|

Paul

Calello, chairman and CEO, Asia-Pacific Region, Credit Suisse

First Boston, has just finished a packed fortnight in India trying

to get the investment bank's reputation back on track, grab an FII

license to begin portfolio investments in the country and meeting

with corporate leaders. He spoke to BT's Ashish

Gupta and Aditya Wali on the

bank's plan for the country. Paul

Calello, chairman and CEO, Asia-Pacific Region, Credit Suisse

First Boston, has just finished a packed fortnight in India trying

to get the investment bank's reputation back on track, grab an FII

license to begin portfolio investments in the country and meeting

with corporate leaders. He spoke to BT's Ashish

Gupta and Aditya Wali on the

bank's plan for the country.

Why did the Securities and Exchange Board of India ask you to

wind up operations in India in 2001?

We were suspended by SEBI for two years-April 19, 2001 to April

18, 2003-but that suspension is over now. First, CSFB accepts full

responsibilities for anything its employees did. But that was before

my time and none of the employees involved with the incident still

work for CSFB. There were allegations with regards to transactions

our firm did with Ketan Parikh and I am not going to get into the

details of what we believe happened from a CSFB management perspective

versus what SEBI believed happened. We feel we have served our time.

Have you applied for a Foreign Institutional Investor (FII)

licence?

The current status is that CSFB has made an application for a FII

license and we are still waiting for a reply. And as I said before,

we were only suspended from our brokerage activities.

As an investment bank, credibility is very important. Don't

you think your credibility has taken a beating?

Absolutely. We certainly have felt the pain. And the only way

I see to rebuild credibility is to have individuals with high level

of integrity. We hired Ajeya (Singh, from the India operations of

Lehman Brothers), brought in a new team to help us build the trust

with regulators, government and corporates, some of which we serve

round the globe.

Do you believe in the India growth story, despite what's happening

in the emerging markets and the possible slowdown in the Chinese

economy?

If you read our recent research on Asia, we believe that India

is probably among the most resilient of the Asia-Pacific countries

toward a slowdown in China. More importantly, we do believe that

from a China perspective we will see a soft landing rather than

a hard fall (of the economy).

Has the change in the government at the Centre affected your

outlook towards the country?

We are extremely positive. Prime Minister Manmohan Singh and Finance

Minister Chidambaram have an impeccable record and seem to be very

forward thinking. That's what the financial community looks for.

Losing Its Touch

For long the market leader, Nokia finds itself

challenged by nimbler rivals.

|

| Nokia India's MD Sanjeev Sharma: Facing

stiff competition |

It's

like the cola wars, only worse," says Sanjeev Sharma, Managing

Director, Nokia India. Cola wars may well be Sharma's favourite

metaphor (he was with Pepsi earlier) to describe the battle in the

cellular handsets market, but he has a point. Last year saw a rash

of new entrants-Kyocera, BenQ, Bird, DBTel, Kejian, Primus, Sagem,

Telson, GTran-upping the total number of players to 20 in the GSM

and 10 in the CDMA space. Not only are the models offered by these

vendors cheaper, but often better-looking too. Oomph has never been

Nokia's strong point, and the company is losing ground in the country.

That it entered the CDMA field rather late has not helped matters

either. According to a study conducted by CyberMedia Research, LG

Electronics leads the combined GSM and CDMA handset market, with

Rs 2,797 crore in sales, and a 33.5 per cent market share for FY

03-04 (See Feeling The Heat). Nokia is the number two with sales

of Rs 2,481 crore and a 29.7 per cent marketshare.

Does Nokia have a comeback strategy? You bet.

Following global directives, the Indian subsidiary has just finished

a restructuring of its operations to make itself leaner. It recently

hired Sanjay Behl from Lever to head its marketing, and it is also

revamping its channel strategy, roping in it resellers as retailers.

New market segments-like the enterprise market-are being aggressively

courted. New ideas such as gaming phones are being introduced. Seven

new models are waiting in the wings.

For good reason. The Indian handset market

grew a whopping 568 per cent growth last year in value terms. Of

the total sales of Rs 8,344 crore, Rs 4,153 crore came from CDMA

and the rest from GSM. Expect these numbers to go higher north this

year with unified licensing, consolidation among the service providers

and, of course, newer circles getting into the mobility net. Nokia,

though, has bigger plans. "We are looking at managing the entire

mobile communications ecosystems for enterprises," explains

Sharma. That apart, Nokia plans to go after the rural consumer.

Competition hasn't been sitting idle either.

BenQ is targetting a 5 per cent share in the next one year, and

numero uno LG has revised projected sales for 2004 from 3 lakh units

to 4 lakh. "By 2005 colour phones will dominate about 50 per

cent of the handset market," says Praveen Valecha, Product

Group Head (Mobile Phones), LG. With handset makers battling it

out, the consumer can expect better phones at lower prices.

-Sudarshana Banerjee

Knowledge

KO

Marketrx is a 'different' company.

It is co-founded by an Indian, has about 100 employers in the country

(some 30 of them are IIT-IIM types) and is engaged in Knowledge

Process Outsourcing (KPO) for Big Pharma. Jaswinder S. Chadha,

President and CEO, caught up with BT's Sudarshana

Banerjee on a recent visit to India. Excerpts:

How does KPO work, as opposed to BPO?

Companies hive off business processes or it because they do not

want to do it themselves for reasons of cost or efficiency. KPO

comes into play when a company can't do the knowledge bit itself,

even if it wants to. It is primarily consultancy on strategy issues

and audience research.

How big is the Indian market for pharma KPO?

KPO works mostly with branded pharma products, as opposed to generic

ones. The Indian market mostly runs on generic products, ergo, there

are not much business activities on that front. But if we look at

the KPO service industry, the prospects are very high (in India).

The pharma industry worldwide spends about $30 billion (Rs 1,35,000

crore) a year on sales and marketing and some $3 billion (Rs 13,500

crore) a year on sales planning, market planning and market research.

Add to that the fact that technology analytics requires the kind

of skill set that is not freely available.

What is the business model of marketRx?

KPO, because of its IP-intensive nature is more of off-site than

of offshore. We have a major footprint in US, a workforce of some

125 people. India services the European market. Relationships with

clients are ongoing, multi-year ventures. Size of the deals vary

from quarter to a half million dollars (Rs 2.25 crore) for market

research to $1 to $3 million (Rs 4.5-Rs 13.5 crore) for helping

pharma companies implement enterprise solutions. Typically, billings

for a client is around $18 to $20 million (Rs 81-90 crore). Gross

margins can be as high as 90 per cent.

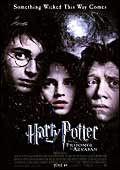

CHARMED

Potter Crazy

Is

the teenaged wizard's magic in India on the wane? If early box office

collections of Harry Potter and the Prisoner of Azkaban are to be

believed, then maybe not. In its first week, the movie had taken

in more than Rs 12 lakh from one theatre alone in Mumbai. "The

initial response has been phenomenal," says Komal Nahata, a

trade expert. But expect the crowds to thin once the schools reopen

in a week or so. Already, the Harry Potter merchandise is going

abegging because of steep pricing. "The Swords and Hogwarts

Castle were relatively popular, but the rest of the range didn't

go down as well as we expected," says Vishal Dabre, Merchandiser

(Kidswear), Westside. Fortunately for Harry Potter's creator, J.K.

Rowling, the books are still doing brisk business. Is

the teenaged wizard's magic in India on the wane? If early box office

collections of Harry Potter and the Prisoner of Azkaban are to be

believed, then maybe not. In its first week, the movie had taken

in more than Rs 12 lakh from one theatre alone in Mumbai. "The

initial response has been phenomenal," says Komal Nahata, a

trade expert. But expect the crowds to thin once the schools reopen

in a week or so. Already, the Harry Potter merchandise is going

abegging because of steep pricing. "The Swords and Hogwarts

Castle were relatively popular, but the rest of the range didn't

go down as well as we expected," says Vishal Dabre, Merchandiser

(Kidswear), Westside. Fortunately for Harry Potter's creator, J.K.

Rowling, the books are still doing brisk business.

-Priyanka Sangani

Tapping

ATMs

Infocomm offers cheaper ATM hook up.

|

| Kishore Oka: From telecom to banking |

For all their convenience, automated

teller machines (ATMs) are devilishly expensive to operate. Blame

it on technology. Currently, ATMs are hooked up to the bank's central

servers through VSAT technology, deploying which requires a licence

from the government (a time consuming process) and a leased telephone

line.

The high cost of setting up an ATM is one reason why their spread

is still limited in the country. Reliance Infocomm believes it can

change that. By providing last mile wireless connectivity through

its CDMA network riding on a nationwide network of optic fibre covering

1,100 cities, Reliance Infocomm claims that it can wire up ATMs

at least 40 per cent cheaper than conventional VSAT technology.

Says Kishore Oka, Head of Finance Vertical at Reliance Infocomm:

"Since ATMs require limited bandwidth, the cost to the bank

for leasing the line is high. Reliance Infocomm's solution is, therefore,

more cost effective."

At present around 11,000 ATMs have been installed in the country

and analysts expect the number to quadruple over the next five years.

State Bank of India has already connected 100 of its ATMs using

Reliance Infocomm's CDMA technology. "Others like HDFC Bank,

ICICI Bank, Citibank and Bank of Punjab have also linked to our

Reliance Infocomm's central point at Navi Mumbai," says Oka.

Lower infrastructure cost may also enable banks to spread card terminals

to B and C class towns. In other words, it's smart business-one

way or another.

-Venkatesha Babu

Flexing

Muscle

Flextronics snaps up Hughes Software.

|

| Flextronics' Ash Bharadwaj: Big deal |

It came, it saw, it bought. Flextronics,

a $14.5 billion (Rs 65,250 crore) electronics manufacturing services

(EMS) provider based out of Singapore, has acquired a 55 per cent

stake in Hughes Software Systems. The deal, being dubbed as the

biggest cross-border deal to date in India, is worth Rs 1,023 crore,

at Rs 547 per share. Ever since Rupert Murdoch disclosed his intention

of selling News Corp's non-core businesses, DirecTV's stake in Hughes

Software had been up for grabs, and several leading tech and venture

capital outfits are believed to have had a go at it. Flextronics

entered the fray after the middle of May. "EMS providers offer

solutions like logistics, reverse logistics, hardware, manufacturing

support, mechanical design etc. With this acquisition, we enter

the crucial software design and services business," says Ash

Bharadwaj, President (Design Services), Flextronics. Hughes, however,

will continue to function as before. "The management structure

will remain the same and HSS will remain a public company,"

Bharadwaj adds. Arun Kumar, President and Managing Director of HSS

clarifies that the guidance of 25 per cent mentioned earlier will

not change, as won't the relationship with HSS' top five customers,

including News Corp.

-Sudarshana Banerjee

|