|

This

is the story of the nameless faces at some of India's most respected

companies that are on the growth path-faces that you wouldn't usually

encounter in business publications (and certainly not on Page 3).

But it's these unknown faces that have over the past decade done

their crucial bit in getting their organisations into shape and,

most importantly thereafter, playing a key role in transforming

a germ of an idea, or a hint of a need, into products and services

that fit consumer expectations. And it's precisely this responsiveness

to rapidly changing markets, highly-discerning consumers, and new

opportunities in the marketplace that have earned these managers

of change and growth their place in the sun. If 2002-03 was one

of the best years in a long time for Corporate India, it's thanks

largely to the efforts of these carefully nurtured and handpicked

elite.

By profiling a key manager at a particular

company that has turned around operations, consolidated, and grown,

BT is in no way implying that just one person made the difference.

Rather, the endeavour was to identify areas of change, and then

zero in on one of the many managers who would have played a vital

role in that revamp. For instance, at Tata Motors, which was smarting

from a Rs 500-crore loss three years ago, there were at least four

factors that contributed to a turnaround. BT chose to focus on the

hr front, where little is known about how General Manager (HR) V.K.Verma

transformed the Tata Motors workforce into a customer-driven, market-oriented

multitude.

BT's list includes managers right from the

DGM level to a couple of coos to one MD. But don't read too much

into it, as some companies are more conservative in doling out promotions

than others. What's more, today's DGM could well be tomorrow's CEO.

|

COMPANY: M&M

BT'S GROWTH MANAGER: PAWAN

GOENKA, Chief Operating Officer, Automobile Sector |

The Man and the Machine

Till a couple

of years ago, pride wasn't something you'd be overwhelmed with if

you owned a utility vehicle from the Mahindra & Mahindra (M&M)

stable. Then, last April, the Scorpio hit the roads. With a 110-hp

turbo-charged engine for a high-performing UV that's exquisitely-styled,

the Scorpio has done wonders not just to M&M's UV sales volumes,

marketshare and span of coverage, but also to M&M's brand image.

The man behind the machine: Pawan Goenka, who

returned to India in 1993 from General Motors to join M&M, and

who today is the Chief Operating Officer of M&M's automotive

business. The brief Vice Chairman Anand Mahindra gave him was clear-cut:

M&M needs a product that will be relevant to India five-to-six

years down the line, taking into account changing customer expectations.

WHY HIM: Transformed

M&M's image from a rural transport vehicle maker to an established

developer of products and processes with the launch of Scorpio.

WHAT TO EXPECT: Upgrades of Scorpio

platform, six-to-seven Scorpio variants and perhaps even a new

platform in four-to-five years.

MOST LIKELY SOUND-BYTE:

"The halo effect of the Scorpio is high. It

has uplifted M&M's brand image." |

Six years ago Project Scorpio took off, a year-and-a-half

later the design was frozen, and today the Scorpio accounts for

roughly 20 per cent of M&M's revenues (and almost two-thirds

of UV sales). Some 20,000 have been sold since launch, at an average

of 2,200 per month, and significantly close to three-fourths of

these buyers never thought of buying a UV until the Scorpio arrived.

M&M will soon ramp up to 3,000 per month in a bid to deal with-surprise-a

four-week waiting period that's built up.

Goenka sees scope for many more variants of

the Scorpio platform, too. For instance, the Euro III norms, which

will be effective from April 2005, will be an opportunity to build

an even more powerful engine. Does M&M need to begin work on

a new platform? Goenka says it would make sense only at volumes

of 3,000-4,000 a month, which today appear unlikely in segments

above the Scorpio. But he's the first one to realise that a new

platform will take at least four years to make, and in that time

consumer expectations could be very much different. But Goenka has

been there before. "We now have the confidence to understand

the market needs five years from now." Don't believe him? Check

out the Scorpio.

The Turnaround Touch

|

COMPANY: TATA

MOTORS

BT'S GROWTH MANAGER: V.K.

VERMA, GM, Corporate Human Resources |

Ask Praveen Kadle,

CFO, Tata Motors for the significant factors that contributed to

the wiping out of the huge Rs 500-crore blot of red from the company's

balance sheet, and without blinking he'll spell them out: "The

Indica, the turnaround in commercial vehicles, cost reductions,

and a change in mindset, which made employees customer-focused and

market driven." Whilst the Indica success and the financial

engineering at Tata Motors have been well-documented, what's not

so well known are the efforts on the hr side that contributed to

Tata Motors' turnaround. "Till we made that Rs 500-crore loss,

we always considered ourselves to be a part of an enormously successful

company. The loss dented our pride, but that also fuelled the desire

to bounce back," explains V.K. Verma, General Manager (HR),

Tata Motors.

WHY HIM: Played

a vital role in wiping out the company's Rs 500-crore loss by

smoothly separating 5,500 people via two rounds of retirement

schemes.

WHAT TO EXPECT: Move towards a

flexible workforce, with an increasing reliance on temporaries,

trainees, overtime etc.

MOST LIKELY SOUND-BYTE: "When

we went into the red, our pride was hurt. We turned around because

our people cared for the company." |

The first step for the badly-shaken monolith

was to create a performance-oriented culture. Rewards from now on

would be heavily linked to performance. Some 1,000 "high-potential"

managers were identified, and put through a programme titled "Winning

Ways of Work". Over a year-and-a-half, 40 such programmes were

conducted by the EDS in rotation, which dealt with case studies

in areas such as cost reduction, new product introduction, external

orientation, team working and Six Sigma quality.

Performance-orientation also meant getting

rid of non-perfomers. All of 800 from the managerial workforce were

"deselected" (sacked, in case you didn't get that one),

and the A-rated managers-who formed 15 per cent of the workforce-were

now getting 35 per cent of the salary increases. To put it another

way, the difference between the salary increase of the best performer

and the non-performer was nine times. Yet, one of the banes at Tata

Motors was its huge workforce, all of 38,000 people at one point

in time. This called for a substantial reduction. In two-and-a-half

years, via two rounds of retirement schemes, Verma shed 5,500 people.

Verma points out that the payback period for the vrs investment

of Rs 240 crore is less than three years.

Ask Verma how he did it, and he'll give you

a simple answer. "People cared for the company." They'll

care even more for it from now on.

|

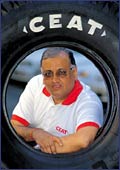

COMPANY: CEAT

BT'S GROWTH MANAGER: PARAS

K. CHOWDHARY, Managing Director |

Burning Rubber

He's the only managing

director on our list, and despite the avowed objective of steering

clear of CEOs and MDs, Paras K. Chowdhary squeezed into BT's list

of growth managers because it would be quite impossible to talk

about the turnaround at tyre maker Ceat without bringing him into

the picture. What's more he's a man who eats, drinks and breathes

tyres, having spent all of 22 years at Apollo, from where he ultimately

called it a day in 1997 as CEO. That's when Chowdhary was pitchforked

by Harsh Goenka into RPG Enterprises' it and telecom businesses.

After three years in those "new economy" activities Chowdhary

was back to what he knows best: Tyres.

When Chowdhary slipped into the hot seat in

2001 January, things didn't look too good at Ceat: Many of the company's

products had outlived their lifecycle, product innovation was unheard

of, and the big boys like Apollo, MRF and JK were turning on the

heat with aggressive strategies. The financials were in a mess,

with the interest burden as high as 10 per cent of sales at one

time, and growth as well as profits were elusive.

WHY HIM: Achieved

highest capacity utlilisation of 1.6 lakh per month this year,

introduced product innovations in the truck tyres market, brought

down finance costs by Rs 15 crore last year.

WHAT TO EXPECT: Aiming for a topline

of Rs 2,000 crore by 2005, with exports contributing 25 per

cent of tonnage.

MOST LIKELY SOUND-BYTE:

"I am still not satisfied. In two years, we should be able to

make investments and step on the gas." |

Chowdhary's kicked off with a four-pronged plan:

Increase capacity- with minimal capital expenditure simply because

there wasn't much capital to play around with-by making existing

assets more productive, outsource the lower-value two-wheeler tyres,

storm the market with product innovations, and bring down the interest

burden.

Ceat may still not be in growth mode, but Chowdhary's

achievement is that he's managed to hold on to his No. 4 status

in the tyre industry, grow the topline, bring the company back into

black-all in two years, and without any significant capital expenditure.

"We should be able to make investments by 2005, and by 2006,

we should be able to take on the industry." It's a long road,

but the first few laps haven't been bad at all.

Right Medicine

|

COMPANY: NICHOLAS

PIRAMAL

BT'S GROWTH MANAGER: VIJAY

SHAH, Executive Director & COO |

Since the nineties,

Ajay Piramal, Chairman, Nicholas Piramal, has been on an acquisition

binge, the primary objective being to attain critical mass in the

pharma space. But the decade-long diet of frenzied M&As, alliances

and joint ventures did create its own problems: The pharma giant

had become too unwieldy and complex. And organic growth was proving

elusive.

WHY HIM: Cleaned

up a hitherto unwieldy company by calling off two alliances

and three JVs that weren't working. Cut costs and selectively

launched new products even as the old range was revamped.

WHAT TO EXPECT: Aiming for leadership

in the domestic market in two-to-three years, with focus on

high-growth lifestyle products.

MOST LIKELY SOUND-BYTE:

"The domestic market has a lot more potential (than exports)." |

Three-and-a-half years ago, Piramal pulled off

a masterstroke of sorts by bringing in Vijay Shah from group company

Gujarat Glass as coo. "We had to clean up the company, and

get organic growth," says Shah. After spending six-to-eight

months to understand the pharma market, Shah got cracking by revamping

the top team. He picked up two key head honchos from Wockhardt,

as well as one from Coke and another from Accenture. The businesses

received a hard relook, as a result of which two alliances were

called off and three JVS disbanded. The marketing and sales network

was beefed up, half of the production would now be outsourced, and

by bringing a supply chain head from Heinz, those costs were halved.

Even as the fieldforce was beefed up by 10-12 per cent, the old

brands were being given a makeover and new launches were focused

on the high-growth segments of cardiovascular, diabetes, respiratory

and central nervous system.

For the past seven quarters, Nicholas has clocked

double-digit organic growth, with last year's figure being all of

12.8 per cent. Shah is now gunning for leadership in the domestic

market. In true contrarian fashion, Nicholas is betting most of

its chips on the domestic market. "It has more potential and

will grow at 8-10 per cent." It's also the fourth largest market

in the world, and Nicholas is today well placed to grow along with

it.

|

COMPANY: HPCL

BT'S GROWTH MANAGER: S.P.

CHAUDHRY, Manager Executive Director (Retail) |

Powering Ahead

A chat with S.P.

Chaudhry throws up, amongst several other things, two of his primary

concerns: One, BT should spell his name correctly. And, two, retail

accounts for 58 per cent of HPCL's business, as against just 51

per cent for the entire industry. "So we are better placed

than the industry," the Executive Director (Retail), triumphantly

makes his point.

In January 2002, a few months prior to the

deregulation of the petroleum sector, Chaudhry took over as retail

ED-a crucial period, and, logically, a crucial appointment. Chaudhry's

first task was to listen to the customer. And what he heard was

pretty revealing. The consumer was expecting a lot. Truckers, for

instance, were keen to receive a quality product, spot credit, conveniences

and electronic dispensing units. The two- and three-wheeler riders

felt neglected, and the car segment expected many more value-added

services. "Our focus had to be on outstanding customer and

vehicle care," says Chaudhry.

WHY HIM: Created

Club HP brand, launched branded fuels and e-fuel initiatives,

focus on outstanding vehicle and customer care.

WHAT TO EXPECT: Network expansion,

more value-added services, 1 million-strong card-based loyal

consumers by March 2004.

MOST LIKELY SOUND-BYTE:

"We have to be customer-focused, customer-centric." |

The Club HP concept was created in a bid to

meet most of these needs. Out of the 5,000-odd HP retail outlets,

850 are Club HP pumps, and by March 2004, that figure will go up

to 2,000. To create consumer loyalty, HP also launched branded fuels.

The Power brand of petrol-with multi-functional additives that improve

engine efficiency-will soon be available in 500 outlets.

What's encouraging for HP is that the conversion

rate from common petrol to Power is as high as 25-30 per cent. Chaudhry

has also launched TurboJet, India's first branded diesel. By March

2004, Chaudhry hopes to have a card base of 1 million consumers.

The big question of course is: Will all this

be enough to meet the challenge from private players (at least till

as long as HPCL stays a public sector unit)? Chaudhry proudly reveals

that HPCL has been able to arrest the slide in marketshare between

1999 and 2001, and as of 2003, marketshare had inched upwards to

just over 24 per cent. The company is also growing faster than the

industry, but clearly the real test of Chaudhry's appetite for growth

has yet to come.

|

|

COMPANY: INDO

RAMA SYNTHETICS

BT'S GROWTH MANAGER: SHAILENDRA

TANDON (R), President & CFO SASHOK

K. CHADHA, President (Polyester) |

WHY HIM: Restructured

shopfloor practices, improved productivity and prepaid high-cost

debts.

WHAT TO EXPECT: Doubling of production

capacity by 2005.

MOST LIKELY SOUND-BYTE:

"There was a time when nobody tracked textiles, but things have

changed." |

Back in the High Life

Circa 2001: Delhi-based polyester manufacturer

Indo Rama Synthetics was trying to come to terms with a book loss

of Rs 255 crore after being in red for the three preceding years.

The share price was trading at Rs 4-5, a far cry from its all-time

high of Rs 170 in 1992. Employee morale was low. But Chairman Om

Prakash Lohia wasn't ready to give up. After all, there were signs

of a turnaround, with the company reducing its losses. What he required

were people who could build sustainable profits. Enter Ashok K.

Chadha, a polymer whiz and then Chief of Marketing at Haldia Petrochemicals.

Lohia's headhunters tracked down Chadha and offered the job of heading

Indo Rama's polyester business. Chadha agreed to join. He immediately

got down to restructuring operations right from shop floor practices

to marketing. Result: the company's sales grew by about 18 per cent

in volumes in the last two years in an absolutely flat market. This

also meant the company's marketshare in the 3.5 lakh tonne Indian

polyester market went up from 15.6 per cent to 22 per cent over

a two-year period (2000-01 to 2002-03).

What also boosted Indo Rama's bottomline were

the efforts of Shailendra Tandon, who had come on board as the President

and CFO around the same time. Tandon embarked on a massive cost-cutting,

pre-paid high cost debts and resorted to foreign currency loans,

besides re-negotiating high interest loans. In 2000-01, the company

got back into the black with a net profit of Rs 18.7 crore, which

grew to Rs 41.3 crore in 2001-02 and Rs 124.8 crore in 2002-03.

Let the good times roll.

-P.V. Sahad

On Full Throttle

|

COMPANY: BAJAJ

AUTO

BT'S GROWTH MANAGER: PRADEEP

SHRIVASTAVA, General Manager (Chakan Plant) |

Around 2000-01,

only 53 per cent of Bajaj Auto's pre-tax profits were coming from

its operations. The rest was accruing from a thriving treasury operation.

This, of course, was at a time when Bajaj Auto was hurting since

it didn't have a good-enough motorcycle portfolio. By 2000-01, operating

margins had dipped to a low of 9.8 per cent, and return on capital

employed to 18 per cent. That's when Rajiv and Sanjiv Bajaj, the

sons of patriarch Rahul Bajaj, began the process of an organisational

change. A core "team of believers" was created of some

15 people. One of them was Kevin D'sa, Deputy General Manager (Finance).

"From there on product profitability became the priority, and

cross-functional roles began to be played. Engineering would talk

to finance and finance would learn engineering," says D'sa.

By 2003-03, Bajaj Auto was back in ship-shape.

A good 86 per cent of pre-tax profits now comes from operations,

ROCE has climbed to 64 per cent, and operating margins are in the

vicinity of 20 per cent. But as another member of the team of believers,

S. Ravikumar, DGM (Business Development), points out: "The

effort really began in 1995-96." That's the year when Bajaj

Auto-with Ravikumar as a key participant-began rebuilding its relationship

with Kawasaki. At the same time, with help from Kawasaki, Tokyo

R&D, and a couple of German and Italian design houses, Bajaj

put together a hand-picked R&D team of 15 people from all over

the world. "That was the most critical step in the reversal

of our fortunes," explains Ravikumar.

WHY HIM: In

charge of Bajaj's plant that rolls out the hot-selling Pulsar,

in the process setting new standards in product and process

engineering for Bajaj Auto's other units.

WHAT TO EXPECT: Newer platforms,

both bikes and scooters, from the Chakan plant.

MOST LIKELY SOUND-BYTE:

"We will do a Pulsar with scooters." |

With the R&D team in place, the core team

now felt that Bajaj Auto needed a third plant-not just to augment

capacity but to create a new work culture and set benchmarks for

the other units. That's when the plant at Chakan came up. And that's

where the R&D group built the totally indigenous platform for

the Pulsar, Bajaj Auto's biggest success to date, what with the

Pulsar selling 30,000 per month.

The biggest challenge for Bajaj Auto though

is to crack the largest segment-the executive or the mid-segment-which

Hero Honda towers over. Already efforts have been made to slice

that segment with the launch of the Caliber 115 and the Wind 125.

Another product, codenamed K60, is in the works. Much of that responsibility

of growing marketshare rests on the shoulders of Pradeep Shrivastava,

GM (Chakan). The man responsible for rolling out the Pulsar-he can

make up to 1 million a year if needed-is encouraged by the response

the bike is getting from international markets. Bajaj Auto has to

do something extraordinary to regain pole position in two-wheelers.

The good news for Rajiv Bajaj is that he has the men to do just

that.

|

|

COMPANY: APOLLO

TYRES

BT'S GROWTH MANAGER: SUNAM

SARKAR, Chief (Strategy & Business Operations) |

WHY HIM: Responsible

for revenue and margin growth by broad-basing offerings to include

much more than just truck tyres, setting up exclusive dealerships

and focusing on employee and customer-satisfaction.

WHAT TO EXPECT: Launch of radial

truck tyres

MOST LIKELY SOUND-BYTE:

"It's simple, really. If truckers do well, we do well." |

Keep Truckin'

Till not so long

ago it was a sick company. The turnaround at Apollo Tyres has been

dramatic, and many attribute this change to the leadership of O.S.

Kanwar and his son Neeraj Kanwar. However, there are more people

behind the scenes at Apollo, and one of them is Sunam Sarkar, Chief

(Strategy & Business Operations).

Sarkar began by broad basing Apollo's offerings.

From being a pure-play truck tyre maker, the company now generates

25 per cent of its revenues from other segments: LCVs, tractors,

passenger cars and two- and three-wheelers.

However, Sarkar himself thinks that the credit

for Apollo's success is something that the entire company, "every

employee", has to take credit for. With Apollo now ready to

enter the radial truck tyre business and with the Golden Quadrilateral

Project well underway, times haven't looked better.

Another thing Sarkar and his team looked at

was studying the consumer-the trucker. "Truckers, for example,

have their livelihood depend on our product, a blown tyre can easily

mean a delay of a day or two for a trucker, which can mean the difference

between a profit and a loss," he says. "It is a very simple

philosophy, if a trucker does well, we do well," he added.

-Kushan Mitra

|

|

COMPANY: VOLTAS

BT'S GROWTH MANAGER: M.M.

MIYAJIWALA, Executive Vice President (Finance) |

WHY HIM: Improved

Voltas' quality of finances by bringing down interest costs,

made most businesses EVA-positive, improved fund flows, and

beefed up credit rating to A1+.

WHAT TO EXPECT: Sharper focus on

cash generation. Sales and profits are fine, but free cash flow

is king

MOST LIKELY SOUND-BYTE:

"Our situation was so bad that nobody, not even group companies,

wanted to lend to us. Today, we are lenders in the market." |

Cash, and the CFO, is King

The three years

between 1995-96 and 1997-98 were easily the worst ever in the history

of Voltas-and in the 23 years that M.M. Miyajiwala, Executive Vice

President (Finance) spent at the engineering major. Losses started

piling up, borrowings were up to Rs 326 crore by 1998, by when the

company had reached a near-default situation. So much so that one

big financial institution, when refusing to reschedule and stagger

interest payments, ridiculed Voltas as a "white circus elephant".

"Our funds flow was horrible," winces Miyajiwala.

But restructuring was inevitable-of businesses,

finances and human resources. For Miyajiwala, the task was to improve

Voltas' quality of finances, improve funds flows and convince lenders

that the company was not a lost cause. He's done all that, and more.

Today, the interest costs stand at just Rs 2.5 crore, down from

a peak of Rs 45 crore in 1997-98. Last year was the best ever for

operations. All the businesses, barring one, are EVA (economic value-added)-positive,

and today, with an a1+ credit rating-the highest-Voltas is lending

to other companies. "The one lesson I have learnt is that cash

generation is more important than turnover and profits." That

lesson should stand Voltas and Miyajiwala in good stead as they

step on the gas in the years ahead.

|