|

What: Infrastructure sharing between telcos

Really?: Yes, although the deal, presumably brokered

by Union IT and Communications Minister Dayanidhi Maran (left),

will only apply to new cell sites (for which the operators will

pool in money). There is a proposal to share existing sites, but

the modalities of this are yet to be worked out

When: Immediately,

and the minister believes a difference in the quality of service

will be seen in the next four to five weeks

Benefits: A 50-per cent reduction in incremental costs

for cellular operators, according to the Cellular Operators Association

of India, and a clear skyline in the metros (Maran is especially

proud of this)

-Shaleen Agrawal

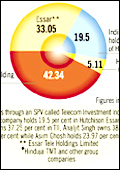

Rainbow Pie

What:

The shareholding pattern of Hutchison Essar, the company that

is slated to go public in a couple of months What:

The shareholding pattern of Hutchison Essar, the company that

is slated to go public in a couple of months

Why: Because the issue of beneficial stakes in the company

is mind-boggling

The facts: Hutchison Telecommunications International

Limited (HTIL)'s beneficial stake in the company itself is 49.60

per cent. Egyptian telco Orascom's 19.3 per cent stake in HTIL

gives it a beneficial 9.57 per cent stake in Hutchison Essar.

Analjit Singh's 38.78 per cent stake in Telecom Investment India

(TII) gives him a beneficial 7.56 per cent stake in Hutchison

Essar. And Asim Ghosh's 23.97 per cent stake in TII, gives him

a beneficial 4.67 per cent stake in Hutchison Essar. Phew!

Problem: Essar has written to the government calling

for clarity on the rules concerning indirect holding structures;

the group isn't exactly happy about Orascom's beneficial stake

in Hutchison Essar

Insight: Multi-tiered holding structures were common

in the telecom industry when the ceiling on foreign direct investment

was 49 per cent. That number is now 74 per cent. The Hutch Essar

imbroglio, then, belongs to an earlier era

--Krishna Gopalan

Citizen Kumaraswamy

|

| CM Kumaraswamy:

Making news |

Ie's media-savvy

and before he jumped into the world of politics, he was a successful

producer and distributor of Kannada movies, with two blockbusters

to his credit. It shouldn't come as a surprise to anyone, then,

that Karnataka Chief Minister H.D. Kumaraswamy is all set to launch

a Kannada news and entertainment channel, albeit, through his

wife Anitha, who is tipped to be the channel's MD. Today, the

Kannada television market is dominated by Kalanidhi Maran's Sun

Network (through several channels such as Udaya, Ushe and Udaya

News), and Ramoji Rao's ETV network (ETV Kannada). That, says

an aide of the CM, is reason enough to launch a channel. "Why

should the Kannada TV market be dominated by Tamil (Sun is headquartered

in Chennai) and Telugu (ETV is headquartered in Hyderabad) people?"

Then, perhaps realising that this sounds a bit jingoistic, he

adds, "Kumaraswamy wants to be long-term player on the state's

political scene and feels that owning a channel helps."

-Venkatesha Babu

P-WATCH

A bird's eye view of what's hot and what's

not on the government's policy radar.

| IN

A NUTSHELL |

|

» New

scheme will be introduced in April

» Help

India reach $150 billion in exports by 2009

» TPS

incentivised incremental exports; new scheme to focus on

FOB (free on board) value

» Focus

on products with high employment generation potential in

rural and semi-urban areas

» To

target new markets and countries

|

NEW INCENTIVE SCHEME FOR EXPORTERS

The government is putting the finishing touches to yet another

incentive scheme for exporters. On the chopping block: the Target

Plus Scheme (TPS), which was introduced in 2004. On the anvil:

incentives for exporting some products to the world at large or

all products to some "key" countries. The TPS scheme, which benefited

barely 1,000 exporters, was reportedly being misused. The cost

to the exchequer is likely to be Rs 8,000 crore, though official

estimates put the total value of credits till date at a modest

Rs 3,000 crore. Moreover, it was not compliant with World Trade

Organization rules. "The scheme is expected to benefit many more

exporters than TPS," says Ajay Sahai, Director General, Federation

of Indian Export Organisations. The new policy will help the Indian

export community break into new territories such as Africa, Latin

America and the CIS countries, and help the country achieve the

export target of $150 billion (Rs 6,75,000 crore) by 2009.

-Shalini S. Dagar

NEW GUIDELINES FOR COMMODITIES TRADING

The forward markets commission (FMC) is planning to bring out

a common platform for trading by drawing up uniform contracts

for commodities trading in the country. Similar norms prevail

on the Bombay Stock Exchange and the National Stock Exchange.

FMC is also planning to standardise contract specifications for

commodities and will soon announce common delivery centres for

all commodities. Once this policy is implemented, it will phase

out illiquid commodities from the exchanges and ensure that contracts

for the same commodity have the same expiry dates across exchanges.

The logic behind these moves: price discovery will become more

efficient, the market will gain depth, trading volumes will rise

and arbitrage opportunities will increase. A final decision on

when these new features will be introduced will be taken in due

course.

-Mahesh Nayak

CECA WITH SINGAPORE AMENDED TO SIMPLIFY PROCEDURES

The comprehensive economic cooperation agreement (CECA) between

India and Singapore, which came into effect on August 1, 2005,

is being amended to further reduce transaction costs, simplify

procedures and encourage a deeper integration between the financial

systems of the two countries. The new CECA will lay special thrust

on the tourism, information technology, telecom, audio-visual

products, health, education, transport, construction, financial

services, legal, architectural and engineering services, and environmental

services sectors. The amendments are expected to be ready by the

end of this month.

-Ritwik Mukherjee

|

| Oil Minister

Deora: Just sort it out |

DEARER LPG SOON

Petroleum minister Murli Deora says public sector oil retailers

IBP, BPCL and HPCL will go bankrupt in two months, two years and

three years, respectively, if the oil subsidy issue is not sorted

out. The Rangarajan Committee has recommended raising LPG prices

by Rs 75, petrol prices by Rs 1.21 per litre and diesel prices

by Rs 1.96 per litre. A final decision is expected to be taken

only after the elections in five states in May.

-Shalini S. Dagar

7 MORE NAVRATNAS

Seven more PSUs-power finance Corp., Rural Electrification Corp.,

PowerGrid Corp., National Hydroelectric Power Corp., Bharat Sanchar

Nigam, National Aluminum Co. and Hindustan Aeronautics-are likely

to be granted navratna status soon. This will give them more operational

autonomy and make them "board-managed companies". They will also

be allowed to raise funds from domestic and international debt

markets, subject to approval from the appropriate authorities.

How 16 companies can still be called navratnas has not been explained.

-Ritwik Mukherjee

|

What:

The shareholding pattern of Hutchison Essar, the company that

is slated to go public in a couple of months

What:

The shareholding pattern of Hutchison Essar, the company that

is slated to go public in a couple of months