|

| Ringing out? Hutchison's

Li |

|

| Acting tough: Essar's Shashi

Ruia |

After

countless rounds of sparring with the Ruias of Essar, his partner

in a cellular telephony joint venture in India, Hong Kong billionaire

Li Ka-Shing, Chairman of Hutchison Whampoa, decides enough is

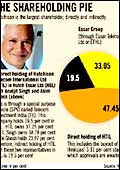

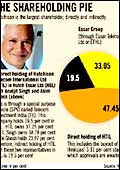

enough. Despite holding almost 67 per cent in his Indian JV Hutchison

Essar Ltd (hel, 47.45 per cent of it directly), which contributes

all of 42 per cent to his global telecom operations, he realises

that he cannot see eye to eye with the Ruias. The head of the

HK conglomerate has few options to fall back on. The best choice:

Cut his losses (just figuratively; HEL boasts one of the highest

gross margins amongst Indian cellular companies), and exit the

Indian JV when the going isn't that bad (it's steadily getting

worse). The Ruias, who were distinctly minority partners with

33 per cent before Li's exit move, are cock-a-hoop as they are

now finally in the driving seat of India's fourth-largest mobile

telephony play.

It's an unlikely scenario, but the way the

relationship between Essar and Hutchison, the two partners of

the cellular JV, has been steadily deteriorating, you can't but

help get the feeling that this is one end game one of the sides

is angling for. After all, there have been instances of global

telecom giants like Telstra, AT&T, Telekom Malaysia and Vodafone

packing up one fine day and leaving (Vodafone and Telekom Malaysia

came back, but that's another story). The circumstances of the

Essar-Hutch acrimony are of course unique, but they might well

have their origins in the tremendous growth opportunities on offer

for the telecom sector, and the resultant astronomical valuations

such plays are commanding. For instance, Idea Cellular, the JV

between the Tatas and the Birlas, witnessed considerable mud-slinging

too, and the matter was eventually sorted out with one partner

buying out the other (the Tatas exited Idea).

Is the Hutch-Essar partnership headed down

the same road? To be sure, over the past several months, the path

has been getting rockier by the day, and last fortnight, the JV

hit rock bottom when the partners went to court to decide the

fate of one circle, the lucrative Mumbai one, which was to be

merged into HEL. However, the Ruias, via their telecom holding

company Essar Teleholdings Ltd (ETHL), fired off a termination

notice to Hutch, calling off the transaction, because the HK ally

wasn't able to get the necessary approval from the Department

of Telecommunications (dot) by July 31, the set deadline.

| HICCUPS IN THE HUTCHISON ESSAR RELATIONSHIP |

2004

Essar Teleholdings Ltd (ETHL) acquires a 9.9 per cent stake

in BPL Mobile Communications from France Telecom. The deal

was done when Essar was a significant shareholder in Hutchison

Essar (HEL)

2005

Essar Spacetel, another Essar Group company, applies for

licences in seven new circles-Orissa, Madhya Pradesh, Assam,

North-East, Bihar, J&K and Himachal Pradesh. This was

again done when Essar was a part of HEL. Interestingly,

the licences were sold to HEL along with the four circles

owned by BPL Communications

2006

Essar writes to the Department of Telecommunications (DoT)

seeking clarity on indirect holdings. This was after Orascom

acquired a 19.3 per cent stake in Hutchison Telecommunications

International Ltd (HTIL), giving it an indirect holding

in HEL

2006

The Hindujas decide to exit their 5.11 per cent holding

in HEL. Both Hutch and Essar pitch for it. Hutch eventually

buys the stake for $450 million (Rs 2,115-crore)

|

It's difficult to give the Hutchison Essar

combine a big chance of working together in harmony again. The

first time the two partners got together was around 1999 when

they joined hands in the Delhi circle. Other circles like Kolkata

and Gujarat followed swiftly. Essar, too, had its own operations

in circles such as Haryana and Rajasthan and the grand plan was

to merge all the circles at some point in time to form a large

telecom entity. Following several rounds of reworking shareholding

structures, by early 2006, the combine was down to three partners-Hutchison

Telecommunications International Ltd (HTIL), the HK telecom arm

of Li, ETHL and the Hindujas (who had a stake by virtue of their

presence in the Gujarat circle where Hutchison Essar was operating).

However, last fortnight's courtroom drama

wasn't the first sign of discord between the two partners. The

Ruias, it would seem, have their telecom game plan clearly charted

out, which may or may not have to synergise seamlessly with the

JV with Hutchison. For instance, in 2004, group company Essar

Teleholdings acquired just under 10 per cent in BPL Mobile Communications,

which ran the Mumbai circle, and which was then being operated

by Rajeev Chandrasekhar. This was at a time when Essar was a partner

with a 26.99 per cent shareholding in HEL. (Chandrasekhar later

agreed to sell his operations in Mumbai, Maharashtra, Tamil Nadu

and Kerala to ETHL, which in turn sold these operations to HEL,

the JV with Hutch. Maharashtra, Tamil Nadu and Kerala were run

by a company called BPL Mobile Cellular, whose merger with HEL

has been completed. It's the BPL Mobile Communications' deal,

for the Mumbai circle, which is still hanging fire.) Similarly,

a few months later, Essar Spacetel, another group company, applied

for licences in seven new circles (which were eventually sold

to HEL).

You could argue that such transactions were

driven by sheer commerce and hence the Ruias were perfectly justified

in doing them. But that the two partners were clearly not in sync

came out in the open early this year when Essar wrote to dot,

seeking clarity on Hutch's indirect holdings in the JV. This came

after Orascom acquired a 19.3 per cent stake in HTIL. Since Orascom

also had operations in Pakistan and Bangladesh, the bogey of a

security threat was duly raised. The issue got murkier when it

came under government scrutiny, which was the result of the National

Security Advisor writing to the government stating that Orascom's

indirect presence was a threat to national security. It is gathered

that Hutch was not aware of the letter sent to dot, which only

added to the intrigue. If there was an issue between the promoters,

why did they not settle it between themselves instead of going

to dot? According to a senior telecom industry official, a development

like this can only send the wrong signals. "An issue going

directly to the regulator or dot is not really the right way for

two partners to settle their differences," he states. And

finally, a couple of months ago, when the Hindujas felt the time

was right to sell their 5.11 per cent holding in HEL, there was

a scramble between the two partners to grab that stake. Hutch

came up trumps, with a $450-million (Rs 2,115-crore) offer, and

the buyout helped it bolster its position as the single-largest

shareholder in HEL.

Did

that leave a bitter taste in the mouth of the Ruias, who then

waited till the July 31 deadline to get back at Hutch (the Ruias

were unavailable for comment)? Interestingly, the petitioner in

the court last fortnight was the JV itself, and the respondent

BPL Communications, but the battle clearly is between Essar (the

current owner) and Hutch (the would-be majority owner). Hutch

says it has paid Essar Rs 1,617 crore for the deal, and hence

the transaction should be culminated, but the Ruias insist on

an approval from dot for this intra-circle acquisition. The Hutch

counter is that it has applied for the approval, and the termination

notice may, in fact, delay the go-ahead. Essar doesn't think too

much of the fact that the JV has paid its telecom holding company

Rs 1,617 crore, and is willing to refund the money. But Hutch

obviously doesn't want to take the money back, as it has already

paid 97.5 per cent of the total money due, and is keen that the

transaction goes through. Did

that leave a bitter taste in the mouth of the Ruias, who then

waited till the July 31 deadline to get back at Hutch (the Ruias

were unavailable for comment)? Interestingly, the petitioner in

the court last fortnight was the JV itself, and the respondent

BPL Communications, but the battle clearly is between Essar (the

current owner) and Hutch (the would-be majority owner). Hutch

says it has paid Essar Rs 1,617 crore for the deal, and hence

the transaction should be culminated, but the Ruias insist on

an approval from dot for this intra-circle acquisition. The Hutch

counter is that it has applied for the approval, and the termination

notice may, in fact, delay the go-ahead. Essar doesn't think too

much of the fact that the JV has paid its telecom holding company

Rs 1,617 crore, and is willing to refund the money. But Hutch

obviously doesn't want to take the money back, as it has already

paid 97.5 per cent of the total money due, and is keen that the

transaction goes through.

Now, with the BPL

Mobile Communications case in court, it is anybody's guess how

the relationship between the two partners will pan out. Regardless

of the outcome, the question is whether the two partners can work

together again. Sources familiar with the development point out

that it is crucial for Hutchison Essar to put an end to the dispute

at the earliest. "If they are keen on deriving value from

the BPL Mobile brand and enhance the value of the Hutch brand

in Mumbai, that seems like the only way to go about it. In the

legal context, it is really a question of not just getting the

approvals from the dot, but more about when it will come through,"

they add.

| WHO COULD BUY BPL MOBILE? |

|

|

| Waiting in the wings:

Ambani (left) and Birla |

If the deal between Essar and

hutch for the sale of BPL Mobile Communications does not go

through, Essar will have to end up looking for a buyer. For

starters, Mumbai is an extremely lucrative circle with a healthy

average revenue per user (ARPU). BPL Mobile, at the end of

June 2006, had over 1.29 million users. The question is who

would be the interested parties?

Some obvious names come to mind immediately. There is

Sunil Mittal's Bharti Airtel, which already has a presence

in Mumbai. One option for Mittal could be to acquire BPL

Mobile and then merge it with Bharti, which is exactly what

Hutchison Essar intended to do. The other candidate is the

Aditya Birla-owned Idea Cellular, which, post the buyout

of the Tatas' stake, controls over 98 per cent of Idea Cellular.

Idea does not have a presence in Mumbai and has put an application

to provide services in the circle in addition to 11 other

circles. Besides, the group is very keen on telecom as a

business.

Anil Ambani's Reliance Communications appears to be a

logical candidate since the company has already filed an

application to provide GSM services in Mumbai and Delhi.

Ambani already operates CDMA services and the BPL Mobile

operation could complement his existing operation. Another

name doing the rounds is that of Malaysian operator, Maxis,

which some time ago acquired a 74 per cent stake in the

C. Sivasankaran-promoted Aircel that gave it a presence

in Chennai and Tamil Nadu. Maxis is looking to expand its

footprint and Mumbai will be a useful operation to have.

Though there is no confirmation, it is learnt that Russian

operator Sistema and Luxembourg-based Millicom could be

the other suitors. These names are not surprising since

they have always been keen on India as a market.

|

From Li's and Hutch's Indian operations head

Asim Ghosh's point of view, there would be no ambiguity on how

important the Indian operation is. The numbers tell the story:

Of HTIL's total turnover of HK$ 24 billion (Rs 13,440 crore then)

for 2005, India accounted for hk$10 billion (Rs 5,600 crore then).

For the same period, EBITDA (earnings before interest, taxes,

depreciation and amortisation) margins for HEL were at a very

healthy 47.1 per cent. Apart from India, HTIL provides cellular

services in Indonesia, Vietnam, HK, Israel and Thailand. At the

end of June 2006, HEL has a total subscriber base of 17.54 million.

Given that the subscriber base is on the growth path and given

HEL's massive presence in 16 out of a possible 23 circles, India

provides a huge opportunity for HTIL. Besides, with most of the

regulatory overhang out of the way, HTIL can increase its stake

to 74 per cent from the current level of 62 per cent-it will be

67 per cent once the deal with the Hindujas is concluded.

For the Essar Group, telecom looks like a

convincing story and the group, after its initial teething problems

with the sector, is sitting pretty with a 33 per cent holding

in HEL. If the partners resolve the current stalemate amicably

and if BPL Mobile Communications can merge itself with HEL-this

will be the first intra-circle merger if it goes through-the value

of HEL will only go northwards. Based on the Hinduja deal of $450

million for 5.11 per cent, HEL would be worth a cool $8.8 billion

(Rs 41,360 crore). However, it may be interesting to arrive at

a valuation for bpl Mobile's Mumbai circle. Would it be today

more than the Rs 1,600 crore-odd Hutchison has deposited with

ETHL? If so, Essar may see a great opportunity to sell the Mumbai

circle to another operator. And there will be no dearth of interest

(see Who Could Buy BPL Mobile?). The big question, though, is

that if matters do at all come to such a pass, would it be possible

for the two partners to work together ever again?

|

Did

that leave a bitter taste in the mouth of the Ruias, who then

waited till the July 31 deadline to get back at Hutch (the Ruias

were unavailable for comment)? Interestingly, the petitioner in

the court last fortnight was the JV itself, and the respondent

BPL Communications, but the battle clearly is between Essar (the

current owner) and Hutch (the would-be majority owner). Hutch

says it has paid Essar Rs 1,617 crore for the deal, and hence

the transaction should be culminated, but the Ruias insist on

an approval from dot for this intra-circle acquisition. The Hutch

counter is that it has applied for the approval, and the termination

notice may, in fact, delay the go-ahead. Essar doesn't think too

much of the fact that the JV has paid its telecom holding company

Rs 1,617 crore, and is willing to refund the money. But Hutch

obviously doesn't want to take the money back, as it has already

paid 97.5 per cent of the total money due, and is keen that the

transaction goes through.

Did

that leave a bitter taste in the mouth of the Ruias, who then

waited till the July 31 deadline to get back at Hutch (the Ruias

were unavailable for comment)? Interestingly, the petitioner in

the court last fortnight was the JV itself, and the respondent

BPL Communications, but the battle clearly is between Essar (the

current owner) and Hutch (the would-be majority owner). Hutch

says it has paid Essar Rs 1,617 crore for the deal, and hence

the transaction should be culminated, but the Ruias insist on

an approval from dot for this intra-circle acquisition. The Hutch

counter is that it has applied for the approval, and the termination

notice may, in fact, delay the go-ahead. Essar doesn't think too

much of the fact that the JV has paid its telecom holding company

Rs 1,617 crore, and is willing to refund the money. But Hutch

obviously doesn't want to take the money back, as it has already

paid 97.5 per cent of the total money due, and is keen that the

transaction goes through.