Subbiah, 65

|

| M.V. Subbiah: Setting the standard |

When you are the Chairman

of a family-owned business, it takes both courage and commitment

to let go. Courage because it isn't easy cutting yourself off from

a business that you have helped nurture, and commitment to abide

by the decision once it is made. On both counts, M.V. Subbiah scores

full marks. In April 2001, three years ahead of the due date, he

stepped down as the Chairman of the Murugappa Group, making way

for Infosys co-founder N.S. Raghavan, a non-family member, to head

the Murugappa Corporate Board. And last fortnight, Subbiah once

again demonstrated his commitment to the corporate governance rules

that he himself introduced in the group in the late 90s, by deciding

to retire from all group executive positions upon turning 65. Ever

the knowledge-seeker, Subbiah intends to go on a sabbatical to study

history of family businesses.

STREET WISE

Beyond The Mirage

The feel-good factor is real. Unfortunately

it touches just the tip of Indian society.

Last

fortnight, I met up with the Boston-based Partha S. Ghosh, once

a partner with McKinsey, and now regarded as a "creative problem-solver".

Ghosh was on a two-day whistle-stop tour of India, during which

he gave a few lectures and met up with Indian head honchos. He also

found time to tell me that free market capitalism isn't a perfect

panacea for India (coming from an ex-McKinsey guy this sounded too

cool!). His reasoning is simple: It works only when knowledge and

capital can be easily accessed, and India isn't brimming over with

either.

I ask him for his view on the feel-good factor.

"Yes, there is a self-satisfied feeling in the top echelons

of Delhi, Mumbai, Bangalore, Hyderabad. But it doesn't exist in

other towns." The man then goes on to systematically chip away

at the many illusions many of us cherish with respect to India Shining.

Sample 1: Becoming backoffice to the world

is great, but just 2 per cent of the population benefits. Recent

successes on that front could blind India to the "mega-possibilities

of the future".

Ghosh advocates a brand of capitalism that's

adaptable to the Indian market-he calls it "circular capitalism"-in

which value-addition is circular, inclusive of all Indians, and

revolving around its strengths, just one of which is agro-based

industries.

Now this is no bleeding heart story. There's

plenty of money to be made for corporates willing to take that big

leap (Ghosh himself has invested in a fuel cells company, and touts

them as a possible answer to India's power problems). To the CEOs

he meets, Ghosh suggests a "two-tier strategic management system"

(the McKinsey touch!). The first tier involves maximising opportunities

and profits. But at the same time they should also be looking to

give birth to the next generation of services and industries.

Sample 2: Did you know, goes Ghosh, that ballet

in Russia is a billion-dollar industry? My jaw drops, but I am left

even more open-mouthed when the man tells me that India's culture-based

industry could be worth $100 billion. "Baul music of Bengal,

Bhangra from Punjab, can be packaged and promoted abroad."

A pipedream? Perhaps. But Ghosh's concept of circular capitalism

ever does show even the remotest signs of working, Dr Feelgood would

have finally arrived.

-Brian Carvalho

Only Half Open

Not all easing of FDI is that.

|

| FM Jaswant Singh: He's been on an overdrive |

Since this is the season of feel good,

all kinds of measures are masquerading as nifty reform without the

bluff being called. Until now, that is. So, here we go. Let's start

with the government's decision to up foreign direct investment (fdi)

in private banks from 49 to 74 per cent. The catch? The voting right

is capped at 10 per cent, which means any foreign investor who buys

into a private bank will have little say in what the bank does.

So, why would anybody want to invest? Here's another example of

bureaucratic legerdemain: A 100 per cent foreign investment is allowed

in the petroleum sector (as also in scientific and technical journals),

but the much awaited relaxation of FDI limit in telecom from 49

per cent to 74 per cent has been shelved, for the third time, ostensibly

in the interests of national security. Never mind that telecom is

a capital- and technology-intensive industry where access to foreign

equity capital may be important to fight fierce price wars. Worse,

the sop was promised to GSM players who have been affected by the

turning of limited mobility into full-blown mobility through unified

licensing. The real reason why the move has been scuttled has nothing

to do with concerns of national security, but everything to do with

Sangh Parivar, or some corporate lobbies. How is the petroleum sector

any less a strategic industry than telecom? We are still trying

to figure that out.

-Sahad P.V.

What A

Rush

Cairn Energy strikes black gold in Rajasthan.

Know

why gold diggers rarely call it quits? Because the more you dig,

the better your prospects of finding gold. Just ask Cairn Energy.

Seven years ago, strategic investor in oil exploration venture in

Rajasthan, Royal Dutch Shell, sold its 10 per cent stake to Cairn

after failing to find any oil despite having spent Rs 200 crore

over 10 long years. Circa 2004, it is Cairn that's laughing its

way to the bank. On January 19, 2004, it announced that it had struck

oil in the Barmer district of Rajasthan, with an estimated reserve

of 450-1,150 million barrels of oil. Earlier, in February last year,

Cairn had managed to hit another oil geyser, but with a smaller

in-place reserve of 20 million tonnes. The January find promptly

upped Cairns market value on the London Stock Exchange to £665

million (Rs 5,523.18 crore), and when BT went to press the Cairn

stock was quoting at 632 pence (70 per cent higher than its pre-find

level of 370 pence).

What does the discovery mean for India's oil-deficit

economy? For one, it will cut the country's oil import bill of about

Rs 84,400 crore. For another, as Petroleum Minister Ram Naik commented,

it will help improve the "perception of hydrocarbon prospectivity

in India". That means the investments in the 70 blocks given

out under the New Exploration Licensing Policy (NELP) for exploration

could be much higher than $3 billion (Rs 13,800 crore). "It

could easily touch $7-8 billion (Rs 33,600 crore-Rs 36,800 crore),"

says Avinash Chandra, Director General of Hydrocarbons.

But the greatest benefit would be in terms

of exceeding the Tenth Plan target for the oil find. The targeted

180-200 million tonnes of oil and oil-equivalent gas now seems like

a cinch. As for Cairns, it has already announced that it will make

many more acquisitions in Asia, especially in India and Nepal. And

as for the Shell executive who made the decision to sell, well...a

good place to look for him may be Siberia.

-Ashish Gupta

|