|

| Rising aspirations: Buoyed

by rising incomes and an explosion in products and services,

a growing number of small-town consumers want to keep up with

Joneses in metro |

| THE BIG PICTURE |

Our Definition of Small Towns:

Population of 5-10 lakh

Number of such towns in India: 40

|

Breakup:

North: 17

South: 12

East: 3

West: 8 |

This

is a story about spaces through which the information highway winds

its way in tandem with endless stretches of cement-and-mortar tarmac,

thatched-roof hamlets dotting one side and sugarcane fields swaying

in the wind the other. These are the spaces where roaming has as

much to do with mobile banter as with walks through bustling, brand-bristling

bazaars, where the often-excitable vernacular is being increasingly

peppered with hitherto urban jargon like footfalls and walk-ins

as well as stock-trading talk like shorting and timing. Where brands

such as an unabashedly-wannabe "Polo Jean Joint" co-exist

peacefully with the phoren Lees, and Wranglers, where cutting-chai

at the roadside dhabhas and the cappuccinos of the branded coffee

shop chains often attract the same client on different days.

These are the towns whose people are discovering

the virtues of a new form of plastic-that with the Visas and Masters

stamped on them, with which they can buy PCs to ride the information

highway and mobile phones to rap and roam, gain a sense of self-assurance

in those brand-buzzing bazaars, and pay for those cappuccinos and

sandwiches in those novel coffee parlours.

These are the people who, taking a cue from

their brethren in the metros and mini-metros, are beginning to believe

that debt isn't always a four-letter word. That buying one's own

home is actually possible in the first half of life itself, that

automobiles big and small aren't just for well-heeled city slickers,

and that televisions, washing machines, air-conditioners and the

entire durables gamut aren't urban luxuries any more but virtually

indispensable add-ons.

To be sure, this story isn't about FMCG majors

selling shampoos with moisturisers to wide-eyed countryfolk. That

happened at least 20 years ago. Neither is it about the advent of

television into mud-walled homes. That happened over a decade ago.

This is a story about the millions earning more, borrowing cheaper,

and spending freely on products and services that you always thought

were only the purview of the urban rich. No longer. Thanks to exposure

from multi-media-television, Internet, publishing, Hollywood and

Bollywood-Small Town India is aspiring like never before. For any

marketer worth his spiel each one of them is king, and small-town

India his temple. Estimates arrived at by BT indicate that in just

40 towns with a population of 5-10 lakh, there exist at least 20

million customers for products like Rs 1,000 shirts, Rs 55-per-ticket

multiplexes, Rs 20 capuccinos, Rs 1-4 lakh home loans, credit cards,

mutual funds and insurance. And that, be assured, is just the tip

of the ice berg. According to the 2001 Census, India has some 5,161

towns (excluding the 384 "urban agglomerations") and some

6.38 lakh villages, with a population base of some 600 million.

The Big Forty

Be it Jalandhar or Trichy, Rajkot or Gorakhpur,

Jodhpur or Vijayawada, they're breaking out of long-forgotten cocoons

and discovering the joys that only the market can bring. And their

providers-the marketers-are, across products and services, responding

to the growth in up-country India that's driven largely by affordability

triggered by lowering interest rates and increasing income levels.

That can only, for instance, explain why close to 50 per cent of

the home loans market is concentrated outside of the top 20 towns,

which has prompted HDFC to expand into some 172 locations (the latest

being Anand in Gujarat), and others like IDBI Bank to head toward

towns like Kolaphur and Erode.

|

| Mangalore: Saibeen Shopping Complex is

a favourite haunt of the city's rich |

| SOUTH Towns

like Madurai and Vijayawada are the new frontier for marketers |

That's why broking houses like India Bulls and

Kotak, along with the big mutual funds like ICICI Prudential-which

have so far penetrated just a minute fraction of the Indian population-are

spreading the equity cult to the deepest parts of India, riding

on the National Stock Exchange's presence in over 350 cities. The

insurance majors too have hopped on to the wagon: MetLife, for instance,

has trained its sights on 64 towns with a minimum population of

5 lakh. Car major Maruti has tied up with State Bank to leverage

its 12,000 branches to sell new as well as used models in centres

like Trichy and Madurai, and convert two-wheeler users into car

owners. After all, a graduation of 1 per cent of the two-wheeler

base translates into 50,000 new car buyers.

Meantime, handset major Nokia is finetuning

a major thrust into tier II and tier III centres, a fast-food chain

like Café Coffee Day is looking at towns right from Ranchi

to Sangli, Titan showrooms have mushroomed in 75 centres, including

Bhatinda and Bharuch, McDonald's and Pizza Hut are eyeing Dehra

Dun, an all-veg avatar of Domino's Pizza has dropped anchor in Surat,

huge retail spaces are mushrooming in Surat and Bharuch, apparel

brands like Peter England are present in over 100 towns, right from

Solapur to Chapra, PCs are selling faster in tier II and tier III

centres than in metros and brands like Benetton, Lee, Levi's, Woodland,

Reebok, Adidas, Nike, Raymond and Weekender can be found in the

markets of Ganpat Galli of Belgaum and Model Town in Jalandhar.

It's difficult not to run into an ICICI Bank

or an HDFC Bank or a UTI Bank in the 40-odd towns with a population

in the 5-10 lakh range-which is the sample Business Today has closely

explored for this story-not just raking in deposits but offering

all kinds of loan products to prospective clients. "If earlier

the multiple for buying a house was 10-15 times, today it is just

4-5 times across India. That's one reason why the trend is shifting

towards secondary markets," says Suresh Menon, General Manager

(Mumbai Region), HDFC.

|

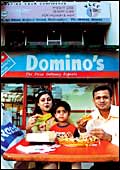

| Dehradun: Rahul Windlass (R) with his

wife and son at a Domino's outlet |

| NORTH Big

brands, the preserve of metros so far, are making their presence

felt |

Listing out all the brands and services entering

smaller towns will prove exhausting, and also pointless after a

point. What's evident is that it's the huge opportunity out there-see

following story-that's pushing marketers deeper up-country, each

of whom has reached different destinations in the urban-to-rural

expedition, depending on what they have to offer and also how long

they've been in the Indian market. For instance, for every McDonald's

just about to get into a 4.5 lakh populated Dehradun, there will

be a Peter England or a Titan that crossed that hump long ago, and

which would now be looking at a tier III town now with a population

under 3 lakh.

Making mid-size towns-those that follow the

metros and the mini-metros on the value chain-even more attractive

and accessible are two significant, contrasting, factors: One, connectivity

via a network of national highways, and two, migration into such

towns from villages. Take the migration factor first: If, earlier,

the metros were the first option for job-hungry rural folk, today

it's towns like Mangalore and Belgaum that are attracting people

from the interiors. Suraj Kaeley, Marketing Head of insurance major

MetLife, points out that one reason for the focus on towns is that

that the potential for growth is faster here than in the metros

because of the migration effect. "The population in a town

may be only 5 lakh, but it can soon become 10 lakh due to migration

from rural areas. On the other hand, the metros have very little

scope left for expansion."

And if they're aren't migrating, they at least

know where the action is. In Belgaum, for instance, brokers point

out that they get enquiries from the nearby small towns of Gokak,

Raibag and the agricultural belt Khanpur. Reliance Web World too

is getting walk-ins from Khanpur and Nipani (a tobacco-growing centre),

even though its network is not yet up and running in those areas!

Whilst migration will help broaden the consumer

base in the mid to longer term, simultaneously the national highways

originating from Big City India that will pass through these towns

will also bring with them products, services and a quality of life

never experienced before. A drive down the still-to-be-completed

four-lane Pune-Bangalore National Highway already reveals a changing

landscape: A mechanic who gets under your car with spanner in one

hand and cell phone in the other, a couple of Reliance petrol pumps

amidst a stark barren setting, swanky motels-cum-restaurants that

make the good old dhabas appear prehistoric, a Tata Motors dealership

across which a shepherd nonchalantly guides his trudging folk, and

a public sector petrol pump in an obscure village between Kolahpur

(roughly 600 km from Bangalore and 380 km from Mumbai) and Karad

(85 km from Kolahpur) whose attendants grunt matter-of-factly to

let you know they accept plastic of most hues. Meantime, towns like

Hubli, Belgaum, Vijaywada and Madurai coming onto radar screens

of low-cost airlines like Deccan Air also help give these mini-cities

immediate access and the added bonus of metro-like respectability.

|

| Rajkot: The crowd at the City Mall exemplifies

te shift in consumer mindsets |

| WEST Huge

retail spaces have altered consumer attitudes towards spending |

Marketers rushing into these towns is also helping

unleash the entrepreneur shackled in Small Town India. Rather than

migrate to cities or overseas for better opportunities, many of

these well-educated youth are exploring, for instance, the huge

franchising opportunity that's emerging-be it for a Baskin Robbins

ice cream outlet, or a Compaq reseller or a McDonald's or a Pizza

Hut. If a Café Coffee Day has ambitions of having over 500

outlets all over, and has already opened up in towns like Belgaum,

Vijaywada, Madurai and Mangalore, it's got as much to do with the

promoters' enterprise as with the rash of enquiries emanating from

a Sangli, Shillong, Siliguri and Ranchi. As Sudipta Sen Gupta, Head

(Marketing), Café Coffee Day, tells it: "We expand on

the basis of enquiries we get, and their conversion into an outlet

depends mainly on the location."

Clearly, the opportunities in the Indian market

don't exist only in the metros. And we're not talking just about

low-cost, plain-vanilla products and services-why else would Siemens

be distributing its high-end appliances in Salem or Toyota Corollas

and Camrys selling in Gulbarga in Karnataka. Small Town India enjoys

similar aspirations and spending power than the metros, the difference

being that the metros have more of such consumers. But that's today.

As the metros get saturated, marketers will rely on other catchment

areas: the mini-metros, the 10 lakh population towns, the 5 lakh

ones, the sub-three lakh towns.... That's why a company like HDFC

will continue with its "outreach programmes"-executives

make regular once-a-week visits to prospective centres, stay in

hotels and gauge the potential of consumers and credibility of developers

for months, sometimes years, before deciding to put up a full-fledged

office in that town.

It's not only metro-India that's clamouring

for a better quality of life: The rest has aspirations too and,

make no mistake, they're not just for gel toothpaste, liquid soaps

and defrost refrigerators.

|