|

ITC

We Also Make Cigarettes

|

| Biscuits, anyone? Deveshwar has quickly

created some top-selling brands in the FMCG market |

| In three years, ITC has attained 45 per

cent share in the branded wheat flour segment. And it took

just two years to garner 8 per cent of the biscuit market |

Imagine getting

into a fragmented and messy market for wheat flour (atta), where

there's no supply chain, no consistency in quality, no brand loyalty,

or even proper packaging. Kolkata-based tobacco giant, ITC, did

just that more than three years ago, and far from get scared,

it plunged right into the market. Result: Its Ashirwad Atta today

boasts of a whopping 45 per cent share in the branded and packaged

wheat flour segment. It did something similar in biscuits, where

it took on two major players (Britannia and Parle) and has garnered

8 per cent of the market in just two years.

Sure, it helps that ITC is a marketing behemoth

that spends a staggering Rs 226 crore on advertising. But that

alone can't explain why ITC has been able to crack the staples

and biscuits markets. "ITC's traditional strengths of brand

building, trade marketing and distribution provide distinctive

sources of competitive advantage in the marketplace-whatever may

be the product or service," says ITC's Chairman, Y.C. Deveshwar.

The company believes, say its executives, that at the heart of

a great brand is a great product. That means investment in product

development. Last year, for instance, ITC spent Rs 54 crore on

research and development of various products. "For any leader

in its field, innovation is a byword for success. ITC's marketing

prowess has been significantly enhanced by a constant flow of

innovations that have become benchmarks in the industry,"

says Kurush Grant, ITC's head of FMCG and tobacco businesses.

Pre-printed vinyls instead of hand-painted hoardings, and planograms

at points of sale are two such innovations.

Aggressive marketing has sent ITC's non-tobacco

FMCG sales soaring. In 2004-05, that part of the business fetched

a relatively modest Rs 564 crore (it's a Rs 16,510-crore company

we are talking about here), but last year the figure almost doubled

to Rs 1,013 crore. Agreed, ITC has some consumer products such

as incense sticks, stationery and even apparel that aren't doing

as well, but it is evident that with each passing year, the company

is looking less and less like the tobacco giant it once was. "At

the fundamental level, we haven't changed," says Grant. "We

still retain our passion for obtaining consumer insights and understanding

consumer behaviour," he says. At the end of the day, marketing

is all about reading the consumer's mind.

-Ritwik Mukherjee

|

| Numero Uno: But Khattar's MUL has hit

roadblocks in recent months |

| Maruti sold a record 53,396 units in May

this year. But, subsequently, sales dropped because it cut

back on production of two B-segment cars, the Zen and WagonR |

MARUTI UDYOG

Tenacious Leader

Marketing is

about keeping customers happy," deadpans Jagdish Khattar,

Managing Director of Suzuki-owned Maruti Udyog. How seriously

does the small car-maker, which has a 45 per cent share of the

market, believe in the motto? Enough for Khattar to cut his marketing

budget and transfer it over to sales and service. No wonder, Maruti

has been topping J.D. Power's customer satisfaction survey for

six years now. But there are times when even the savvy market

leader trips up. Like in the recent months. Maruti's sales peaked

in May this year at a record 53,396 units, but have declined since.

What went wrong? Production of its B-segment car, Zen, was stopped

a couple of months ago to make room for the new Zen, due for launch

in November. WagonR too went off the assembly lines for a few

weeks as Maruti worked on a facelift. "Withdrawing the Zen

has been one of the most difficult things we have ever done,"

says Khattar, a former IAS officer. "Not only did it make

a 3,000-4,000 unit hole in sales, we should have launched the

replacement model straight away." Needless to say, Khattar

is a wiser man today. "We will not make the same mistakes

next time," he promises. Rivals, take note.

-Kushan Mitra

|

| Well oiled: Marico's image has been

overhauled by Mariwala |

| Advertising and packaging innovations have

changed Marico's image from a fuddy-duddy one to a modern

brand. Plus, the company has stayed focussed on its key brands |

MARICO

Marketer Of Wellness

Harsh Mariwala

has a name for the strategy he has been employing at Marico ever

since he joined the family business way back in the 70s. He calls

it 'discontinuous growth and the philosophy of wellness'. It was

discontinuous growth when he led a small family-owned business

from (oil) wholesale to retail, it was discontinuous once more

when he dumped (after a seven year-long battle) tin for plastic

as the packaging medium. "The shift to plastics resulted

in huge gains in market share to about 30-40 per cent, from the

pre-plastic days of 10-15 per cent," says Mariwala, Chairman

and MD.

Over the years, Mariwala has kept ploughing

profits back into advertising and packaging innovations to change

the image of the company from a fuddy-duddy one to a modern brand.

And that's how products like Parachute Jasmine and Parachute hair

cream were born. Another thing that Marico has done is to stay

focussed on its key brands and emphasise the wellness quotient.

Saffola, for instance, has retained the "good for heart"

essence of the brand over the years. "It is very tempting

to cross the boundary to extend market size, but it should not

dilute the brand," says Mariwala. Therefore, all brand extensions

(into salt, wheat flour, and three varieties of oil) have kept

the touchstone in mind. "We have always been in the business

of wellness and Kaya is just an extension of that philosophy,"

says Mariwala, referring to Marico's newest diversification into

skin care clinics. It took Mariwala 15 years to hit Rs 1,000 crore

in annual revenues. He expects going from here to Rs 2,000 crore

to take just three years.

-Shivani Lath

PARAS PHARMACEUTICAL

FMCG's Serial Brand Builder

|

| What's in a name? Patel has made a successful

foray into the FMCG market |

Perhaps it's

time Paras dropped or changed the second part of its name. In

the five years since the Ahmedabad-based company started focussing

on FMCG products, it has amassed an enviable portfolio of brands.

Dermicool (talcum powder), Afterbath (freshness cream), Livon

(hair protection), Set Wet (hair styling gel) are just some of

its well-known FMCG brands. "I think the quality of our distribution

has made us more an FMCG company than a pharmaceuticals company,"

quips Chairman & CEO, Girish Patel, who also believes in advertising

like an FMCG company. In the market for over-the-counter pharma

products, Paras has top-selling brands such as D'Cold, Borosoft,

ItchGuard, Krack, and Moov, to name a few. Evidently, going from

otc to fmcg hasn't been too hard for the family-managed company.

"Our USP lies in having products that are specifically targeted

at the consumer," points out Patel.

|

| Wide range: Paras has portfolio of small

but well-known brands |

Today, Paras is a Rs 250-crore company with

a Rs 50 crore bottom line, but Patel is thinking big. "By

2011, we want to be a Rs 1,000-crore company," he states.

Raising money to fund the growth won't be a problem for this closely-held

company. It recently sold a 23 per cent stake to private equity

investor Actis (which also owns 41 per cent in Paras-promoted

Sterling Hospitals) for about Rs 200 crore. Paras already has

a manufacturing unit at Kalol, near Ahmedabad, and is building

another one at Baddi in Himachal Pradesh. The logic behind the

new plant is simple: about half of the company's products are

outsourced, and Patel is keen to reduce that percentage. By 2011,

Patel also wants a fifth of his revenues to come from exports

(currently it is 8 per cent). In other words, the show has just

begun at Paras.

-Krishna Gopalan

IIM AHMEDABAD

Simply the Best

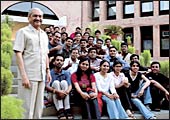

|

| Class apart: Dholakia (standing) and

his school are in the A-league |

| IIM-A has worked consistently to deliver

on the brand promise. It's no wonder that Wall Street firms

and big MNCs make a beeline to recruit from the school |

Its rivals pooh-pooh

its Numero Uno status in the business of management education

("it's only a perception," says the director of a rival

IIM), but that doesn't really bother Bakul Dholakia, the man who

runs India's best-known B-school, IIM Ahmedabad. The numbers speak

for themselves. Out of every 680 candidates who apply for admission

via the gruelling Common Admission Test (CAT), IIM-A admits only

one. Big recruiters who queue up every year to hire from A often

go back empty-handed because bigger Wall Street firms and MNCs

have cleaned out the graduating class.

What's the secret of A's enduring success?

Rama Bijapurkar, a marketing consultant and an IIM-A alumna herself,

says it is the school's focus on the four Ps of marketing. "The

school stands for the best and affordable business education in

the country," she says, pointing out the first two Ps: Product

and pricing.

Dholakia, on his part, says that the brand

perception is not based on nothing. "The custodians of IIM-A

have worked consistently over the years to keep the institute's

brand essence alive and to deliver on the brand promise without

fail," he says. And when you have brand ambassadors (read:

alumni) such as Unilever's M.S. Banga, ICICI Bank's K.V. Kamath,

and management guru C.K. Prahalad, promotion takes care of itself.

-Archna Shukla

|

| On track: That was just a sneak preview,

says Yadav |

| Yadav took simple steps like reducing the

wagon turnaround time and raising the capacity of goods trains.

His turnaround story has become subject of case studies |

LALU PRASAD YADAV

Mass Marketer

"Remind people that profit is the

difference between revenue and expense. This makes you look smart"

Scott Adams

Chances are,

union railways Minister Lalu Prasad Yadav, India's newest 'management

guru', may never have heard of Scott Adams, the legendary creator

of the Dilbert comic strips. But ask him how he made the Indian

Railways, a Rs 55,000-crore behemoth tottering at the brink when

he took over in May 2004, into a money- spinner (it had a fund

balance of Rs 11,000 crore in 2005-06), and Lalu, revelling in

his trademark rusticity, espouses, "Dekho railway bhi to

ek dhanda hai, to bas dhande ke jaisa chalaayaa, aur kya."

("See, the railways is just another business, and we ran

it like one. That's all.") Yadav has managed to market the

turnaround story so well that it's now the subject of management

case studies at some top B-schools, including IIM-A and Paris'

HEC School of Management. Yadav is scheduled to speak at IIM-A

on September 18 over the finer points of the turnaround.

So, just how did the turnaround happen? Simple.

Yadav asked for an increase in throughputs and a reduction in

costs. Simple steps such as reducing the wagon turnaround time

from seven to five days and raising the capacity of goods trains

from 3,200 tonnes to 4,000 tonnes have resulted in an improvement

of 25 per cent in the total carrying capacity. Moreover, the diesel

price hike of Rs 12 per litre proved favourable for the railways,

as diesel accounts for just 8 per cent of the railways' transportation

costs, compared to 60 per cent for trucks. "The need of the

hour was to redefine ourselves as just a carrier of people and

goods," says Sudhir Kumar, an Officer on Special Duty in

the Rail Ministry, and a Lalu confidante. "The new business

environment offered no room for complacency."

Lalu claims he'll have a fund balance of

Rs 20,000 crore this fiscal. Rail Bhawan mandarins have even more

ambitious plans: a Rs 3,00,000 crore target for the 11th Plan-a

five-fold increase over the 10th Plan. Also, reports indicate

that retail major Pantaloon may soon form a joint venture to develop

some prime railway properties into retail destinations. "Abhi

to aap ne trailer hi dekha hai," says the 'turnaround man',

"film to abhi shuru bhi nahin hui hai." ("All that

you have seen so far is the trailer. The film hasn't even begun.").

We'll be watching, for sure.

-Aman Malik

ICICI BANK

One-stop Financial Shop

|

| Reflecting success: Kamath's bank has

the largest retail banking portfolio of Rs 1,00,000 crore |

| ICICI Bank is today the market leader in

every product segment, be it auto loans or personal loans.

And the key to its marketing strategy has been smart cross-selling |

Would India's

retail banking have been the same without ICICI Bank? Perhaps

not. The Mumbai-based development-institution-turned-bank was

probably the first domestic banker to spot a retail boom as well

as tap customers before others could sense an opportunity. The

results tell the rest of the story: ICICI Bank enjoys a 40 per

cent market share in auto loans, 31 per cent in home loans, 28

per cent in personal loans and 29 per cent in credit cards-that

makes it the market leader in every product segment. ICICI's story

is also the story of a marketer who learnt how to cross-sell well.

"We follow a marketing mantra of presenting an identical

image across all our products," says Chanda Kochhar, Deputy

Managing Director, ICICI Bank.

Few will disagree that the K.V. Kamath-led

bank today is the most aggressive marketer, with the largest retail

banking portfolio of Rs 1,00,000 crore. And the marketing philosophy

is not so much to sell just another loan product, as to deepen

the relationship with customers and, in turn, save on marketing

costs. Today, such an approach brings a fee income for the bank

that shows in the 55 per cent jump in its fee-based income-up

from Rs 2,098 crore in 2004-05 to Rs 3,259 crore in 2005-06. "Cross-selling

has been one of the very important themes in our marketing strategy,"

says Kochhar, adding that, "cross-selling originates from

the fact that the bank has the largest customer base and an array

of products to offer."

ICICI was the first to introduce innovative

marketing schemes like pre-approved loans for its 6 million 'good'

borrowers out of a total 17 million. "We also tapped customers

by discovering their latent needs. We are quick to tap a customer

for a personal loan if a card customer crosses overdraft limit,"

says V. Vaidyanathan, ICICI's retail head. Similarly, a young

auto loan customer is tapped for a home loan product once he or

she is close to repaying the auto loan. "We have seen a success

rate of 10 per cent in such initiatives," reveals Vaidyanathan.

From urban India, ICICI's Kamath is taking

banking into the heart of rural markets. Shunning high-cost brick-n-mortar

marketing, Kamath plans to employ franchisees and kiosks to sell

banking products to rich farmers and rural middle-class. By 2008,

he wants ICICI to cover 600,000 villages in 600 districts. Small-town

India, get ready to say hello to ICICI.

-Anand Adhikari

|

| Let the good times roll: Mallya's gamble

in the face of low-cost carriers has paid off |

| All its planes are new and it pampers its

customers with gourmet meals and in-flight entertainment.

In less than two years, Kingfisher has cornered 8 per cent

of the market |

KINGFISHER AIRLINES

Flying Against The Low-fare Wind

Trust Vijay

Mallya, the flamboyant Chairman of UB Group and Kingfisher Airlines,

to make a contrarian bet. About 15 months ago when he launched

Kingfisher Airline as a 'true value carrier' and positioned it

between a low-cost (Air Deccan) and full-service carriers (Jet

Airways and Indian), there were sceptics who predicted that it

would fall between the two stools. Neither here nor there.

While Kingfisher, with 16 aircraft and 102

flights per day, has some way to go before it can be hailed as

a complete success, Mallya can rightfully claim that his decision

to pamper customers with good service and care was a considered

one. His airline has cornered more than 8 per cent of the market

in less than two years. "We felt that the discerning Indian

consumer would pay the right price for good service, and that

is the reason why we call ourselves a true value carrier,"

says Hitesh Patel, Executive Vice President, Kingfisher.

From gourmet meals-featuring six different

vegetarian and non-vegetarian options, apart from low-sugar, low-fat

and Jain meals-to in-flight entertainment, Kingfisher has tried

hard to differentiate itself from its competitors. It is not just

meals and entertainment, but Kingfisher says it is the first private

carrier to have advanced airborne communications addressing and

reporting system that continuously monitors and tracks every aircraft,

even when it is in flight. Also, all the planes are new, resulting

in greater technical reliability, claims the airline. Girish Shah,

Head (Marketing), Kingfisher, asserts that sec A and sec B+ consumers

in the age group of 22-45 years are the airline's target. "We

never aimed at low-cost carrier audience. We created a new niche

for ourselves," he says.

However, the airline has had to make a few

adjustments to meet the requirements of the customer. At the time

of launch, Mallya had declared that there would be just one class

called 'Kingfisher Class'. The airline has quickly realised that

there are corporate customers, mostly flying on expense accounts,

who would not mind paying a premium for additional facilities.

Admits Patel: "Yes, there is some learning from the marketplace."

As a result, the airline has launched Kingfisher First. He adds

that starting November, Kingfisher First would offer satellite

TV, besides personalised valet service that is already available.

"With Kingfisher Airlines, the good times never stop,"

he beams. The challenge for Mallya is to extend the good times

to UB's shareholders.

-Venkatesha Babu

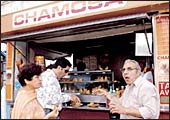

FUTURE GROUP

A Retailer For All Seasons

|

| Maverick retailer: Biyani is completely

focussed on the customer wallet |

Here's the first

thing you need to know about Kishore Biyani. The man isn't in

the business of retail. Rather, he's in the business of getting

the consumer to spend-on anything and everything. And Biyani,

CEO of Future Group, which includes Pantaloon stores and Big Bazaar

hypermarkets, will do just about anything to get customers into

his stores and keep them. Consider Future Group's most recent

format, Chamosa. The exotic-sounding name is actually a compound

word for chai (tea) and samosa (a popular snack). True to their

name, the Chamosa kiosks (see photo next page) sell 12 different

varieties of samosas. "The most popular snack in India, chai

and samosa, is served here in a modern format," says Biyani.

"We are a mass retailer and want to cater to everyone,"

adds Sanjeev Agrawal, President (Marketing), Pantaloon Retail.

|

| Snack time: Chamosa may not be hi-tech,

but it works |

That's precisely the reason why Future's retail

empire looks like nothing else on earth. At one end, it has the

Big Bazaar chain that stocks everything from loose rice and wheat

flour to electronics to jewellery to footwear. At the other end,

there's a joint venture with Italy's Generali Group for life and

non-life insurance that hopes to leverage the retailer's access

to consumers. In between, Future has several other things, including

Pantaloon fashion stores, malls (Central Mall), and a tie-up with

Blue Foods (which runs three restaurants, Copper Chimney, Bombay

Blues and Noodle Bar in Mumbai) for food and beverages retail.

The plan is to open restaurants, food courts, coffee shops and

lounges in all Pantaloon stores across Mumbai, Bangalore, Ahmedabad,

and Hyderabad, among others. "We want to offer the best brands

under one roof in eateries," explains Agrawal.

With Biyani moving in all directions, Pantaloon's

revenues are clipping. For nine months ended March 31, 2005, Pantaloon

(which has a June year-ending) had revenues of Rs 714.29 crore;

same period this year, the figure stood at Rs 1,292.61 crore-an

81 per cent jump. Apparently, Biyani plans to up revenues to $7

billion by 2010. That's Rs 32,900 crore at today's exchange rate.

Biyani may miss his target by a wide margin, but you can be sure

about one thing: He'll give it his best shot.

-Ahona Ghosh

NAUKRI.COM

Guess Who's Getting Heard Now?

|

| Two to tango: Bikhchandani (below) and

Oberoi built a brand on a budget |

Marketers who

focus only on enhancing their share of voice to be heard and bought

must listen to Sanjeev Bikhchandani, Co-founder and CEO, Info

Edge India, the company that runs well-known online businesses

like Naukri.com, 99acres.com and Jeevansaathi.com. Naukri.com

is the second-youngest marketer on our list, yet Bikhchandani

could teach his seniors a lesson or two on how to create brand

awareness and build one's equity without spending a penny on it.

"My understanding of the business was that it needed to get

into a virtuous cycle to take off," says the IIM-A alumnus,

explaining why Naukri let companies list jobs cheaply in a bid

to draw job seekers and thus trigger a 'virtuous cycle'. "When

we started off in 1997, we had no money. Hence, we had to rely

on our product to create noise for itself and hence, it was crucial

for it to be good," says Hitesh Oberoi, coo, Info Edge.

Today, Naukri, best remembered for its controversial

'Hari Sadu' TV commercial that still airs, gets more than 15 million

page views a month and has in excess of seven million registered

users. Over the past five years, over 24,000 clients have used

the site to recruit people and over a million have found jobs

through the web site, says Bikhchandani. Not surprisingly, the

company's revenues have grown more than nine times to Rs 84 crore

in 2005-06 from Rs 90 lakh in 2000-01 and profit-after-tax, last

year, was Rs 13.5 crore. Bikhchandani and his team, meanwhile,

have also got investors such as KPCB and Sherpalo, two of Silicon

Valley's most renowned venture firms, who picked up a 5 per cent

stake in the company for $6 million (Rs 28 crore at today's exchange

rate). That means Bikhchandani needn't fear having to post his

own resume on Naukri-ever.

-Archna Shukla

|