|

In 2006-07, foreign direct

investment (FDI) into India tripled to $16 billion (Rs 67,200

crore) and nearly half (48.5 per cent) of it came from us companies.

This, argues Pamela Parizek, Director, KPMG, Washington (above),

is justification enough for Indian companies listed on us exchanges

or doing business there, to comply with the provisions of the

Foreign Corrupt Practice Act (FCPA), a US law. "FCPA seeks

to place us companies operating in foreign countries and foreign

companies listed on us exchanges or operating there on a level

playing field with respect to compliance issues," says Parizek,

who was in India recently to "educate Indian business leaders

on the importance of compliance".

The anti-bribery provisions of FCPA prohibit "us persons"

from paying or offering to pay "anything of value to any

foreign official" with the "corrupt purpose" of

obtaining business. The penalties for violating the FCPA's anti-bribery

prohibitions are potentially severe. Both companies and individuals

indulging in corrupt practices will be subject to civil fines.

Other potential penalties include disqualification from us government

contracts and denial of export licences. "I have been interacting

with CEOs and CFOs of various Indian companies and have got the

impression that they all follow very stringent codes of ethics

and have checks and balances in place," she says, adding

that while many of them prohibit their own employees from bribing

government officials, they sometimes hire agents to do so. "This,

too, violates FCPA norms," she says.

Strict norms, but that's the price that companies have to pay

for enjoying the benefits of globalisation.

-Aman Malik

Pharma

Outsourcing to Grow Seven-fold

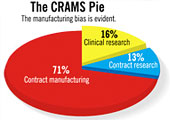

The

dynamics of the global pharma and life sciences industry continue

to favour outsourcing of research and manufacturing, and India

is one of the preferred low-cost destinations for this. India's

contract research and manufacturing services (crams) market was

valued at $895.44 million (Rs 4,029 crore) in 2006, a growth of

43 per cent over the previous year, says a study by Frost &

Sullivan, which expects the market to grow 33-34 per cent annually

on average to reach $6.6 billion (Rs 27,720 crore) by 2013. crams,

which has been contributing close to 8 per cent to the Indian

pharmaceutical industry's revenues, comprises contract research,

clinical research and contract manufacturing. The

dynamics of the global pharma and life sciences industry continue

to favour outsourcing of research and manufacturing, and India

is one of the preferred low-cost destinations for this. India's

contract research and manufacturing services (crams) market was

valued at $895.44 million (Rs 4,029 crore) in 2006, a growth of

43 per cent over the previous year, says a study by Frost &

Sullivan, which expects the market to grow 33-34 per cent annually

on average to reach $6.6 billion (Rs 27,720 crore) by 2013. crams,

which has been contributing close to 8 per cent to the Indian

pharmaceutical industry's revenues, comprises contract research,

clinical research and contract manufacturing.

"Indian contract manufacturers have traditionally been

strong in making active pharmaceutical ingredients (APIs) and

formulations. Now, we are seeing them developing competencies

in making oral solids and injectibles. This is a move up the value

chain," says Mahesh Sawant, Programme Manager (Healthcare

Practice), Frost & Sullivan. The study also points to India's

growing biology-based skills as opposed to chemistry-based capabilities.

In the clinical research space, which makes up 16 per cent of

the crams market (revenues: $143 million or Rs 600 crore), Indian

players have mostly been offering clinical trial facilities (mainly

bio-availability and bio-equivalence studies) to their foreign

clients, the market for which is set to grow "exponentially".

Despite greater business opportunities, not everyone is excited

about clinical trials and toxicology studies.

N. Raghuram, Professor of Biotechnology at Delhi's GGS Indraprastha

University, says: "Foreign drugmakers are outsourcing clinical

trials to India mainly because costs and compliance issues are

becoming prohibitive for them in the West. In India, however,

our capacity for complying with safeguards is very low, which

is a cause for concern." Sawant counters this saying that

most clinical trials outsourced to India are beyond the stage

where they can be a threat to the health of volunteers. In the

contract research arena (mostly pre-clinical R&D), whose revenues

were $116 million (Rs 522 crore) in 2006, the study sees chemistry-based

services continuing to drive business. Most common therapeutic

segments outsourced to India are oncology, infection control,

endocrinology and psychiatry.

-Kapil Bajaj

Realty

Stars

It's now the turn of real estate

companies to jump onto the celebrity endorsement bandwagon. Leading

realtors have roped in Amitabh Bachchan, Shah Rukh Khan, Rahul

Dravid, Ustad Amjad Ali Khan and several other stars to sell realty

dreams to India's consuming classes. The rationale: even a utilitarian

product like housing needs crutches. "It's unfair to single

out realty companies. Even a soap like Lux, which is as necessary

as a house, has been using celebrities to its advantage,"

argues Prabhakar Mundkur, COO, Percept H, the creative agency

behind DLF's Shah Rukh Khan commercial.

But Madhukar Kamath, Managing Director and CEO, Mudra Group,

dubs it a ridiculous idea. "It's probably to hide the lack

of product differentiation in real estate that celebrities are

being used." But what started as a niche has now become mainstream,

negating the very purpose for which these highly paid endorsers

are hired. So, it's back to square one.

-Tejeesh N.S. Behl

|

The

dynamics of the global pharma and life sciences industry continue

to favour outsourcing of research and manufacturing, and India

is one of the preferred low-cost destinations for this. India's

contract research and manufacturing services (crams) market was

valued at $895.44 million (Rs 4,029 crore) in 2006, a growth of

43 per cent over the previous year, says a study by Frost &

Sullivan, which expects the market to grow 33-34 per cent annually

on average to reach $6.6 billion (Rs 27,720 crore) by 2013. crams,

which has been contributing close to 8 per cent to the Indian

pharmaceutical industry's revenues, comprises contract research,

clinical research and contract manufacturing.

The

dynamics of the global pharma and life sciences industry continue

to favour outsourcing of research and manufacturing, and India

is one of the preferred low-cost destinations for this. India's

contract research and manufacturing services (crams) market was

valued at $895.44 million (Rs 4,029 crore) in 2006, a growth of

43 per cent over the previous year, says a study by Frost &

Sullivan, which expects the market to grow 33-34 per cent annually

on average to reach $6.6 billion (Rs 27,720 crore) by 2013. crams,

which has been contributing close to 8 per cent to the Indian

pharmaceutical industry's revenues, comprises contract research,

clinical research and contract manufacturing.