|

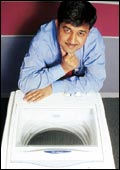

| Raj Jain, Managing Director, Whirlpool of

India: Will another brand give him volumes? |

The

financials alone cannot explain the upbeat 'got-it' tone that marks

most senior managers of the Rs 1,116-crore Whirlpool of India (WOI).

After posting its maiden profit in the country in 2000, the company's

net profit did decline nearly 54 per cent to Rs 9 crore in 2001,

even though sales rose 5 per cent.

But then, the Indian arm of the US-based white-goods

major has been a confusing picture ever since its tumultuous entry

in the mid-1990s. Remember? It pipped its transatlantic rival Electrolux

to snap up Kelvinator of India (KOI), and found itself selling Kelvinator

fridges in India, briefly, even as it struck a separate joint venture

for washing machines with TVS. Then it tried transferring Kelvinator's

'compressor' reputation to Whirlpool, before returning the 'coolest

one' to its global owner, Electrolux. That done, it was time to

exert centripetal forces to bring all its operations together-in

a single company, to market all products under a common global brand.

Since then, Whirlpool has taken just a few

years to blast into the Indian mind, and that too, under pressure.

''Our performance needs to be looked at more in the context of key

competitors bleeding bottomline or marketshare, even both,'' says

Raj Jain, Managing Director, WOI. He may well be right. Take Electrolux,

which managed to keep up its sales momentum, but by losing a huge

Rs 144 crore on sales of Rs 463 crore. Or BPL, which maintained

10 per cent net profit, but suffered such marketshare erosion that

it reportedly plans to exit fridges and washing machines altogether.

Market conditions are tough. Traditional direct

cool refrigerators saw volumes decline by nearly a tenth in 2001.

But Whirlpool upped its overall refrigerator share by two points

to 26.4 per cent-edging past Godrej GE for market leadership.

WHIRLPOOL HAS

GAINED FROM... |

»

Existing KOI operations

»

Sensitivity to Indian realities

»

Need-specific products

»

Single brand advantage

»

Homemaker bonding |

| BUT WORRY ABOUT... |

Widening the portfolio

Penetrating India deeper

Customising service

Rivals catching on

Dual brand expenses |

The washing machines market also lost volumes-some

9 per cent. But Whirlpool held steady at No 2, with a marketshare

of 17 per cent (a dip since 1999 though). Videocon, at 32 per cent,

is still the leader by far, but Whirlpool won't let it rest. That's

for sure.

In a market of undercurrents, eddies, and counter-eddies,

Whirlpool has sure got something figured out.

Centripetal Brand

When Whirlpool launched its 'Flexigerator',

with foldable shelves, in 1997, observers were more impressed by

the thoughtfulness than the sales. A year later, when Whirlpool

started addressing the upper-crust Indian 'homemaker' with its 'ice'

selling proposition for its Quick Chill refrigerators, observers

weren't sure if the brand had done its homework for India. As it

turned out, it had. The market had long moved on from compressor

and insulation talk, and the Indian consumer needed her beyond-the-box

aspirations addressed. Today, 'ice magic' is charming people in

markets as diverse as soap and shirts.

It's no surprise that Whirlpool defines its

strategic edge as consumer insight, with nearly half per cent of

sales going into consumer research. ''Our research is so rigorous

that sometimes we have a better sense of how a competitor brand

is positioned than its own marketer,'' boasts Ashok Bhasin, Vice

President (Marketing), WOI.

|

Ashok Bhasin, VP (Marketing), WOI

"Opera will go to lower strata towns, but the brand differentiator

is the consumer need-mindset" |

Well, that may sound overstated, but the firm

does have a good grasp of the domestic competitive scenario. Take

differentiation of products. In washing machines, for example, it

zeroed in on the Indian housewife's faith in the efficacy (rigour

and fibre-sensitivity) of her own hand-wash-and designed its Agitator

machine to mimic the same washing action. The overall theme: magical

empowerment.

Similar thinking could now help Whirlpool sell

several other home products, from air-conditioners (ACs) to microwave

ovens. The only trouble is that the brand's appeal remains upmarket.

By WOI's reckoning, of India's 49-million potential households,

just 4 million are run by 'discerning modernists', in psychographic

terms, while 17 million aspirants and 28 million traditionalists

make up the market's bulk. Bridging the modernist-aspirant gap could

take ages, while WOI needs quick volumes.

''It is not tenable in the long run for a single

brand,'' feels Jain, ''to straddle the entire spectrum of consumers.''

That's why the company has started experimenting

in Andhra Pradesh and Maharashtra with Opera, a local brand that

differs from Whirlpool not so much by way of price (though it's

marginally cheaper) as appeal segment. Elaborates Bhasin, ''Opera

will go to lower strata towns, but the real brand differentiator

is the consumer need-mindset.'' So while the first-time buyer of

a 170-litre direct-cool Whirlpool fridge would value quick ice-making

and electronic features, the typical Opera consumer will be more

interested in chilled water, sturdiness and seven-year warranty.

And wherever Opera is introduced, the firm will re-map its 5,500-dealer

strong distribution network to optimise the brand and retail catchment

matrix.

Interestingly, WOI's dual-brand strategy comes

at a time when Electrolux is merging its mass-market Kelvinator

and topline Electrolux brands into a single entity (the idea is

to sell on universal appeal).

Can't Whirlpool do the same? Well, perhaps.

But more-than-organic growth is the imperative. WOI needs no further

production or distribution infrastructure. It already has three

factories in Faridabad, Pondicherry, and Pune (combined installed

capacity of 4.5-million appliance units). It needs a crowd-puller.

Yet, WOI's dual-brand proposal is still under debate. Brand-building

is expensive and risky, after all. Any brand buy-out options? Possibly.

''There has to be some amount of shake-out and consolidation in

the home appliances market,'' says Jain.

Being profitable helps. Also, since 1999, WOI

has lowered its debt: equity leverage ratio from a high of 4 to

just 2. The company is busy replacing the Rs 150-crore plus high-cost

debt it had taken on in 1997-98 with low-cost domestic non-convertible

debentures, and may even borrow funds from overseas, with or without

the support of its US-based parent, which has invested $150 million

in its 82-per cent subsidiary so far.

Brand Consistency

While the dual-brand debate continues, what's

clear is that Whirlpool will not be allowed to spin away from its

core set of values. According to Benoy Roychowdhury, Vice President

(Sales), ''It's more important to be consistent than correct.''

|

Benoy Roychowdhury, Vice President (Sales),

WOI

"It's more important to be consistent than correct. It's

a cut-throat, hyper-competitive market" |

All of Whirlpool's recent launches, be it the

White Magic Hot Wash machines (first hot wash in the semi-automatic

segment) or the just-unveiled MagiCool air-conditioners, remain

loyal to the brand's central mission-of responding to the homemaker's

need, under pressure, for magical powers to feather her family nest.

''We have build the brand such that today a

housewife has an appetite for Whirlpool. All it needs is product

form,'' says Bhasin, claiming that the brand has made a dramatic

splash in the market for ACs.

And yet, WOI is aware that key competitors

are onto its game already. ''It's a cut-throat, hyper-competitive

market,'' admits Roychowdhury. Samsung and LG, in particular, are

likely to offer stiff resistance. With market growth ranging from

negligible to negative, it's a bare-boned battle for marketshare-with

one's gain the other's loss. ''This year we'll double our volumes

in washers,'' says Ravinder Zutshi, Vice President (Sales), Samsung

India, which has just commissioned its first washing machine production

line in the country. Even Electrolux is playing catch-up aggressively,

with a slew of washing machines launches aimed at closing what Anand

Bhardwaj, Executive Vice President (Marketing & Marketing Services),

Electrolux Kelvinator, calls, ''Whirlpool's three-year headstart

in washers.''

As WOI moves to consolidate itself and leverage

its brand in other markets (including cooking ranges, linen dryers

and dish-washers), it will need to shield the equation it has struck

with its modernist homemaker from rival attack. ''The issue now

is to do more of all that which brought us to leadership,'' says

Jain. By that, he refers to cost-control and bottomline management

as much as launching meaningful products and keeping the brand relevant

to the consumer. The brand interface is paramount. ''We ultimately

want to get out of all component manufacturing,'' says Jain. In

2001, the company sold its plastic manufacturing business to Brite.

Target for 2002: evaporators. ''Investments will no longer be in

manufacturing capacity, but developing new product solutions for

the consumer,'' says K.V. Chandrasekaran, Vice President & Chief

Financial Officer, WOI, making it clear that the company views itself,

primarily, as a fulfiller of human needs. Not a metal-basher.

The consumer services division, which provides

post-purchase service through 550 service providers in 140 cities

(and contributed Rs 6 crore to WOI's gross profits for 2001), has

become important to the process of customer relationship management.

The idea is to deliver on the actual promise-of homemaking partnership

that lasts long after the actual purchase. The service doesn't yet

match developed-market standards, but WOI hopes to be wowing customers

soon with customised solutions (washing machines in high-rises,

for example, need special plumbing to handle the water pressure).

The objective: life-long loyalty. It's already starting to pay back.

As B.K. Srivastava, Vice President (Consumer Services), discloses,

most of its microwave ovens are being bought by the existing Whirlpool

customer base.

That still doesn't resolve WOI's dilemma on

targeting the traditionalist consumer. Perhaps the same brand can

do the job. Perhaps it's just a matter of altering the brand's outward

get-up for the traditionalist-turned-aspirant, while retaining the

original essence of the same customer bond.

|