|

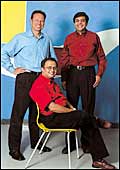

| MphasiS' A-team: Chairman

and CEO Jaitirth 'Jerry' Rao (sitting) with Vice Chairman Jeroen

Tas (L) and CFO Ravi Ramu |

It

is now 14 hours since his day began 1,200 kilometres away in Mumbai,

but 51-year-old Jaitirth 'Jerry' Rao, former high-profile Head of

Citibank's Indian operations, current Chairman of India's National

Association of Software and Service Companies (NASSCOM), Chairman

and CEO of MphasiS, poet, author, and occasional math instructor

is juggling an oily samosa and fielding an analyst call from New

York in what is likely to be the only pit-stop between now and the

end of the day, at least five hours away.

Secretary Awanti Agarwala interrupts the call

to remind him that his senior management team, led by CFO Ravi Ramu,

is close to finishing its presentation to a group of executives

from an American company shopping for some it services. "You

have to make the final remarks," she reminds him.

Rao finishes the call and turns to the window

of his seventh floor office. It is half past six in the evening

and the Bangalore skyline and a restored Ulsoor Lake-one of the

city's largest fresh-water bodies-present a restful sight in the

lambent light.

The view seems to recharge Rao, but not before

a moment of weariness crosses his usually cheerful visage. Then,

he is out of the chair, striding with his usual energy and confidence,

all five feet and three inches of him, a pocket dynamo, to the conference

room next door.

He's back 15 minutes later, grinning from ear

to ear, and accompanied by Ramu. The visitors seem happy and the

deal could well be in the bag. He congratulates Ramu, a KPMG-veteran

who worked on Infosys Technologies' NASDAQ listing, on a job well

done, instructs that the visitors are to be dined at the seven-star

Leela Palace hotel on Bangalore's Airport Road before they catch

a flight out at 10.30 p.m. "I will join you guys there,"

he promises. It is going to be one long evening for Rao.

The man wouldn't have it any other way: the

length of his days is an indication of sorts of MphasiS' progress,

from just one among the countless Indian software companies aspiring

to greatness to the next big thing in Indian software. "Look

at its customer base, growth rates, and offerings," says Rahul

Bhasin, Managing Partner, Baring Private Equity Partners (India),

an investor in MphasiS. "It is a tier-I company, and it has

a management team with real multinational experience."

Four years ago, MphasiS was ranked 20 in NASSCOM's

listing of India's largest software services companies; today it

is ranked eighth on the list.

There's more: the company has just completed

the acquisition of Kshema Technologies, an embedded software player

to build up its non-banking, financial services, and insurance (BFSI

in techie jargon) business, and it is pushing what it considers

a revolutionary software services plus business process outsourcing

(BPO) offering that makes it, if its claims are to be believed,

India's only truly integrated software firm. In a field dominated

by biggies such as Tata Consultancy Services, Infosys Technologies,

and Wipro, that is some claim.

| "We Have A Unique Strength" |

|

Since taking over as chairman

and CEO of MphasiS BFL in April 2000, 51-year-old Jaitirth

''Jerry'' Rao has virtually doubled the size of the company

every 18 months. Now, as he tries to take MphasiS into the

big league of Indian software services companies-populated

by the likes of TCS, Infosys, Wipro, and Satyam-he faces a

formidable set of challenges. In a candid interview, Rao outlines

his vision for the future.

While the last couple of years have

been good in terms of growth for the company, the software

services business seems to have had a not-so-good 2003-04;

margins are down; and manpower utilisation has come down...

Yes, the services business has not lived up to our

expectations. However, remember that it is a two-quarter and

not a two-year trend. We are fixing the services business

and we hope we will see accelerated growth. Margins have been

impacted. We hired in the hope that some of the projects in

the pipeline would fructify. It did not happen, (manpower)

utilisation fell, costs went up, margins went down...

Your numbers show an over-dependence

on the banking, financial services, and insurance (BFSI) market.

And the top customer accounts for 13 per cent of the business

and the top five, 45 per cent. Isn't that risky?

There is nothing inherently wrong with being a major player

in the BFSI segment as this is the biggest and fastest growing

segment of the it services market. We have already entered

utilities and retail and we will enter other spaces too. As

far as number of clients are concerned, we have fairly well-established

relationships. At the same time, we are also increasing the

number of clients.

A third of your revenues come from

BPO. Isn't that a risk too?

Instead of seeing this as a matter of concern, I take pride

in the fact. This is something that sets us apart. Last year,

our BPO business grew by 100 per cent. We added more clients

and the business has not only broken even, but started making

money. We quietly invested in developing high-end BPO services

such as a 'Virtual Tax Room'. We have been able to convert

a number of our services customers into BPO ones.

What sets MphasiS apart from an Infosys

or a Wipro?

Until a few years back, we would go (to customers) and say

'we are Indian, we are cheap, give us your business'. They

would say 'yes, you are Indian and cheap, but Infosys, Wipro,

and TCS are bigger' and give them the business. Now we have

a unique strength to offer: our integrated play. This is an

emerging area like our Virtual Tax Room where both software

services and business process outsourcing have to be co-mingled

as an offering.

Yes, the others are trying to do the same, but even today

Spectramind accounts for less than 10 per cent of Wipro's

revenues and Progeon, around 4-5 per cent of Infosys'. We

are not a me-too player. We are doing to BPO what Infosys

and TCS did to software services. They changed the paradigm.

Each player has what in Sanskrit is called swadharma (its

own unique philosophy). MphasiS' swadharma is to provide an

integrated BPO-services offering. This will power our growth.

|

A Brief History Of Possible Greatness

It's hard to say exactly, but MphasiS may well

have been born in Rao's mind when he was Chairman of Transaction

Technologies Inc, the it arm of Citibank.

This was the late 1990s, the bank was handing

out multi-million dollar contracts to software companies, including

Indian ones such as i-flex and Polaris, and the man spotted an opportunity

to do his own thing. "In 1998, there was something in the air,"

says Rao, who admits that his entrepreneurial career may have had

something to do with his base in California. "Money was easily

available and every second guy was starting a company." And

so, after an exit interview that lasted over two hours, Rao and

a colleague from Citi, Jeroen Tas, set out to ''focus on internet

solutions in the banking and financial services space and do some

body shopping from India''.

Eighteen months later, coincidentally around

the time the great dotcom bubble burst, the duo had reached a dead

end: MphasiS had become a $6-million company, but it did not seem

to have what it took to bag big projects. "Scale was an issue

and MphasiS wasn't a known entity," says Rao.

Meanwhile, back home in India, BFL, a company

originally promoted by Kolkata's Bangur family, had run into all

sorts of trouble for reasons as varied as speculative interest in

the scrip to lack of leadership to inefficient project management

processes. In 2000, on revenues of Rs 121 crore, the company returned

profits of a mere Rs 44 lakh, a net profit margin of around 0.36

per cent, something that is a nadir of sorts in the highly profitable

software services business.

ING Barings, the single largest shareholder

in the company (it held 52 per cent of the equity), facilitated

a merger of the company with MphasiS (Barings had a 25 per cent

stake in MphasiS too). And so, in February 2000, Rao found himself

Chairman and CEO of MphasiS BFL. The turnaround was almost immediate.

Even as Rao, Tas and another former Citibanker,

Bhaskar Menon, now Head of MphasiS' bpo operations in the US and

soon to head MsourcE, the company's BPO arm in India, were celebrating

the revival of the merged entity (revenues had increased from Rs

121 crore in 1999-2000 to Rs 273 crore in 2000-01 and net profits

from Rs 44 lakh to Rs 13.6 crore), the tech winter struck.

Rao and his team decided to hunker down and

focus on efficiency. Revenues grew a mere 14 per cent in 2001-02,

but net profit more than doubled to Rs 41 crore. The markets, however,

were unmoved; the stock, which now trades at Rs 489 after a 1:1

bonus, reached a low of Rs 26. Rumours flew about the company looking

for a buyer. Meanwhile, Rao and cfo Ramu-he came on board in June

2001-were shopping for investors.

Finally, in July 2001, Chrys Capital's Ashish

Dhawan invested $10 million for a 7 per cent stake in the company.

Chrys had also picked up an additional 7.4 per cent stake in the

company from the open market for between Rs 26 and Rs 100 per share.

Today, the firm holds 13-14 per cent and the scrip trades at Rs

490 after a 1:1 bonus. ''What attracted us to MphasiS was their

differentiation," says Dhawan, Senior Managing Partner, Chrys

Capital. "They were extremely focussed on financial services

instead of being everything to everybody and they had a small BPO

offering. Remember, this was at a time when the Infosys' and the

Wipros were not talking BPO." The company had the money it

needed to grow, and grow it did.

| Four years ago, MphasiS was ranked 20 in

Nasscom's listing of India's largest software services companies;

today it is ranked eighth |

Is MphasiS Really Different?

There is no denying the fact that MphasiS'

numbers look good: a net profit of Rs 98.5 crore on revenues of

Rs 580.5 crore, and a guidance of 35-40 per cent growth in 2004-05.

Pooja Narayanan, an analyst at Mumbai-based B&K Securities,

believes the company will register revenues of Rs 780 crore and

profits of Rs 135 crore in 2004-05, which should see it meeting

its guidance. However, what worries some analysts is that around

a third (Rs 186 crore) of the company's revenues in 2002-04 came

from MsourcE, its BPO arm.

Back in 1999, Rao had turned his nose up at

the suggestion that his company venture into the then emerging BPO

business-"Here we were, doing high-end Java programming, and

somebody was suggesting we set up call centers," laughs Rao-but

eventually relented and invested in a 15-employee operation in Pune.

Even then, the man was reluctant to invest in the company (MsourcE

was formed as a separate company, but on February 26, the board

passed a resolution recommending merger with the parent, a move

that some analysts say was prompted by a desire to dress the numbers

up some).

It was only when growth in the IT services business

proved elusive that Rao started focussing on MsourcE. In 2003-04,

the IT services business of MphasiS grew by a mere 16 per cent,

while the BPO one did by around 100 per cent (almost 70 per cent

of the company's 7,000 employees are on the rolls of the BPO).

Getting There

The momentum may be with it, but MphasiS

has to work harder still to break into the honours list. |

|

| Shanghai's Pudong Software Park: Home

to MphasiS' development centre in China |

If venture capitalists, the

managers of private equity funds, even lay investors-MphasiS'

stock has zoomed to Rs 489 from Rs 273 over the past one year-are

certain MphasiS is set to play in India's software major league,

there is reason for it: the company's management. After all,

a clutch of its equals (in terms of size), from Hexaware Technologies

to Hughes Software Systems, have managed to grow both revenues

and earnings faster in 2003-04. "Though its BPO arm MsourcE

is doing extremely well, its software services business grew

by only 17 per cent," says Ganesh Duvvuri, an it analyst

at Mumbai brokerage Motilal Oswal Securities. That, he explains,

is well below the average growth rate of its peer group. In

2003-04, almost a third of the company's revenues came from

the bpo arm. That, say analysts, is bad from the valuation

point of view. "Because value addition is low in this

business, the valuation is lower," says Sandeep Shenoy,

Head (Research), Pioneer Intermediaries. The acquisition of

Kshema will no doubt help the cause of valuation-Duvvuri expects

it to enhance MphasiS' margins-but certainly not enough to

justify the growing opinion that this is Indian software's

next big thing. That comes from three factors: the halo that

surrounds Rao, the company's gumption in setting the trend

in terms of facilities in China and Mexico, and its ability

to make an integrated BPO-plus-software-services play, something

that companies as varied as Infosys and IBM are also trying

to do.

-Narendra Nathan

|

The irony isn't lost on Rao. "Three years

ago, we were reluctant to even tell people that we had a call centre,"

he says. "Now, our integrated play of offering end-to-end offerings

is our uniqueness." One example of this integrated play is

Virtual Tax Room, a branded BPO offering that combines a traditional

back-office function with project-management of a level one normally

encounters in high-end it services outsourcing. "Unlike Infosys

and Wipro, MphasiS has integrated its IT and it-enabled services

businesses to offer unique services," explains Barings' Bhasin.

Rao seems convinced that this is the company's

key differentiator, but analysts do not share the sentiment. Both

Infosys and Wipro have strong BPO plays through Progeon and Wipro

Spectramind.

"MphasiS is branding a BPO offering and

that is a positive," says Ravindra Datar, Principal Analyst,

Gartner India, a technology consulting firm, "but other companies

may be able to offer similar offerings." He adds that the company

stands to gain in an "era of vendor consolidation", but

stresses that this is something that would also benefit "the

likes of Infosys and Wipro".

Then, there are concerns about the emphasis

on the BFSI market (62 per cent of its revenues come from this segment)

and the seeming lack of management depth. Rao claims the company

is aware of these concerns (see MphasiS Faces Challenges Aplenty...)

and points to the presence of Tas, Menon, Ramu, and Anant Koppar,

the CEO of Kshema who has been named President, MphasiS Technologies,

the company's embedded software division, as proof that MphasiS

doesn't depend on him, and on his Rolodex for growth.

Rao is right: MphasiS' senior management team

has pretty impressive credentials. However, it is Rao's own standing

as a professional-manager-turned-entrepreneur and his individualism

that gives the company much of its character.

The man, you see, isn't the typical buttoned-down

banker. Instead, he is arguably the most versatile and colourful

of Indian software CEOs, peppering his conversation with literary

metaphors, laughing easily, and generally managing to convey the

impression that he knows what he is doing without really saying

so in as many words.

| Rao is hoping for an encore as the company

tries to break into the top 5, a honours list where it will

rub shoulders with TCS, Wipro, Infosys, and HCL Technologies |

Back in Citi's early days in India, when its

young team would work Saturdays, most executives would come dressed

casually, in jeans and T-shirts. Rao would turn up for work in a

neat dhoti and half-sleeved shirt. Indeed, after Infosys' N.R. Narayana

Murthy and Nandan Nilekani, Wipro's Azim Premji and Vivek Paul,

and HCL Technologies' Shiv Nadar, Rao may well be the most recognised

software executive within the country and without, and not just

because he heads NASSCOM.

All these, of course, do not immediately translate

into software greatness and Rao recognises this. Still, he believes

MphasiS has what it takes and a unique selling proposition besides,

that can help it succeed. "Not many people believed we could

make it to the top 10," Rao reminds this writer on his way

out. That's right, not may people did. After all, analysts rated

companies such as Polaris, Hughes, Mastek, even Aztec much higher

than MphasiS just a few years ago. Today, the company has clearly

managed to set itself apart, if not in terms of revenues, then in

terms of positioning.

"We did it," says Rao. Now, he's

hoping for an encore as the company tries to break into the top

5, a honours list where it will rub shoulders with TCS, Wipro, Infosys,

Satyam, and HCL Technologies.

A Global Accent

MphasiS may be small, but it is as global

as it gets. |

|

| Shanghai's Pudong Software Park: Home

to MphasiS' development centre in China |

One would have expected Infosys

technologies, Wipro, or TCS to be the first Indian company

to make an m&a play in China. Instead, it was MphasiS

that in February 2003, announced the acquisition of the Shanghai-based

Navion Software Development Company for $2 million. The amount

involved was small, and Navion was then a 50-employee company,

and Rao himself admits that it was more of a strategic move

than something that would pay immediate dividends. ''Our Japanese

clients wanted us to be located there because it is in the

same time zone and there is cultural proximity,'' says Rao.

''However, in the long run China itself will become an attractive

market for us and we already have our feet on the ground.''

Not to be outdone, the company's BPO arm MsourcE has put down

a 22,500 sq ft, 125-seat Spanish language BPO at Tijuana,

Mexico. Then, there are MphasiS' marketing offices in New

York, Memphis, Houston, Boston, London, Singapore, Tokyo,

and Amsterdam, and a small software development centre in

Memphis, but these are par for the course for most Indian

software services biggies. The Chinese and Mexican plays are

not.

|

Me And My Uncle

A famous uncle believes Jerry Rao is the

smartest in the family. |

|

| N.R. Narayana Murthy, Chairman and

Chief Mentor, Infosys: Proud uncle |

It is inconceivable that a man

with as diverse interests as Rao ends up an academic. Still,

that's what the young Jaitirth tried his hand at six years after

graduating from the Indian Institute of Management, Ahmedabad

in 1973. Citibank hired him from the IIM-A campus and sent him

as a trainee to Beirut, Lebanon. However, fascinated by academia

(his brother is a professor in the US), he took a leave of absence

in 1980 and enrolled for a doctoral programme at the University

of Cincinnati. But, stifled by the hidebound rules of academia,

Rao quit two years later to return to Citibank. Over the following

25 years, Jerry (a name given to him by his batchmates at IIM-A)

held several senior positions in the bank, including a famous

stint as head of its Indian operations. Then, at a time when

he was counted among the top 50 managers in the company, he

quit and started his journey as an entrepreneur.

He may well have been inspired by an uncle of his who made

a similar mid-life switch from salaryman to entrepreneur with

spectacular results, N.R. Narayana Murthy, the Chairman and

Chief Mentor of Infosys. ''We neither advertise nor hide the

fact (that we are related),'' says Rao. ''He has always been

an inspiration for me; we meet socially and chat about the

economy and family matters; rarely about business.'' The more

famous uncle is more forthcoming. ''Jaitirth is a convincing

example of intelligence, smartness, dedication, and leadership,''

says Murthy. ''He is also a rare example of success both in

the highest echelons of the corporate world (Citigroup) and

in entrepreneurship. As an individual, he is fun to be with.

I keep laughing most of the time we are together. He is a

man of highest integrity and humility. He is extraordinary

in his breadth and depth of knowledge. He can quote Kalidasa

as easily as he does Shakespeare. He is as comfortable with

the rural poor as he is with the most sophisticated urban

rich. I have known him since he was a child of two years.

Right from the beginning, I knew we had a winner in our family.

I would say he is the brightest in the Nagavara clan.''

Rao's first book of poems Gemini II is already out and a

second one is in the offing. He is also writing a murder mystery.

The man is also a connoisseur of art and has an eye for paintings

which have traditional Indian motifs (there's a painting of

Vishnu's 10 avatars, Dashavatara, that is prominently displayed

in his Bangalore office). His wife Neelambari runs a non-governmental

organisation, Sujaya Foundation. Twice a year, during school

breaks, Rao teaches math to kids from impoverished backgrounds

with whom the foundation works. He has three children: two

sons, Vijayendra, 23, currently a paralegal in the US waiting

to enter law school, and Raghavendra, 13, a high-school student,

and one daughter, Sanjeevini, 19, a graduate student at the

University of Chicago.

|

The Embedded Executive

Or why MphasiS acquired Kshema. |

|

| Kshema's Anant Koppar: Old pro |

On April 2, 2004, MphasiS announced

the acquisition of Kshema Technologies, a Bangalore-based mid-sized

player in the embedded software (Read, the software present

in electronic devices that help them to operate. For example,

all TV remotes have embedded software.) market with revenues

around Rs 60 crore and a net profit of Rs 7 crore. The company

paid $21 million (Rs 94.5 crore) in a part stock, part cash

deal (the cash component was $6 million, Rs 27 crore). MphasiS

has good reason to pay 13 times earnings for Kshema. Its own

embedded software business, which accounts for around 15 per

cent of revenues is stagnant. The business needs critical mass

to give it the locus standi to bid for high-value projects,

and it needs an executive who can spearhead its growth in the

area. The Kshema acquisition gives it both: the business almost

doubles in size, and Anant Koppar, the Managing Director of

the company who has just been named President of the embedded

software business, MphasiS Technologies, is an old pro. The

fact that there were no overlapping clients only sweetened the

deal. |

|