|

What:

The Mumbai Metro Rail project, which is expected to ease traffic

flows in India's financial capital. It was inaugurated by Prime

Minister Manmohan Singh on June 21. The first phase will start

from Versova in west Mumbai and terminate at Ghatkopar in central

Mumbai. The total distance: 11.7 km

When: Work on this will commence in

October and be completed by 2009

How much will it cost: The first phase

will entail an investment of Rs 2,356 crore

What next: There are three more phases with different

timelines. The total cost of the project is Rs 19,525 crore; it

will cover a total distance of 146.5 km and the entire project

is expected to be completed in 2021

Who is in charge: Anil Ambani's Reliance Energy and MMRDA (Mumbai

Metropolitan Region Development Authority) have bagged the contract

for the first phase. Reliance Energy had to downscale the viability

gap funding from Rs 1,251 crore to Rs 650 crore

-Krishna Gopalan

Methane Power

|

| Fishing: For energy |

What: A

government-run programme has struck significant reserves of gas

hydrates in the Krishna-Godavari Basin off the country's east

coast

What are they: Gas hydrates, also called clathrate hydrates,

are ice-like crystalline molecules containing gas, usually methane,

and surrounded by a cage of water molecules

So what: Extraction of methane from this source can address

some of India's energy concerns. Studies show that there could

be big volumes of methane hydrates at depths of up to 2,000 metres

below the Earth's surface

The catch: Methane is 10 times more powerful a greenhouse gas

than carbon dioxide

How can it be exploited: The technology for exploiting methane

hydrates on a commercial basis is still under development at the

Oil and Natural Gas Corporation (ONGC) in India. Japan and the

US are the other countries where such research is being carried

out

-Kapil Bajaj

ECONOMY WATCH

MONSOON

Status: Delayed. After 12 dry days from June 9-22, the

South-West monsoon has finally revived over the southern part

of the country. It is expected to cover the entire country by

July 15. The Indian Meteorological Department estimates that there's

a 22 per cent probability of it being deficient by 10 per cent.

Impact: "The delayed monsoons, coupled with inequitable

distribution of rain, may lead to 10-15 per cent lower foodgrain

production this kharif season," says Tuhin Kumar Singh, Research

Analyst, Agriwatch. However, he adds that if rainfall remains

normal from now till September, the effect on foodgrain output

might be minimal.

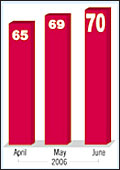

OIL PRICES

Status: Heading north

Impact: Will affect every sector of the economy and every

section of society. Global crude prices are ruling at about $70

(Rs 3,220) per barrel. If prices rise further, and domestic prices

rise in tandem, India's growth story will come under severe pressure.

Besides, the government will have to fork out billions of dollars

more for buying oil abroad.

-Compiled by Pallavi Srivastava

and Anand Adhikari

P-WATCH

A bird's eye view of what's hot and what's

not on the government's policy radar.

TOWARDS

GREATER TRANSPARENCY

The new system will: |

|

» Eliminate

the need to physically visit RoCs to file documents

» Allow

registered users to track status of applications online

» Increase

public access to documents

» Cut

down harassment and delays

» Result

in a dramatic savings in time

|

ELECTRONIC FILING OF DOCUMENTS MANDATORY AT ROCS

Come July 1, and companies will have to electronically file

their annual statements with the Registrars of Companies (rocs).

So far, companies had to physically file these annual statements

relating to registration, compliance, etc., at any of rocs across

the country. Individual rocs are converting existing documents

into electronic form. The project is expected to help reduce red

tape and bring greater transparency into the system. It will also

reduce the incidence of corruption by precluding companies from

filing false, misleading or incomplete documents. Registered users

will also be able to track the status of their applications, online,

thus, reducing harassment and delays. The public at large will

also now be able to access corporate documents more easily on

payment of a prescribed fee.

-Anand Adhikari

BANKS MAY FIND IT TOUGH TO MEET BASEL II DEADLINE

Some Indian banks may not adhere to the march 31, 2007 deadline

for complying with Basel II norms. Several public sector banks

have already informed the Reserve Bank of India about their inability

to provide additional capital. They are, in fact, struggling to

meet the RBI-mandated tougher provisioning norms on standard assets.

In such a situation, they say, that it will be well nigh impossible

for them to meet the additional cost of complying with Basel II

norms. Under these norms, they will have to maintain a stringent

capital adequacy ratio depending on the quality of assets they

have on their books and the bank management's assessment of such

risk. Data collection for such risk assessment has been a major

issue with banks in India. Given government ownership, which must,

out of political necessity, remain above 51 per cent, several

smaller banks may find capital constraints just too much to handle.

RBI will take a decision on the matter soon.

-Shalini S. Dagar

COAL TRADE MAY BE REVAMPED

The coal trade may soon take on a new look. For one, domestic

prices may soon be linked to global prices. The Planning Commission

has recommended that high quality coking and non-coking coal should

be sold at a price that is equal to its import price at the nearest

port minus 15 per cent. Steel plants are already paying for good

quality coke using this formula. The commission also wants 20

per cent of the total coal production to be sold through e-auctions.

The balance, it has recommended, should be sold through long-term

fuel supply and transport agreements with users. The coal ministry

will take a decision on the recommendations only after studying

them in detail. No time frame has been set for the decision.

-Amit Mukherjee

|

| POs: Now pay your service

tax |

SERVICE TAX AT POST OFFICES

Service taxpayers in Delhi will be able to file their returns

at select post offices. A pilot project will kick off in the Capital

in July in about 20 post offices. "The idea is to make it convenient

for assessees to file their tax returns and register themselves

without any hassles," says Gautam Bhattacharya, Commissioner,

Service Tax, Central Board of Excise and Customs. It will be rolled

out nationally after the results of the pilot project are assessed.

-Kapil Bajaj

PADDY SUPPORT PRICE LIKELY TO RISE

The government is likely to increase the paddy procurement price

soon. The idea is to avoid a repeat of the wheat procurement fiasco-the

government was unable to procure adequate quantities to replenish

its buffer stocks due to high prices. "A Cabinet decision needs

to be taken. Apart from the possibility of an increase in paddy

procurement price, coarse grains are also likely to be procured

to cope with the shortage in supplies," an agriculture ministry

official says.

-Shalini S. Dagar

Unsound Advice

Junk fiscal prudence, government told.

| WHAT

THE PLAN PANEL WANTS |

|

»

Government should defer the 2008 deadline to eliminate the

current account deficit

» Higher

expenditure on social and developmental projects

» Deregulation

of the sugar and fertiliser sectors

» Review

of the mineral policy

» Free

market pricing of petroleum products and targeted subsidies

|

Beg or borrow, but spend more. This,

in a sense, appears to be the Planning Commission's advice to

the government to ensure an 8.5 per cent growth rate in gross

domestic product (GDP) during the 11th Plan period (2007-12).

In a recent draft approach paper, the Commission has argued for

relaxation of the fiscal discipline regime that the government

undertook to implement two years ago. The fact that discipline

doesn't come easy has already been demonstrated; the Fiscal Responsibility

and Budget Management (FRBM) Act was put on pause mode last year.

While the FRBM Act aims to eliminate the revenue deficit by 2008,

the Commission wants to defer this deadline.

The planning body of the government, which has lost its relevance

in almost all sectors apart from infrastructure, has argued on

the basis of preliminary estimates that the allocation of funds

for development projects for states as well as the Centre be increased

from 7.15 per cent of GDP, during the 10th Plan period (2001-06)

to around 9.5 per cent in the next five years.

Although the Planning Commission's role in framing government

policies has taken a back seat in recent times, the government

is unlikely to dismiss its advice on reviewing the FRBM Act, as

it offers scope to indulge in more populism. Moreover, the plan

body has pegged its argument on the practice adopted globally,

where fiscal responsibility legislation does not take into account

revenue deficit management. "It is not a good idea to tinker

with the FRBM Act. Although there is nothing sacrosact about the

Act, nevertheless, stability and continuity in government demands

that it sticks to the rules," says Kavita Rao, Senior Fellow,

National Institute of Public Finance and Policy (NIPFP).

Sure, global practices ought to be adopted, but not on a selective

basis.

-Balaji Chandramouli

IT's Time For SMEs

IT giants eye huge business opportunity.

| POINTS

OF CONVERGENCE |

|

»

SMEs are under-invested in technology; as they begin to

operate in a global market they will be compelled to adopt

IT

» According

to IDC, Indian SMEs spent $5.6 billion on their technology

requirements in 2005 out of a total domestic market of $8.6

billion; Frost & Sullivan pegs it even higher at $9 billion

» Technology

companies are devising special packages and solutions for

SMEs to suit their smaller budgets

» The

largest chunk of the budget is spent on networking, telecom,

hardware and enterprise software

» The SME market is growing at well over

20 per cent, compared to 15-16 per cent for the rest of

the domestic IT industry

|

Historically, the IT intensity at

small and medium enterprises (SMEs) has been very low, but as

they grow, they will need it solutions to de-bottleneck internal

constraints," says Alok Shende, Director (it Practice), Frost

& Sullivan. He estimates that SMEs across the country spent

around $9 billion (Rs 40,500 crore) on it in 2005; and that this

number is galloping along at 27 per cent year-on-year.

"The SME market is no longer a side show for us,"

says Subhodeep Bhattacharya, National Manager, Marketing, Hewlett-Packard

India, adding that small business owners don't have homogenous

technology requirements. "Small companies are all aggressively

investing in it today. Though they can't afford a full-fledged

ERP or CRM package, they don't often need many of the bells and

whistles that large corporations do, so we build customised solutions

for them," he explains. IT companies now offer integrated

solutions for their SME clients. ICICI Bank, hp and Intel have

recently tied up to address the problem of finance by providing

credit ranging from Rs 1 lakh to Rs 50 lakh to small enterprises.

IBM has created facilities where smaller software vendors can

port their applications on to IBM platforms and customise them

for small businesses. "Several companies have used our centres

in Delhi and Bangalore for providing such technology solutions,"

says Ganesh Margabandhu, Director, Global Mid-market Business

(South Asia), IBM. "The real growth in SME business will

happen now," he says.

-Rahul Sachitanand

'Tis The Season To Fly

Airlines are offering special fares and incentives

to woo flyers this monsoon season.

The

ads talk of Re 1, Rs 99 and Rs 500 air fares. But why the sudden

rush of rock bottom fares even from carriers that historically

offer low fares? The answer: to shore up the abysmal passenger

load factor (PLF) encountered by the airlines during the monsoons. The

ads talk of Re 1, Rs 99 and Rs 500 air fares. But why the sudden

rush of rock bottom fares even from carriers that historically

offer low fares? The answer: to shore up the abysmal passenger

load factor (PLF) encountered by the airlines during the monsoons.

A SpiceJet spokesperson says the low-cost airline has seen load

factors of 92 per cent in May, but admits the number is expected

to decline 7-8 per cent in June. "The cost of flying a plane

from Point A to Point B is more or less constant. And seats are

perishable goods. That means empty seats mean losses for airlines.

So, it makes sense for them to sell seats at a steep discount;

it is better than making no money at all," explains Deep

Kalra, CEO, MakeMyTrip.com, an online travel portal.

There are some other reasons for the PLF decline during the

monsoons. This period is considered inauspicious in the southern

states (which see the biggest drop in passenger numbers); also,

this is the traditional holiday season, so business travel (which

still accounts for the majority of travellers) drops.

"If you want to plan your travel in advance, now is a great

time to do it," says G.R. Gopinath, CEO, Air Deccan. But

he warns that despite Air Deccan, SpiceJet, GoAir and others offering

bargain basement fares, not all passengers will be lucky. "Every

airline has complex yield management systems, which raise fares

on days a lot of travellers are flying. When we say we have 10,000

Re 1 or Rs 500 tickets, it does not mean that they are equitably

distributed through the system."

SpiceJet

has a similar policy. "We have 23,000 Rs 99, Rs 299 and Rs

499 tickets, but these are almost always on routes that need to

be promoted-like Delhi-Chennai or Delhi-Kolkata. You are unlikely

to find these fares on the Delhi-Mumbai or Pune-Bangalore or Mumbai-Hyderabad

sectors where demand is very high," says a company spokesperson.

Similarly, since Goa sees a downturn in traffic during the monsoons,

discounted fares to Goa are available even on full-service carriers

such as India, Jet Airways and Kingfisher, which tend to package

their deals in conjunction with large hotel chains. A three day-two

night package at a five star resort in Goa, including airfare,

is available for about Rs 10,000 ex-Mumbai. SpiceJet

has a similar policy. "We have 23,000 Rs 99, Rs 299 and Rs

499 tickets, but these are almost always on routes that need to

be promoted-like Delhi-Chennai or Delhi-Kolkata. You are unlikely

to find these fares on the Delhi-Mumbai or Pune-Bangalore or Mumbai-Hyderabad

sectors where demand is very high," says a company spokesperson.

Similarly, since Goa sees a downturn in traffic during the monsoons,

discounted fares to Goa are available even on full-service carriers

such as India, Jet Airways and Kingfisher, which tend to package

their deals in conjunction with large hotel chains. A three day-two

night package at a five star resort in Goa, including airfare,

is available for about Rs 10,000 ex-Mumbai.

And though these fares will be harder to come by once business

travel perks up again in end-July, MakeMyTrip.com's Kalra feels

that passengers might still get a good deal. "With carriers

like IndiGo and Jagson starting up and GoAir becoming more aggressive

and expanding in a big way, I don't think that you will see fares

increasing significantly on routes that have major competition,

even during the peak October-March period. There has never been

a better time to be an air-passenger."

-Kushan Mitra

Opportunity Lost

The Pension Bill imbroglio has cost

crores.

|

| Losing out: Finally, its pensioners

who pay |

As the left parties continue to

act as peeved partners of the UPA government, one of its antics

is hurting its own constituency. As the Pension Fund Regulatory

and Development Authority Bill hangs fire due to opposition from

the Left, the employees who joined the New Pension Scheme (NPS)

from January 1, 2004, onwards are losing out as their pension

contributions are sitting idle or earning extremely low returns-typically

5-8 per cent. The equity market, during this period, has doubled,

dipped and risen again.

Under NPS, employees joining the central or state governments

or autonomous bodies moved to the defined contribution pension

regime, in contrast to the earlier defined benefit scheme. The

new system was to work as follows: pension contributions from

individuals would flow to a Central Recordkeeping Agency, which

would allocate these to pension fund managers (PFMs) on the basis

of individual risk preferences. The PFMs would then invest the

amount accordingly.

In the absence of parliamentary approval for the pension Bill,

there is no clarity about how the pension contributions are being

invested. The central government has assured its own employees

8 per cent interest on the pension corpus, but it is not clear

if this covers the contributions of employees of various autonomous

bodies.

Compounding the confusion is the fact that nobody seems to know

the total number of autonomous organisations under the NPS or

the total number of employees involved. The Finance Ministry has

just started compiling such a list. Guesstimates put the total

number of central and state NPS members at between 100,000 and

600,000. "These people have lost out on two years of compounding

of returns for no fault of theirs," says a pension analyst.

And the Left continues to drag its feet on pension reforms.

-Shalini S. Dagar

Taming The Lions

This was India's best year at Cannes.

The Cannes Lions International

Advertising Festival took up the mindspace of every ad professional

worth his salt last week. The festival, in its 53rd year, is said

to have received an unprecedented 24,862 entries from 81 countries

this year. The total number of categories: nine-film, press, outdoor,

direct, media, cyber, radio, promo and titanium; plus the young

creative.

For India, this has been one of the best years-both in terms

of entries and awards won. India sent 738 entries-including 244

in the Press, 275 in the Outdoor, five in Radio, 16 in Promo,

66 in the Film categories and one for the Titanium Lion. Of these,

only 59 made it to the finals. Indian participants made a contribution

of £239,568 (around Rs 2 crore) to the coffers of the organisers.

The entry fee-it varies from $130-1,615 (Rs 5,980-74,290) depending

on the category-at the upper end is a big constraint for the smaller

agencies, which complain that the awards are more about affordability

than creativity.

For the record, India won 12 Lions this year, its best ever

showing at the festival. Of these, four were gold, three silver

and five bronze. JWT India's Slim Jeans campaign for Levi's won

many accolades, and a Gold Lion under a sub-category in the Press

segment; it was also the second runner up in the Grand Prix in

Press. Others who won gold include O&M in the Outdoor category

for Discovery Channel, Rediffusion for Midland Bookshop and JWT,

again, for its Kurkure promo. Other winners include Leo Burnett,

Everest and Madison Communications.

-Archna Shukla

|

The

ads talk of Re 1, Rs 99 and Rs 500 air fares. But why the sudden

rush of rock bottom fares even from carriers that historically

offer low fares? The answer: to shore up the abysmal passenger

load factor (PLF) encountered by the airlines during the monsoons.

The

ads talk of Re 1, Rs 99 and Rs 500 air fares. But why the sudden

rush of rock bottom fares even from carriers that historically

offer low fares? The answer: to shore up the abysmal passenger

load factor (PLF) encountered by the airlines during the monsoons. SpiceJet

has a similar policy. "We have 23,000 Rs 99, Rs 299 and Rs

499 tickets, but these are almost always on routes that need to

be promoted-like Delhi-Chennai or Delhi-Kolkata. You are unlikely

to find these fares on the Delhi-Mumbai or Pune-Bangalore or Mumbai-Hyderabad

sectors where demand is very high," says a company spokesperson.

Similarly, since Goa sees a downturn in traffic during the monsoons,

discounted fares to Goa are available even on full-service carriers

such as India, Jet Airways and Kingfisher, which tend to package

their deals in conjunction with large hotel chains. A three day-two

night package at a five star resort in Goa, including airfare,

is available for about Rs 10,000 ex-Mumbai.

SpiceJet

has a similar policy. "We have 23,000 Rs 99, Rs 299 and Rs

499 tickets, but these are almost always on routes that need to

be promoted-like Delhi-Chennai or Delhi-Kolkata. You are unlikely

to find these fares on the Delhi-Mumbai or Pune-Bangalore or Mumbai-Hyderabad

sectors where demand is very high," says a company spokesperson.

Similarly, since Goa sees a downturn in traffic during the monsoons,

discounted fares to Goa are available even on full-service carriers

such as India, Jet Airways and Kingfisher, which tend to package

their deals in conjunction with large hotel chains. A three day-two

night package at a five star resort in Goa, including airfare,

is available for about Rs 10,000 ex-Mumbai.