|

|

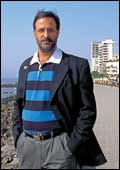

| HDFC Bank's A. Aima (L) &

Motilal Oswal Securities' R. Agrawal: Upbeat mood |

Boom

Times Ahead

FII interest in India can only intensify. Look

out for new all-time highs for stockmarket indices.

If 2003 saw the

highest ever inflows of foreign institutional money, they could

easily get bigger in the coming year. As Abhay Aima, Country Head,

Equities & Private Banking Group at HDFC Bank, puts it: "What

is huge for us isn't internationally. That is because what we get

now is (still) minuscule." What should continue to benefit

India and emerging markets is the pressure on the US dollar. "That's

because the US has a huge current account deficit (currently placed

at around 6 per cent of GDP)," says Raamdeo Agrawal, Managing

Director, Motilal Oswal Securities.

So where could the Sensex be headed, if flows

similar to the $7 billion-plus of 2003 continue? Nobody's talking

about 6000 levels any more. Aima is upbeat that the 30-share index

will cross the previous all-time high of 6150 during 2004. And if

liquidity is not an issue, the fundamentals too look good. Corporate

results are expected to be excellent at least for the first two

quarters of 2004. The budget too will be reforms-oriented, what

with 2004 being an election year. The BJP, encouraged by its victories

in the assembly elections on the reforms plank, will obviously be

wise enough to intensify that thrust. What should also help, as

Agrawal adds, is that the selling pressure (from Indian financial

institutions) is more or less over. So any way you look at it, it's

boom times ahead.

-Narendra Nathan

|

| Hyundai Getz: All set to

hit the road |

Driving Into India

Expect some new car makers to enter the country

in 2004.

Three new car brands

may find their way onto Indian roads in 2004. Volkswagen, Nissan,

and BMW are tipped to be bringing their products into India. BMW

plans to launch the 3-Series and 5-Series and Nissan may bring its

sports utility vehicle Extrail. Hyundai Motor India will finally

launch Getz in the B+ or the Fiat Palio segment. Hyundai is hoping

to sell over 3,500 units of Getz each month after its launch (in

mid-2004). The company would also be launching the Elantra. Also

expected are the new Honda Accord V6, Toyota Vios, Indigo Estate,

Chevrolet Tovrea, and Ford Fusion.

In bikes, both Bajaj Auto and TVS are launching

indigenously-developed products to take on Hero Honda's warhorse

Splendor. While Bajaj is launching a bike codenamed S1 in April

and another 100 cc bike (codenamed K60) in June, TVS would be launching

Electra in mid-2004. Market leader Hero Honda, incidentally, has

only a new variant of Ambition up its sleeves for 2004. This could

be the year in which when Honda Motorcycles and Scooters India (a

100 per cent subsidiary of Honda Motor Corp of Japan) launches motorcycles.

And with the Hero group's joint venture with Honda Motor of Japan

coming up for renewal in March 2004, tables may turn in the motorcycle

market.

-Swati Prasad

The Year Of The IPO

There'll be plenty of public issues to subscribe

to.

If you've missed

out on the stockmarket rally, and can only helplessly watch the

Sensex gallop towards 6000 and beyond, there's still a way to get

in and make some decent returns. After all, it's now time for the

primary markets to get a dose of the action, and initial public

offerings (IPOs) provide a great (and safe) route for investors

to get into stocks. The number of IPOs expected in the New Year

would be more than enough to satiate the hungry appetites of investors.

"There would be a lot of opportunities for investment since

monies in excess of Rs 30,000 crore are expected to be collected

from the IPO market in 2004," says Prithvi Haldea, MD, Prime

Database. A warning from Haldea, though: Be cautious when the IPO

rage becomes a frenzy.

-Shilpa Nayak

The Numbers Look Good

Corporate results will continue to please, Q

after Q.

Automobiles:

The industry has been growing comfortably in double digits on the

back of domestic demand. And it looks immensely sustainable. "Auto

companies should grow by 15-20 per cent for the next two to three

years" says Nimish Shah, Director, Parag Parikh Financial Advisory

Services.

IT: Billing rates

are beginning to stabilise, and the margin pressure that plagued

the it services sector for long seems to be over. "The earlier

strategy of competing on price is getting replaced by value added

(innovation) services", explains Ganesh Natarajan, CEO, Zensar

Technologies.

Pharma: Though

there was a small blip in the September-ended quarter of 2003, pharma

companies are expected to report good numbers in the coming years.

"The factors that drive this will be exports picking up and

the increased domestic demand", says Bhavin Chheda, Pharma

Analyst at Pioneer Intermediaries.

Banking: Banks

may witness a slowdown, as the long rally in the gilt market has

just reversed (during the quarter ended December). Private banks

won't be too badly affected, though, since the treasury income component

is small for them.

-Narendra Nathan

No More Pie In The Sky

CAS and DTH could finally become realities in

2004.

Much

like a clichéd saas-bahu serial, cable operators, multi-service

operators and giant broadcasters have been fighting battles (during

most of 2003) for and against the launch of conditional access in

the country. And so far, the broadcasters have been successful in

scuttling the launch of CAS, which has, at present only happened

in select pockets of the country. Some like Zee and Star, on the

other hand, are fine-tuning their direct-to-home strategies. Zee

launched its DTH services on October 2, 2003, which according to

a company spokesperson, has over 50,000 subscribers. An aggressive

marketing and advertising plan will roll-out early next year. Much

like a clichéd saas-bahu serial, cable operators, multi-service

operators and giant broadcasters have been fighting battles (during

most of 2003) for and against the launch of conditional access in

the country. And so far, the broadcasters have been successful in

scuttling the launch of CAS, which has, at present only happened

in select pockets of the country. Some like Zee and Star, on the

other hand, are fine-tuning their direct-to-home strategies. Zee

launched its DTH services on October 2, 2003, which according to

a company spokesperson, has over 50,000 subscribers. An aggressive

marketing and advertising plan will roll-out early next year.

With the introduction of CAS and DTH, the number

of cable homes may grow even further. As of today, 45 million homes

in the country have access to cable TV (total number of TV homes

is approximately 85 million), up from 20 million in 2000. By 2007,

this number is expected to grow to 64 million. The idiot box rules.

-Swati Prasad

|

| Soap opera: They might just

get a bit more progressive |

More Power To The Weepy

The family soap will continue to rule the roost.

They've ruled

the idiot box for a couple of years, but what's starting to affect

the popularity of once-hot saas-bahu soaps like Kahaani Ghar Ghar

Kii and Kyunki...Saas Bhi Kabhi Bahu Thee are the arrival of fresher

concepts, like Jassi Jaisi Koi Nahin on Sony, the story of a clumsy,

but intelligent secretary. But that doesn't necessarily mark the

end of the saas-bahu theme. At least that's what Sameer Nair, Chief

Operating Officer, Star India, believes: "The soap is a story

telling device about Indian families," he observes. Sunil Lulla,

Executive Vice President, Sony TV, feels, "there will be a

change towards more competitive and compelling alternative programming".

A recent survey revealed that almost 50 per

cent of the respondents considered the character of Tulsi (from

KSBKBT) as their role model even though they voted heavily in favour

of an equal marriage and an independent career. The saas-bahu syndrome

will go on, albeit with some much-needed, progressive amendments.

-Supriya Shrinate

Budget 2004-05 Revealed

Even if it's vote-on-account, expect the reforms

thrust to continue.

Here's what to

expect on February 28. Hopefully it won't be another 135-minute

crawl. But in defence of Finance Minister Jaswant Singh, you'd have

to admit that he'll have a lot to say in an election year, even

if it's not a full-fledged budget and just a vote-on-account. "No

prizes for guessing it will be a populist-cum-reforms-oriented budget,"

as a finance ministry official puts it. And once budget is announced,

peak tariffs will be rationalised to 20 per cent or so, from the

existing 25 per cent limits. The focus again will be on reducing

import duties on various commodities, especially steel, copper,

aluminium, etc, whose prices have virtually gone through the roof

in recent times. The hardware sector could see a reduction in excise

duty from 16 per cent to 8 per cent, and the 4 per cent special

additional duty (sad) could be done away with. The focus on hardware

also stems from the fact that the previous Budget's special focus

on textiles, healthcare, housing, and auto has paid handsome dividend.

"Tax cuts (read government intervention) in these sectors have

worked,'' avers a senior finance ministry official.

Another proposal is to do away with the 2.5

per cent surcharge on corporate tax and to promote India as an investment

centre through greater liberalisation of policies. Then there will

be the usual populist measures like greater spend on agriculture

and rural sector (development of wasteland, capital expenditure

in agricultural growth and expansion of irrigation and value addition

of agricultural produce). Subsidies on food and fertilisers won't

of course be tinkered with. The thrust on infrastructure-creation

will continue, with ports getting special attention. But what is

it that industry wants? Says Anand Mahindra, Managing Director,

Mahindra & Mahindra: "A pragmatic, reform-oriented, forward-looking

budget.'' That's all?

-Ashish Gupta

Year Of The Indian Tiger

In 2004, India will be the place to do business

in.

|

| G. Kliesteriee: Banking on

exports from India |

Circa 2004 is the

year of the monkey according to the Chinese calendar. But as far

as business goes, it could well be the year of the Indian tiger,

a year in which the world finally starts speaking of "India

with China'' in the same breadth-both in terms of growth opportunities

and a great place to do business in.

The positives of the world's second fastest

growing economy (slated to grow at 7.3 per cent in 2003-04) are

now being heard louder in the first world: Relatively undervalued

stocks, an appreciating rupee, strong corporate performance, low

interest rate, a billion dollars in forex, and a huge domestic market

are just some of them.

"What has also changed is the brand image

of the country and a new-found confidence among Indian corporates

to take on the world, ''contends Jyoti Jaipuria, Head (Research),

DSP Merrill Lynch. That's why G. Kliesterlee, CEO, Philips, is looking

to ramp up exports from India in the next three to five years. There

will be many more like him.

-Ashish Gupta

|

|

| Power tussle: Sonia Gandhi

(L) & Atal Bihari Vajpayee |

Clean Sweep?

The BJP-led coalition is the favourite to win

the elections.

Most likely by

september a billion-plus people will cast their vote to elect some

545 members of Parliament in the 14th Lok Sabha elections. And the

two big national parties-the BJP and the Congress Party-along with

their alliance partners will be slugging it out to gain that magic

270-plus seats to form the government.

One likely scenario: The BJP comes back to

power with a slight majority, albeit with a little help from its

National Democratic Alliance (NDA) partners. Expect then to see

a speeding up of the reforms process, contends Kashi Memani, Chairman,

Ernst & Young. Reason: Not only is the BJP convinced that good

economics translates into good politics-a lesson well learnt from

the assembly elections-it will also have no fear of facing any elections

in the near future. "Moreover, it will also get greater support

from the allied parties, which are also convinced about the efficacy

of reforms,'' adds Memani.

So, expect a consolidation of reforms, even

attempts at tackling the second generation of reforms and greater

consensus building on disinvestment issues, if (or rather when)

the BJP is returned to power.

-Ashish Gupta

Shakeout Season

There will no more than five big players jostling

for a pie of 60 million wireless subscribers by year-end.

The Leviathans: Bharti

Televentures and Reliance Infocomm will leverage their all India

presence. Bharti will fuel growth inorganically. Reliance will launch

of the much popular pre-paid cards and enterprise products to grow

numbers.

Tata Group: Has

recently acquired almost a dozen new licences for offering CDMA-based

telephony taking the total number of licences to 17. Expect it to

grab a larger share in 2004.

BSNL: In a league

of its own is the government-owned behemoth Bharat Sanchar Nigam

Limited. The planned network expansion is likely to see it recapturing

its place in the sun.

Hutch: Deep pockets

will ensure survival.

-Vandana Gombar

|