|

| HDFC Bank's Puri: He has kept the ball

rolling |

In

mid-1994, when economic liberalisation, as we know it today, was

a gleam in Manmohan Singh's eye, somewhere in the Far East, the

Head of Citibank Malaysia made a rather strange decision: Even

as his banker buddies laughed at him, he began blueprinting a

plan to set up a full-fledged private bank in India, an opportunity

that had just opened up in a market dominated by the sheer physical

presence and reach of public sector banks and the pinstriped haughtiness

of their foreign counterparts. Even more bizarrely, the Citibanker

decided to locate his headquarters in a grimy mill in the distinctly

downmarket area of Lower Parel in central Mumbai. Having done

that, he went about the unenviable task of trying to persuade

people to work for him out of the mill. He succeeded in recruiting

a snug team, but the rats and cockroaches crawling out at night

wouldn't have boosted the confidence of most of the new recruits

as they went about blueprinting a strategy for the new bank.

The ex-Citibanker in question is of course

Aditya Puri, the bank is HDFC Bank, the location of the headquarters

is still Lower Parel, but instead of a dusty mill, it's a spanking

new building with a glass façade. And the strategy that

was on the drawing board in 1994, has translated into results.

And how! If HDFC Bank tops the list of India's Best Banks in this

year's BT-KPMG study, it's for a variety of reasons. These range

from low deposit costs, to high interest spreads, to a healthy

interest margin (despite declining asset yields), to a low level

of non-performing assets (NPAs).

WHAT MAKES

HDFC BANK THE BEST |

»

Deposit costs are amongst the lowest at 3.2 per

cent

» Healthy

interest margin at 3.9 per cent, despite declining asset yields

» Net

NPAs at 0.22 per cent are amongst the lowest in the industry

» One

of the highest interest spreads, at 3.20 per cent

» Leading

player in third-party distribution like MFs and life policies

» Top

three positioning in most major products in target segment

» Enjoys

high price-earning multiple in the capital market |

So, how did a motley bunch of low-profile

bankers go about building from scratch one of India's most respected

and best performing banks over the past decade (and somewhere

down the line the bank got listed on the New York Stock Exchange

in July 2001)? The way Puri saw it way back in the mid-90s, crucial

to HDFC Bank's success would be a right mix of talent that would

be able to give his bank a much-needed public sector feeling along

with the refined customer culture of the foreign banks. You have

to remember that when HDFC Bank started up, the state-owned banks

ruled the roost in mobilising low-cost deposits, and offering

advances to almost the entire corporate sector. What's more, those

days the PSU banks had the branch reach, rupee resources and enduring

customer relationships (they still do, but today they aren't the

only ones); the foreign banks for their part boasted premium products

and services. "We decided to have the best of both. We adopted

the fund-raising capability of PSU banks and the service culture

of foreign banks," says the 56-year-old Puri, sitting in

his corner room, which is conspicuous by the absence of a pc (Puri

doesn't carry a mobile phone too).

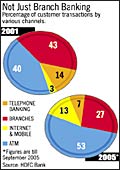

There's

rich irony in that detail, when you consider what's really worked

in Puri's favour is the dramatic change in the Indian banking

landscape since the late 90s. As telcommunications and information

technology converged, Indian banks suddenly found themselves at

the front door of limitless possibilities. "Suddenly geography

and large capital became irrelevant and with outsourcing taking

off, banks found a great way to become more efficient," says

Puri. There's

rich irony in that detail, when you consider what's really worked

in Puri's favour is the dramatic change in the Indian banking

landscape since the late 90s. As telcommunications and information

technology converged, Indian banks suddenly found themselves at

the front door of limitless possibilities. "Suddenly geography

and large capital became irrelevant and with outsourcing taking

off, banks found a great way to become more efficient," says

Puri.

Those opportunities and efficiencies are

amply evident in the bank's showing over the past decade. Since

inception, HDFC Bank has emerged the country's second largest

private sector bank, growing at a breakneck speed of 25-30 per

cent annually. It closed fiscal 2005, with revenues of Rs 2,230

crore, net profits of Rs 665 crore and reserves of Rs 4,200 crore.

It's maintained that momentum in the first half of the ongoing

year, with both topline as well as bottom line growing at 30 per

cent. The balance sheet size has touched Rs 67,623 crore as of

December 2005, with a total deposit base of Rs 51,195 crore.

The pace of growth may be uniform, but that

doesn't mean HDFC Bank has been following the same strategy all

along since inception. In fact, initially the game plan was to

raise low-cost deposits and deploy them with large triple A-rate

corporates. Then the Indian consumer came on the scene. "Corporate

lending was a high margin business then, but we slowly moved to

other businesses, especially the retail segment," points

out Puri. Today, HDFC Bank services over 8 million customers,

and operates from 535-odd branches in 228 cities. Some 1,326 ATMs

offers anytime, anywhere banking. And net banking as well as mobile

banking are available for upwardly mobile customers.

|

"Our corporate banking segment

is growing at over 30 per cent with leadership amongst the

private banks in products like cash management, supply chain

financing and treasury"

Samir Bhatia

Country Head/

Corporate Banking |

In true champion style, HDFC Bank figures

amongst the top three in most of the vital product segments, right

from auto loans, personal loans and credit cards, to commodities,

foreign exchange and cash management. Comparisons with peers is

inevitable, and on the interest spread front, for instance, HDFC

Bank is right up there with a spread of 3.20 per cent; ICICI Bank

has an interest spread of 1.80 per cent. The bank's net NPAs as

a percentage of advances, at 0.22 per cent in March 2005, are

the lowest in the industry. The capital adequacy ratio is very

much in the comfort zone at 12.16 per cent.

It's been a fantastic ride so far for HDFC

Bank, and it can only get better, what with the economy growing

at over 7 per cent, 64 per cent of the country's GDP being consumption-based

and most of those consumers under 30. "Now is the best time

for the banks," grins Puri. "If I ask god to give me

a better market than this, probably even he would find it difficult."

With a chunk of the consumption happening outside the main metros,

HDFC Bank is aggressively targeting towns and mini-cities. For

instance, close to half of its two-wheeler and car business comes

from the non-metros. As Puri sees it, the challenge is not to

create a market but to reach it. As he points out, two-thirds

of India's population has yet to partake of the good times. Sensing

the huge potential, the bank is ready with products for the masses

like jewellery loans, loans to shopkeepers, restaurants, warehouses,

cold storages and other small establishments in the non-metro

areas.

Puri points out that a large portion of India's

savings is not coming into the banking system. Much of that chunk

of savings is caught up in unproductive areas. "We are providing

liquidity against jewellery in semi-urban and rural areas,"

adds the Chief Executive Officer. Puri also sees plenty of business

coming from the agricultural hinterlands, which is why HDFC bank

has launched its Kisan Gold Card for crop loans, and has ventured

into equipment financing. Farmers are also being targeted for

other loans. As Puri, who plans to take the Kisan Gold Card all

over India, says: "We are trying to meet his (the farmer's)

every need."

On

the distribution side, the bank is tying up with post offices

and cooperative banks to sell financial products in the urban

and semi-urban areas. HDFC Bank also has plans to flag off a non-banking

financial company (NBFC) to sell small-ticket loans upcountry. On

the distribution side, the bank is tying up with post offices

and cooperative banks to sell financial products in the urban

and semi-urban areas. HDFC Bank also has plans to flag off a non-banking

financial company (NBFC) to sell small-ticket loans upcountry.

|

| Cash in hand: With 1,326 ATMs, it's

definitely anytime, anywhere banking |

The focus on retail and the non-metros doesn't

mean that corporate banking is getting short shrift at HDFC Bank.

As Samir Bhatia, Country Head (Corporate

Banking), explains: "Our corporate banking segment is growing

at over 30 per cent with leadership amongst the private banks

in products like cash management, supply chain financing and treasury."

With regard to future growth, Puri isn't too kicked about the

inorganic route-"it would be nice, but is not a necessity",

is how he puts it-but he has plans to tap the non-resident Indian

(NRI) population in international markets like Singapore, Hong

Kong and London. The bank has already made its presence felt in

the NRI segment in the US, the UK, the Middle East, Africa and

the Far East.

Today, with 8 million customers in the bag,

a market cap of $5.10 billion or Rs 22,950 crore, and the highest

price-earning multiple amongst all Indian banks (34.5), Puri is

in a position to put his feet up and relax. But don't expect to

catch him doing that. "I'm more than satisfied today. There

is nobody in the company with regret. We all worked like mad men.

But when you are growing at over 30 per cent compounded there

is hardly any time to sit and relax."

|

There's

rich irony in that detail, when you consider what's really worked

in Puri's favour is the dramatic change in the Indian banking

landscape since the late 90s. As telcommunications and information

technology converged, Indian banks suddenly found themselves at

the front door of limitless possibilities. "Suddenly geography

and large capital became irrelevant and with outsourcing taking

off, banks found a great way to become more efficient," says

Puri.

There's

rich irony in that detail, when you consider what's really worked

in Puri's favour is the dramatic change in the Indian banking

landscape since the late 90s. As telcommunications and information

technology converged, Indian banks suddenly found themselves at

the front door of limitless possibilities. "Suddenly geography

and large capital became irrelevant and with outsourcing taking

off, banks found a great way to become more efficient," says

Puri.

On

the distribution side, the bank is tying up with post offices

and cooperative banks to sell financial products in the urban

and semi-urban areas. HDFC Bank also has plans to flag off a non-banking

financial company (NBFC) to sell small-ticket loans upcountry.

On

the distribution side, the bank is tying up with post offices

and cooperative banks to sell financial products in the urban

and semi-urban areas. HDFC Bank also has plans to flag off a non-banking

financial company (NBFC) to sell small-ticket loans upcountry.