|

|

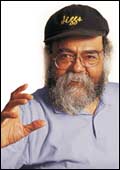

| MTR Foods' CMD P. Sadananda Maiya (L) with

CEO & Executive Director J. Suresh: Trying out a new

recipe |

TAKE A RESTAURANT

In

the beginning was the restaurant. and what a restaurant it was (and

still is). A chief minister once stood in a queue to have a go at

its fabled masala-dosa (rice pancake with a stuffing of potatoes

and onions); a Bollywood showman would spend at least half an hour

in it every time he visited Bangalore, focusing exclusively on the

coffee, five or six cups of it (pure filter coffee as people in

the southern part of the country call it); and the best pace bowler

to come out of India since Kapil Dev-he goes by the tag, The Mysore

Express-is still a regular.

Mavalli Tiffin Rooms is its name, although

people like to refer to it as mtr; and its only outlet-mtr shut

its lone branch in the Infosys campus in Bangalore's Electronics

City recently-is in a nondescript single-storey building opposite

one entrance to the city's best-known park, Lalbagh.

Even today, a queue of 50-odd waits patiently

for the restaurant to open for business. This article isn't about

breakfast at mtr, but it does have something to do with the experience.

...ADD A DASH OF EMERGENCY STIMULATED INNOVATION

If Parampalli Sadananda

Maiya's mtr is more than just a restaurant, he has the Emergency-22

months between June 25, 1975 and February 3, 1977-to thank for it.

mtr's dosas come with a liberal daub of clarified butter. It may

be bad for the heart, but sure is good for the tastebuds.

MTR COULD

SPICE THINGS UP... |

» Its

brand equity isn't something to be sneezed at

» It has

managed to hire a more pro-than pro CEO

» Its portfolio

spans southern and northern cuisines

» It has

proven manufacturing and technological capabilities |

...BUT IT

RISKS FALLING FLAT? |

» Its

North Indian cuisine offerings could fail to tickle the taste

buds

» It continues

to be seen as a South Indian company

» Competing

with the unorganized sector won't be easy

» Distribution

in northern and western markets continues to be a problem |

At the height of Emergency, the government fixed

the price of a dosa at 50 paise. The cost of the butter that went

into each mtr dosa was itself 50 paise (each was priced at Rs 1.50).

''We had to either compromise on quality or shut down,'' recalls

Maiya. mtr decided to close shop, and remained closed between May

and December 1976.

Retrenchment didn't figure in the vocabulary

of the Maiyas who favoured a paternal management style.

So, with no small amount of reluctance, mtr

branched out into processed ready-to-cook foods-these didn't come

under the price control regime. The first product, ready-to-cook

Rava Idly (steamed broken wheat dumplings), did famously well and

soon the mtr gravy train was chugging along.

More ready-to-cook foods (termed instant food

mixes in Indian English), pickles, and spice powders dotted the

Mavalli Express' progress.

In 1996, Maiya hived off mtr Foods as a separate

entity; the restaurant is wholly-owned by the family and managed

by Hemamalini Maiya and Vikram Maiya, Maiya's niece and nephew.

''We just wanted to find work for our staff,'' chuckles Maiya. ''We

never thought we'd become the leading processed foods brand in the

country.''

...STEW IN THE PRESSURE-COOKER ENVIRONMENT

OF A BOOMING MARKET

mtr Foods may be a Rs 87 crore company today,

but it operates in the Rs 10,000 crore processed foods market-the

unorganised sector accounts for close to 80 per cent of this.

The market, as one would expect in a country

as vast and varied as India, is fragmented; there aren't many brands

that can stake claim to a pan Indian audience; and the term processed

foods spans everything from Everest chilli powder to Bambino Vermicelli

to Kitchens of India Chicken Chettinad.

Processed foods are largely an urban phenomenon

and companies such as mtr Foods, Tasty Bite Eatables, and itc (with

its Kitchens of India offerings) are essentially targeting the urban

double-income household with money to spare, but no time to cook.

That's a tremendous opportunity. ''With an

increase in the number of nuclear families where both husband and

wife work, the demand for ready-to-cook and ready-to-eat foods has

increased dramatically,'' says Ravi Nigam, President, Tasty Bite

Eatables.

|

"We are working on getting the

taste for the North Indian recipes right.

MTR's North Indian offerings will definitely taste authentic."

Jiggs Kalra, Food

Expert |

Maiya knows this is true-''Per capita spend

on food is still 40 per cent of total income; our aim is to capture

a significant portion of this''-and that could explain his decision

to divest some equity and hire a professional manager.

...COOL AND ADD A SPRINKLING OF FOREIGN

INVESTMENT

Growth is good but it hurts and Maiya is no

stranger to the pain.

He knows that for mtr Foods to become a Rs

1,000 crore company by 2007-that's his articulated objective-it

needs to institute systems and processes.

He knows that the company needs to invest in

marketing (and in marketing pros).

Anil Ahuja, the ceo of JP Morgan Partners,

had been following mtr's dream run-his personal favourite is the

company's instant rasam powder-and when, in August 2001, a friend

mentioned that the company was actively wooing investment, he got

on the phone with Maiya. ''mtr is the only player that straddled

the entire processed foods market,'' gushes Ahuja, whose initial

call to Maiya recently translated into a 29.91 per cent stake for

Rs 19.2 crore in the company.

Money isn't the only thing JP Morgan has invested

in mtr Foods. ''We bring a degree of professionalism, expertise

in accounting and legal practices, and provide access to funds,''

says Ahuja.

Maiya plans to use the money to retire some

high-cost debt and fund a marketing onslaught. And that's where

a certain Jayaraman Suresh comes in.

...SEASON WITH A SINGLE CEO AND SERVE

Morgan also helped Maiya poach J. Suresh, formerly

head of Hindustan Lever Limited's Rs 1,800-crore beverages business.

The new ceo, a 17-year-veteran of hll, may

be a few hours old in his job when he meets with this writer, but

he pushes all the right buttons. ''I grew up with hll, but this

was a once-in-a-lifetime opportunity to build a pan Indian food

brand.''

Maiya understands the value his new ceo will

bring to the company. ''His understanding of the market and his

ability to work out the logistics is a tremendous advantage.''

A owner-manager clash is unlikely (although,

who knows?): Maiya will look after the production and r&d functions;

Suresh, sales and marketing.

There's enough to do on both fronts. Suresh

plans to increase mtr's reach to 12 states from the five where its

products are currently available.

And Maiya's fascination with the micro aspect

of recipes makes him an ideal production and r&d man.

An electrical engineer by training, he is equally

at home rattling of the names and proportions of the nine spices

that go into sambhar powder, sharing trivia about how chillies ground

in December have a high oil content and are dark red in colour,

while those ground in August have lower oil content and are not

so dark.

Tarry a trifle longer, and he is apt to tell

you when this oil will evaporate-at 17 degrees for the December

chillies and 12, for the August ones.

What's r&d doing in a foods company? Well,

last year mtr spent close to 2 per cent of its turnover on research,

and way back in 1998 it developed, in association with Defence Food

Research Laboratories, the foil-pouch packaging that's now become

the industry standard for ready-to-eat foods.

...BUT THERE ARE OTHER RECIPES THAT COULD

TASTE AS WELL

It's easy

being a Rs 87-crore company in a market dominated by the unorganized

sector; it's a totally different ball game being a Rs 1,000-crore

company-even if Maiya gives the process five years.

More importantly, mtr does face competition

in every area in which it operates. In vermicelli, it is Bambino;

in spices it is heavyweights Everest, mdh, Asoka; in ready-to-cook

foods and it is Gits, Orkay, Vasu; and in ready-to-eat foods it

is Tasty Bite and itc.

And oh, yes, there is a host of smaller companies

in each business. Tasty Bite's Ravi Nigam believes there is space

for all existing players and more but adds that the recipes for

mtr's North Indian offerings could do with a little tweaking. ''mtr

has tremendous brand equity but the market is sufficiently big for

everyone.''

mtr is conscious of its shortcomings; it has

hired foodie Jiggs Kalra to rejig the recipes for its North Indian

offerings. ''We are working on getting the taste for the North Indian

recipes right," says Kalra, who is a recognised authority on

North Indian cuisine. ''Given my understanding of the North Indian

dishes, mtr's North Indian offerings will definitely taste authentic.''

...BURP

JP Morgan believes Maiya's Rs 1,000-crore target

is achievable (of course it does, silly; why else would it take

a stake in the company?). "Even if they continue to grow at

the same pace as they have grown at over the past three years, this

should be possible," says Ahuja who is tipped to join the board

of mtr Foods. Ahuja also hints at acquisitions-if the fit is right.

Growth could also come from exports-a mere

7.8 crore or 9 per cent of turnover last year, but slated to go

up to Rs 250 crore by 2007, purely on the strength of targeting

the Indian diaspora.

''We'll be putting out best food forward,''

puns the rotund Maiya, on a high after the Morgan investment and

the hiring of Suresh. Will the customer bite?

|