|

Television

has been credited with several things, and here's one more: it

may be responsible for creating the market-segment known as tweens.

Created here is used in the loose sense of the term. Tweens existed

(as one would have expected them to) before the onset of the television

age, the period soon after World War II (the late 1940s and 1950s).

Howdy-Dowdy, the first ever television serial targeting tweens

(or children) went on air in the us in 1947 (NBC). And when television

started beaming programmes targeting tweens, marketers realised

the merits of reaching out to them. In many ways, the evolution

of tweens as a consumer category was television-led. There were

other things that contributed to it, too, in the us: the economic

boom following WW II, for one, and the baby-boom, which turned

parents into benevolent money-machines. Television

has been credited with several things, and here's one more: it

may be responsible for creating the market-segment known as tweens.

Created here is used in the loose sense of the term. Tweens existed

(as one would have expected them to) before the onset of the television

age, the period soon after World War II (the late 1940s and 1950s).

Howdy-Dowdy, the first ever television serial targeting tweens

(or children) went on air in the us in 1947 (NBC). And when television

started beaming programmes targeting tweens, marketers realised

the merits of reaching out to them. In many ways, the evolution

of tweens as a consumer category was television-led. There were

other things that contributed to it, too, in the us: the economic

boom following WW II, for one, and the baby-boom, which turned

parents into benevolent money-machines.

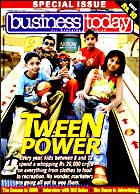

Sixty years after WW II, the same phenomenon

is being repeated in India. To be fair, the beginnings of the

tween-boom in India can be traced back to the mid-1990s. The causative

factors, however, remain the same. The emergence of niche television

channels targeting tweens (in this case Cartoon Network that went

on air in 1995), the arrival of several me-too as well as differentiated

media-offerings, an economic-boom-in-the-making, and other such.

Today typical eight-to-12-year-olds in urban India who belong

to the higher reaches of the sec (socio economic classification)

are aware of brands, conscious of their power over their parents,

and empowered to take purchase decisions (especially when it comes

to products and services they will end up using). And with cable

and satellite television penetrating the hinterland, tweens in

rural areas are pretty much the same, minus the spending power

(for now).

There are two ways to look at this phenomenon.

The first is to indulge in the sort of breast-beating that liberals

are prone to, lamenting the loss of childhood for these young

consumers. The other is to realise the inevitability of children

becoming consumers in any country that is working its way up the

economic-progression curve. The emergence of tweens as consumers

is an opportunity for everyone, for the television channels that

helped create the segment, for the companies that hope to make

money, and for parents who can help their children learn all about

consumption without becoming consumerist. That, the chance to

create balanced individuals and balanced consumers, is reason

for celebration.

Bearish Symptoms

After

9,000 it's only natural that the punters start setting new targets

for the benchmark Sensex-12,000, and 15,000 for 2006 are just

two of them. Such naked bullishness isn't unwarranted, but it

isn't as if there aren't any dark clouds hovering over Phiroze

Jeejeebhoy Tower, the headquarters of the Bombay Stock Exchange

(BSE). One particularly gloomy patch in the sky is courtesy the

rupee's decline against us dollar, which has been a major worry

for foreign institutional investors (FIIs), whose liquidity has

been largely responsible for the current bull run. The domestic

currency has plummeted by over 6 per cent from $43.48 in July

to $46.21 in December (at the time of writing). Going forward,

the growing current account as well as trade deficit, coupled

with a strengthening dollar, will put pressure on the rupee. In

fact, if the forex kitty has been swelling up, it's thanks almost

entirely to FII inflows, rather than foreign direct investments.

Experts point out that with the economy growing at over 8 per

cent, the current account deficit, which stood at $6.2 billion

(Rs 27,900 crore) in the April-June quarter can only balloon in

the days to come.

A falling rupee will naturally bring down

the returns of FIIs investing in Indian market. Amongst the BRIC

countries, Russia, Brazil and China are running current account

surpluses. Similarly, South Korea and Taiwan have current account

surpluses, indicating a healthy currency situation going forward.

Yet another factor that is turning the tide

against India is the measured hike in the US Fed rate from a decade-low

1 per cent to 4 per cent. With rates expected to go up to 4.5

per cent or a maximum 5 per cent, short-term speculative FII dollar

inflows have received a jolt. The Fed rate hikes are boosting

the dollar, as more Asian economies begin chasing the us treasury

for higher returns.

According to Sebi statistics, there is hardly

any growth in the FII inflows in 2005 as compared to 2004. The

FIIs made net purchases of Rs 38,965 crore in 2004 while the net

purchases so far have touched Rs 38,964 crore (till December 11).

In the same period, the Sensex has jumped by over 35 per cent

to 9,133.67 points.

What's more, globally interest rates are

moving up which is also signaling a revival in the debt market;

this results in significant shifts in asset allocation. In the

meanwhile, India Inc is in expenditure mode, which could bring

down the return on equity and the return on capital employed.

The rising interest rates both domestically and globally will

also put pressure on the margins. In fact, South Korea, Indonesia,

Thailand and Singapore have seen upward movements in interest

rates. Are the FIIs watching?

The Renaming Bug

|

| Bangalore-bound: Or

Bangalore Unbound? |

There's

much consternation, in some quarters, over Karnataka Chief Minister

Dharam Singh's recent announcement that Bangalore would soon take

on its original name, Bengaluru. Some of the protests have emanated

from individuals worried about the impending obsolescence of the

neologism Bangalored, a term they have apparently just learnt

to use in sentences. Others are worried that India's #1 destination

for it companies will lose some of its luster. Fact is, in democratic

India, name-changes are a way of life. Some never catch on; New

Delhi's attempts to get people to say Rajiv Chowk instead of Connaught

Circus or Connaught Place have flopped, just as Chennai's attempts

to get them to say Uttamar Gandhi Salai instead of Nungambakkan

High Road. Others have fared better. Bombay is now Mumbai, Madras,

Chennai, and Calcutta, Kolkata. All are changes that evoked a

considerable amount of ire, and provoked the usage of reams of

newsprint, just as the Bangalore-Bengaluru thing will. Yet, apart

from the fact that the change in name has, in each case, been

surprisingly accompanied by a fall in the quality of urban infrastructure,

nothing much has changed. Mumbai remains India's commercial capital;

Kolkata would like to think it remains its cultural one; and Chennai

remains, well, Madras. If the Chief Minister of Karnataka wants

to change the name of the state's capital, it is within his rights

to want to do so. And if the Chief Minister of Karnataka wants

to change Bangalore's name then, it is a move that should be applauded.

This, after all, may well be the first thing the man has done

for the city since he took over the reins of the administration

in mid-2004. The importance of this decision also explains why

Singh may have hitherto neglected Bangalore (the name-change must

have been weighing on his mind). Now that he has got that toughie

out of the way, maybe he will get on to the easier tasks at hand

that concern such trivialities as power, water, pot-hole free

roads, over passes, better traffic management and the like. Bravo,

Mr Singh. It takes a brave man to opt for complete change.

|

T

T