|

India

Inc. has a cold and it shows in the financial results for the July-September

quarter. Aggregate net profit (for the 485 companies that had declared

results till October 28) is up by 16 per cent, the lowest growth

in the past nine quarters. This figure (16 per cent) is also lower

than the growth in aggregate revenues (21.6 per cent), again for

the first time in nine quarters. Finally, the aggregate net profit

margin for the companies has decreased from 9.32 per cent in the

July-September quarter of 2003 to 8.88 per cent in the July-September

quarter of 2004. More worryingly, the aggregate operating profit

margin has declined from 24.3 per cent to 22.1 per cent. As the

trendlines show, the momentum definitely points to the South.

Should we-that term encompasses anyone with

an interest in corporate performance, CEOs, other executives, analysts,

brokers, investors, economists and assorted busybodies-be worried?

That depends on the reasons behind India Inc.'s performance.

The main reason, spiralling commodity prices,

is evident in the results of companies in this business. Gujarat

Ambuja Cements, for instance, grew its revenues for the July-September

quarter by 59 per cent as compared to 1 per cent in the same quarter

last year. That trend, says Anil Singhvi, Executive Director, Gujarat

Ambuja Cement, will continue (he dismisses the recent fall in cement

prices as an aberration that will soon correct itself). "Demand

in October has grown by 15 per cent (year-on-year)," he adds.

That, growing demand, is

the silver lining for companies in downstream industries that have

been affected by an increase in commodity prices. "With the

underlying demand still there, companies have been able to partially

pass on the higher costs," says Jamshed Desai, Head of Research,

IL&Fs Investsmart. The result? Slimmer profit margins.

Then, there is the oil effect. Although the

government's effort at administering oil prices has helped, most

companies are feeling the heat. "The paints industry has been

affected by the increase in the price of crude oil," says Ashwin

Dani, Vice Chairman and Managing Director, Asian Paints. "Margins

have been under pressure for some time." The government's approach

has meant different things for different companies in the oil business

itself. "Normally, when oil prices go up sharply, refining

margins shrink," explains Tridib Pathak, CIO, Chola Mutual

Fund. "However, because of the high demand this time, the prices

of (downstream) products has grown faster than that of crude; so,

refining margins have gone up drastically."

That explains why pure refining companies such

as Chennai Petroleum (its net for the quarter has increased by 174

per cent) have benefited while marketing companies such as Bharat

Petroleum (its net profit has dipped by 54 per cent) are feeling

the pain.

Finally, the base effect (read: their own superior

performance in past quarters) seems to have caught up with companies,

with only the software services companies displaying gravity-defying

abilities. "There is a good business momentum across our businesses

and we are confident on our long term prospects," says Suresh

Senapathy, Corporate VP (Finance), Wipro.

All three reasons-the base effect, increasing

input cost, and spiralling oil prices-are beyond the control of

companies, although smart ones can mitigate the impact through effective

hedging strategies. A linear trend line analysis of aggregate sales

and profit after tax indicates that India Inc. is likely to grow

both, although far slower than it did in the past nine quarters.

With their operations as efficient as they are ever likely to be,

India Inc. can rest easy for now. It only remains to be seen whether

companies can cope with the not-now-but-definitely-coming hike in

interest rates.

-By Narendra Nathan

SECOND

The Bigger, The Better

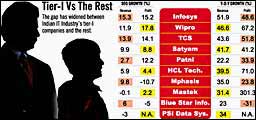

The gap between the men and the boys in the

software industry grows.

Bigger

is definitely better in the Indian software services domain. Heavyweights

such as Infosys, Wipro and TCS have grown their sales (sequentially,

and for the quarter ended September) by between 12 per cent and

14 per cent; the others haven't fared as well. Mumbai-based Mastek

has seen no growth at all; Mphasis-bfl has grown by 10 per cent,

but largely on the strength of an acquisition (Kshema Technologies)

and increased activity in its business process outsourcing business;

HCL Technologies has grown its revenues by 6 per cent and Patni

by less than 3 per cent; and the Aditya Birla Group's PSI Data Systems

actually saw its revenues decline 3 per cent. Even in terms of year-on-year

growth (see Tier-I Vs The Rest), Indian software's first tier has

performed far better than the rest: a growth in revenues of anything

between 40 per cent and 52 per cent. "The market for offshore

it services has been completely taken over by the top-tier,"

says Upinder Zutshi, coo, Infinite Computer Solutions, an unlisted

Rs 330-crore company based in the us and India. "The only way

to survive is to adopt completely different strategies." "Clients

prefer to work with large companies that have the capability to

offer end-to-end solutions," adds Kris Gopalakrishnan, coo

and Deputy Managing Director, Infosys Technologies. While some companies

are trying out the "different strategies" Zutshi mentions-Mphasis,

for instance, is trying to offer integrated BPO plus it services-others

are hopeful that the future will be better. "The recovery of

the it sector has not happened in full," says Ashank Desai,

Chairman, Mastek. "Demand is just starting to pick up and the

larger companies have ended up bagging the big projects, but I expect

the pie to grow over time." Bigger

is definitely better in the Indian software services domain. Heavyweights

such as Infosys, Wipro and TCS have grown their sales (sequentially,

and for the quarter ended September) by between 12 per cent and

14 per cent; the others haven't fared as well. Mumbai-based Mastek

has seen no growth at all; Mphasis-bfl has grown by 10 per cent,

but largely on the strength of an acquisition (Kshema Technologies)

and increased activity in its business process outsourcing business;

HCL Technologies has grown its revenues by 6 per cent and Patni

by less than 3 per cent; and the Aditya Birla Group's PSI Data Systems

actually saw its revenues decline 3 per cent. Even in terms of year-on-year

growth (see Tier-I Vs The Rest), Indian software's first tier has

performed far better than the rest: a growth in revenues of anything

between 40 per cent and 52 per cent. "The market for offshore

it services has been completely taken over by the top-tier,"

says Upinder Zutshi, coo, Infinite Computer Solutions, an unlisted

Rs 330-crore company based in the us and India. "The only way

to survive is to adopt completely different strategies." "Clients

prefer to work with large companies that have the capability to

offer end-to-end solutions," adds Kris Gopalakrishnan, coo

and Deputy Managing Director, Infosys Technologies. While some companies

are trying out the "different strategies" Zutshi mentions-Mphasis,

for instance, is trying to offer integrated BPO plus it services-others

are hopeful that the future will be better. "The recovery of

the it sector has not happened in full," says Ashank Desai,

Chairman, Mastek. "Demand is just starting to pick up and the

larger companies have ended up bagging the big projects, but I expect

the pie to grow over time."

That it could, although it is increasingly

becoming evident that Indian software's first and second tiers are

no longer operating in the same market. "My personal view is

that the story is not over for tier-II companies," says K.R.

Laxminarayana, Corporate Treasurer, Wipro. "They are not really

competing in the same market and many have special offerings that

will see continuing demand." But with biggies Infosys, Wipro

and TCS eyeing even profitable niches, no business model is safe.

-Priya Srinivasan

BRIC

Redux

|

|

| Goldman Sachs' Roopa Purushothaman:

BRIC-a-brac collector |

A

year ago Roopa Purushothaman, associate Global

Economist, Goldman Sachs, co-authored a paper on how the world might

change if the BRIC (Brazil, Russia, India and China) economies continued

to grow. Now, in Global Economics Paper No. 118, Purushothaman explores

what these projections would mean to world growth in general and

three markets, crude, cars and capital, in particular. Roshni

Jayakar speaks to the London-based economist.

You have revisited the original report after

a year. Are you comfortable with the original projections?

Yes. The BRICs projections are our best guess

about long-term trends, given the basic building blocks for the

economy.

Why did you take just three markets to gauge

the opportunities associated with the BRIC dream?

We took three important areas of market development-commodities,

consumer durables and capital markets-to illustrate an approach

that could be used to look at the market impact, stemming from our

original projections. Within these broad areas, we focussed on signature

sectors.

So, how do the BRIC countries impact the

global markets in these three areas?

They could see their largest impact on commodity

markets first, followed by consumer durables markets and finally,

on global capital markets. India's peak occurs later than the other

countries. Broadly speaking, Russia is a 'sleeper' story for consumer

spending, while China is the dominant force for commodities now.

India could move into similar roles in about 10-15 years if growth

continues.

Is the Indian growth story a long-term one?

Two main factors underlie India's sustained

growth potential: the scope for it to catch up with developed economies

and its very favourable demographics. These factors are, of course,

not new, and India bulls have been disappointed in the past. Raising

productivity has everything to do with strengthening the conditions

for growth we laid out in our first paper: maintaining stable macro

policy, strengthening political institutions, and increasing education

levels and openness.

Limited

Progress

Still, the UPA government has more to show on

the FDI front than critics thought possible.

Consider

this: the United Progressive Alliance (UPA) government has managed

to hike the ceiling on foreign direct investment (FID) in domestic

airlines from the existing 40 per cent to 49 per cent, managed to

allow a marginal increase in the FDI ceiling in private banks to

30 per cent, and is working hard to allay the fears of the communist

parties (the Left) regarding foreign investment in telecom. Doing

the same in insurance is still a no-no; then, who would have thought

all this possible (also see Left In The Lurch, on page 40). Indeed,

the sectoral ceilings have changed enough to warrant a new primer

(this item).

Suitably enough, FDI has been pouring in. In the first four months

of this year (April-July), as much as $1.44 billion (Rs 6,624 crore)

has flown into the country, nearly 169 per cent more than the corresponding

FDI last year. The India story, it would seem, is still alive and

kicking.

-Ashish Gupta

|