|

The

entry, into a country, of brands such as Aigner, Valentino, Boss,

Zegna, Lamborghini, Bentley, Tag Heuer, Chanel, and Bang and Olufsen

is actually a lag indicator of a certain economic phenomenon.

Much like the arrival of the sourcing arms of shoe firms like

Nike and the manufacturing divisions of gigantic electronic manufacturing

services (think contract manufacturing with a twist) firms is

a lead indicator of another, the emergence of the country as a

manufacturing base. The luxury brands signal the growing prosperity

of a country, the transition of a significant number of people

from merely well-to-do to really rich. In theory, the lead indicators,

as their names suggest, come before the lag indicators, like they

did in China. In practice, and in an economy as heterogeneous

as India's, they come together, and are, along with other indicators

such as visible urban renewal, sign that an economic boom is underway.

Some Indians have always bought these brands.

Every Indian city has, and has always had, several customers who

have patronised the stores (of course, they travelled abroad)

of Bulgari, not the local jeweller, B&O, not BPL, and Tag

Heuer, not Titan. By entering the country through what all India

calls 'official channels' and by opening large and luxurious stores

in the metropolitan cities, these brands are essentially recognising

the growing importance of the domestic market, of people who do

not travel abroad, of people who travel abroad, but prefer to

shop at home, and of people who buy luxury brands because they

have been told they are luxury brands, and they are available

at 'the new outlet' at the 'neighbourhood' five-star. "Aside

from increasing disposable income, Indians are travelling overseas

more and are acutely aware of the latest fashion trends,"

says Denise Seegal, President (Sportswear), VF Corp., which recently

launched its Nautica range of apparel and accessories in association

with Arvind Brands. In truth, this is more about the disposable

income than it is about travel or fashion sense.

And

it isn't actually about the products at all, but the lifestyle

the brands imply. "Lifestyle is not something people look

at as an investment," says Raghavendra Rathore, a fashion

designer who has sported a Bulgari watch for years now. It isn't,

and thanks to growing prosperity, more people are looking at it

now. "Over the past nine years, I have seen a 15-20 per cent

growth in the luxury market across the country for branded products,"

says Anthony Rodriguez, Director (India Operations), Euro Traditions,

the company that markets and distributes Christian Dior, Givenchy,

and Versace in India, quoting from a recent report on the local

market for luxury goods that claims that 1.6 million Indian households

spend Rs 5,00,000 a year on luxury products. In math, that would

translate into a Rs 80,000-crore market. "Luxury was earlier

the preserve of only rich business families," adds Manishi

Sanwal, Brand Manager, Tag Heuer India, which has increased its

retail presence from four outlets, in December 2002, to 70, across

20 cities today. "In the past few years, Indian salaries

have grown tremendously and the hitherto untapped salaried class

can now start buying luxury products." The 'feminist' economy

is doing its bit to accelerate the trend. "The working woman

is contributing very substantially to this luxury market,"

explains Harish Bijoor, who runs an eponymous marketing consultancy,

and who puts the number of rich households in the country at six

million by 2007.

Marketers of a range of products have been

quick to catch on. 'Exclusive', 'by-invitation-only' luxury apartments

are available for sale in most large cities. Bangalore's Mantri

Developers actually selected the 12 individuals who would occupy

its 5,515 sq. ft apartments (price: Rs 3-5 crore). And strictly

middle-of-the-rung brand Levi Strauss has found that there is

a market for its Vintage Classic Wear (they start at Rs 9,000

and could cost up to Rs 11,000). It would be difficult for vendors

of other luxury products to ignore India now, says Shumone Jaya

Chatterjee, Levi's India head. That it would.

-Rahul Sachitanand, Ahona Ghosh

and Shivangi Misra

INSTAN

TIP

The fortnight's burning question.

Will racial profiling and heightened

security concerns hurt India's export prospects, either as a non-tariff

barrier or a simple logistical issue?

No. S.N. Menon,

Commerce Secretary, Government of India

The issue of exports is related primarily

to trade and measures such as racial profiling will not have any

adverse impact on India's export prospects.

No. T.S.

Vishwanath. Head, International Trade Policy, CII

Security is a sensitive issue and countries

have a right to adopt measures to secure themselves. Till date,

there is no evidence of any large-scale exporter having been affected

by racial profiling measures. Having said that, it is important

to put measures and procedures in place so that business does

not suffer.

No. Deepak

Puri, Chairman, Moser Baer

Given the global issue of terrorism, these things

will happen and what is important is to understand the cultural

issues, the rule of the land and take this in our stride. We might

have done the same if 9-11 had happened here.

-Compiled by Aman Malik

Q&A

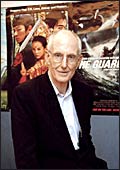

Made In India

Columbia

Tristar will produce Sanjay Leela Bhansali's Saawariya, scheduled

to be released in early 2007. Gareth

Wigan, the company's Vice Chairman, speaks to Shivani

Lath and Krishna Gopalan on

the India imperative.

Why the decision now to produce Indian

films?

Eight years ago, we developed a programme

to make films in languages other than English and countries other

than America. We are now making films in 12 countries.

What interests you most about the Indian

film industry?

The fundamental criterion for local language

for us is that there needs to be a large audience. In certain

cases, films that have been successful in their own countries

can be marketed in others.

You have started off with production.

What next? A studio?

No. Our primary business is distributing movies.

The reason we make movies is so that we have movies to distribute.

What are the things that you look for

in a film proposal?

The film will have to be popular and should

be able to attract an audience. Our job is to entertain, not teach.

Would you look at other Indian languages?

The essence is to make a movie that is profitable

in a territory. I am not aware of any other language beyond Tamil

with which that will be possible.

Political

Football

Politics behind reversal of residual stake

sale in Balco.

The

government's decision to return the payment of Rs 1,098 crore

made by Sterlite Industries for its residual 49 per cent stake

in Bharat Aluminium Company (balco) has shattered its pro-reforms

image. The procedure for the sale of the government's stake-and

the valuation process-were outlined in the shareholders agreement

signed between Sterlite and the government in 2001, when the latter

sold a 51 per cent stake in the company to the former. The agreement

also had a clause on resolving disputes through arbitration. The

deal was vetted by Parliament in March 2001. Later, in December

that year, the Supreme Court in its judgment on a public interest

litigation challenging the deal said, "...Unless any illegality

is committed in the execution of the policy or the same is contrary

to law or mala fide, a decision bringing about change cannot per

se be interfered with by the Court".

| TIMELINE |

March 1, 2001: Balco sale approved

by Parliament

March 2, 2001: Sterlite buys 51 per cent for Rs 551.50

crore

December 10, 2001: SC rejects PIL challenging sale

March 4, 2004: Sterlite exercises call option for 49

per cent residual government stake in Balco (deal was to be

done in 60 days)

May 2004 onwards: Government seeks 9 extensions to

complete the sale of residual shares

November 2005: Govt appoints valuers for 49 per cent

stake

January 2006: Valuation report submitted

July 2006: CAG questions legality of deal

August 31, 2006: Govt decides to cancel sale of residual

stake |

To reopen the case now, after five years,

hence, reeks of arbitrariness. The issue arises from comments

of the Comptroller and Auditor General (CAG) that the call and

put options, on the basis of which the residual stake was to be

sold, are ultra vires of the Companies Act. Corporate lawyer Somshekhar

Sundresan of JSA Associates, who has been involved in many disinvestment

deals, however, disputes this: "Call and put options are

not in conflict with the Companies Act." CAG further says

the valuation is low given that aluminium prices have risen over

the past two years. Says former disinvestment minister Arun Shourie,

during whose tenure the BALCO sale took place: "There has

to be finality to the contracts that the government enters into."

The same issue of contractual obligation

comes up in case of Paradeep Phosphates also. The company, which

was losing money (a lot of it), was sold to the Zuari-Maroc combine

in 2002. The new owners are now demanding refunds for misrepresentation

of facts at the time of the sale. Legal experts believe that the

demands must be examined and, if justified, should be settled

by the government.

How the drama unfolds remains to be seen,

but for now, it does seem as if political undercurrents, rather

than commercial considerations, are setting the agenda on the

issue.

-Shalini S. Dagar

PUNJAB

INDIA'S TOP STATE

|

| Consolidation: That's the buzz in the

outdoor ad world |

The

fourth annual India Today ranking of states is out, and, on the

face of it, shows little change from the rankings last year. Punjab,

Kerala, Himachal Pradesh (HP), Tamil Nadu and Haryana maintain

their positions at the top of the table on Overall Best Performance.

Andhra Pradesh, at #10, swaps places with 11th ranked Jammu &

Kashmir. This is the only change in the Top 10 list.

But the real story lies elsewhere. Madhya

Pradesh, Uttar Pradesh and Orissa, which still rank quite low

in the overall list (at #14, #17 and #18, respectively), show

the maximum acceleration, which means they are developing faster

than their higher-ranked counterparts. Another surprise: Jammu

& Kashmir is the fastest mover when it comes to wooing investments.

A Chief Ministers Conclave 2006 was held

in Delhi to mark the occasion. Representatives of HP, Tamil Nadu,

Maharashtra, Punjab, Uttaranchal, Andhra Pradesh, Orissa, Madhya

Pradesh, Haryana, Uttar Pradesh, Chhatisgarh, Kerala, Goa and

Delhi took part in the panel discussion on Centre-state relations.

President A.P.J. Abdul Kalam gave away awards and mementos, based

on these rankings, to the Chief Ministers of various states on

September 1.

-Pallavi Srivastava

|