|

It

turns 14 this year, yet the BT 500 has only just arrived. The

listing, the first of its kind in the country, is many things.

It is a measure of performance. It is a point-in-time assessment

of a company's past, present and future (the last as measured

by the expectations of investors). And it is an indicator of what's

in, and what's out, in terms of businesses, even individual companies.

The past listings, 13 of them, tried to be all that, but they

were constrained by the pace of evolution of India Inc., and that

of the country's stock markets. In the first half of the 1990s,

the listing was biased heavily in favour of past performance.

In the second, and in the first years of the 21st century, it

showed itself susceptible to speculative forces (HFCL anyone?).

Circa November 2005, the stock market (despite talk of an impending

correction) is at a high; even a fall of 10 per cent from its

current position will see the Bombay Stock Exchange's Sensex at

around 7,500 (a number that everyone, including the bulls, will

take happily); and companies are justifying their seemingly-high

valuations with revenues and profits of a magnitude they haven't

seen before and peg (price-earnings to growth) ratios less than

or equal to 1. In an ideal market, the ratio of a company's price-earnings

multiple and its earnings growth should be 1.

| THE TOP 10 |

Company

Average Market capitalisation, H1 2005-06

|

1

RELIANCE INDUSTRIES

Rs 88,281.73 crore

2 TATA

CONSULTANCY SERVICES

Rs 62,462.96 crore

3 INFOSYS

TECHNOLOGIES

Rs 60,584.70 crore

4 WIPRO

Rs 49,677.94 crore

5 BHARTI

TELE-VENTURES

Rs 48,647.50 crore

6 ITC

Rs 39,716.41 crore

7 HINDUSTAN

LEVER

Rs 33,688.57 crore

8 ICICI

BANK

Rs 33,166.46 crore

9 HDFC

Rs 21,144.45 crore

10 TATA

STEEL

Rs 20,637.88 crore

|

Any stock with a peg ratio of 1 is fairly

valued; those with peg ratios less than 1 are undervalued. Bharti

Tele-Ventures' peg ratio, for instance, is just around 0.3. And

Glenmark Pharmaceuticals' less than 0.2. While the latest bull

run has left even penny stocks looking respectable (even after

the recent bloodbath in that category), the fundamental soundness

of the valuations of companies in the higher reaches of the BT

500 (as evident in their low peg ratios) is indisputable. That

is one reason why the BT 500 has arrived.

The other reason has to do with the listing

itself. With the markets beginning to reflect a company's real

worth, more and more organisations are beginning to tap it. This

year's BT 500 is, thus, a far more accurate reflection of the

diversity of India Inc than last year's. And next year's listing

could be even more so.

In the top 50, for instance, are companies

from sectors as diverse as software, fast moving consumer goods,

banks and financial services, automotive (carmakers, two-wheeler

manufacturers, even auto component firms), metals (steel as well

as non-ferrous), pharmaceuticals, petrochemicals, energy, cement,

infrastructure entertainment, even airlines.

The top 100 includes companies from all these

sectors and then some. The first companies from a sector that

decide to tap the stock markets will start with high valuations,

the result of what analysts call 'scarcity premium', but over

time, as more companies from the business make initial public

offerings (IPOs), these (the valuations) will become realistic.

Three years from now, the top 10 of the BT 500 could well have

a retail chain, a biotech hotshop, an airline, and a media firm

apart from usual suspects from sectors such as software, steel,

and energy.

Behind The Numbers

THE TOP 10 GAINERS

By absolute market capitalisation. |

| RANK |

COMPANY |

INCREASE |

| 3 |

INFOSYS TECHNOLOGIES |

22,461.89

|

| 1 |

RELIANCE INDUSTRIES |

21,245.43

|

| 5 |

BHARTI TELE-VENTURES |

20,889.38

|

| 6 |

ITC |

14,771.63

|

| 2 |

TATA CONSULTANCY SERVICES |

14,332.62

|

| 8 |

ICICI BANK |

13,341.19

|

| 4 |

WIPRO |

12,421.31

|

| 12 |

HDFC BANK |

8,260.07

|

| 10 |

TATA STEEL |

7,470.51

|

| 9 |

HDFC |

6,674.57

|

| Figures are

absolute increase in market capitalisation in Rs crore. Companies

that listed on the stock exchanges in the past 12 months have

not been considered. Only companies with a market capitalisation

over Rs 1,000 crore have been considered |

The BT 500 isn't the only corporate listing

around; there are several others. One includes information about

closely held and unlisted companies, but the data is at least

a year, some times two, old, immediately rendering it irrelevant.

Others rank companies on sales alone, but this magazine has always

believed that only a market capitalisation based listing can look

at the future.

Still others opt for hybrid listings, marrying

unrelated measures such as sales and assets. For the record, the

BT 500 listing also ranks companies on the basis of sales and

net profit, and while it does provide information on the total

assets of a company, it does not believe in an asset-based ranking

(simply because the utilisation of assets is far more important

than the assets themselves).

A market value-based listing is prone to

stock market aberrations, but these are temporary phenomenon.

If averages won't weed out the kinks (the ranking is based on

average market capitalisation in the period between April 1, 2005

and September 30, 2005), then a comparison with the previous year's

listing will.

That integrity, and its inherent dynamism

make the BT 500 a perfect trend-spotter.

|

|

|

It is like the old finance boom,

and it isn't.

Anil Ambani's Reliance

Capital, for

instance, has emerged the

vehicle for his investments |

As this

magazine goes

to press

(November 11), Nandan

Nilekani's

Infosys has overtaken

TCS to

emerge #2 |

Just when everyone was begining to take Videocon for granted,

Chairman Venugopal Dhoot struck aggressive deals with Thomson

and Electrolux and unveiled a grandiose merger plan |

Big Is Beautiful

Nine of the 10 companies that registered

the highest increase in market capitalisation (between last year's

listing and this year's) figure in the top 10. The only one that

doesn't, HDFC Bank, comes in at #12. That shouldn't surprise anyone:

these companies have posted revenue and net profit growth rates

that are staggering or just short of it; four of these companies

are in the top 10 in terms of sales, and the lowest rank (by sales)

that any of these companies boasts is 35 (again, HDFC Bank).

At one level, this loops back to reinforce

a growing belief, among analysts, fund managers, and just about

anyone who has anything to do with the market that Sensex levels

of 7,500-plus are reasonable. At another, it proves that there

is something called economies of scale.

The three software companies in the listing,

for instance, have broken away from the rest of the pack. Not

only are they growing revenues and earnings faster than other

companies in the business, their size is allowing them the luxury

of trying new things.

THE MARKET'S FAVOURITES

Companies enjoying the highest market

capitalisation to sales multiple. |

| RANK |

COMPANY

|

MARKET CAP-SALES

MULTIPLE

|

| 110 |

VIDEOCON INDUSTRIES |

119.77

|

| 71 |

FINANCIAL TECHNOLOGIES (INDIA) |

89.25

|

| 82 |

INDIA BULLS FINANCIAL SERVICES |

47.56

|

| 105 |

YES BANK |

37.54

|

| 45 |

RELIANCE CAPITAL |

30.1

|

| 164 |

GATEWAY DISTRIPAKS |

13.18

|

| 117 |

KSL & INDUSTRIES |

10.3

|

| 3 |

INFOSYS TECHNOLOGIES |

8.49

|

| 23 |

SUN PHARMACEUTICAL |

8.31

|

| 102 |

HFCL INFOTEL |

7.19

|

Wipro, for instance, believes in the acquisition

approach. Infosys has invested in a consulting subsidiary. It

isn't just software; ICICI Bank and HDFC Bank have used scale

to good effect, setting the retail banking industry on fire. As

has Bharti Tele-Ventures, which has parlayed an all-India presence

and around 15 million subscribers (as on October 31) into real

money. And when the buzz on D-street hinted that Reliance would

acquire a $15-billion (Rs 67,500-crore) us- firm, not many people

were surprised by the magnitude of the amount involved or that

RIL was considering something as audacious as this (never mind

that the rumour proved baseless).

The New New Thing

A few years ago, this was media and entertainment.

Then it was pharmaceuticals. Then retail. The most significant

thing about this year's BT 500 is that there is no one new new

thing.

On the basis of valuations, it is evident

that analysts and investors are betting on several companies in

a variety of sectors. They are hoping new banks on the block Kotak

Mahindra and Yes will replicate, at least to some extent, the

success of those who came before them, ICICI Bank and HDFC Bank.

THE TOP 10 GAINERS

By absolute market capitalisation. |

| RANK |

COMPANY |

INCREASE

|

| 178 |

SPICEJET |

1,284.65

|

| 110 |

VIDEOCON INDUSTRIES |

1,189.69

|

| 71 |

FINANCIAL TECHNOLOGIES (INDIA) |

998.49

|

| 82 |

INDIABULLS FINANCIAL SERVICES |

888.40

|

| 117 |

KSL & INDUSTRIES |

779.59

|

| 142 |

GUJARAT FLUOROCHEMICALS |

730.13

|

| 51 |

ESSAR OIL |

672.06

|

| 135 |

NAGARJUNA CONSTRUCTION CO. |

602.92

|

| 185 |

UNITED BREWERIES |

518.24

|

| 173 |

GUJARAT NRE COKE |

478.72

|

| Figures are

per cent increase in market capitalisation. Companies that

listed on the stock exchanges in the past 12 months have not

been considered. Only companies with a market capitalisation

over Rs 1,000 crore have been considered |

They are betting that Jet Airways can scale

up and become one of the largest airlines in this part of the

world (and by virtue of being the only other airline company listed,

SpiceJet comes in at #178 in the listing). They have seen Pantaloon's

Kishore Biyani deliver, and expect him to deliver some more (Pantaloon

enters the top 100 at #69 for the first time). And they are cautiously

optimistic about the software company everyone is talking about,

Sasken, which debuts in the listing at #172. Heightened investor

interest in past new new things (such as software and pharmaceuticals)

have boded well for these businesses. There are some 43 software

companies in this year's listing and at least a handful of them

are there simply because investors believe Indian it firms have

what it takes too succeed.

The Ideal Top Ten

| On the basis of valuations, it is evident

that analysts and investors are betting on several companies

across sectors |

What would be an ideal (from the perspective

of contributing to a GDP growth of around 8 per cent to 10 per

cent a year) top 10, or top 20 in the BT 500? That's fairly straightforward.

There would have to be a retail firm (maybe two) because as the

US experience shows, retail is the lifeblood of the economy. One

carmaker would have to feature in the top 10 (the automotive industry

is a mixture of the best and the worst of old-world manufacturing).

As would, for obvious reasons, one bank. A couple of energy firms

(at the very top of the listing) is a must; there is a direct

correlation between energy consumption and economic growth. A

few software and pharmaceutical firms wouldn't hurt either. Nor

would an infrastructure firm, one into engineering or construction.

It would be nice to have a media firm too (then, we could be getting

greedy).

Will 2010 see a listing such as this?

Banking: This Boom Won't Crash, Not

Yet

Retail is it, but banks are betting

on SMEs and non-metros for growth. |

|

|

|

| Retail Ahoy: (Top to bottom) ICICI

Bank's Chanda Kochhar, Yes Bank's Rana Kapoor and SBI's

A.K. Purwar are all betting on the retail banking boom |

The retail lending boom shows

few signs of letting up, with Indian banks flooding the market

with cheap consumer finance. And even as the doomsayers crawl

out of the woodwork, questioning the sustainability of the

retail surge, bankers are taking various steps to ensure that

the boom doesn't turn into a bubble. Some are spreading their

risks by moving away from the big cities into smaller towns.

Others are aggressively tying up with user companies (auto

makers, for instance). At the same time, lending to small

and medium enterprises (SMEs) is picking up, which gives banks

another growth avenue to train their sights on. "The

penetration of banking into rural and semi-rural areas is

still very low, which offers plenty of scope for growth,"

says N. Mohan Raj, Chief Executive Officer, LIC Mutual Fund.

Yet, it's clearly the homes, cars, credit cards and holidays

you purchase that's keeping the banks' cash registers ringing,

be it the oldest state-owned State Bank of India, the market

savvy ICICI Bank and HDFC Bank, or the new kids on the block,

Kotak Bank and Yes Bank. For instance, ICICI Bank, which

is sitting on the largest retail portfolio of all, witnessed

a 68 per cent jump in its retail assets to Rs 56,133 crore

in March 2005. "The transformation of the erstwhile

ICICI Ltd from a financial institution to a retail powerhouse

has been phenomenal," says Asit Koticha, Managing Director,

ASK Raymond James.

Goliath SBI, with a balance sheet size of Rs 4,70,000

crore, has also successfully transformed itself from a typical

state-owned bank to a powerhouse of financial services,

especially housing, automobile and personal loans. According

to SBI, its retail advances in the personal segment have

grown by Rs 13,301 crore, with the outstanding retail portfolio

being at Rs 46,451 crore. The bank is aggressively scouting

for acquisitions both in the domestic as well as overseas

market. In fact, SBI has already acquired banks in Indonesia,

Mauritius and Kenya.

The new entrants, too, are fighting for the retail pie.

Leveraging the strengths of the 20-year-old Kotak Group,

the two-and-a-half-year-old Kotak Bank's retail assets spurted

by over 73 per cent from Rs 1,717 crore to Rs 3,159 crore

in March 2005. Yes Bank, more focussed on sectors like food,

infrastructure and healthcare, took its first steps into

retail when it launched its gold and silver debit cards.

Clearly, the Indian consumer can't be ignored.

-Anand Adhikari

|

| |

Retail: Great Expectations

The potential for retail may just

justify the skyrocketing valuations. |

|

|

| Boom time?: It's here

for Pantaloon's Biyani and Shoppers' Stop's B.S. Nagesh |

It would only to be fair to say

that the organised retail sector in India is yet to enter

the growth phase. The reason for this is simple-only 3 per

cent of the overall retail market comes from the organised

segment. With the hope that FDI in the sector will be permitted

at some point, the sector is expected to witness some of the

highest levels of action.

Today, the number of companies in the organised retail

segment that are listed at the stock exchanges are also

few in number-Pantaloon, Trent and Shoppers' Stop. The trigger

for retail, apart from FDI being allowed, is the real emergence

of new demographics, rising incomes and the ability and

willingness of the average Indian to spend. Investors, for

their part, are clearly impressed by the retail story waiting

to play out.

Pantaloon Retail India's Managing Director, Kishore Biyani

agrees that the demographics are looking good. "There

is no fear to consume," he states, terming the new

phenomenon as the "arrival of the Indian consumer"

which he attributes to factors such as more exposure and

the greater availability of goods and services. "Modern

formats have greatly helped in the fact that more spending

is taking place" he adds. The Indian economy is in

the midst of an optimistic growth phase and this has resulted

in higher levels of consumer spend. If FDI is eventually

permitted, one is certain to see some large global retailers

making a bid for a share of the consumer wallet here.

-Krishna Gopalan

|

| |

Telecom: Happening!

Just ask the foreign telcos waiting

to get in. |

|

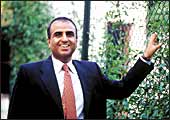

| Bharti's Sunil Mittal:

With a market cap of Rs 64,723 crore he can smile |

As an article elsewhere in this

magazine explains (see India, connecting Partners on page

220) a slew of multinational telecommunication majors are

waiting to enter the country. It helps that the government

has notified that it is raising the ceiling on foreign direct

investment (FDI) in telcos operating in the country to 74

per cent. And it helps that India happens to be the second-most

happening (if not the most happening) telecom market in the

world.

Much of the growth has come (and will continue to come)

from mobile telephony operators (on either one of two rival

platforms GSM or CDMA). Already, mobile tariffs in India

are the lowest in the world and both telcos and equipment

providers such as Nokia and Ericsson are working on ways

to take them lower still. With a teledensity that is already

into the double figures (and which is several times PC penetration),

it is likely that an entire generation of Indians will first

access the net through their mobiles.

The financial success of companies such as Bharti Tele-Ventures

(as this magazine goes to press, the company has risen to

#4 in the market capitalisation rankings, with a market

cap of Rs 64,723 crore) has proved that it is possible to

be big, offer low rates and still make money, irrespective

of what analysts have to say about the low ARPUs (average

revenues per user) for most telcos, just around Rs 400,

less than $10 a month. With more telcos lined up for listing,

next year's top 10 could see at least one more.

|

|