|

Roving

arc-lights, a mock up of the Golden Gate Bridge and dark-suited

security men whispering into their two-way microphones. The visit

of AOL's Chief Operating Officer Ron Grant to India a couple of

weeks ago to launch the company's country-specific portal was

meant to be a high-decibel event. For good reason. AOL, which

has had a call centre in Whitefield, Bangalore, for about five

years now, is a lot late to the Indian internet market compared

to its global rivals such as Yahoo!, msn (of Microsoft) and Google.

That's a pity because, as part of the $44-billion media behemoth

AOL Time Warner, AOL is the only media conglomerate of the four.

"We're very excited about our launch in India and believe

this market can be a key growth driver for us globally,"

says Grant.

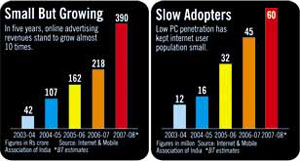

Wait a second. What are we talking about

here? The future of global internet giants riding as much on India

as on the us and China? That's a joke isn't it, considering that

everyone knows India has less than 50 million internet users,

just a little over 2 million broadband connections and a minuscule

online advertising market worth Rs 240 crore? "It is definitely

not the current market base or size that is enticing any player

worth his salt to come here," admits Jaspreet Bindra, MD,

msn India. "Everybody wants to get in hoping that they can

play a seminal role in influencing the shape of the market."

Adds Sandeep Singhal, Managing Director, Sequoia India, the most

active venture capital (VC) firm in the Indian internet space:

"These numbers are eerily similar to those of the us a decade

ago. In 1997, in the US online ad spend was just around $65 million.

Today, it is probably more than $10 billion. I see a repeat of

that kind of growth happening in the Indian market."

|

"If somebody

announces unlimited mail storage, others will offer it too"

George Zacharias

Managing Director/ Yahoo! India |

Well, folks, in case you haven't noticed,

the internet is back. In calendar 2006, according to Venture Intelligence,

27 dotcoms got funded compared to just two the year before. The

VC investment also shot up from $17 million to $166 million, and

in the first four months of this year, while fewer dotcoms have

been funded-four versus eight in the same period last year-the

average investment is higher at $5.25 million compared to $4.75

million. In some sense, then, this is Indian internet's second

coming. And this time around, there's a fundamental difference.

Earlier, VCs said 'show me the business plan', but now they are

saying 'show me the money'. Says R. Ramraj, former co-founder

CEO of Sify: "You will be laughed out if you try to raise

money based on just an idea. You need to have a concrete business

plan and indicate how exactly you are going to make money."

|

"India

is a top growth driver for AOL and the growth of the online

ad market is a positive sign"

Manish Dhir

Executive VP/

AOL India |

From the overall internet environment, too,

things seem far more propitious and real. The market, for one,

is growing at close to 100 per cent year on year, and over the

next three years or so, the user base is expected to touch 100

million, with over 10 million broadband connections. The bandwidth

costs are falling by half every 18 months and those of storage

costs, every 12 months. it and Telecommunications Minister Dayanidhi

Maran is talking of cheap (perhaps, free) broadband, besides setting

up 100,000 cyber cafes in India's hinterland to bridge the current

digital divide. Some others are talking of low-cost PCs for kids,

while yet others are working on applications that don't require

users to be literate. Says Rajan Mehra, Country Manager, eBay

India: "Around 12,800 people in India use eBay as their primary

source of revenue and there is a growing number of such sellers,

specifically from the smaller towns. Going ahead, we see more

opportunities in the non-metros." Meanwhile, thanks to the

mobile revolution, millions of Indians are getting onto the wireless

bandwagon, giving marketers an alternative, but merging, technology

with which to tap them.

The biggest reason of all, and which is driving

old media towards the internet (see Attack of the Old Media, page

62), is that advertisers are getting serious about online advertising.

Says Tushar Vyas, National Director (Interaction), Group M: "Many

clients are talking about spending 8-10 per cent of their total

ad spends on online advertising." Such clients, Vyas says,

include marketers of mobile handsets, computers & peripherals,

travel & tourism, and banking and financial services. One

should add car-makers as well. Maruti Udyog, for instance, has

used the internet aggressively ever since it launched its B-segment

car Swift, and now it plans to launch a massive internet campaign

to promote its newly-launched sedan, the SX4, which already has

a micro-site (www.marutisx4.com). Says Mayank Pareek, General

Manager (Marketing), Maruti Udyog: "Online, you know your

customers better, they visit the site because they proactively

click a link after seeing an advert in some of the larger web-portals.

On TV, you hope that your target customer sees the advert, but

online you know that they have, and we can even target them better."

More importantly, a buck goes farther online than in any other

medium in India today. More about that later.

|

WIRELESS SWEET SPOT

In India, internet companies have to

crack the mobile market.

|

|

All

the major players on the internet are eyeing the mobile

space. If you are wondering why, the answer is simple. India

has an installed base of around 20 million PCs that is growing

by 5 million every year. In contrast, India's mobile phone

user base has crossed 170 million, with 6 million new connections

getting added every month. Jaspreet Bindra of MSN India

says that "the intersection between mobile and PC is

the Holy Grail. World over nobody has been able to completely

crack it". In India, it is even more of a challenge

because mobile operators control the entry point for value-added

services, and retain chunk of the revenues from such services.

Says the head of another portal who did not wish to be identified:

"Given the growth happening in voice, the operators

are not too focussed on value-added data services. But once

the ARPUs (average revenue per user) start declining, things

will improve."

Meanwhile, the internet companies are

taking baby steps towards mobile. AOL has engineered an

e-mail application specifically for mobiles, Google has

tied up with several mobile telecom firms for mobile search

(and is reportedly considering offering its other services

such as Google Talk, Maps and AdWords), while Yahoo has

launched a complete package for GPRS-enabled handsets called

Mobile Internet, which allows users to access its entire

suite of applications on their smart phones. Local players

such as travel portal Makemytrip.com and IRCTC have also

tailored applications for the cell phone, while many industry

watchers see hybrid companies such as JiGrahak that combine

the internet and mobile phone as the next big wave in India.

Others like Monster already offer SMS job alerts and may

soon allow users to upload resumes via mobile phones.

Sure, there are just two million smart

phones in India, and even fewer net-enabled, but that's

not a big hurdle. If consumers find enough value in buying

higher-end handsets, they will.

-Venkatesha Babu

|

|

"We see

ourselves as the only real portal from India and benchmark

ourselves with global competition"

Ajit Balakrishnan

CEO/ Rediff.com |

The Portals Hot up

Typically, a portal is the first stop for

an internet user. According to some data, of the 40 minutes that

the internet user in India spends online, 23 minutes are spent

on portals, including e-mails. The advertising revenues for the

internet portals come from three sources: Classifieds, display,

and search. Most of the revenue from classifieds goes to domain-specific

verticals such as travel, jobs, matrimony or real estate (see

Vertical Limit, page 66), and what the general portals (Yahoo!,

msn, Rediff, Sify or AOL) get are money from display and search

ads. As can be expected, there is fierce competition for this

ad spend. Google, Yahoo!, msn and AOL joust not just with each

other, but also home-grown rivals Rediff and Sify. Each player,

therefore, is drawing up its own strategy to get a leg-up in the

online marketplace. Things like e-mail, instant messenger, and

search are all passé. These are considered hygiene factors.

Says George Zacharias, Managing Director, Yahoo! India: "If

somebody announces unlimited mail storage, others will offer it

too." So, each of them is plotting its own moves to attract

eyeballs, as well as improve stickiness. The goal: make their

own portal the entry point for your experience on the world wide

web.

AOL, for instance, offers unlimited e-mail

storage, but more importantly, has started a dedicated Bollywood

channel, CityGuide, an education portal and offers videos of top

global music hits to improve its stickiness. "The Indian

market is in its infancy as yet and we don't think internet users

have built up strong brand loyalty to any specific portals yet,"

reckons Manish Dhir, Executive vp and Country Head, India, AOL,

who was responsible for setting up the portal's India operations.

AOL is the first portal globally to have the head of its international

operations in Bangalore. "India is among the top two or three

growth drivers for AOL globally and the growth of the online ad

market and the broader markets are positive signs for us,"

says Dhir.

The person entrusted with the portal's India

operations P.G. Ponappa, Vice President and General Manager, AOL

India, sees the burgeoning online ad market as an immediate target.

"Today, less than 2 per cent of the ad spend is online, but

even if that goes to 4 per cent, that's a significant opportunity

for companies like us," he explains. Zacharias of Yahoo!

points out that in developed markets online ad spends tend to

be around 15 per cent of the total ad spend, and that it is 4-5

per cent even in China. "The moment we have 10 million broadband

connections and at least 5-10 per cent of the ad spend coming

online, we are talking serious numbers here," says Zacharias.

It isn't as far fetched as it sounds. Next year, the online jobs

(classifieds) market will become larger than its print counterpart

with revenues of $120 million.

|

THE MSN-YAHOO! DEAL

The deal makes sense for both as they

can take on Google together.

|

|

For

more than a year now, there have been rumours of software

giant Microsoft making a bid for Yahoo!. Over the last few

weeks, the rumours have gained ground, and many expect Microsoft

to make a $50-billion bid for Yahoo!. The deal makes sense.

Both have a common enemy: Google, which started as a small

search engine but has grown into a monstrously ambitious

company that now wants to shake the foundations of Microsoft's

lucrative office suite applications by offering competing

but free open-source applications. Google, of course, is

also the net's most valuable at $145 billion (as on May

11, 2007). With Yahoo! in its bag, Microsoft would get access

to the former's much-touted search engine ad ranking platform

codenamed Project Panama, and thus challenge Google's stronghold

in the search-related advertising market. The hope in Redmond

must be that such a move will distract Google enough to

make it stay away from Microsoft's core business of software. For

more than a year now, there have been rumours of software

giant Microsoft making a bid for Yahoo!. Over the last few

weeks, the rumours have gained ground, and many expect Microsoft

to make a $50-billion bid for Yahoo!. The deal makes sense.

Both have a common enemy: Google, which started as a small

search engine but has grown into a monstrously ambitious

company that now wants to shake the foundations of Microsoft's

lucrative office suite applications by offering competing

but free open-source applications. Google, of course, is

also the net's most valuable at $145 billion (as on May

11, 2007). With Yahoo! in its bag, Microsoft would get access

to the former's much-touted search engine ad ranking platform

codenamed Project Panama, and thus challenge Google's stronghold

in the search-related advertising market. The hope in Redmond

must be that such a move will distract Google enough to

make it stay away from Microsoft's core business of software.

-VB

|

| |

INDIA INTERNET LAB

Internet's cool apps, made in

India. |

|

| Global Team: Amazon has three

software centres in India that are part of global teams |

Internet giants are leveraging

India's software skills to come up with innovative and sticky

offerings for global markets. Want proof? Here you go: Yahoo!

Answers, Google's Mobile Search, Amazon A9 (a visual yellow

pages directory), MSN's Desktop TV and AOL's instant messenger…

all are examples of products and applications with a strong

India scent. Says George Zacharias, MD, Yahoo! India: "We

will leverage the talent base available here in India not

only to meet the requirements of our Indian operations but

also our global user base."

MSN India customised its desktop TV offering that runs

advertisements continuously on the home page and its partners'

pages to the needs of the Indian market. Jaspreet Bindra,

MD, MSN India, says that this feature has been used by MSN

elsewhere also. "The India centre is part of every

major development initiative at Google and we're also working

on a mobile search product for the global market from here,"

says Prasad Ram, R&D Head, Google India. Google India

engineers have also recently devised a Hindi transliteration

service for its Blogger product that could be expanded to

reach the global market. At Yahoo!, the move to relocate

Chief Product Officer Pete Deemer to the Indian R&D

centre is perhaps a sign of how serious the company is about

its local operations. Aside from Yahoo! Answers, this centre

has been designated as the centre of excellence for the

entire developing markets geography.

-Rahul Sachitanand

|

Advertisers, on their part, are coming up

with unique ways with which to create buzz or online communities

around their products. Hindustan Unilever launched a rather successful

campaign around the Sunsilkgangofgirls community portal. Procter

& Gamble has also created an online interactive community

for teen girls between 14 and 19 years of age, www.beinggirl.co.in

, around its Whisper feminine hygiene brand. In fact, Vyas of

Interaction has proof of how effective online medium is for brands:

"We have a very interesting case from Listerine where online

medium was primarily used," he says. As the brand has overarching

social proposition, the agency sought to place the message of

oral hygiene in personal interactions on Yahoo! messenger that

sought to weave in the "Listerine" lingo in everyday

conversations. It has worked, claims Vyas: "The brand sales

have gone up up three times post the communication." Validation

has come in from other ends as well-purchase intent and brand

awareness were measured in partnership with Yahoo! and Factortg

(proprietary methodology to measure online response). The readymade

online conversations, one-liners such as "boss really needs

to use Listerine", etc., were downloaded and the viral environment

saw it being propagated among a cool 300,000 users.

|

"Our

understanding of the unique requirements of the Indian marketplace

is unparalleled"

V. Sivaramakrishnan

President (Portals division), Sify |

Local Relevance

All the portals, including the newcomer AOL,

know that the key to long-term survival is in being locally relevant.

Yahoo!, for example, says that it is localising its offerings

with content in nine different Indian languages. "We have

city specific pages that serve up information relevant to your

city. We are already doing this for 20 cities across the country,"

points out Zacharias. Google, not exactly a portal but almost

the default entry into the world wide web, admits that the key

to cracking the local market lies in regional language offerings.

"Our R&D team here has already worked on a Hindi transliteration

product for our Blogger product, and we provide search in multiple

Indian languages too," says Shailesh Rao, Managing Director

(Sales & Marketing), Google India. "We don't see the

Indian market as a far-flung outpost, and given that there could

be 100 million consumers in the next three years, we expect to

make significant investments here," he adds.

Google is a classic example of how new markets

can be created within the internet space in India. Before the

world's most feared internet company came to India, there was

literally no market for search-based advertising. Google got in

here and in just 36 months created a Rs 100-crore market out of

search advertising. With its recent acquisition of DoubleClick

and its AdWords initiative, Google says the market is accelerating.

Travel portal MakeMyTrip.com already gets 15 per cent of its traffic

from internet advertising alone by leveraging programmes such

as Google's AdWords. MSN India, on the other hand, has innovated

by putting a 'desktop TV' on its homepage and those of its partners.

"Instead of the standard click-per-model, we sell airtime

on these desktop TVs, which run ads. It has become a huge hit,"

says Bindra.

|

"Everybody

wants to get in, hoping they can play a seminal role in influencing

the shape of the market"

Jaspreet Bindra

MD, MSN India |

How are the local portals, Rediff and Sify,

coping with the onslaught of internet biggies? "We see ourselves

as the only real portal from India and benchmark ourselves with

global competition," says Ajit Balakrishnan, who took an

early bet and launched Rediff.com in 1996, and today has Rs 160

crore in revenues. Sify, which also offers local content in regional

languages, says that because of its access business (it is also

an internet service provider, or ISP), it is uniquely placed to

take advantage of the growth happening in the Indian market. It

has 3,500 iWays, or branded cyber cafes, spread across 162 cities,

with 8,000 people accessing the net from these locations at any

given point in time. As an ISP, it has 10 per cent of the 2.2

million broadband connections. "As we scale up, we see significant

traction in all our businesses," says V. Sivaramakrishnan,

President (Portals division), Sify. "Our understanding of

the unique requirements of the Indian marketplace is unparalleled."

According to Subho Ray, President, Internet

and Mobile Association of India (IAMAI), the apex industry body,

the focus on regional language content is inevitable. "Fifty

per cent of the English-speaking market has already been tapped

by these companies and now they need to target the latent audience,"

he contends. This latent market includes the 100-million plus

mobile users in India, as well as a market that is offline currently,

due to connectivity issues and the lack of regional language applications

(see The Wireless Sweet Spot). "Markets such as e-commerce

and internet advertising will only take off once this happens,"

he adds.

But as the VCs and internet companies seem

to have sensed it, there's an inexorable shift happening towards

the internet. And if not tomorrow, then someday soon, the internet

will be the lingua franca of the most important consumers in a

country of more than a billion people.

-additional reporting by

Shamni Pande, Rahul Sachitanand, Kushan Mitra and Pallavi Srivastava

|

For

more than a year now, there have been rumours of software

giant Microsoft making a bid for Yahoo!. Over the last few

weeks, the rumours have gained ground, and many expect Microsoft

to make a $50-billion bid for Yahoo!. The deal makes sense.

Both have a common enemy: Google, which started as a small

search engine but has grown into a monstrously ambitious

company that now wants to shake the foundations of Microsoft's

lucrative office suite applications by offering competing

but free open-source applications. Google, of course, is

also the net's most valuable at $145 billion (as on May

11, 2007). With Yahoo! in its bag, Microsoft would get access

to the former's much-touted search engine ad ranking platform

codenamed Project Panama, and thus challenge Google's stronghold

in the search-related advertising market. The hope in Redmond

must be that such a move will distract Google enough to

make it stay away from Microsoft's core business of software.

For

more than a year now, there have been rumours of software

giant Microsoft making a bid for Yahoo!. Over the last few

weeks, the rumours have gained ground, and many expect Microsoft

to make a $50-billion bid for Yahoo!. The deal makes sense.

Both have a common enemy: Google, which started as a small

search engine but has grown into a monstrously ambitious

company that now wants to shake the foundations of Microsoft's

lucrative office suite applications by offering competing

but free open-source applications. Google, of course, is

also the net's most valuable at $145 billion (as on May

11, 2007). With Yahoo! in its bag, Microsoft would get access

to the former's much-touted search engine ad ranking platform

codenamed Project Panama, and thus challenge Google's stronghold

in the search-related advertising market. The hope in Redmond

must be that such a move will distract Google enough to

make it stay away from Microsoft's core business of software.