|

| King Kong? BSNL is Indian telecom's

800-pound gorilla |

You

probably didn't need an investment banker to tell you this, but

somebody's got to do the job: ICICI Securities (I-Sec)-saddled

with the onerous responsibility of "synergy consultant"-has

tabled two options for the merger of Mahanagar Telephone Nigam

Ltd. (MTNL) and Bharat Sanchar Nigam Ltd. (BSNL). Either BSNL

buys out MTNL or MTNL picks up 51 per cent of BSNL, if not all

of it. That, of course, is the simpler part-making the recommendations.

Getting somebody to make the decision is turning out to be the

tougher part-a meeting scheduled last fortnight to thrash out

the options was postponed, with the outgoing Department of Telecommunications

(DOT) secretary Nripendra Mishra preferring to let his successor

do the honours (till that successor is appointed, it secretary

Brijesh Kumar will fill in).

On paper, it would appear logical for bsnl

to buy into MTNL (the government owns all of BSNL and 56.25 per

cent in MTNL, which is listed domestically as well as on the New

York Stock Exchange). Whilst MTNL is confined to Delhi and Mumbai,

BSNL already has a pan-Indian footprint, with a presence in 5,200

cities and 5.4 lakh villages. Naturally, BSNL would have more

subscribers too: 46 million, as against mtnl's 4.84 million. As

far as investments go too, BSNL is stepping on the gas, with a

proposed capital expenditure of Rs 25,000 crore a year for the

next three years-and this comes in the wake of the Rs 32,000 crore-plus

spent over the past three years. The short point: BSNL can simply

go ahead and acquire the government's stake in MTNL.

Government sources point out that the intricacies and modalities

of various options, valuations and swap ratios will come up only

later. "Right now, opinion is being sought from key stakeholders

(BSNL and MTNL)." R.S.P. Sinha, Chairman & Managing Director,

MTNL, appears to have his problems with MTNL being acquired. "Is

BSNL's acquisition of the government's stake in MTNL to be called

a merger?" is his favourite question these days. "A

merger should be the route-I am okay with a straight or reverse

merger."

You could argue that the hairsplitting about

whether the marriage will be a merger or an acquisition is secondary

(though MTNL's 53,000 employees and BSNL's 3.5 lakh workforce

may disagree); after all, the purpose of the amalgamation is to

create a bigger, more efficient giant that can dance. "The

two PSUs have not performed well-in the last four years, their

share of expansions has been only 20 per cent, with 80 per cent

coming from private players, of a total of 50 million lines,"

points out Dayanidhi Maran, Union Minister for Communications

& it. "I want MTNL and BSNL to achieve a target of 50

per cent (80 million lines) in the next three years." That's

great, but will somebody bring them together first?

-Kumarkaushalam

AMBUSH

The Perils Of A

Long Teaser

To promote their

daily, slated for a September release, the Zee-Dainik Bhaskar

combine retained Rediffusion to develop a teaser campaign. The

agency did one with potential readers with duct tape over their

mouth and the punchline, "Speak up, it's in your DNA",

and blitzed it across some 150 hoardings in Mumbai. In just a

few days, Bennett, Coleman's (publisher of The Times of India)

agency Enterprise Nexus piggy-backed on the curiosity created

with its own version showing the tape peeled off. The ads were

for Maharashtra Times. Zee has taken BCCI to court for Rs 100

crore in damages; the court has asked the company to hold its

rip-off; but the damage is done. Moral: the perils associated

with a long teaser are almost the same as that of launching a

competitor to TOI in Mumbai.

-Abir Pal

SECOND

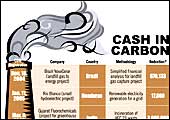

Carbon Currency

There's money in environmental soundness,

as Gujarat Fluorochemicals is discovering.

There's

money in carbon. Just ask Gujarat Fluorochemicals (GFL) that stands

to make anything upwards of $21 million (Rs 92.4 crore) a year

(its own capacity and market dynamics are the only constraints

in a euro 10-billion-by-2008, Rs 56,000-crore, market) from it.

The carbon in question is carbon credits that companies can earn

by reducing emissions of greenhouse gases. Companies can trade

in these as a commodity under the United Nation's Framework Convention

for Climate Change (UNFCC).

Vadodara-based refrigerant-gas manufacturer

GFL has become the first Indian company, and the third in the

world to have an emission-reduction project certified as a Clean

Development Mechanism (CDM) by the Executive Board of the CDM

established under the Kyoto Protocol. GFL makes HCFC 22, also

known as Green Gas or Top Gas, a coolant widely used in air-conditioning

and refrigeration applications. In the process, it generates HFC

23, another fluorochemical, as a by-product. HFC 23 is a potent

greenhouse gas with a global warming potential of 11,700 (the

global warming potential, measured as the ratio of the warming

or 'radiative forcing' that would result from the emission of

one kilogram of the greenhouse gas to that from the emission of

one kg of co2 over a period of say, 100 years). GFL's CDM initiative

involves the thermal destruction of HFC 23. With the CDM certification,

GFL will be able to sell its carbon emission reductions (CERs,

popularly referred to as carbon credits; one CER is the reduction

of a tonne of co2) to companies in developed economies that can

offset it against the greenhouse gases they produce (the Kyoto

Protocol places a legally binding cap on such emissions by industries

in developed countries). GFL will likely generate three million

CERs a year, and the number could increase as the company scales

up production of HCFC 22. The CDM initiative, according to Deepak

Asher, Vice President (Corporate Finance), GFL, will "add

a new healthy revenue stream".

There are differing estimates on the value

of a CER. The National Commission on Energy Policy in the us recommends

a ceiling price of $7 (Rs 308), while the high-profile McCain-Lieberman

bill in the us Senate (it missed being passed narrowly) mentioned

the band $6-17 (Rs 264-748). Estimates suggest that, were the

US to sign the Kyoto Protocol, the cost for American firms by

2010 would be $51 (Rs 2,244). And as previously mentioned in this

article, the trade in CERs is expected to grow into a euro 10

billion a year industry by 2008.

If the trend catches on, the fluctuating

price of a carbon credit may soon compete with that of commodities

such as gold and cotton for the attention of speculators.

-Roshni Jayakar

BUSINESS

ON THE EDGE

Corporate

Colours

A Mumbai gen-nexter launches a unique décor

initiative.

|

| BP Ergo's Piramal: Now what does the

colour of this workspace signify? |

If

Aparna Piramal has her way, the term corporate colours would soon

have an entirely different (and a far more significant) meaning.

In December 2002, the 29-year-old daughter of Dilip and Gita Piramal

took charge as executive director of BP Ergo, the Rs 130-crore

office furniture and interiors division of family-flagship Blow

Plast. An MBA from Harvard Business School, Piramal was convinced

that the workplace was a strategic tool for organisational change

and that the colours used in it had an impact on employees' moods

and motivation levels. She embarked on a journey to find out what

colours work, and in which workplaces. Her research took her across

the country; she met architects, designers, CEOs, managers; she

also spent a lot of time with colour consultants from Freedom

Tree Design, a global firm.

Now, Piramal has come up with three themes,

and associated colours, for three types of firms. Story telling

is her theme for big brand manufacturers, television channels

and music firms; connectivity for companies that work across time

zones; and community for companies that like to position the workplace

as a home away from home. There are sub-themes and colours for

them as well: transparent material, special-effect paint and ephemeral

blues for progressive brands; blue, beige and grey, the colours

of respectability for software firms.

"It will take some time to get corporates

to use colours in ideal combinations," says Piramal who will,

over the next two months, hold workshops to explain her theory.

Still, companies such as IBM, Nilkamal Plastics and Airtel have

bought into the colour-themes, and bought furniture from BP Ergo.

As they do teach you at Harvard, if it is helping move stock it

is probably a good sales and marketing strategy.

-Roshni Jayakar

BORDERLINE

If

Only...

|

| Win-win for all: It pays to be an MP |

What

if the government were to be treated like any other employer and

MPS like employees? For starters, Finance Minister P. Chidambaram

may have re-thought his Fringe Benefits Tax (FBT). Here's why.

MPS earn Rs 30.6 lakh every year as salary and perquisites. They

paid Rs 62,854.44 as tax on this amount last year. This year,

they stand to pay far less as tax on salary (Rs 31,840). However,

under the FBT regime, their employer, that is the Government of

India, will have to pay Rs 1,73,349 as tax on perquisites (on

constituency allowance of Rs 1,20,000 a year, on 20 per cent of

their daily travel allowance of Rs 2,00,000 a year, on 10 per

cent of telephone allowance of Rs 2,00,000 a year, and so on).

Ah, to have had the pleasure of having the shoe on the other foot,

even if it is only hypothetical.

-Ashish Gupta

Oil

At $100

A what-if hypothesis.

Who is saying this?

Investment bank Goldman Sachs is. In a recent

report, it says: "Crude prices might have entered a super-spike

period that can push them up to an astronomical $105 (Rs 4,620)

a barrel."

Is this possible?

Very much, says Subir Raha, Chairman and Managing

Director, ONGC. He adds that prices came close to $100 (Rs 4,400)

a barrel during the Iranian revolution of 1979. Over the past

two years, prices have nearly doubled. Analysts warn that a large

supply dislocation from a major oil producer is all it will take

for prices to cross the $100 barrier.

What will be the macro-economic impact

of this on India?

India imports nearly 70 per cent of its crude

requirements. Last year, 2004-05, its crude import bill was around

Rs 1,25,000 crore. If the price of crude touches $105 a barrel,

this could exceed Rs 3,00,000 crore. Inflation, too, will skyrocket,

and GDP growth rates could plummet.

And the micro-economic?

Petrol at Rs 80 a litre and diesel at Rs 60

a litre. Maybe it's time to take up cycling.

-Ashish Gupta

|