|

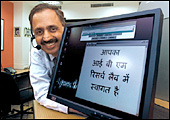

| IBM's P. Gopalakrishnan: Domestic

concerns |

If you walk into the office of Ponani

Gopalakrishnan (Gopal), Director of IBM's India Research Laboratory,

in the sprawling campus of the Indian Institute of Technology, Delhi,

expecting to meet a dishevelled researcher, you would be in for

a surprise. Gopal is as much a suit as any of Big Blue's product

managers and even talks business. His office is very unlike that

of an academic: the table is clean and uncluttered.

That isn't altogether surprising. In 1997, when the IBM lab opened

shop in India, it was largely a resource pool that had a 'quota'

of patents that it had to file. Today, Big Blue actually sees a

large and strategic market here for cutting-edge it services and

is talking about using the resources of the seven other IBM labs

in the world to help Indian companies deploy it to differentiate

themselves. It has announced what it calls 'On Demand Innovation

Services' where IBM research scientists will collaborate with the

Business Consulting Services division (PricewaterhouseCooper's consulting

arm that IBM bought out) to help companies architect their it infrastructure.

"This is a reflection of the evolution of the local it services

market," says Gopal, who took over as head of the lab from

Manoj Kumar, a hardcore techie, in July 2003. "There are several

industries which are growing rapidly where it can be used for a

strategic advantage."

It isn't just the corporate market that IBM is eyeing. Indeed,

the arena where it will fight its biggest battle is the e-Governance

market. The Government of India has announced an annual e-Governance

budget of over Rs 4,000 crore-part of the Rs 12,000 crore that will

be spent on the Prime Minister's dream e-Governance project. All

the biggies, Oracle, Intel, Red Hat, and Microsoft are in the fray

here. The battle will be fought on the strength of standards and

ease of use. Big Blue wants the government to go open source, as

do Intel, Red Hat, and Oracle, but that doesn't mean this is a Microsoft

versus everyone else fight. At one level, it is a hardware companies

versus software companies one. After all, margins in the hardware

business are slim and software, healthy. Companies like IBM are

rooting for open-source because they'd then retain control by providing

the hardware and services. And the research aspect becomes important

for hardware companies because it is imperative that they work with

developers within and outside the organisation to create open-source

applications.

For starters, the giants backing open source have forged a consortium

called Eclipse, focused on developing a software development environment

built around open-source development tools. And IBM research is

helping train Indian developers in the use of Eclipse.

The booming telecom market provides IBM's lab with another opportunity.

The world sees telecom networks as a retail channel for services.

For instance, if a customer wants to withdraw money from an ATM,

all he will have to do is send in a request to his mobile service

provider. This, in turn, will access information on the customer's

bank from his database, information from the bank's network on where

its ATMs are located, and information from a GIS service provider

on the respective locations of the customer and the ATMs before

sending him a reply. IBM is working on creating an architecture

that will enable telcos do this.

Big Blue is so excited about the Indian market that it is bringing

its other programs to India too. Its 'First-of-a-kind' programme-its

researchers work with researchers in other companies to see how

it can be used to find technological solutions to crucial problems-will

soon be launched in India. Which are the Indian companies involved?

Watch this space.

-Vidya Viswanathan

An Intelligent Communication Device...

...aka Smartphone. And the first just hit India.

Take

one part cellphone, one part digital camera, and one part handheld,

add a Microsoft heart and you get a crossover device potentially

capable of doing everything. Welcome to the next generation of personal

mobility solutions. Carrier Devices, a Glasgow-based company has

begun selling its i-mate Qtek 1010 PDA-cum-phone (Rs 39,000) and

i-mate Smartphone 2 (more phone and less PDA, Rs 25,000) in India

through its marketing agency e-Charge. Both devices boast Microsoft's

Pocket pc 2003 phone edition, the lower priced device missing MS

Pocket Word and Pocket Excel.

The smartphones can do all the things a phone can and a lot more.

Like with any handheld you can synchronise them with your pc and

update MS Outlook. At a press conference to announce the launch,

company officials were extremely upbeat and predicted sales upwards

of 25,000 units in 2004. We'd like to scoff: true, Indian telcos

will add some 15 million mobile subscribers in 2004, but most users

prefer low-priced phones. The relatively low penetration of the

similarly priced Nokia 9210i Communicator, for instance, is a bad

portent for i-mate. However, company officials expect the 'Windows'

tag to help push sales. Then, it may, or it may not.

-Kushan Mitra

Hitting

The Right Buttons

The Tata Group finalises its telecom

communications blueprint.

|

| Tata Industries' Kishore Chaukar:

We also connect people |

According to tech research and advisory

firm Gartner, just four large nationwide players will survive and

thrive through 2004 in the Indian telecom space: Bharti, Reliance,

BSNL. And the fourth? Tata. A year earlier, the last name wouldn't

have been an automatic shoo-in into the list of cellular survivors

and thrivers. Thanks to the era of unified licensing, however, the

Tata Group-it has converted its applications for basic service licences

in seven new circles into ones for universal access service licences-has

emerged as a telecom powerhouse with muscle and steam enough to

last the long haul.

To be sure, unified licensing means a lot for the Tata Group's

grand telecom game plan, which is being put together by Tata Industries

Head Kishore Chaukar. It would have meant even more had direct-to-home

(DTH) services been dovetailed into this licence. Analysts point

out that thanks to the acquisition of VSNL, the Tata Group is sitting

on plenty of satellite capacity and earth-station infrastructure,

which will come handy in the launch of DTH services.

The unified licence may not include DTH, but that hasn't stopped

the Tata Group from announcing an 80:20 joint venture for DTH television

broadcasting in India with Star TV subsidiary, Space TV. Whilst

the former will provide the infrastructure for what's touted as

India's largest digital platform, the Rupert Murdoch company will

provide content for 100-odd channels, ranging from news to movies.

Clearly, it's all coming together pretty well for the Tata Group.

And the numbers too are beginning to look impressive. Take the 1.5

million subscribers to the Indicom basic service, club it with Idea

Cellular's user base-which has now shot up to a little over 3 million

after the buyout of Escotel's six circles-for good measure add VSNL's

6.5 lakh internet dial-up subscriber base, and you're looking at

a telecom behemoth that can hold its own against any competition.

VSNL's reported plans to buy Dishnet's internet and digital subscriber

line business will help the Tata Group consolidate further in the

internet space. Watch out Bharti, Reliance, and BSNL, the Tata Group

is finally getting its act together.

-Brian Carvalho

DASH

BOARD

A

Union Cabinet Minister Arun Shourie minced no words at the World

Economic Forum in Davos in telling the European Union and America

exactly what he thought their trade policies aimed for: (to paraphrase)

stiff the developing countries.

D

The passing of a Federal law banning government contractors from

sub-contracting to Indian companies dents the US' image as a free-market

proponent. Had the WTO's services framework been ready, this would

have been a non-tariff barrier.

|