|

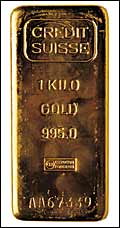

The Bullion Angle: Idle Asset Or Great Investment

Option?

Circa

2003, everyone, including this magazine, thought gold had reached

its peak. The yellow metal's price shot up to $372 an ounce (Rs

17,112 at the then exchange rate) and the universal opinion was

that it was unlikely to go any higher. Well, we were all wrong Circa

2003, everyone, including this magazine, thought gold had reached

its peak. The yellow metal's price shot up to $372 an ounce (Rs

17,112 at the then exchange rate) and the universal opinion was

that it was unlikely to go any higher. Well, we were all wrong

January 2004 was a great year for gold: prices rose from $343

an ounce on January 1 to $416.25 on January 31, reaching a 15-year

high. More importantly, the domestic price of gold on April 13,

2004 was Rs 6,040 for 10 grams, up from Rs 6,010 on January 31,

and just 4.88 per cent off the all-time high of Rs 6,335 registered

on January 12, 2004.

Gold's intrinsic value as an investment vehicle is considerable.

"It is a good hedge against currency fluctuations," says

Hiroo Mirchandani, Vice President (India), World Gold Council. That

makes it a must-have in any investment portfolio, a point of view

that most investment advisors are now coming around to. K.V.S. Manian,

the head of retail liabilities at Kotak Mahindra Bank, for instance,

advises his customers to build a diversified portfolio that includes

gold. "Gold generally has a negative correlation with other

asset classes, debt and equity."

However, given the age-old Indian approach of hoarding gold rather

than trade in it, there aren't too many gold-linked products around

(SBI and ICICI Bank are the only banks offering such products).

The market exists: "Last year, we sold 123,000 ICICI Bank Pure

Gold pieces," says Anup Bagchi, Joint General Manager (Retail

Liabilities Group), ICICI Bank. With other banks mulling the launch

of gold-denominated certificates, it may soon be possible to trade

in the yellow metal. You should.

-Ashish Gupta

Should

you invest in commodities? Should

you invest in commodities?

Yes. And here's why: diversification

into commodities can help investors reduce their overall risk. Smart

investors have always been aware of this and made surrogate investments

in commodities. Direct investments in industrial commodities such

as steel and aluminum and agricultural ones such as rubber and pepper

requires a sales tax registration and a warehouse. However, commodities

futures now make direct investment in paper-commodities possible.

Investors can choose from three exchanges, the National Commodity

and Derivative Exchange, the Multi Commodity Exchange of India Ltd

and the National Multi Commodity Exchange of India Ltd, and start

with an investment as low as Rs 5,000. Several equity brokers have

diversified into commodities trading and the process itself is fairly

similar to equity trading (down to the extent of possessing a DEMAT

account). Even better, as long as trades are squared off, and there

is no delivery, investors do not have to pay sales tax . "If

you expect steel prices to go up, just buy steel (futures) instead

of steel companies," says Satish Menon, Chief Operating Officer,

Geojit Securities. Caveat: it takes some expertise to make money

from commodities. For instance, investors would do well to avoid

buying into bullion now. "At the moment the price is on the

high side and it makes sense to wait for the correction," says

Harmesh Arora, Vice President, Bombay Bullion Association. Like

gold, most commodities go through cycles and an understanding of

these could prove invaluable.

-Narendra Nathan

|