|

| Hovering war clouds: A swift, decisive

US blitz could put an end to much of the uncertainty that's

dogged the global markets |

Richard

(Rick) R. Tynes, like most of us, doesn't like war. Yet, as the

Senior Vice Vice President (Asia Pacific) of global money transfer

major, Western Union, reveals, previous wars gave his company an

opportunity to do "very good things in very bad times."

At the height of the Bosnian conflict, for instance, Western Union

was the only company to bring money into that country, explains

Tynes.

Tynes, to be sure, isn't looking for similar

"bad times" in Iraq to do some more "very good things''.

Yet, even as US President George W. Bush continues to brandish his

sabre and Iraq President Saddam Hussein remains unfazed by the incessant

rattle, a war may indeed be a good thing. That's because currently

it's just threat of war that's resulting in pretty bad times: Stock

prices are stagnating, oil prices are zooming, and consumer confidence

is ambivalent, just when it was threatening to improve. "Nobody

likes uncertainty, especially the stockmarkets," says Nimesh

Kampani, Chairman, JM Morgan Stanley.

So if Bush is able to assert himself quickly on the battlefield--in

say 10-12 days-that would take care of (amongst other things) the

cloud of uncertainty hovering over global markets. Stocks are unlikely

to crash since a war is already factored into current prices, oil

prices will fall into saner territory, and investment decisions

that have been deferred because of the uncertainty will be taken.

"A short war that's localised will be good, and won't have

much of an impact," reckons Rajiv Chopra, Managing Director,

The Resort, a Mumbai hotel that's part of the C. Raheja Group. For

Chopra, the threat of war is an irritant he could do without at

a time when occupancy levels are healthy (80 per cent upwards) and

expansion and development plans are in the pipeline.

Of course, if a short war could be beneficial,

a long-drawn conflict would be disastrous--not just for the recession-struck

US economy, but for Indian industry too. Consider just one sector:

Industrial electricals and electronics, which boasts such players

as BHEL, L&T, GE, Alsthom and abb. "We have a considerable

stake in that region (the Gulf), all of which will get affected

if there's a long war. Investments there will stop, so there won't

be new orders for some time, and there will be a lag in executing

existing orders," points out Sunil More, Secretary General,

Indian Electrical & Electronics Manufacturers' Association (IEEMA).

He adds that in two years, the Middle East was projected to account

for 50 per cent of the IEEMA's exports of Rs 3,000 crore.

If there's one sector that is actually benefiting

from the threat of war, it's shipping. As crude oil inventories

build up, along with the oil prices freight rates too are heading

northward. For instance, the average freight rate for a very large

modern crude carrier more than doubled from $35,000 per day in 2001

to $72,000 last month. "This is an artificial spurt largely

created by the war-like situation. These prices will fall if the

war isn't a long one," says H.K. Mittal, Chairman & Managing

Director, Mercator Lines. The shipping sector won't be celebrating

a short war too much, but almost everybody else will for sure.

-Brian Carvalho

SPARK

Got A Light, Anyone?

ITC has. Here's how the behemoth entered the

Rs 800-crore matchbox market, at little cost to itself.

It's as efficient

a business model as you can get: Tobacco major ITC feeds small-scale

match factories in Tamil Nadu with paperboard from its Bhadrachalam

plant and labels from its printing division. And it sells the seven

brands-yes it has that many-at prices ranging from 50 paise to Rs

3 through a 4-million strong retail network that it uses to sell

cigarettes. ''We have just around 8-10 dedicated employees," says

Rajeev Gopal, Chief Executive, Matches Strategic Business Unit.

And that's itc's strategy to take on the Rs 179- crore Wimco, the

only organised player in the matches industry. Numbers? ITC isn't

saying anything but analysts estimate its matches business to touch

the Rs 100-crore (sales) mark by the end of this year. Now, what

did the company wait this long to enter the business?

-Shailesh Dobhal

MUNIFICENCE

Three-Letter Rescue

It's called CDR and it is a handout with strings

attached.

|

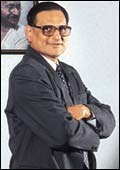

| IDBI's P.P. Vora: Playing Father Christmas |

''The whole purpose is accountability and

the proper implementation of the plans for which the money was borrowed

in the first place. The overruns have assumed alarming proportions

and it is time to bring in some discipline."

P.P. Vora, Chairman, IDBI and Head, Corporate Debt Restructuring

Forum

"The proposals are balanced and should

help the companies effect a turnaround. There are some tough clauses

in case there are defaults, but that is only to be expected."

S.K. Gupta, Managing Director, Jindal Vijaynagar Steel

Lenders and borrowers

aren't supposed to mouth the sort of win-win lines that the two

gentlemen quoted above have done. Not unless the deal they've struck

is as fair as fair can be. Or not unless one of the interested parties,

in this case the lenders, is actually presenting a brave face in

the wake of a decision that will really not change things. The decision

of the Corporate Debt Restructuring (CDR) Forum, chaired by IDBI

Chairman P.P. Vora to create two revival packages, one for the steel

industry, aimed at preventing the default on some Rs 5,500 crore

of debt on the books of steel projects started in the 1990s, and

another, a Rs 750-crore one seeking to prevent a default on loans

of around Rs 1,000 crore by Spic Petro, works both ways. The revival

in the steel industry, coupled with the package's efforts to make

each of the ailing companies-Essar Steel, Ispat, and Jindal Vijaynagar

are the biggest beneficiaries-competitive by aligning interest costs

to existing rates makes it look like a fair deal. The companies

turn profitable, and the lenders don't have to watch their debts

degenerate into non-performing assets. However, the CDR Forum, has

steered clear of changing the management teams of these companies,

teams that some analysts believe are responsible for the state of

affairs. And while the steel bailout took the form of an industry-wide

package, Spic managed to wrangle a unique one-off deal. That said,

the project's geographical location-in the South where there aren't

too many petrochemical plants-does bestow it with some advantages.

Maybe, things will be different this time around. ''We have to deliver

now, or it may be too late,'' says Vinod K. Mittal, Managing Director,

Ispat Industries. We agree.

-Debojyoti Chatterjee

MARQUE

Chevy Chase

General Motors brings its mass-market

brand, the Chevrolet, to India.

When your grandfather's

generation wanted to make a statement, it went out and bought itself

a Chevrolet. That may no longer happen, but gm is hoping that it

can cash in on the equity Chevy once had in India. How else do you

explain the fact that while gm has announced the launch of Chevrolet

in India, it will be months before the car hits the road. Or the

fact that the legendary bow-tie emblem may actually hide a Subaru

or Daewoo (other gm brands) underneath? GMI's CEO Aditya Vij wouldn't

give any details except to say that it will target the mass market.

The Chevy is no greenhorn when it comes to competition. Its 490

(named so to reflect its dollar price) was launched in 1915 as an

answer to Ford's Model T and by 1917, it had sold more than a 100,000

units. All that Vij has to do now is to pray for an encore.

-Suveen K. Sinha

|