|

In

the days ahead, 10-12 per cent of Hindustan Lever (HLL's) 60-odd

senior managers-right from general managers to category heads-will

find themselves out of Lever House, the headquarters of the Rs 10,138-crore

fast-moving consumer goods giant. No, they won't be sacked, but

most of them-in the words of a senior HLL director-will be "compensated

with regional positions". A few would be redeployed or, to

put it more bluntly, demoted. In

the days ahead, 10-12 per cent of Hindustan Lever (HLL's) 60-odd

senior managers-right from general managers to category heads-will

find themselves out of Lever House, the headquarters of the Rs 10,138-crore

fast-moving consumer goods giant. No, they won't be sacked, but

most of them-in the words of a senior HLL director-will be "compensated

with regional positions". A few would be redeployed or, to

put it more bluntly, demoted.

This isn't some Machiavellian plot being hatched

by the Unilever top brass, but rather a logical extension of the

restructuring announced last fortnight at the $47 billion Anglo-Dutch

major's Indian subsidiary. Come May 1, Chairman Banga will hand

over day-to-day operational management to two "considerably

autonomous" managing directors. Arun Adhikari, currently Executive

Director (Personal Products), will head the home and personal care

business (along with detergents), and S. Ravindranath, Executive

Director (Beverages), will take over the foods portfolio (including

beverages and ice cream). "With two MDs, we will now be a more

empowered and more focused organisation,'' says Banga, with a reminder

that "I will (still) be fully accountable for the Indian operations."

And be based in Mumbai, not in Singapore.

|

|

| ARUN ADHIKARI: The MD-designate has been

mandated to infuse Lever's home and personal care segment with

much-needed dynamism |

S. RAVINDRANATH: The former head of beverages

business has been charged with jumpstarting the FMCG giant's

foods business |

Lever's current management committee comprises

13 members, and the operations are divided into five business units

(detergents, personal care, foods, beverages and ice cream). Under

the new structure, there will now be just two divisions (HPC and

foods) headed by the two MDs, each with a five-member management

committee. The newly-cast board will have five members, with a Finance

Director, D. Sundaram and a Vice Chairman, M.K.Sharma, in addition

to the two MDs and the Non-Executive Chairman. As Banga explains,

the benefits of such a structure are that HLL will now be able to

respond more aggressively, and respond faster in the marketplace.

"It couldn't have come at a better time," he adds.

What also couldn't have come at a better time,

at least for Banga, is his elevation as head of the Asia HPC business,

worth $6.1 billion, accounting for a little under 30 per cent of

Unilever's worldwide, and the biggest HPC business for the Anglo-Dutch

behemoth (bigger than Europe and North America). The Chairman swears

that the reorganisation and his elevation are "disconnected",

and insiders at HLL aren't surprised by either. "The reorganisation

is the next phase of the rationalisation that Banga kicked off two

years ago-and which is in line with Unilever's worldwide structure.

As for his elevation, he's obviously played his cards well,"

says a clearly indifferent HLL manager.

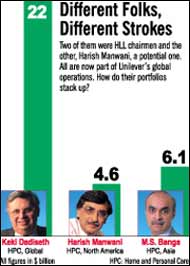

Banga isn't the first HLL Chairman to make it

big on the global stage. Predecessor K.B. Dadiseth is today head

of Unilever's worldwide HPC activities, worth all of $22 billion,

and another former director Harish Manwani heads the $4.6 billion

North American HPC portfolio. Banga's new posting is doubtless prestigious

but Banga, like Manwani, reports to Dadiseth. In his own words:

"HLL's revenues today are $2 billion. HPC Asia is $6 billion.

So I have another $4 billion of responsibility." Asia includes

Vietnam and Thailand (where just as in India Unilever enjoys a dominant

position), Indonesia, the second largest Unilever business in Asia

after India, and the fledgling $350 million China operations, a

late starter, but surely with the most potential.

TRICK OR TREAT FOR BANGA?

Is M.S. Banga getting promoted or

kicked upstairs? |

POINT:

The restructuring at Lever is a reaction to the company's inability

to grow, and the competitive pressures being felt in the market

place. POINT:

The restructuring at Lever is a reaction to the company's inability

to grow, and the competitive pressures being felt in the market

place.

COUNTERPOINT: Not true.

For one, the reorganisation, and Banga's appointment as President

of the Asian HPC business are disconnected events. The reorganisation

is the logical next step in the rationalisation that began a

couple of years ago.

POINT: Is Banga's appointment

at the Asian level really a promotion?

COUNTERPOINT: Yes, yes,

yes! HPC Asia is a $6 billion business, with India accounting

for roughly $2 billion. So in effect, Banga has got a further

$4 billion worth of responsibility.

POINT:

Does Banga deserve a promotion, in the light of Hindustan

Lever's domestic woes?

COUNTERPOINT: Of course.

Since he took over in 2000, he has significantly restructured

the company by divesting 7-8 businesses at a good value. Today

HLL has a lean portfolio focused on FMCG, thanks largely to

Banga. Foods profitability too has improved. If growth hasn't

come, it has more to do with the "counter-forces"

in the marketplace since 2000, during which Banga determinedly

pursued his strategy.

POINT: By making Banga

Non-Executive Chairman, and empowering two managing directors,

Banga's wings have been clipped domestically.

COUNTERPOINT: In the light

of the Chairman's new Asia responsibilities, he will be travelling

a lot. Since Indian regulations don't allow for a part-time

director concept, a non-executive role was imperative to heed

to good governance practices. Although Banga's role won't

be hands-on anymore, he is still fully accountable for the

Indian operations.

POINT:

Banga's elevation is not as impressive as that of some of

his predecessors. K.B. Dadiseth, for instance, is head of

the global HPC business, and a former HLL Director Harish

Manwani is now President of Unilever's North American HPC

business.

COUNTERPOINT: The Asian

HPC business is larger than that of Europe and North America,

and has the most potential for growth.

POINT:

The restructuring is a precursor to splitting the foods and

HPC business.

COUNTERPOINT: "We

have no intention to split the business," says Banga.

In fact, at various levels, like fieldforce, for instance,

there will be integration.

|

Lever's Quest For Growth

The debate doesn't so much surround whether

Banga has been kicked upstairs, but whether he deserves the elevation

against the backdrop of HLL's performance over the past four years.

At least on the surface, Lever's performance has deteriorated since

May 2000. Between 2000 and 2003, HLL's net sales shrunk, and low-cost,

nimble competitors have nibbled at its marketshares in key categories

like soaps, detergents, shampoos and toothpastes. In contrast, in

the four years before Banga took over-when Dadiseth was Chairman-HLL

was growing in double digits-at over 30 per cent. Banga, it would

seem, just couldn't maintain the tempo. So what has he achieved

to deserve such a handsome posting?

Plenty, avers the Banga camp at Lever House.

The biggest achievement, points out one manager, is the "significant

restructuring", during which Banga divested at least eight

low-margin or non-FMCG HLL businesses with revenues totalling close

to Rs 1,000 crore-including oils & fats and animal feeds-all

at handsome values, making HLL a more pure-play FMCG than it was

pre-2000. "Of course, acquisitions are more sexy than divestments,"

quips the manager, with an obvious reference to Dadiseth's acquisition

binge, during which he gobbled up diverse companies right from ice

cream maker Kwality to cosmetics major Lakme.

So whilst inorganic growth did account for

a large part of the growth between 1996 and 2000, the flurry of

acquisitions also resulted in HLL being saddled with an unwieldy

basket of 110 brands. That's where Banga's second major accomplishment

comes into the picture: He consolidated the portfolio into a lean,

sharply-focused range of 35 power FMCG brands.

Such efforts at consolidation have been noted

by the Unilever top brass. But a section of analysts points out

that these initiatives, though noteworthy, aren't enough to hide

the shortcomings of HLL in the Banga years. Other than the company's

inability to grow the topline, there's also the troubled foods business

that hasn't been able to enter the black. The ventures that were

flagged off with fanfare-like e-tailing and confectionery-haven't

yet succeeded in becoming the badly-needed growth engines that Lever

has been striving for.

Banga

maintains that the new ventures have to go through their "incubation

period," and they will achieve critical mass in the fullness

of time. As for foods, the Chairman explains that plenty of progress

has been made: Operating and gross margins are up, gross profits

have trebled over the past four years, and the company is today

in a position to invest in growth in this business. "Foods

needs nurturing," says Banga, who credits the current Foods

head Gunender Kapur for improving profitability. Whilst Kapur's

new assignment overseas hadn't yet been announced at the time of

writing, Lever insiders are pretty sure it's going to be a ''hot

posting for a hot guy''. ''I will miss him, but there's no dearth

of talent at HLL," smiles Banga. Banga

maintains that the new ventures have to go through their "incubation

period," and they will achieve critical mass in the fullness

of time. As for foods, the Chairman explains that plenty of progress

has been made: Operating and gross margins are up, gross profits

have trebled over the past four years, and the company is today

in a position to invest in growth in this business. "Foods

needs nurturing," says Banga, who credits the current Foods

head Gunender Kapur for improving profitability. Whilst Kapur's

new assignment overseas hadn't yet been announced at the time of

writing, Lever insiders are pretty sure it's going to be a ''hot

posting for a hot guy''. ''I will miss him, but there's no dearth

of talent at HLL," smiles Banga.

It will now be largely up to Adhikari-who effectively

will be responsible for 68 per cent of HLL (the HPC business has

revenues of Rs 6,800 crore) and Ravindranath-who incidentally began

his career in HLL on the non-management side-to marshal that pool

of talent, with Banga providing the strategic leadership and operational

direction. Besides enabling a sharper focus, more aggression, and

faster decision-making, the new structure with Banga as the Asian

HPC head honcho enables Lever to think pan-Asian, much like competitor

Procter & Gamble does. For instance, HLL can look at sourcing

opportunities from the region, thereby reducing costs wherever possible.

The new structure will come into play from

May 1, and the next couple of weeks won't be without their share

of unease, as managers get accustomed to new reporting relationships.

But going by the action at Lever House, you could be forgiven for

believing a new aggressive and nimble Lever is already in place.

At the time of writing, the haircare managers were readying to launch

Clinic Plus with a lower price tag, and a host of similar such initiatives

were in the works. Banga may be on a new high, but back home HLL

still has to battle familiar demons closer to the ground.

|